Is owning a home a good investment? In my last post, many were shocked that 28% of our monthly spending goes to our home. I’d become numb to this fact, but the outcry drove me to look more closely at this fact. So I analyzed our 10 years of home ownership in Los Angeles to see if it’s been a good investment. Curious? Read on!

This post may contain affiliate links.

The American dream means living life to the fullest. For many, that involves owning a home. But there’s a running debate within the FIRE community if owning a home is a good investment. A few different camps exist:

- Own a home. Pay it off as soon as possible.

- Own a home. Keep a low interest mortgage. Invest excess capital.

- Rent a home. Invest excess capital.

Group One: Own a home. Pay it off as soon as possible.

If you’re in this group, you acknowledge that owning a home is valuable. Perhaps you like the feeling of having a piece of this world that is all yours. You want to own it outright as soon as possible. So you pay off your mortgage to free yourself of monthly mortgage payments and the cashflow drain that this represents.

While you’ll always owe real estate taxes, at least the bank will never have a claim on your home!

In 2019, Zillow reported that 37% of US homeowners owned their properties free and clear. Congratulations to this lucky cohort!

Group Two: Own a home. Keep a low interest mortgage. Invest excess capital.

If you’re in this group, you plan to pay your property off over time using a mortgage. You’ve probably got a 30 year mortgage with a nice 21st century low interest rate. This is what the majority of homeowners choose to do.

I fall into this group. I’ve made a bet that by using a low interest mortgage, I’ll come out financially ahead if I invest my excess capital, rather than using it to pay down my mortgage faster. I’m making the same bet with the $220,000 I still owe in student loans.

Group three: Rent a home. Invest excess capital.

If you’re part of this extreme group, you want to put every penny into assets like stocks or rental real estate. You rent a modest apartment or home and invest every extra dollar.

This isn’t a crazy idea. In a high cost of living area like Los Angeles, for example, a small home could run you well over $1 million. A typical down payment of $200,000 could take many years to accumulate. If you simply invest all this money as you accumulate it, is it possible that you could come out ahead in the long run? Perhaps.

How did it go for the Darwinian family?

We’ve been homeowners in Los Angeles for the last 10 years. Read below for some specifics about our two homes during this time, and an analysis of the numbers.

Home #1: 2 bedrooms, 1800 square feet.

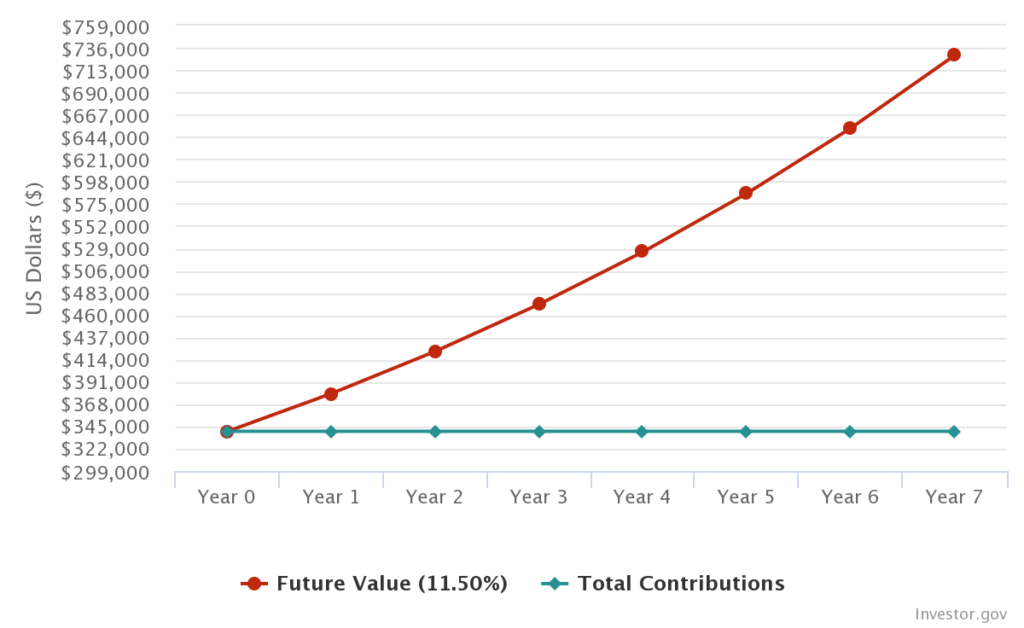

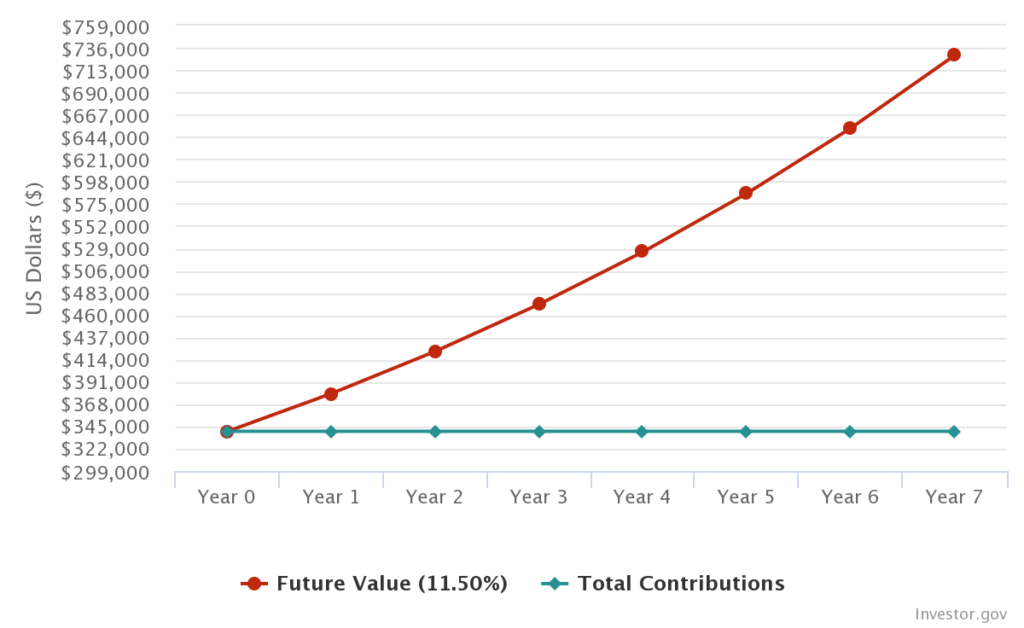

As I wrote about previously, a large part of our net worth is due to our first home. We got help (OK, a whole lot of help) with the purchase of our first home in 2010 from the Dr-ess’ parents. We bought it close to the bottom of the real estate crash for about $850,000, and sold it about 7 years later for $1.34 million.

How does this look when we consider the return on investment from our down payment? Pretty good:

| First Home | |

| Purchase price | $850,000 |

| Down payment | $340,000 |

| Sale Price | $1,340,000 |

| Realtor fees (6%) | $80,000 |

| Cash from sale | $730,000 |

| Return | $390,000 |

| Hold period | 7 years |

| Return on investment | 115% |

| Annual ROI (compounding) | 11.50% |

After 7 years, the $340,000 of cash grew to $730,000. Most of this went into our next home (see below), but $300,000 was left over as cash. We invested this into the stock market.

Comment: our mortgage during this time period was an interest only mortgage, so this return doesn’t reflect any benefit from principal paydown.

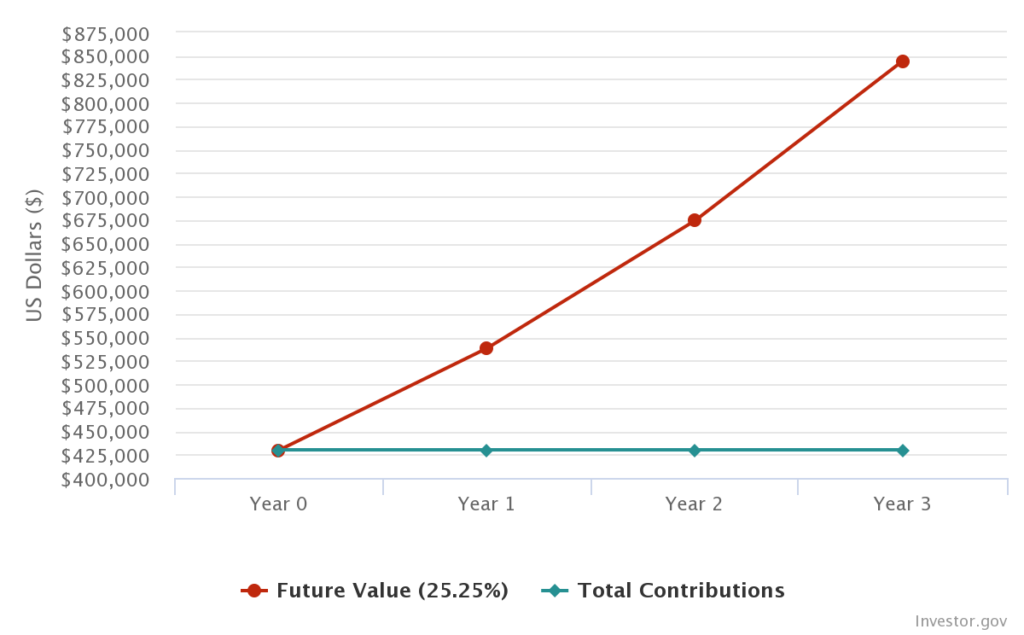

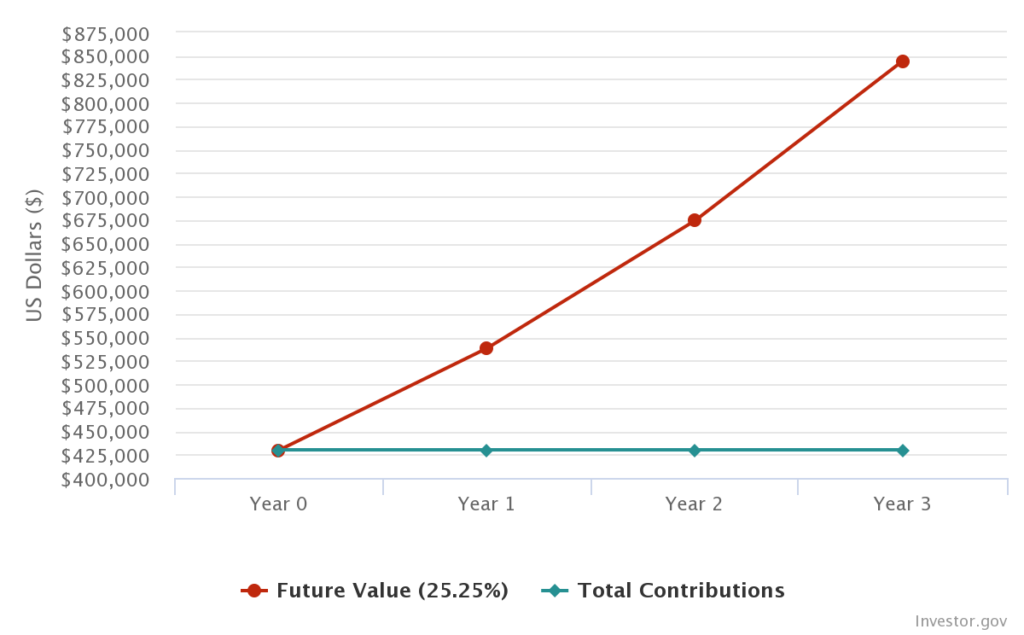

Current home: 5 bedrooms, 3400 square feet.

In 2017, with a second child on the way, we decided to trade up to a larger home. A priority was to have enough room to accommodate my parents, as well as my growing family. I wrote about this here.

So 3 years ago, we bought a 3400 square feet home in the heart of Los Angeles. It cost us $1.8 million. We financed the purchase and moved $430,000 from the sale of our first home into the second home as a down payment.

In the last 3 years, our home has appreciated. It’s hard to tell by how much, because the only real way to tell is to sell the home. We got the house formally appraised about 6 months ago for a refinance, but I feel the bank’s estimate was too conservative. But I also don’t agree with most of the home value estimates on the real estate websites. The comparable homes used in some of the Zillow’s data, for example, are from a much more expensive neighborhood.

These are the current value estimates:

| Home Value estimates | |

| Bank Appraisal | $2,000,000 |

| Redfin | $2,270,000 |

| Zillow | $2,740,000 |

| Trulia | $2,740,000 |

| Average | $2,583,333 |

Out of these, I think the one most connected to reality and recent sales in my neighborhood is the estimate from Redfin ($2,270,000). I’ll use this estimate in the calculations below.

| Current Home | |

| Purchase price | $1,800,000 |

| Down payment | $430,000 |

| Current Redfin est. value | $2,270,000 |

| Potential realtor fees (6%) | $136,000 |

| Current mortgage balance | $1,290,000 |

| Potential cash from sale | $844,000 |

| Hold period | 3 years |

| Potential return | $414,000 |

| Return on investment | 96% |

| Annual ROI (compounding) | 25.25% |

Comment: we started out with a $1.37 million mortgage, so we’ve paid off about $80,000 of this over the past few years. This ROI value is counting this principal paydown as additional gain.

Caveats and criticisms

I should acknowledge some obvious criticisms of this analysis:

- What about maintenance costs?

- What about your huge mortgage payments and taxes?

These are both valid. Every few months something fairly big seems to break or require maintenance in our home. A few months ago it was clogged and leaky gutters. This month it’s the air conditioner. Every time something happens, it seems like it’s a thousand dollars or more to fix.

Also, our mortgage payment and real estate taxes are very large. As I discussed in my breakdown on our pandemic spending, these two costs together comprise 28% of our monthly cash outflow. This large costs puts pressure on me and the Dr-ess to work hard to support our high cash flow needs.

However, it’s important to note that interest on our mortgage is tax deductible up to the first $1 million of our mortgage balance. (We were grandfathered into this limit.) So most of our mortgage interest is deducted come tax time.

And you’ve got to live somewhere. Obviously we could rent, but then I wouldn’t be able to provide housing for my parents. Also, renting a house in Los Angeles is very expensive. In desirable areas, houses rent for between $5000-7000 a month.

Finally, if I rented, I wouldn’t be benefitting from the magic of leverage, tax deductions, principal paydown, and appreciation.

Conclusion

So is owning a home a good investment?

My admittedly biased analysis of the numbers shows that it’s been a strong wealth builder for the Darwinian family.

For sure, we’ve disproportionately benefited from the appreciation of the real estate market in Los Angeles. Overall, big coastal markets like Los Angeles swing much more wildly on the real estate pendulum than most of the country. We caught this pendulum near the bottom (through sheer dumb luck) and rode it to the top.

If we’d been renters for the past 10 years, our monthly costs would have been lower, but our wealth would likely be less as well.

As a final comment, in “Rich Dad, Poor Dad”, Robert Kiyosaki writes that an asset is something that puts money into your pocket each month. A liability is something that instead takes money out of your pocket.

While this is a simplistic view, it did help us view our primary home in a new light. A liability that takes $7860 out of our pockets every month won’t help us reach financial freedom, unless we sell it or turn it into an asset.

So to tap our equity and turn our home into an asset, we secured a $500k home equity line of credit right before the pandemic gripped the world.

How are we going to use the HELOC to put money into our pockets? I’ll give you one guess. Stay tuned for our next edition of Anno Darwinii for the juicy details!

— TDD

Home ownership generates some pretty strong feelings in the world of personal finance. What do you think about my analysis? Please leave your thoughts below, share, and subscribe for more!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Other personal finance posts

- How the pandemic changed our spending

- How a mortgage refinance dropped my credit score 35 points

- End of year investments update | 2019

- What’s a hedge fund? I interview a hedge fund manager to find out

- Why I bought a Tesla Model 3

- How accurate are credit score simulators?

- Mid year investments and goals update | 2019

- Why the rich don’t feel rich

- You can’t buy avocado toast with VTSAX (Why cash flow is king)

- Inheritance and intergenerational wealth transfer

- Retirement via an accessory dwelling unit (my parental support solution)

- Increase your credit score by 25 points in 4 weeks

- Detours on the road to financial independence

- How we amassed an investment portfolio of over $1 million

- The fastest way to improve your credit-score

- A Darwinian Doctor origin story: the meatball sub

- My 15 year plan to financial independence, moFIRE style

- How to calculate your net worth and savings rate

- What is moFIRE (morbidly obese FIRE) and why do I want it?

- The Darwinian Doctor’s 13 Monthly Expenditures (with real numbers)

- Golden Handcuffs: Why I can’t quit my day job (for now)

- The great blessing of inflation

- Student Loan Management Mistakes: How one mistake added $10,000 to my debt

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

6 comments

TDD,

The stages in life are interesting. We are currently in group 3 as we rent a very modest apartment. We moved a while back for jobs but used to be in group 2. We will likely own a house in the future and plan on being in group 3.

We went back and forth quite a bit about homeownership as an investment. When we moved to a lower cost of living area, we decided to rent and save/invest any excess money. This also allowed us to quickly save a large downpayment for a future home. We will likely be moving back to a high cost of living area and the temporary geographical arbitrage really boosted our savings goals.

In the end, I think we settled on a house not really being an investment for us, but rather a known expense as a tradeoff for housing. Our investments in the market still do the heavy lifting for us.

Another rental coming up for you?

Hey Medimentary,

Geographic arbitrage is such an amazing tool for wealth building! I’m so glad it’s working out well for you and your family.

Homeownership has been so interesting for us. One thing I didn’t discuss above is that our first home gave us options when we needed to make a change. If we didn’t have the down payment appreciating in the first house, I think it would have been much tougher to scrape together a down payment for the second home. It made it psychologically easier to stomach the numbers when it came to buying our second home.

For both of our benefits, I hope there’s a downturn in the real estate market! More rentals are definitely in the cards. Stay tuned!

— TDD

You’ve been lucky, and I’m glad for you. Being that leveraged and using up that much of your monthly cash flow on a place to live is risky. One of my biggest gripes about hcol areas is they require folks like you to have a high percentage of your net worth tied up in an asset whose value could go to zero overnight. In lcol areas we could just walk away from our paid off house and our net worth would not change significantly. I’d be nervous if a house represented more than a singe digit percentage of my net worth, but in hcol areas it almost always does.

Hey Steveark!

The large mortgage does worry me, though I do insure against catastrophic loss to the extent that I can with various insurance policies. And although there’s a significant portion of the value tied up in the house, the land itself is quite valuable. So the house may burn, but the land will remain.

I’d contrast this with paper assets like my Tesla stock, which very well might fall to zero someday.

I count the house as part of my real estate portfolio and as one aspect of my diversified investment portfolio. It’s one of big reasons I don’t invest locally — I’ve already got enough money in the LA market!

I am quite envious of your paid off house. Even though I’m betting I’ll come out numerically ahead in the long run if I keep a mortgage, I really long for the comfort of a paid off house.

— TDD

[…] Just take a look at the appreciation we’ve had on our two Los Angeles homes over the last 10 years (through lucky […]

Owning a home can be a good investment for several reasons. Firstly, it provides the potential for appreciation in value over time, allowing homeowners to build equity. Additionally, mortgage payments contribute towards ownership, serving as a form of forced savings. However, the overall return on investment can vary based on factors such as the real estate market, location, and individual circumstances. While homeownership offers potential financial benefits, it’s essential to carefully consider factors like maintenance costs, property taxes, and market conditions before determining if owning a home aligns with one’s financial goals.