In this post, I explain why I prefer real estate investing over the 401(k) retirement account. The 401k vs Real Estate debate: Let the fight begin!

This post may contain affiliate links.

Please run all medical, life, and financial advice by your own physician or financial professionals before applying it to your own life!

Introduction

At this point in my real estate journey, I’ve come full circle with regards to 401k retirement plans. In my first attending job after six years of residency training, I finally had a good paycheck with full benefits.

Initially, my wife and I socked away as much money as legally allowed into our 401(k)s and our other retirement funds (Keogh and 403b). We prayed that the stock market would work its magic and allow this money to grow to a large amount by the time we were ready to retire in our sixties.

In fact, I mapped out a careful plan to financial independence using the stock market. I calculated that these retirement funds together would all grow to over $4.6 million dollars within 15 years (as long as we continued to enjoy 8% compounded growth). I was convinced this was the safest and best way to grow wealth.

But after a year or two, I had completely changed my approach to investing. I was increasingly funneling all the extra money in our bank account towards real estate investments.

And after a few more years, I was actively looking for ways to free my capital from the “money jail” of my 401k. For me, the 401k vs real estate debate is over.

Why the change? Basically, I came to the conclusion that real estate investing offers a shorter path to financial freedom. I’m going to explain why I believe this. But before I make my case, let’s go over some basic terminology.

The 401(k)

The 401(k) is a type of retirement fund that allows account holders to save money “pre-tax”. The name of this retirement fund is based off of the relevant tax code from the Internal Revenue Service. Saving in a 401k offers tax benefits, because employee’s money can go into this fund prior to the usual income tax bite from the government. The money invested grows tax free and is only taxed upon withdrawal at retirement age.

The money you invest into your 401k reduces your taxable income, which can lower your tax bracket (and therefore your average tax rate). There is a limit to the amount of money you can save in your 401k. In 2023, the limit will be $22,500. Once invested, this money can be used to buy mutual funds or bonds as defined by your plan’s investment options.

If $22.5k seems like a large figure, it is. Only about 13% of people will ever max out their 401k, though some employers will offer a match. There are various IRS rules around a match, but employers can match up to 6% of your compensation up to the total contribution limit.

This is pretty dry stuff, but without a basic understanding of these funds, you can’t interpret the 401k vs real estate debate.

Real Estate

What about real estate? Well let’s first define that term.

For most real estate investors, “real estate” refers to physical buildings where people pay to live. Residential rental properties are not the only type of “real estate,” though. You can also invest in commercial real estate, raw land, farmland, and even a real estate investment trust. These all are types of real estate.

But for the sake of this argument, let’s consider “real estate” referring to residential rental real estate.

A common investment strategy for real estate investors is to purchase an investment property, improve it in some way, and then rent it out to tenants. This ideally provides a continual source of rental income, as well as additional benefits like tax deductions and appreciation. Over time, rental property can create a continual stream of passive income from rent payments.

As opposed to stocks, though, there are maintenance costs associated with real estate. Property taxes, insurance, landscaping, utilities, and repairs are all contant drains on profitability. Unless you properly balance these expenses with income, profit is not guaranteed.

Read more about how real estate makes you money: 5 simple steps to calculate your Real Return on rental property

What did I decide?

When it comes to my opinion about the 401k vs real estate debate, I’m firmly on one side. As my preferred investment vehicle , I decided to focus the majority of my money and energy into real estate over the past few years.

To be clear, we did like the tax advantages of investing into retirement funds pre-tax. We also like the diversity of index funds. So we still maxed out our retirement funds, but a far greater portion of our earnings were invested into real estate.

Here’s why I chose rental property investment:

- Real estate is more valuable in the long run

- Our money goals include early financial freedom

- The 401k limits access to your money

Real estate is more valuable

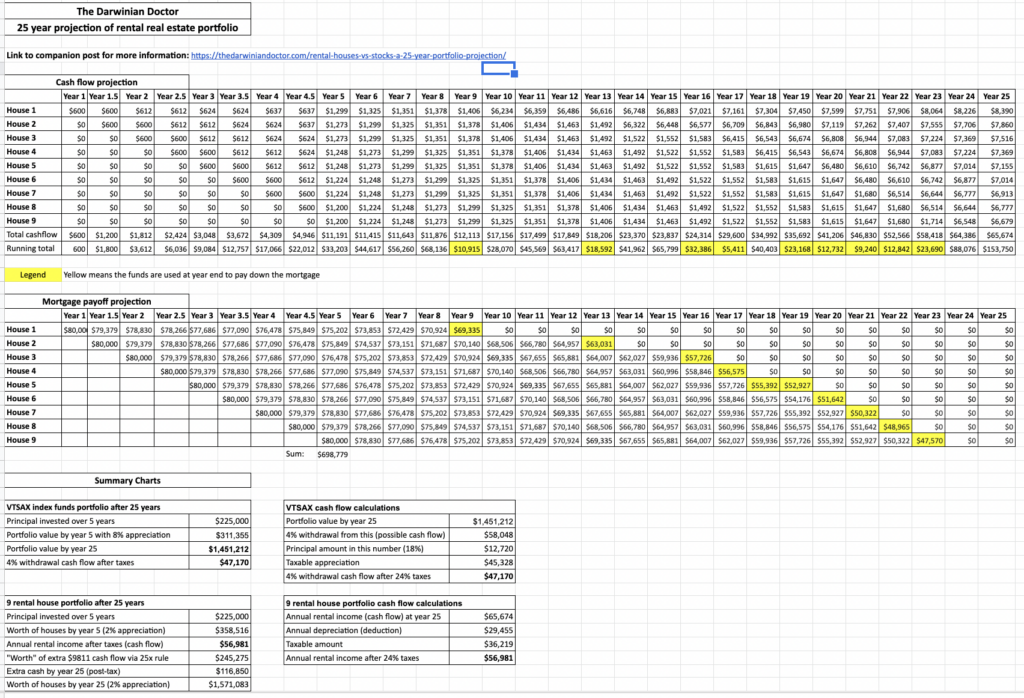

As a physician, I am very data driven. My wife also has an MBA and is comfortable making decisions based off of spreadsheets. So to help us decide how to invest, I made a big spreadsheet that projected the growth of a rental property portfolio over 25 years versus a similar stock market investment.

In each scenario, I invested $225,000 over 5 years. For the stocks, I assumed an 8% compounded return. For the homes, I assumed a $100,000 purchase price, $100/month cash flow, and 2% annual increase in both home value and rent. The monthly cash flow from the property accounts for all expenses such as maintenance and property management.

While nothing in life is guaranteed, my projection showed that rental property beat the stock market quite handily.

You can read this post for all the details: Rental houses vs. stocks: a 25 year portfolio projection

Real estate is better for early financial freedom

The beauty of residential real estate investment is that a lot of its return comes back in the form of monthly income. Rent is paid in cash, which can be used to directly offset living expenses. Therefore, real estate property can be thought of like a living, breathing money printing machine that can support your expenses and lifestyle.

Like it or not, you need cash (or access to cash) to live in our society. While stocks can be very valuable, you have to sell them to have access to their value. (Remember: You can’t buy avocado toast with VTSAX.) And if you don’t want to deplete your stocks before you die, you can only access 4% of it annually.

The 4% Rule is based off of the Trinity study, and you can read more about it here: The 2 Ways to Reach Financial Independence [Finance 101]

Based on this knowledge, real estate is a more efficient way to get monthly cash flow.

Here’s an example of this reasoning in action:

- $25,000 down payment + closing costs = $100/month cash flow = $1200 annually

- $30,000 in stocks = $1200 annual withdrawal via the 4% rule

Buying cash flow via stocks is therefore 20% more expensive than doing it via the real estate market.

Once I had this realization, we greatly accelerated the growth of our rental empire.

Read more about our growing real estate empire here: Anno Darwinii Archives

The 401k is money jail

Real estate investors love calling the 401k “money jail.” This means that it’s hard to withdraw your money from these accounts. This is by design.

If you try to withdraw money from your 401k before the age of 59.5 years, you will face:

- Income taxes

- Capital gains taxes

- An extra 10% penalty

This is just enough penalties and tax implications that most people won’t raid their 401k when they need money. To access money to finish my renovations in Palm Springs, I utilized a 401k loan, but this was limited to $50,000. This is a great way to tap some of your 401k’s capital, but it’s temporary. If you take out a 401k loan, you have to pay the money back to the account or risk the penalties listed above.

Read more about creative financing strategies here: 9 Creative Financing Strategies for Real Estate Investment

Why I still like the 401k

Despite everything that I said above, I’m not going to say that people should not invest into their 401k. I still think it serves an important role in the United States. Since the pension is largely a thing of the past, people need to save money for retirement. But without a convenient vehicle to do this, it’s just not going to happen. This is evidenced by the fact that half of all Americans don’t have enough personal funds to cover even a $500 expense.

The bottom line is the 401k is a form of forced savings in our country. Most people in our country won’t start a real estate business. This is due to everything from lack of a down payment to lack of knowledge.

For these poor souls, the 401k vs real estate debate isn’t relevant. In the absence of real estate, I think the 401k is better than nothing. It’s a perfect vehicle for many people to save for retirement.

How do you decide?

This topic could use its own dedicated post, but basically, I think you need to consider some basic questions:

- What is my desired timeline to financial independence?

- Am I interested in early retirement?

- Do I like real estate?

If you answered yes to any of these questions, I would highly consider real estate investment in addition to (or instead of) investing into a 401k.

Conclusion

If you’re a seasoned real estate investor, you probably don’t need any convincing that real estate is better than a 401k. The 401k vs real estate grudge match has already been decided.

But if you’re completely new to investing, I recommend you try to max out your 401k each year until you decide what’s right for you. I say this because it’s not easy to be a successful real estate investor, but it is easy to invest into your 401k. And given the paltry state of personal finance in our country, we need to encourage all forms of retirement savings for the long term.

I personally believe that a real estate purchase is better than investing into a 401k. But you need to come to your own conclusions. Take another look at my argument above and let me know your conclusions in the comments below!

— The Darwinian Doctor

Make sure to subscribe to the newsletter below!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

6 comments

I just wanted to say to diversify, real estate investing AND a 401K.

I love it. Who says you can’t have it all!?

I like the data driven approach to your decision making. We have been diverse in our investing over the last 30 years and have seen the benefits by maximally funding our IRAs, owning my office building, investing in a couple of small rental properties and putting extra $ into our brokerage account. Probably the best investment has been my office building which was paid off last year. We were never as intentional for the first 15 years of my career as you are wisely doing but were able to achieve financial freedom in my 50s. Your approach makes sense to use rental properties for cash flow and depreciation. Rentals do require attention though which is something we personally never seemed to have enough energy for more than a couple of properties. We will enjoy the cash flow of our office building when I call it quits. Thanks for writing this.

Thanks a lot for the comment! It sounds like you’re well positioned. Unspoken in a lot of financial writing is that a good income, steady investment, and time will set up most people very well for retirement.

Your comparison seems a little off due the fact that you’re not taking into consideration some of the benefits you mentioned for the 401k. You didn’t address if your employer offered matching for your 401k plans. Did you and your wife both contribute to 401k plans that had a zero percent match? Any matching provided by your employers would add to the 225,000 over the 5 years. The other part you didn’t address was the tax savings for your annual contributions. 45,000 a year off your taxable income at a 22% or 24% tax bracket (depending on your income and assuming married filing jointly) is about 9,900 to 10,800 a year you’ll be saving. What did you do with that money? If you further invested it in a Roth IRA (Or back-door Roth IRA if your incomes exceeded the limit for eligibility) that would be another account invested with growth that’s tax deferred and all tax-free after being opened for 5 years and you reached age 59 and a half. In addition, since it’s a Roth IRA all the contributions can be taken out at any time without penalty. That would be 49,500 to 54,000 in five years based on figures in my example. Which means over 25 years based on your calculations and 8% growth a year is around 370,000 tax-free!

Great point about the employee match. My 401k provider didn’t provide a match, but you’re right that many do. I don’t follow regarding the tax savings inherent to the 401k. Just because it’s tax protected doesn’t mean that you’re getting this money back immediately so you can invest it into something else. It’s only tax protected in the sense that it’s not taxed going in and it grows tax free. But overall a good point about something that I didn’t consider!