Below you’ll find a brutally honest breakdown of our monthly expenditures. With real numbers, I’ll show you why I’m handcuffed to my job.

This post may contain affiliate links.

This is a follow up to my previous post in which I frame this discussion: Golden Handcuffs: Why I can’t quit my day job (for now)

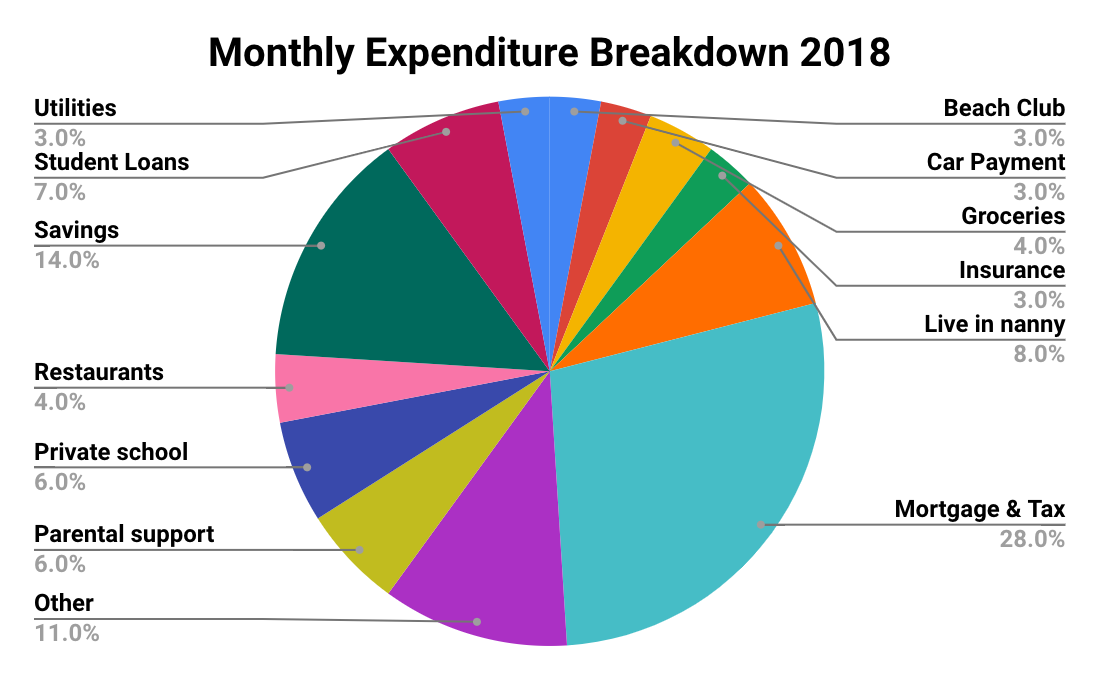

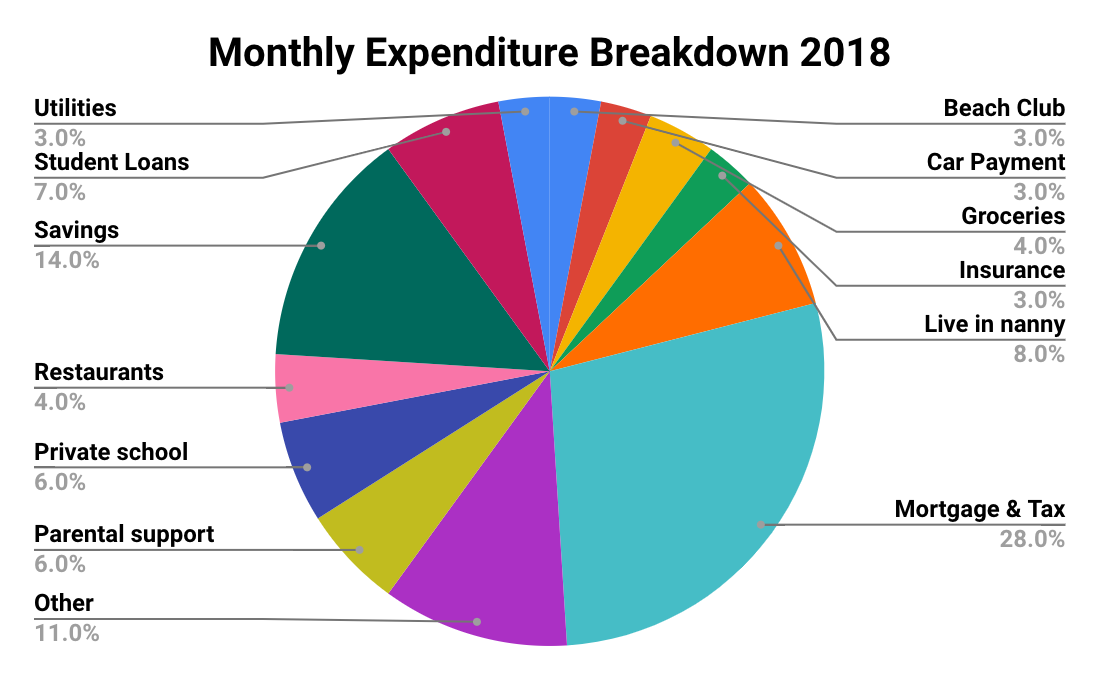

My 13 Monthly Expenditures in One Chart

This chart below represents the vast majority of our disposable (post-tax) income. In full disclosure, our lifestyle is also is supported by the Darwinian Dr-ess’ (AKA my wife’s) salary. Also, I couldn’t decide how to represent our pre-tax retirement savings, so I left that out.

Beach Club: $750 a month

As our most indulgent luxury, we have a membership that grants us access to the facilities of a beach club. In our mind it’s equivalent to a super fancy gym membership. It gives us a built in weekend destination where the Dr-ess and I can take turns working out while the kids safely roam the sand. It’s a good example of the cognitive dissonance that allows me to pursue financial independence while also having such an incredible luxury in my life.

Car Payment: $930 a month

I bought a Tesla Model 3 a few months ago. I have a lot to say on this subject, but will save it for another post. For now, I will leave you with three words: Tesla. Future. Now.

Groceries: $1100 a month

We recently decided to start buying organic produce when possible, and our grocery costs increased by about 30%. The fruits in general are notably less sweet and smaller, and I struggle to find a good crisp apple. The jury is out on this choice, but emerging evidence supports the link between organic food and reduced risk of cancer.

Insurance: $790 a month

Being well insured buys us peace of mind. I’ll break down our policies in the future, but briefly, they include car, disability, property, term life, and umbrella insurance.

Live in nanny: $2240 a month

As the Dr-ess and I both work full time, we need significant childcare to help with our two young boys. The Dr-ess grew up with live-in nannies, so we decided to go this route via a foreign Au Pair when our first son was born. It’s been a bit rocky at times, but overall has worked out well for us, and has been about 20-30% cheaper than if we had utilized a traditional nanny.

Mortgage and Property tax: $7900 a month

Seeing this chunk of our expenditure pie surprised me. The White Coat Investor has spent countless hours warning against the a big house purchase early in one’s career, but has also acknowledged that in many cases the allure of the “Doctor House” is too much to resist. This was the case for me. I still think I underestimated the impact of property tax on the cost of the house, as well as endless stream of thousand dollar maintenance related projects that aren’t reflected in this graph. The Dr-ess has asked me to point out that she was quite happy in our small two bedroom house which was much more affordable, and her proclivities towards private school and nice vacations impact our finances much less than our big mortgage payment. She’s quite right.

Other: $3200 a month

This is anything from Amazon purchases to new car tires and plane tickets; anything that doesn’t fit into a neat category. Since they’re not repeating costs, this category is theoretically one in which we can trim a lot of fat from our spending. However, it’s also a tough category to analyze because of the nature of the expenditures (mainly one-offs).

Parental support: $1600 a month

When I lured my parents to come out of retirement from Nevada, where their cost of living was minimal, I did it with the promise that I would help supplement their rent and living expenses here in SoCal. Here, they share childcare duties with our au pair, much to the joy of my kids and hopefully my parents as well. In any case, I consider it money very well spent. In fact, we’ve recently decided to convert our garage into a small apartment for them. This is a pretty huge development, which I plan to chronicle over the next year as the project progresses. Let me just say that construction costs in SoCal are massive, as are the Dr-ess’ concerns about having her in-laws living 10 feet away from us.

Private School: $1740 a month

As a proud product of the public school system (at least through high school), the cost of private school in Southern California boggles my mind. But it’s a cost the Dr-ess (AKA wife) is happy to pay if it buys a better education for our kids. Her reasoning is that parents have two main jobs: 1) impart morality and 2) educate their kids to best prepare them for the challenges of life. I share these thoughts, but we differ in deciding if it’s really worth it to spend over $20,000 a year to send our 4 year old to a private preschool. If my understanding of his school day is correct, 15% of the time is spent napping. So that’s $3000 a year of supervised naptime that we’re paying for!

Given the firmness of the Dr-ess’ opinions on this matter, I don’t see her compromising on this choice unless our financial position changes significantly. Only time (and our kids’ academic success), will decide if the investment will be worth it.

Restaurants: $1120 a month

Between getting food during the workweek and date night with the Dr-ess, we tend to spend a fair amount of money on restaurants each month. This is one area that I feel I can decrease while also improving my health by being better about bringing food to work. To this end, I recently purchased an Instant Pot.

Savings: $4000 a month

Half of this goes to taxable accounts, and half goes into 529 educational savings accounts for our kids. I feel this number should actually be higher given our high income, but inevitably some large cost comes along each month that seems to eat up the rest of our cash.

Student Loans: $2100 a month

When I graduated from residency, I had about $300,000 in student debt. I decided to refinance this with a private lender and have been slowly paying this off with a 3.5% interest rate over a 15 year repayment period. The debt weighs on me, and I often wonder if I should be paying this off faster. Thus far, I’ve decided to invest my extra cash rather than accelerating paying off my relatively cheap debt. Out of the many student loan re-financiers out there, I found the best rate with First Republic Bank. (Feel free to use my referral link to their loan refinancing services.) There is a lot to say about student loans, and I hope to cover this in detail in future posts.

Utilities: $900 a month

Energy and water in Southern California is not cheap. There’s not too much to do about this given the landscaping constraints the Dr-ess has dictated (read: green lawn and cool house). However, with a smart sprinkler system and drought tolerant grass, I’ve made my landscaping as water wise as possible. I’ve also given some thought to solar panels. There is an economic calculation that definitely makes solar a good long term play, but it’s still a relatively expensive investment. For now, we are putting this off in favor of other projects.

Total Monthly Expenditures: $28,000 a month

All the categories together translates to an annual expenditure of about $340,000. So you can see why the Dr-ess and I both feel that we are handcuffed to our high paying jobs.

Conclusion

I debated for weeks if I should post the actual dollar amounts of our expenditures in this blog. I finally decided to share all the details for a few reasons. I want this blog to be as interesting and useful as possible to others who feel similarly shackled by their high cost of living. I want our journey to financial independence to resonate and inspire others who would like to do the same. Specific numbers are necessary to do this.

It also helps that for the time being, the avatar of this blog is the Darwinian Doctor fish, and not my smiling face. So I feel somewhat protected by my veil of anonymity.

Despite our crazy high costs, I hope to stabilize our finances, invest wisely, and be financially independent within 15 years. Does this sound impossible, based on what you’ve read? I don’t think so, and I will present some numbers and projections in the next post to support this.

— TDD

What do you think about these expenditures? Does it sound crazy or make sense? It probably depends on where you live.

Please comment below and subscribe for more content!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

19 comments

Thanks for sharing such details. And putting yourself out there. I was probably around $250k total spending for a few years. I have a general excel sheet but find it too difficult to keep track of all the spending but keep track of the savings target and if I reach that then the spending is ok. Lately the spending, excluding all investments and savings, is in the lower 100s now. I hear you with how we have to compromise with our spouses.

Hi Dipak, I’m also finding it much easier to keep track of saving than it is to keep to a strict spending limit.

You’ve really managed to bring down your spending! Congrats!

I’m sure it gives you much more flexibility in your day to day choices.

Best wishes,

TDD

I am ready to do this I am wonting to go back school to be an auto body and auto mechanic so I can start my own business this has been always my dream and I want to succeed with my dream before I never get to do it

Thus was helpful, except my kids are grown, I have no nanny, student or car debts, beach club or mortgage payments; my insurance costs are higher because I’m 61, about 40k per year.

Still, I spend 20k per month, and I can’t figure out how these FIRE blogs do it for 5k!!

Dr Bob!

Your lack of debt is wonderful, sincere congratulations! I think blanket condemnation over spending money is a fallacy in a lot of personal finance blogs. If you’ve got the money and the financial security, who am I to judge?

The high cost of living in the coastal cities is a major factor in spending habits, though. I’ve noticed most of the more frugal bloggers out there have made conscious choices about avoiding high cost areas, and are therefore able to live on much less money.

To be honest, if the Dr-ess’ job didn’t require a big city, we’d probably consider moving somewhere cheaper. But alas, we’re tied here for the foreseeable future.

— TDD

Relocate to an area where you can live without mortgage payments. Save enough to buy house cash only and trim expenses to within a minimalistic life style. Pay with debit cards, reduce credit card balances to 200$ or less. One debit card, one credit card.

That 300K in student loan debt will not go away in 15 years but more like 20 years. The loan compounds the interest if you read the contract carefully. Me, I’ve quit medicine and am in an online law school where I can do some good for society and help myself as well. I was formerly in a surgical speciality and was very disappointed with how poor the reimbursements were for literally saving lives full time.

This sounds like a winning formula for living without much cash outlay. Regarding the student loan, it really will be gone in that amount of time (now about 11 years). I refinanced it with First Republic and amortized it over 15 years. This time period and monthly payment takes interest into account.

I’m glad you’ve found fulfillment in education.

— TDD

That looks about right for a 2 physician family in a high cost of living area. But clearly you have a plan and are doing a great job executing it!

I think everyone struggles with the costs of private school.

It hurts writing tuition checks that are almost what I spent on medical school.

Thanks for sharing.

Hi Dr. In Debt, thanks for stopping by. Private school is such a thorny issue in our household. It seems like a ludicrous cost when there is the public school system there essentially for free. But the Covid-19 pandemic has put some things into perspective. The extra resources of my son’s private school is providing for a fairly robust online experience. So for the first time in years, I feel like we’re “getting our money’s worth.” I doubt this feeling will outlast the pandemic, though.

Wow! Big bucks! First time visitor. Glad to see someone highlighting how much they really spend. I’ve received a lot of flak about living a middle class lifestyle off $300,000, so I’m glad to see this.

I’ve got to run my spending numbers again.

With a $300K+ monthly spend, what is your target net worth for retirement?

Sam

Greatness has visited my blog! Welcome and good day. I’m trying to normalize the living costs of people in big cities like yours and mine.

When I ran the numbers and mapped out a 15 year plan, my net worth target was $10,765,864. I’m coming around to the idea that net worth isn’t as useful of a figure as I thought, due to the variability of taxes.

I’m warming up to the concept of just a cash flow based concept of financial independence.

I look forward to seeing your updated numbers!

— TDD

Thanks for sharing the details and numbers! It does put your view of golden handcuffs in perspective. I love this “If my understanding of his school day is correct, 15% of the time is spent napping. So that’s $3000 a year of supervised naptime that we’re paying for!” My husband and I are products of public K-12 so we’ll stick with public schools.

You’re welcome! Public school is great. I wish the Dr-ess and I could agree on this point!

Thank you for sharing. I am in a very different situation than you — single, no kids, pretty young, but still HCOL area and finding it difficult to plan for a future where spending increases with age.

I’ve had a lot of confusion for a long time with FIRE people all living in LCOL areas, and it’s nice to see someone who spends probably 7x what I do be so transparent about it. This helps me plan for my future.

I’m glad you find it useful, Rad!

Does this add up to your total income? How do save enough money for down payments and rehabs for your investment properties?

Hey Kareen! As a surgeon, I have a high income. My wife isn’t in medicine, but she does too. So we are able to pay for these expenses and still save money and invest. It’s a privileged position and we are very lucky. But when I added together all the expenses, it still shocked me.

Nice post: it feels real. The cost of living in socal is very high, just like mine in Manhattan where 300k is middle class. Taxes are really the killer. I’m writing to say that the “doctor house” complex is actually not a problem in my view. For 3 reasons: 1) you enjoy it, 2 ) the mortgage gets decimated by inflation overtime and the payments gets easier and easier, this is very noticeable after 10 years, 3) it’s a large chunk of money parked in the house which, in 2 or 3 decades can be the source of peace of mind in retirement, lots of people from Cali or NY have been able to finance their later years from the sale of that property and moving to a cheaper locale.

Good point! Buying an expensive house is such a controversial topic, but with some luck, it can be a tremendous wealth accelerator due to appreciation. I think that’s the problem — it’s so hard to know where we are in the real estate cycle. So for some, a house might cause problems due to variable rate debt or dropping valuations.