It’s been roughly two years since I started sipping the financial independence Kool-Aid. In that time, I’ve learned that seeking moFIRE is a marathon and journey, rather than a sprint.

One of the things that I love about blogging, though, is that it helps keep me accountable to my goals. This helps ensure that I’m making progress as I evolve into the sparkling, self-actualized, best version of myself.

In early 2019, I published my 15 year plan to financial independence, moFIRE style. Around that time, I also wrote down some specific goals.

- Six months of living costs into an emergency fund

- Stabilization of my parent’s living situation

- Purchase of my first rental property

- Financial independence by 2034

We’re now roughly six months since that time, so let’s see how I’m going on these goals!

Six months of living costs in an emergency fund

Since our annual expenditures are quite high in Los Angeles, six months of living costs are > $100,000. To achieve this, we converted some equities (index funds) to money market shares. At the time, we didn’t consider the tax implications of this, which would later come back to bite us in the ass.

Alas, since February, some big one-time costs drained our emergency fund almost completely dry.

- $40,000 surprise tax bill in April

- $15,000 of capital gains tax from the equities conversion

- $25,000 of under withheld income tax for 2018 (oops!)

- $50,000 construction bill in April

- See below

- $45,000 private school bill in May

- Prepayment for the 2019-2020 school year

You can imagine the crazy transactions flying between Vanguard and our First Republic checking account. They probably thought we were laundering money; it was moving that fast.

We’re slowly replenishing this emergency fund, and it’s back up to about $22,000 today.

Stabilization of my parent’s living situation

This was a major short term priority.

As I’ve mentioned before, my parents and I went through some rough financial times during my childhood. Things are better now, but my parents were not able to build up enough of a nest egg by retirement age to be financially independent in Los Angeles.

After moving here a couple of years ago to be closer to their grandkids, they were burning through over $30,000 per year in rent alone. The Dr-ess and I considered various options, but eventually decided that the best option was to build an ADU (accessory dwelling unit) in our backyard.

We hired a contractor and converted and expanded our garage into a 600 sq ft, one bedroom apartment.

Please see this guest post on the White Coat Investor blog where I detailed this adventure.

Overall, the project cost about $200,000. We took out a personal loan from my parents to cover $150,000 of the construction, but still had to cough up $50,000 of cash to cover the final cost.

It’s been a few months now, and things are working out great. My parents seem happy, and it’s much easier for them to help with childcare. We have dinner together most Saturdays, and overall we’ve never been closer as a family.

We are paying the personal loan back to them (plus interest) every month, which gives my parents much needed cash flow and financial security.

Purchase of my first rental property

This was another major short term goal of mine. I’ve suspected for a long time now that real estate investment offers a unique mix of tax advantages and cash flow for higher income folks. According to my 25 year projections, I’m right. For high income folks, rental real estate has the potential to significantly outperform standard equities investments.

So I felt it was a major victory when I purchased my first investment property in June.

You know what would be a great follow up win? Actually renting the property. I’m still waiting for the property management company to get a tenant in place.

Believe me, I’ll let you know as soon as this happens.

Financial independence by 2034

One of the events that kicked off my journey towards financial independence was mapping out our 15 year plan to financial independence.

In this, I outlined an aggressive plan to keep our expenditures stable while aggressively increasing our savings rate year after year. Along with 8% compounded growth, we would reach our FI number in 2034 with a substantial war chest of $10,765,864.

That’s a ridiculous sum of money, but I find our annual expenditures pretty ridiculous also.

Since publishing our plan in Feb 2019, there is some good news:

- Equities investments have risen $49,253.

- Feb 2019: $1,253,000 in equities

- July 2019: $1,302,253 in equities

- New real estate equity = $18,400

- Total increase in investments = $67,653

What’s the outlook?

Unfortunately, our outlook for the rest of 2019 is pretty stormy.

Our financial plan calls for an end of the year investments goal of $1,514,130. So to stay on track, we need $139,569 more savings or gain by the end of 2019.

We’ll probably save another $35,000 via retirement accounts by the end of the year, but we’re unlikely to make up the rest of that gap without a big rise in the stock market.

Unexpected $40-50,000 cash outlays have the unique ability to destroy the best laid financial plans.

New short and long term goals

Moving into the latter half of 2019 and into 2020, we’ve got a few new concrete goals to lay out.

Financial goals

- Aggressively grow our real estate portfolio

- Purchase at least 2 rental properties a year

- Regrow our emergency fund

- Keep 3-6 months of cash on hand

- Limit wealth busting enormous cash outlays

- Get back on track with our 15 year plan to moFIRE

Family goals

The Dr-ess and I are actively exploring alternative options to private school for our two boys. It’s just hard to spend such a huge chunk of our post tax money on education that might be obtained at a much cheaper cost.

We might be jumping into the jungle of charter schools and intra-district permitting within the public school system. Wish us luck!

Blogging goals

This blog continues to give me joy as a creative outlet and serves as a great echo chamber for my plans of world domination.

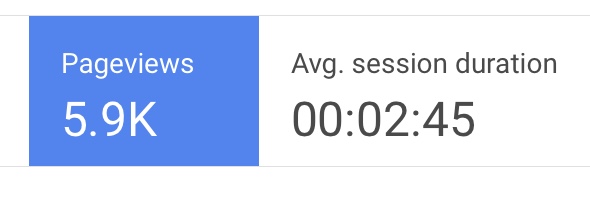

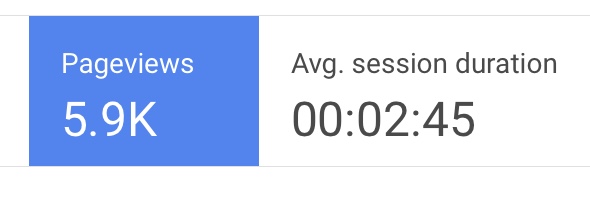

My short term goal is to achieve 10,000 page views by the end of the year.

Conclusion

That’s the update on my goals and investments for mid 2019. I hope you enjoyed it!

How are you doing on your own financial goals for the year? How about other parts of your life? Comment below! Please share and subscribe for more great content!

Related Posts

- The Darwinian Doctor’s 13 Monthly Expenditures (with real numbers)

- What is moFIRE (morbidly obese FIRE) and why do I want it?

- My 15 year plan to financial independence, moFIRE style

- A Darwinian Doctor origin story: the meatball sub

- Retirement via an accessory dwelling unit (my parental support solution)

- Rental house #1: Purchased!

- Rental houses vs. stocks: a 25 year portfolio projection

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

1 comment

Ouch with the unexpected tax issues. That could certainly throw off any well thought out financial plans.

I too have switched to adding a lot of real estate in my portfolio, since May 2017 everything I have invested has been in real estate with the exception fo my tax deferred accounts. Hopefully at the end it is the right play but I should be fine no matter what.

Great goals to have and hope you achieve them. Best of luck.