In this post, I attack the myth “No work, no pay” and discuss why this mindset is holding you back from financial freedom.

This post may contain affiliate links.

Introduction

I recently wrote about my move from Los Angeles to Memphis. The blog post went mini-viral and was eventually read over 15,000 times, mostly by physicians. About 50 people felt strongly enough about the article to leave a comment about it on Doximity. The vast majority of the comments were negative.

I find comments like these fascinating because they are so raw and unfiltered. Behind the veil of a keyboard, these reactions are a magnifying glass into the psyche of physicians in our country. It’s been a rough time to be a physician, with the global covid-19 pandemic and the subsequent fallout in terms of burnout. So I wasn’t surprised to see some vitriol.

I’ve grown a thick skin over the last 5 years of blogging and content creation, so I’m pretty unfazed by the negativity. I see it more as an opportunity to clarify my message.

I was particularly interested in the reaction to the phrase “No work, no pay.” Let’s get into this phrase a bit more, and why I feel this is a harmful myth that is holding you back.

Read more: How Moving to Memphis Cost Us $500k

No work, no pay

At first glance, the principle of “No work, no pay” seems like a straightforward truth. It’s a mantra many of us have grown up hearing, a simple equation that equates effort with reward.

But when I read it, all I feel is a pang of frustration. Why? Because this phrase, as innocent as it sounds, encapsulates a problematic mindset that’s deeply ingrained in our society. (This counts double for physicians!)

Get your butt to work!

Let’s take the comment on Doximity: “Does he know how it works in real life when you are in private practice…. and if you don’t get your butskies to work, no one gets paid ? Welcome to the real world.”

This physician is right. If a private practice physician doesn’t see patients and do procedures, their practice will cease to earn money. The medical assistants, secretaries, and billers will also swiftly go broke. It’s a heavy responsibility.

When it comes to hourly workers whose rate of pay is specifically tied to the clock, even taking sick leave or vacation time will turn off the income spigot. In these cases, lack of work definitely equates to lack of income.

Here’s the message that the physician above missed from my blog post, though: Without converting the fruits of your labor into investments, you’re never going to reach your financial goals.

Necessary but insufficient

The fact is that for doctors, the mere practice of medicine is a necessary but insufficient factor to achieve financial freedom.

In the US, people work very hard for their money. There’s a lot of potential to get a good income, but along the way, Americans take less vacation and work more hours than the rest of the world.

The reward for your hard work in most instances is a paycheck.

Every two weeks, you get a check deposited into your bank account that puts a value on an hour of your effort. For bus drivers, this is compensated at a certain rate. For physicians, that same hour is compensated at a much higher rate.

But aside from the very highly compensated specialists, even doctors will struggle to meet their financial goals without investment. Forget about financial freedom, let alone early financial freedom.

You’re not going to get there without the compound interest that is only possible with investment.

Compound Interest

Just in case you forgot what I mean when I mention compound interest, it’s the “eighth wonder of the world.”

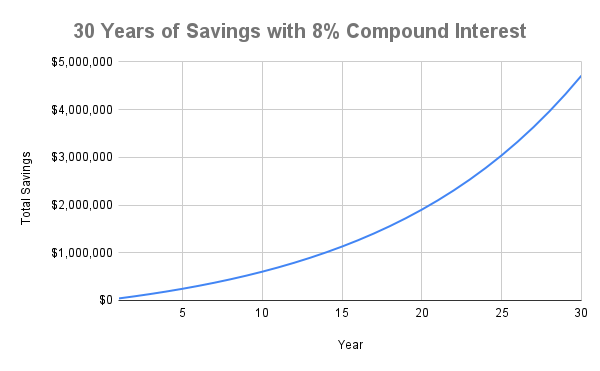

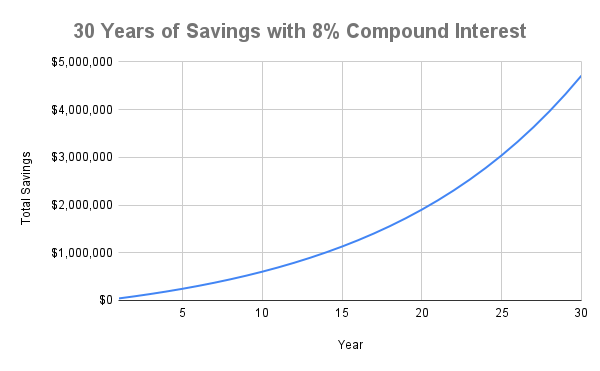

It refers to a type of investment that creates a return, which is then reinvested in that same investment. This “compounds” the growth, making the growth go from linear to exponential over time.

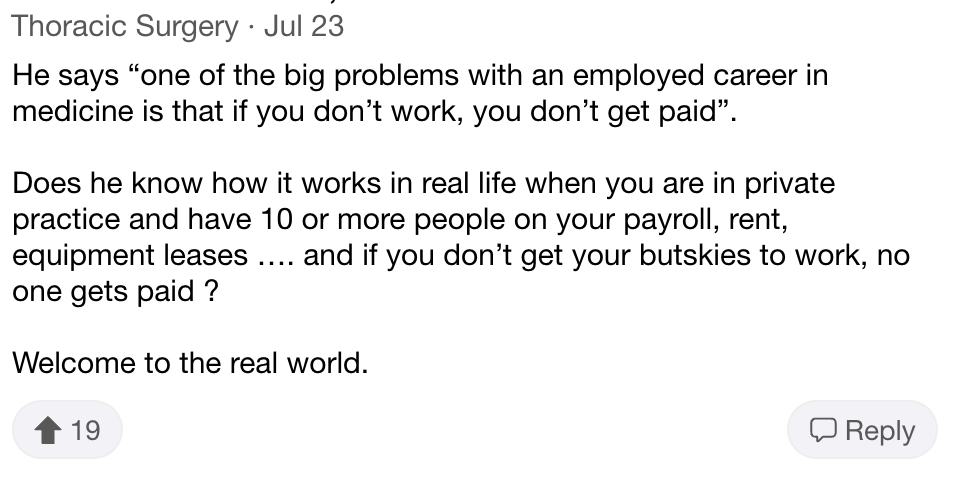

Here’s a typical doctor’s salary of $100/hour over 30 years. This math assumes no inflation, no investment, 40 hours a week, $208,000/year, and a 20% savings rate. That means $3467 of savings a month.

Now $1,248,000 is nothing to be ashamed of, but honestly it may not be enough money for a doctor to survive on for a dozen or more years after retirement.

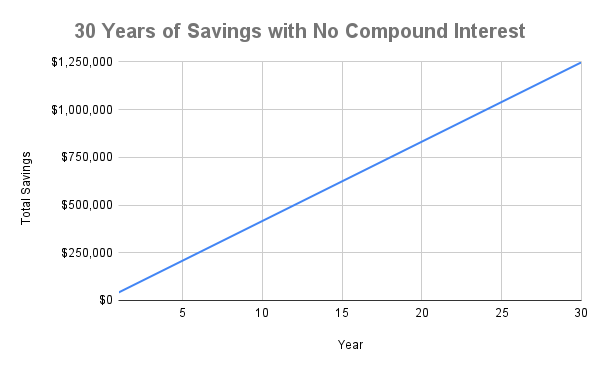

Contrast that with the savings total after 30 years of the same income, but with 8% compound interest.

With 8% annual growth after 30 years, you get $4,712,582 with the exact same savings! That’s 277% more money!

Now this math doesn’t account for inflation or taxes, but I think most would agree that $4.7 million is enough for a secure retirement.

Of course, this example is based on typical returns of the stock market via diversified index funds. When you consider the myriad of ways you make money via real estate investment, you can enjoy returns that are significantly higher than eight percent.

Read more: The 5 ways rental real estate makes you money

You get tired. Investments don’t.

When I was employed full time as a surgeon in SoCal, I worked about 50-60 hours a week. My commute added another 10 hours on top of that. Needless to say, when I finally got home, I was pretty tired. If I was lucky enough to catch my kids before they went to sleep, it was a good day.

And after wolfing down some dinner of my own, I’d be asleep myself just a couple of hours later. I didn’t make any money as a physician outside of the hospital, because I was employed. There was no ancillary income outside of the hours I spent in patient care or via administrative work.

So when I was sleeping, my income dried up. This is what I mean when I say, “No work, no pay.”

And this is the primary reason why I started investing my money – first via stocks, and then via real estate. Because while you might get tired, good investments are tireless. They will keep earning for you, 24/7, forever!

By investing your money, you’re able to greatly magnify your ability to create wealth. And for better or for worse, in our society, wealth = freedom.

Read more: Why I’m investing in real estate over stocks – Part 1

Working for money is perfectly fine

I want to be clear that I’m not criticizing the practice of medicine in some way as a career choice. I’ve written before about the enduring draw of medicine and my rediscovered love for it.

I really do love caring for patients as a physician and I hope to continue to do this as long as I live.

My point is that the income from a typical doctor’s job (either employed or in private practice), is not sufficient to achieve the holy grail of financial freedom and the autonomy that entails.

Financial freedom is empowerment

The reason why I’m such a proponent of financial freedom is that there is nothing more empowering than financial strength. Too many people in our country live in a position of financial weakness, entirely dependent on their paychecks to pay bills and debts. This is true for many physicians as well.

If you don’t believe me, just take a look at these statistics that show that only about half of physicians are millionaires.

Given the average income of physicians, you’d think it would be a higher percentage, right? Well, despite some of the highest incomes in our country, doctors also start earning substantial money much later in their lives, due to the schooling and training involved in earning the MD degree. We also accumulate a tremendous amount of student debt.

Those factors, plus the high cost of living in the expensive cities where most of us have jobs, can lead to a tough financial road for many physicians.

That’s “just life”

While again, many might argue that this is “just life,” I worry about our physician workforce, many who are stuck in employed positions that aren’t ideal. Since most physicians are both employed and burnt out now, poor financial reserves can be a big limiting factor for doctors to find positions that might be a better fit.

Read more: Doctors are More Burnt Out. Is it Being Employed or Just Covid?

A lot of this reasoning applies to our country at large, by the way. Although doctors accumulate some of the highest levels of student debt, we can generally pay it all back once we start earning real “doctor money.” Average employees in our country don’t have the doctor income to bail them out.

This is why I obsess so much about financial freedom. We have only one life to live, after all. We should do all we can to make sure that the majority of our hours are spent doing work that doesn’t cause us grief.

So how do you start investing?

As I said, the key to breaking free from the “No work, no pay” mindset lies in investment. By strategically investing a portion of your income, you can create multiple streams of income that generate revenue even while you’re asleep!.

The easiest way to invest is via the stock market, using index funds. Many of you might already be doing this via your retirement accounts. For doctors who may have additional savings to invest, you can also invest into the stock market via a taxable account.

I recommend reading the Simple Path to Wealth for more on why index funds just work.

Real estate should be on your radar

I’m obviously a huge proponent of real estate investing for the reasons of wealth creation, passive income, and tax benefits. You can get some benefits of real estate through REITs, but to really enjoy the myriad of benefits, you have to own it yourself. You can do this either through something like a real estate syndication or through direct ownership.

If you want to go the syndication route, there are a myriad of options out there for you to consider.

Note: It’s very likely that I’ll be putting together a group of investors soon to take down larger real estate deals. You can schedule a free chat with me below to talk about your goals and see if it’s a good fit!

Or if you want to go the private ownership route, you can consider taking a real estate investing course.

Starting is more important than being perfect

When it comes to investing, starting is more important than being perfect. As you can see in the charts above, you need to get through the first five to ten years of consistent investment before your investments really start to take off.

So just go ahead and start investing!

Conclusion

In conclusion, while hard work is commendable and necessary, it’s equally crucial to recognize the importance of investing to reach your financial goals. “No work, no pay” is a dangerous myth that we need to purge from our mindset. Instead, let’s replace it with another equally catchy mantra: Invest promptly, prosper perpetually!

— The Darwinian Doctor