Today’s post will outline in detail my 15 year plan to financial independence. I’m aiming for moFIRE, which is > $200k cash flow per year!

This post may contain affiliate links.

This financial independence plan has been updated after a few years of real estate investing. Take a look at the update here: How rental cash flow cut 5 years off our plan to moFIRE

Now that we’ve got a basic understanding of how to define one’s financial situation, it’s finally time to lay out my plan to achieve financial independence within the next 15 years. I’ve been dragging my heels on this, because until we got our draft taxes last week, I really didn’t have a great picture of how much income the Darwinian Dr-ess (aka wife) and I actually brought home last year.

With these figures in hand, I’ve put in some serious spreadsheet time and have mapped out a plan to financial independence. I realize that the numbers here are quite large. This is a result of good fortune, high income, and high cost of living. But it is important to realize that high income and financial independence are two very different concepts. Below, see my plan to go from just a good paycheck to morbidly obese FIRE within 15 years.

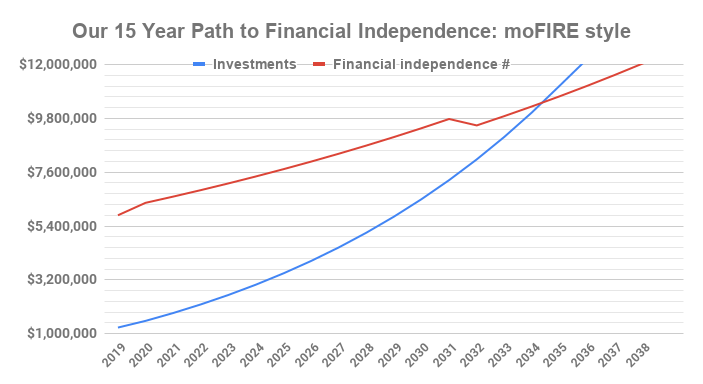

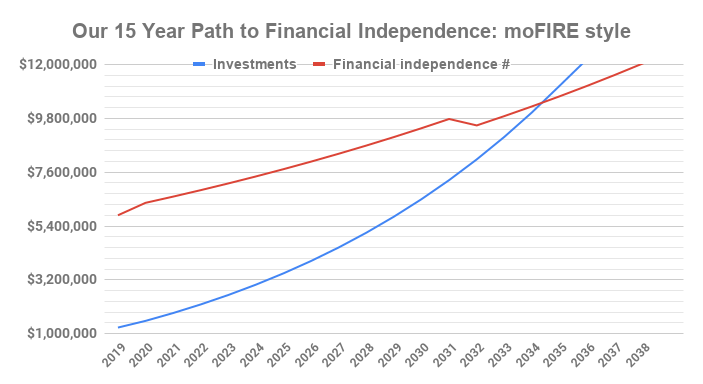

Red line: our “FI number.” If we reach this, we can retire

Blue line: the current and projected worth of our investments

This plan is based on a few important concepts, assumptions, and numbers. We can debate the nuances of the basic assumptions in later posts.

- Basic assumptions

- 8% average rate of return of investments

- 4% average rate of inflation

- Projected costs and expenditures (our “spending”)

- In 2019: $254,000 (recurring expenses)

- In 2034: $428,043 (inflation adjusted number from 2019)

- Financial independence number (spending * 25)

- In 2019: $6,350,000 (that’s a lot of freaking money!)

- In 2034: $10,701,086 (that’s even more freaking money!)

- Investments

- In 2019: $1,253,000

- In 2034: $10,765,864

- Between now and then

- Hold expenditures steady

- Max out retirement accounts

- Invest increasing amounts into our taxable and 529 accounts every year

- In 2034, Value of Investments > Financial independence number = FIRE

Why aren’t I using my net worth in the calculations? Please see this post for a discussion on the difference between net worth and investments.

And if you’re curious, see this post for a breakdown of how we spend our disposable income.

The success or failure of our 15 year plan to financial independence rests on 3 important necessities:

Hold expenses steady

With a detailed budget of our recurring expenses, I can project our 2019 expenses with fair accuracy. These are all the things that, barring some big life changes to our employment, house, or health, will routinely come out of our bank account each month. It doesn’t include big variable things like vacations and home repairs, but does include things like private school tuition, childcare, and the financial support I give my parents each month. All together, our current spending is just over $21,000 a month.

While this level of spending may seem incredibly wasteful to some, it’s the way that the Dr-ess and I have decided to live our lives for now. If we continue on this amount of spending in retirement, we’d be living a moFIRE (morbidly obese financial independence, retire early) lifestyle. On the other hand, if we keep on increasing our expenses even further, we will never reach FIRE.

So the first basic pillar of our FI plan is to keep our expenses as similar as possible to our 2109 projections. If we do end up with a surplus at any point, it can either be spent or saved, but cannot be spent in a way that commits us to higher recurring costs. In another words, our plan allows for a vacation, but doesn’t allow for us to finance another expensive car or move to a more expensive house.

These projections take into account an inflation rate of 4%, which as you can see above, is by itself responsible for a huge increase in the FI number over 15 years time.

Are you curious why the red line dips so significantly in 2031? That’s when I should finally pay off my student loans. Getting rid of that $2100/month loan payment drops our FI number by $52,500.

Max out retirement accounts

The Darwinian Dr-ess and I are very lucky. She works at a nonprofit institution in an administrative capacity that gives her access to both a 403b and a 457b plans, which in 2019 will allow for a total of $38,000 of pre-tax contribution. These are both “deferred contribution” plans that are similar to each other, except the 457 plan doesn’t have a 10% early withdrawal penalty if funds are withdrawn before the age of 59 ½ . The 403b plan is the nonprofit version of a 401k. She gets a match on the 403b that should add another $12k to that account in 2019.

Last year, I was able to max out my 401k plan. If all goes well in 2019, I’ll become a “partner” in my medical group. This will allow me to also start contributing to a “Keogh,” which is a type of tax deferred pension plan. Therefore, in 2019, I’ll likely be able to stash away around $37,000. This should rise to $56,000 in 2020 and beyond.

Between all of our retirement accounts, we should be able to put away around $86,000 in 2019 and $106,000 in 2020, with the vast majority of that being pre-tax income.

To cap it all off, we theoretically should both have access to pensions if we persist in our jobs for the next 10 years. Although rare, some employers, particularly government entities, still offer pensions. Pension payouts depend on the financial stability of the pension plans, which are famously underfunded in many organizations. So for the time being, I’m not going to include the pensions in our projections.

Invest increasing amounts into our taxable and 529 accounts every year

To get to our FI number of $10,765,864 in 15 years, we will have to also aggressively save a lot of our take home income every month. My 15 year plan calls for post-tax savings of about $5000 a month in 2019, $5500 a month in 2020, $6000 a month in 2021, and so on. Sticking to this plan will take discipline and won’t be possible if we continually expand our spending.

I am choosing to include our 529 accounts as part of our “investments”. This is controversial, because there are limitations on what 529 accounts can be utilized for without incurring a penalty. More specifically, if they are spent on anything other than educational activities, you’ll pay income tax and at least a 10% penalty on the earnings! But given the way the Dr-ess and I are approaching education now, we almost certainly are going to need to money. If it’s not in the 529 plan, it would come out of our other investments. So I’m going to lump it all together here. Since we don’t want to overfund a restricted investment vehicle such as this, we will keep this contribution to $1000 a month for both children.

Contribution of various elements to our portfolio in 15 years

I found this chart super interesting. This projects how much each pillar of our investing will contribute to our FI number in 15 years. While the future growth of our current taxable investments is important to achieving our goal of moFIRE in 2034, the biggest share of our investments by far will be from our retirement accounts. The second biggest contributor will be the growth of our future savings, which should kick off in earnest in 2019.

The $2000 a month going into our 529 accounts is a comparatively tiny portion of this pie, and should total about $725,000 in 2034.

Conclusion

So there it is. I’ve found the process of creating this plan incredibly beneficial. It’s given me a goal and proven to me that high expenditures doesn’t necessarily mean that you can’t ever achieve FIRE. It just means that you have to have high earnings and savings rates to match.

I fully intend to beat this projection and achieve moFIRE faster than 15 years, primarily by diversifying my income streams with rental real estate. As that starts to happen, I’ll adjust my projections on an annual basis.

A special note on taxes: astute readers will note that I’m not accounting for taxes in retirement. This is a good criticism. A 15% income tax rate, for example, might add 3 years onto the tail end of this plan. At this point, I’m not sophisticated enough to project this forward, so I’m just going to leave it out. As my investments evolve into a combination of taxable and tax sheltered buckets, I should be able to factor this into future projections.

— TDD

So what do you think of my plan for financial independence? Comment below!

Related posts:

- Golden Handcuffs: Why I can’t quit my day job (for now)

- The Darwinian Doctor’s 13 Monthly Expenditures (with real numbers)

- What is moFIRE (morbidly obese FIRE) and why do I want it?

- How to calculate your net worth and savings rate

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

10 comments

Awesome plan.

I started working in my medical career at age 31. Deep in debt.

17 years later (without making money a big priority) I reached FI at age 48.

That included a voluntary 80% pay cut. And a move from private practice into academia. You can do it.

Thanks for stopping by, Wealthydoc.

An 80% pay cut is quite something! Thanks for the encouragement. Looking at the way big expenses keep on popping up this year, I need it!

— TDD

I would love to see all young doctors perform this detailed financial planning at the start of their careers. You’ve shown here that with even the fairly high expenses of Southern California, saving for your children’s education, student loans, helping your parents (which I think is wonderful), you will still be able to reach financial independence in only 15 years, and you have a high quality of living now.

So many bloggers are penny pinching their youth away to reach lean fire by 30 or 40. I like your slow and steady approach, while enjoying a good life now. And of course a big shovel helps. But we physicians have worked hard to earn that big shovel.

Thanks so much for the words of encouragement, RocDoc!

I am the first to admit that docs do have “big shovels” to throw money at a lot of goals at once. And thanks goodness! Many of us are starting our real financial lives about a decade behind most others.

And yes — that’s the plan: try to live a full life both now during our accumulation phase, while also planning for a full and free life later on.

Thanks for stopping by!

— TDD

Y’know, you don’t have to pay for your kids’ college.

There are plenty of military retirees on early retirement forums who enlisted & then used the GI Bill or went ROTC during/OCS after undergrad.

ROTC scholarships are what my kids used to pay for their $50,000+/year private schools.

Military works for medical school as well…a relative my age took the Army’s offer to go to medical school when he was in his mid-30s.

Since he was prior enlisted he had to spend only ~15 years additional to reach military retirement (in his early 50s) & now works when he wants at civilian hospitals.

Great point Ncbill!

The military is a fantastic way of paying for college. In fact my dad used the GI Bill to attend college after his service in the Air Force.

I feel that having a large educational fund (529 plan) will give us the most options, though. This won’t stop us from searching for alternative ways of paying for college like scholarships and/or military service if that’s what my sons desire.

I’d see it as a huge victory if I could later donate their 529 plans to relatives, future generations, or friends.

The WCI Dr. Jim Dahle has some interesting comments on using military service to get an MD. My take is that he has mixed feelings on it, but it worked out well for him.

Thanks for the comment!

— TDD

This is the 2nd article I am reading on your blog and I have not disagreed with 1 thing you have said. I am really intrigued with your plan. I am still in training and would like to implement this plan as well after fellowship. I like that you included helping your parents financially. Most of the FI plans that I have seen are penny pinchers and doesn’t allow for things like that. I have to continue to help my family and I am glad that I can do both.

Hey Chris, thanks so much for the kind words! I’m glad my blog is in line with your goals. The doctor income is a blessing. While there are certainly some golden handcuffs generated by the cost of our training, the high income (along with intentional investing) can yield many interesting possibilities. I applaud your intention to help your family. It’s a rewarding way to give back to your loved ones. — TDD

This is a great post… almost more amazing is that you started your attending job with 1.2 Million of investments already . Most people dont get there in a life time.

I started my attending job in 2016, so it took us 3 years to get to that level, plus the money that my wife had been saving since starting to work in her early 20s.