Today, learn the fastest way to reliably increase your credit score in just 4 weeks.

Readers may recall that I had an unpleasant shock when I checked my credit score about one month ago. I had just returned from a trip to Memphis, TN, where I checked out a provider of turnkey single family rental homes. In anticipation of mortgage shopping in the near future, I did a soft credit inquiry via Chase Bank’s Credit Journey service. (See this post for more information about this.)

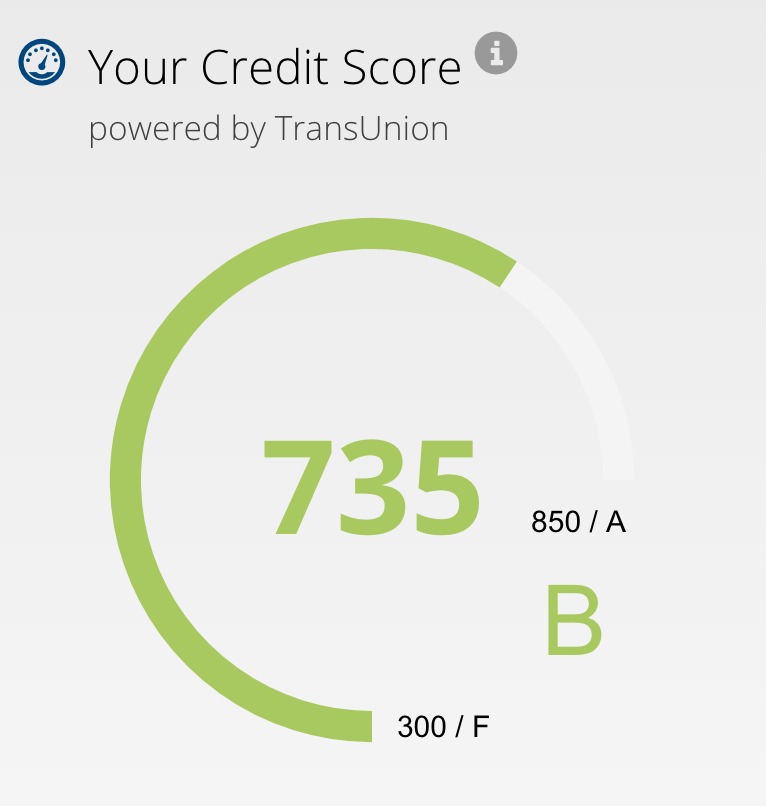

I was surprised when my TransUnion credit score was predicted to be 735, which was well below the magical 760 score that gives you access to the best mortgage rates. (TransUnion is one of the three credit bureaus used to generate the FICO credit score.)

But I make a good paycheck!

This led to some grump-fueled research into what factors combine to make up your credit score. Long story short, I learned that the FICO score doesn’t give a hoot about the size of your paycheck. It’s more concerned with how you use your available credit.

I found that the fastest way to rehabilitate your credit score is to keep “revolving debt” low. Specifically, the balance on all your credit cards should be below 30% of your available credit, and the lower the better.

With this in mind, I started to pay off my credit cards weekly. One would think that this would be pretty easy, given my robust paychecks, but two things conspired to give me trouble on this front.

Accessory dwelling units are expensive!

First, the construction of an accessory dwelling unit (aka granny flat) has severely drained our free cash flow over the last few months. Look for a guest post next month on the White Coat Investor site with more details about why we chose to spend about $200,000 on the construction of the ADU!

Bouncing a check to the IRS

Second, it turns out that we have our checking account more finely balanced than I realized. As part of our 15 year plan to financial independence, we have started diverting an additional $5000 a month to our taxable accounts as of January 2019. This, in addition to the myriad of auto-debited bills every month, caused our checking account to dip about $2000 into the red when I tried to send a payment over to the IRS for about $38,000.

If this seems like a large tax underpayment, it was! Like many others this year, the Dr-ess and I had a nasty shock at tax time, when our CPA gave us the news that we owed over $38,000 to the IRS. Although nothing changed about our exemptions between 2017 and 2018, the Tax Cuts and Jobs Act of 2017 (and a wee bit of capital gains taxes) led to a pretty severe underpayment.

In any case, aggressively pre-paying my credit cards while at the same time sending a $38,000 check to the IRS at the wrong time of the month led to the check bouncing! Thankfully, First Republic Bank called me and we were able to transfer over some money to salvage the transaction.

Did it work?

Risk of angry IRS aside, I think it was all worth it! Below, see the fruits of my labor.

Old credit score four weeks ago

Now after paying down my credit card balances to 10% of available credit

So in just four short weeks, I was able to vault my TransUnion credit score from 735 to 760, which should allow me to get the best mortgage rates on my investment property, thereby maximizing the monthly return on this investment. Interestingly, my Experian and Equifax scores are just fine, which reflects the fact that the three credit agencies don’t always match.

What’s even better, if I push these credit card balances down even a bit further (below 10% of available credit), I should be able to push the score even higher. I won’t get a better mortgage rate, but it will give me a little buffer in case anything else conspires to lower my score.

Conclusion

If you have some free cash on hand and need to improve your credit score fast, pay down your credit cards early and often to keep balances less than 30% of available credit. This is the fastest and most effective short term method to increase your FICO score.

Just don’t let it cause a bounced check to the IRS for $38,000!

— TDD

What do you think? Are you going to use this method on your own credit score? Comment and subscribe!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

2 comments

Up until now, all I have read on this topic is extremely boring, and seems to be written by writers that lack education.

Thanks! I assume that means you found my writing on the topic interesting and informative!

Thank you kindly.

— TDD