In this part, we are going to discuss the magic of leverage, which is the use of borrowed money to increase the return on an investment.

This post may contain affiliate links.

Part of the “Road to Rental Real Estate” series.

This is a follow up post to Part 2. This multi-part post discusses why starting this year, I’m sinking more of my capital into real estate as my preferred taxable investment class.

If you haven’t read Part 1 and Part 2 yet, please go back and do that. This will all make more sense.

In this part, we are going to discuss the magic of leverage, which is the use of borrowed money to increase the return on an investment.

The Business of Mortgages

There would be no leverage in real estate without the mortgage industry. So let’s spend just a moment discussing mortgages.

For most people, home ownership is part of the American Dream. The US government wants you to achieve this dream, so it created not one, but three big government supported entities whose purpose is to facilitate mortgage lending. They are:

- The Federal National Mortgage Association (Fannie Mae)

- The Federal Home Loan Mortgage Corporation (Freddie Mac)

- The Government National Mortgage Association (Ginnie Mae)

If you’re a history buff, you can read this article about how this all came to pass.

When you’ve got enough money for a downpayment, a bank will lend you the rest of the money to buy a house. This is called a mortgage. Many of these mortgages are then sold off to one of the government entities.

This gets the debt “off the books” of the banks so they can go ahead and lend to another homebuyer. This allows more people to purchase homes, pay property taxes, shop at Home Depot, and keep our economy chugging along.

If the people purchasing homes are actually credit worthy, everything works out great. If not, we can end up with the 2008 housing crash.

30 years of fixed interest!?

The most common type of home mortgage in the US is the 30 year fixed interest mortgage. This spreads out the repayment period and makes the mortgage payments more affordable. It also locks in an interest rate for the duration of the loan, making the payments predictable.

In other parts of the world, variable interest rates or shorter payback periods are more common. This makes real estate investment comparatively tougher.

As you’ll see later on, it’s these long term, fixed interest rate mortgages that help make real estate investment in the US so accessible.

Leverage

OK, let’s get back to the concept of leverage. Basically, it means using other people’s money to purchase something. If you’re buying a business, you can use leverage in the form of a business loan. If you’re buying a home, you can use leverage in the form of a mortgage.

Do more with less $$$

First of all, let’s state the obvious. Leverage lets you do more with less. Instead of needing $100k to buy a small investment home, if I take out a mortgage, I just need $20-25k to put as a downpayment.

What other investment class other than real estate has a whole industry supporting the leveraged purchases of assets? All with the blessing, support, and regulation of the US government?

That was a rhetorical question.

Rocket fuel for your investment returns

Second of all, leverage can be like rocket fuel for the return on an investment.

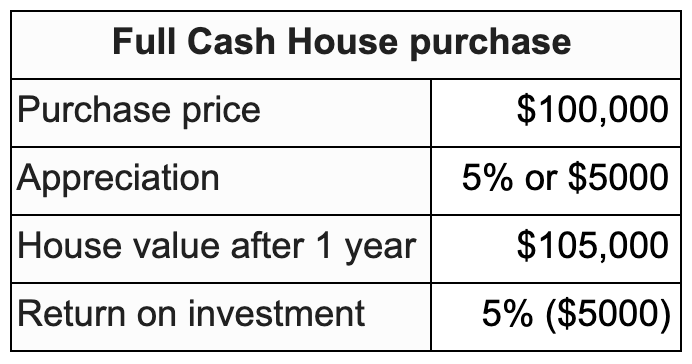

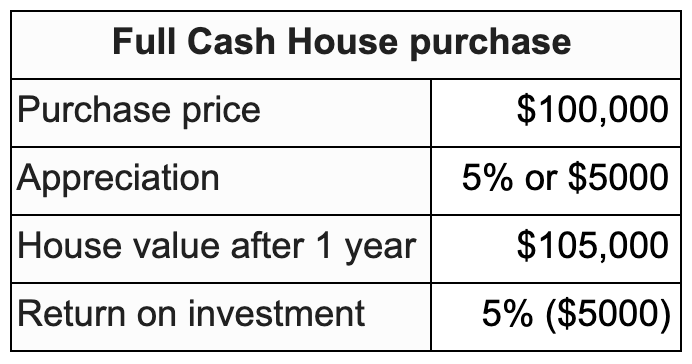

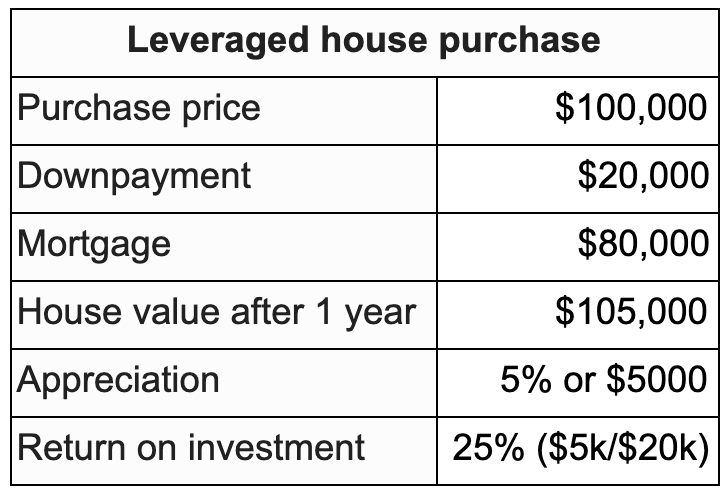

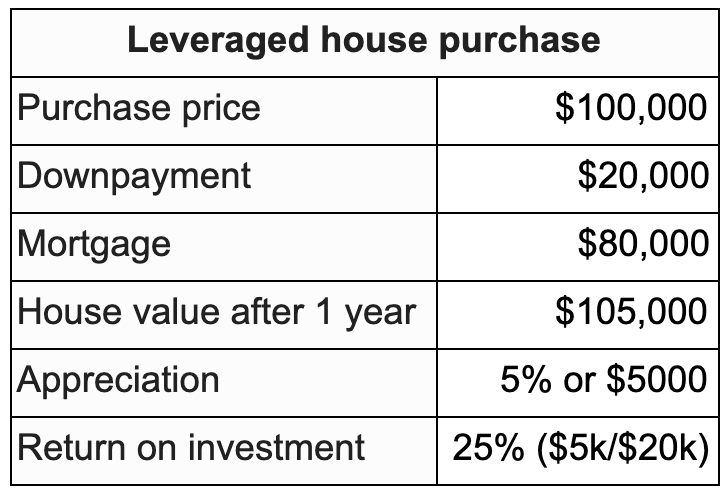

To explain why this is the case, let’s use a simple example where we have 5% appreciation of a rental house after 1 year. Let’s compare two options:

- Full cash purchase (because you’re a baller)

- Leveraged purchase using a 20% down, 30 year fixed mortgage (because you’re a smart baller)

You can see above that when you purchase a rental property all in cash, 5% of appreciation will equal 5% of return.

In this leveraged house purchase, you’ve only put down 20% in cash. The rest is borrowed money. But if the house appreciates, you get to benefit from 100% of that gain. So a 5% appreciation is equal to a 25% return on investment!

Caveats

You might be thinking to yourself, “Hey, what about closing costs?”

You’re right. The closing costs are the various fees required to close a mortgage loan. These add to the initial investment by $3000-5000 and will decrease the return. But even taking this into account, it’s clear that leverage supercharges appreciation returns.

Another point is that leverage only works to your benefit if the property has positive appreciation.

It’s true. Leverage cuts both ways. Let’s say that your $100,000 property drops in value by 5%. Your loss is 5% if you paid all cash and 25% if you leveraged with a 20% down mortgage. Ouch.

Also, I’d generally say that using leverage is only advisable if the property generates enough income to cover all its costs

If you have to contribute money to the investment because the monthly rent isn’t high enough to cover the cost of the mortgage, vacancy, and repairs, your potential gains will quickly evaporate.

Conclusion

There are a lot of moving parts when it comes to returns from real estate. A lot of the returns depend on your specific tax bracket and property.

The end.

…

Just kidding. This is where a lot of blogs stop. They conclude with a generic blessing:

Go forth and invest in real estate and be prosperous! Huzzah!

— Most investing blogs

I think it’s more helpful to give a specific example of a rental property and show the exact expected costs and returns.

So once I get the formal property appraisal, I’m going to model the exact rental home that I am in the process of purchasing. I’m going to show my projections and calculations. It might be a little numbers heavy, but I think it’ll be a worthy entry.

Read about the birth of my real estate empire: Update on the rental empire: Anno Darwinii 0.25

— TDD

What do you think about leverage? Is it the greatest thing since sliced bread or a devil’s bargain? Comment, share, and please subscribe for more content!

Popular Posts

- My 15 year plan to financial independence, moFIRE style

- How we amassed an investment portfolio of over $1 million

- A Darwinian Doctor origin story: the meatball sub

- The Darwinian Doctor’s 13 Monthly Expenditures (with real numbers)

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

4 comments

Leverage in real estate can turbocharged returns as mentioned.

You can sort of do the same thing in the stock market by purchasing stocks on margin however that is a game where the downside risks could be significant.

Hey Xrayvsn,

You’re absolutely right! I considered discussing margin investing but decided that it would muddy the waters. Suffice to say it doesn’t have the nice governmental support like the mortgage industry has.

And yes, seriously risky. I wish I could link to youtube clips in the comments. Anyway, here’s the link to the Margin Call movie preview:

https://www.youtube.com/watch?v=uj4QrAcwVi0

Great blog… Has me thinking about investing in real estate, my first job was taking care of my coaches rental properties

Thanks J’Mir! So glad you enjoy it. Cincinnati is a perfect place for rental real estate investment! Lemme know if you decide to look into it, happy to chat.