Today we discuss how my credit score temporarily dropped by 35 points after a mortgage refinance, and what this means for you!

Buying the Doctor House

A few years ago, the Darwinian Dr-ess and I traded up from our two bedroom house for a five bedroom house in a less desirable area of LA. The new house was still 30% more expensive than our old house, but we got 90% more living space and a 70% bigger lot.

The extra land made it possible for us to help support my parents in their retirement. We built out the garage and turned it into an “accessory dwelling unit” for them. We’ve since settled into a fairly peaceful routine of shared childcare duties and triple-generation family dinners.

One downside of the larger house is a larger mortgage payment. When we moved, our mortgage payment ballooned to $6300 a month! While traditional logic said that we could afford these payments, I’ve always felt uncomfortable with the cost of our housing since the big move.

Mortgage rates in 2017

When we moved, mortgage rates were quite low. While not as good as the historic lows after the mortgage meltdown, we still were able to lock in a 30 year mortgage at 3.75%. As you can see from this chart, this is still great when compared to historical rates.

Mortgage rates in 2019

Despite what the Federal Reserve chair said in late 2018, the Fed actually lowered the Federal funds rate three times in 2019. Although mortgage rates don’t fall lockstep with the federal interest rate, they are related. If the federal interest rates are falling and there’s any sort of international turmoil, you can bet that mortgage rates are probably going to be falling also.

After the third rate drop in December 2019, we ran the numbers and decided to go for a mortgage refinance.

Worries and fears

This was my first mortgage refinance, so I was worried about a few things:

- The cost of a refinance

- How to find a bank to refinance my mortgage

- The effect a refinance might have on my credit score

Let’s take these step by step.

#1: The cost of a refinance

I found that when it comes to your primary residence, most banks will allow you to roll the administrative costs of the refinance into your mortgage. This spreads out the few thousand dollars over 30 years, making its effect on your monthly payments almost negligible. You’ll end up coming out of pocket for the home appraisal, but this is usually just a few hundred dollars.

#2: Finding a bank to refinance your mortgage

To find a financial institution for the refinance, I turned to the obvious choice, Google. With a quick search, I was immediately up to my eyeballs with dozens of banks vying for my business. The harder job was sifting through all the options to find the best rates.

The easiest way to approach this is probably a service like LendingTree.com. (Sadly this is not an affiliate link.) Within minutes, you’ll be able to see many mortgage rates side by side.

The downside of this approach is that you may find yourself spammed with calls and emails from banks following up on your inquiry.

To avoid the incessant calls, I did a targeted search myself. I created a spreadsheet with the name, contact information, and rate of about a dozen banks and credit unions.

After I narrowed this down to the top three options, I started applications to them all. I also checked with Bank of America, who funded our initial mortgage. Their published rates weren’t as good as their competitors, but I thought I’d give them a chance. In the end, they matched the best rate from a local credit union to keep our business. It was easiest to stay with Bank of America, so we ended up refinancing with the same bank who issued our initial mortgage!

#3: The effect of a mortgage refinance on my credit score

I worried about the effect of the refinance on my credit score because as I’ve mentioned recently, I’ve got a SMART goal to grow my real estate empire aggressively over the next five years. I need a good credit score to qualify for loans and be taken seriously by lenders.

So I was perturbed when I saw that my credit score actually dropped by about 35 points after the refinance!

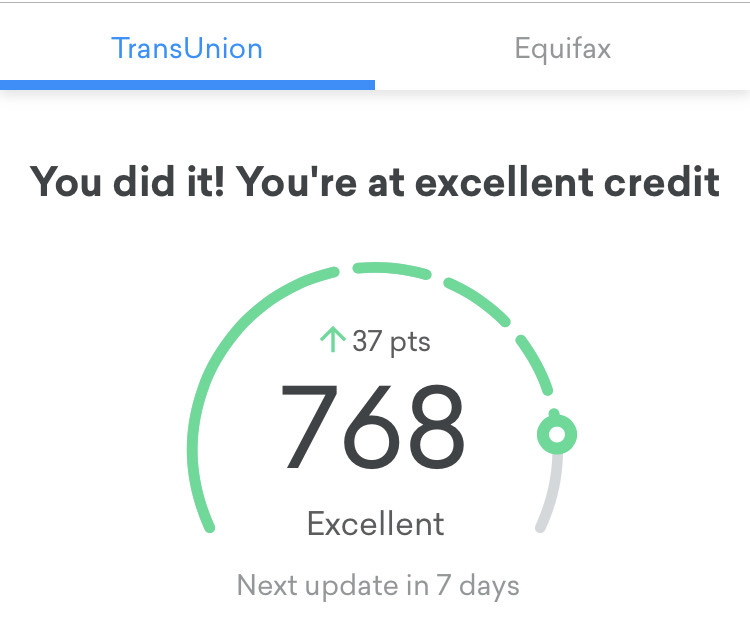

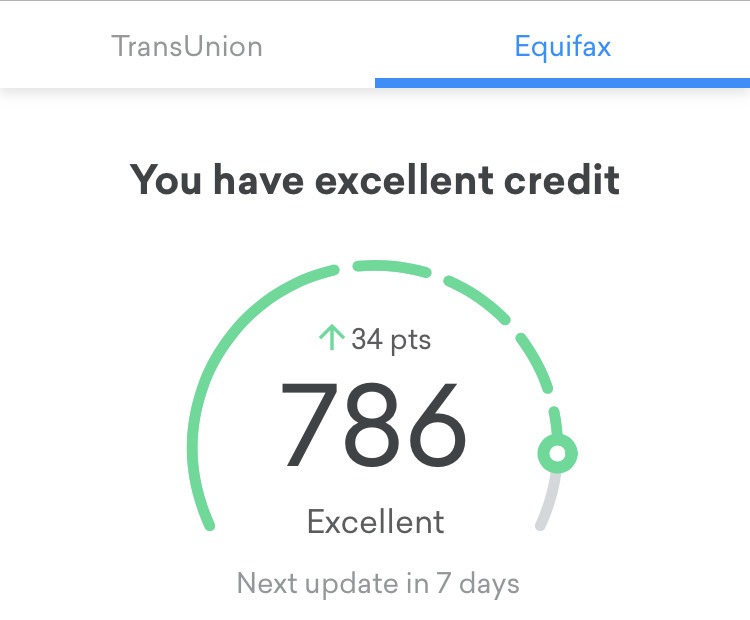

Basically, as soon as the old mortgage was closed, both my Transunion and Equifax estimated scores dropped. (Remember — these are just estimates of your true FICO score, but I found that they’re actually pretty accurate.)

I expected a small drop due to the hard credit inquiry but not the enormous drop that I saw. I obsessively checked my credit score for the next few weeks and I’m happy to report that things are back to normal now.

Here’s a visual of the effect of the mortgage refinance on my credit score.

And here’s how my credit scores looked after they recovered. (Visuals via Credit Karma)

Conclusion

A mortgage refinance seems to produce a large, but temporary decrease in your credit score. The associated hard credit pull will drop your score by a few points, but this should fade with time.

I don’t have a good explanation for this abrupt and severe change caused by the refinance. I think the credit score algorithm didn’t like the sudden shift in my credit load that was caused by the mortgage disappearing then reappearing on my report.

But I wouldn’t let the effect on your credit score stop you from going for a refinance. If you have a sizable mortgage or a high mortgage interest rate, a refinance to today’s historically low rates could make a huge difference in your monthly payment.

In our case, our mortgage payment went down by $500! We had to re-up to a 30 year mortgage again, but we decided that the $6000 of annual cash flow was worth this sacrifice.

By the 4% rule, this equates to $150,000 less that we have to save to meet our goal of financial freedom.

The temporary drop in my credit score seems to be back to normal now. So now I’m applying for a HELOC to gain access to the equity in our home. This will help accelerate the growth of my rental empire. I’ll let you know how it goes!

— TDD

Have you refinanced your house recently? Post about your experience below! Please subscribe to come along as I strive for morbidly obese financial independence!

Other Personal Finance Posts

- End of year investments update | 2019

- What’s a hedge fund? I interview a hedge fund manager to find out

- Why I bought a Tesla Model 3

- How accurate are credit score simulators?

- Mid year investments and goals update | 2019

- Why the rich don’t feel rich

- You can’t buy avocado toast with VTSAX (Why cash flow is king)

- Inheritance and intergenerational wealth transfer

- Retirement via an accessory dwelling unit (my parental support solution)

- Increase your credit score by 25 points in 4 weeks

- Detours on the road to financial independence

- How we amassed an investment portfolio of over $1 million

- The fastest way to improve your credit-score

- A Darwinian Doctor origin story: the meatball sub

- My 15 year plan to financial independence, moFIRE style

- How to calculate your net worth and savings rate

- What is moFIRE (morbidly obese FIRE) and why do I want it?

- The Darwinian Doctor’s 13 Monthly Expenditures (with real numbers)

- Golden Handcuffs: Why I can’t quit my day job (for now)

- The great blessing of inflation

- Student Loan Management Mistakes: How one mistake added $10,000 to my debt

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

1 comment

I recently went through a mortgage refinance that caused a temporary dip in my credit score, likely due to the credit score algorithm reacting to the change in credit load. Despite this initial setback, I highly recommend considering a refinance, as it significantly lowered my monthly payments by $500 and increased my annual cash flow by $6,000. Applying financial principles like the 4% rule has been crucial in aligning this decision with my goal of achieving financial freedom, and I’m looking into using a HELOC to further accelerate the growth of my rental portfolio.