Today, I’ll show you how the pandemic changed the Darwinian Doctor family’s earning and spending.

One of the more practical reasons why I pursued a career in medicine was the perceived job stability. I never wanted to run the risk of my kids experiencing the kind of financial scarcity that marked my childhood.

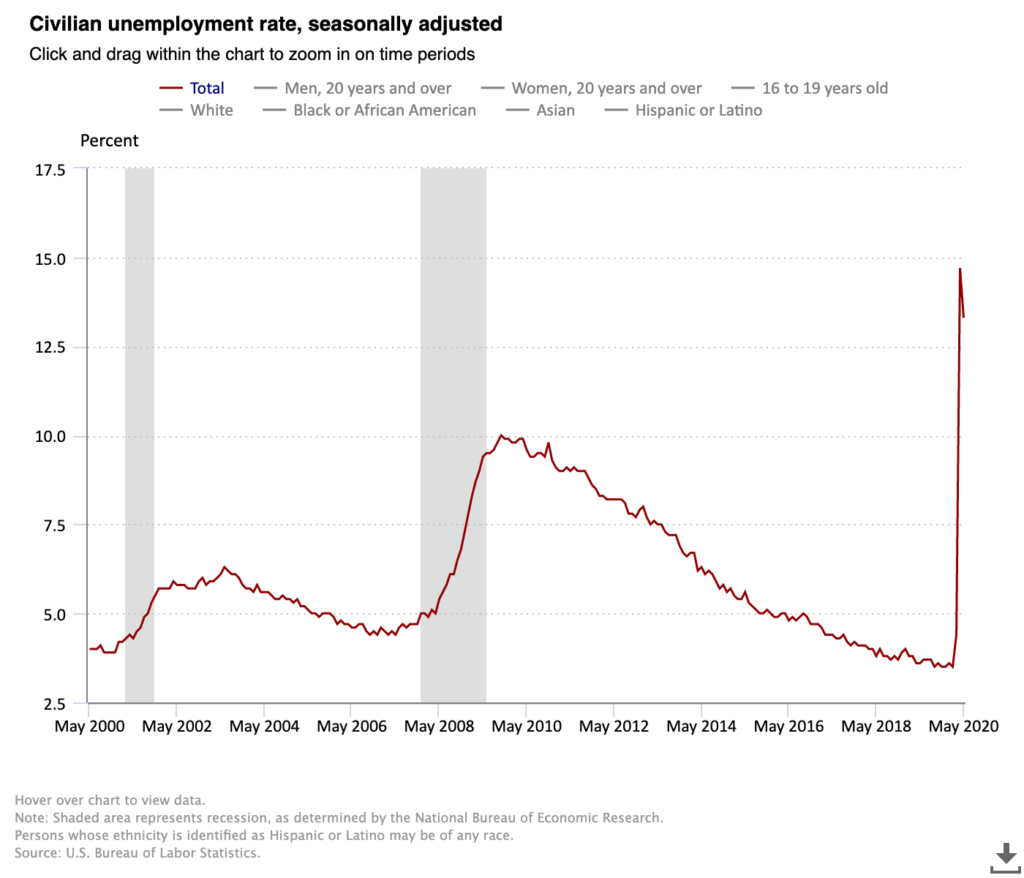

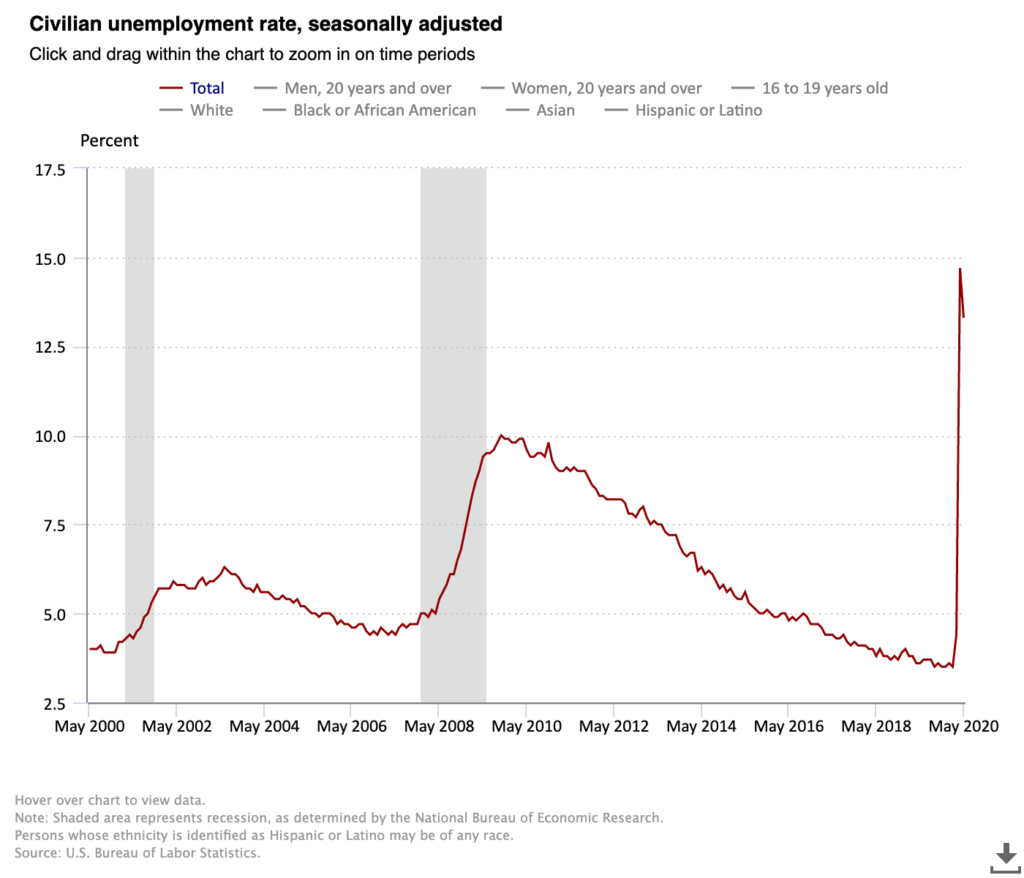

I guess you could say that this gamble has paid off, because I still have a job right now. This isn’t true for millions of people right now.

In May 2020, unemployment hit 15% in the USA, which is far worse than than what we saw in the Great Recession.

But even though I’m still employed, things definitely aren’t the same as they were prior to the pandemic.

Doctors are not immune to unemployment

So far in the USA, this pandemic has sickened 2.4 million people and killed 122,238, according to Johns Hopkins. Ironically, it’s also furloughed many doctors and put some hospitals and clinics on the brink of financial ruin. Without patients coming in for routine medical care, even the most profitable medical practices quickly run into issues.

In my own medical group, there’s a lot of belt tightening taking place. Surgeries and doctor visits are way down, and my work hours are limited to the bare minimum. This has led to an 18% drop in my paychecks.

This has led me to take a critical eye once again at our spending, to make sure the pandemic isn’t sickening our finances also.

How our spending has changed

Back in late 2018, I broke down the Darwinian family expenditures. When I tallied it up, I realized that we were going through about $340,000 a year.

This shocking figure really set the tone of this blog, and thankfully generated surprisingly little bad press. (This was mainly due to the fact that no one was reading my blog at that time.)

Now with the pandemic changing our lives, I went through the last few months of spending and compared it back to that post.

This chart below shows how our current spending (in red), compares to our spending in late 2018 (in blue).

Again, please refer back to this post for some more background details about these categories.

Beach Club: $750 → $300 a month

Yes, despite ostensibly being a personal finance blogger, we’re part of a beach club.

It’s been shut down ever since the stay at home order went into effect, and has only just started to open up for small groups.

We haven’t been back yet, so this cost has fallen to just our monthly membership dues. Without these dues the club likely won’t survive the pandemic, so we’re happy to pay this cost.

Car Payment (unchanged): $930 a month

The White Coat Investor writes that you should pay cash for your car, and also buy something cheap and affordable. I’ve had a Tesla Model 3 for the past two years. I financed the purchase with a loan from a local credit union at 1.9% interest over 5 years. I believe that I can end up wealthier in the long run if I invest the money that would have gone towards the lump sum purchase of the car.

But the monthly payments are huge, and it’s expensive to insure. The car loan doesn’t care that my paychecks are down 18%. It still demands to be paid every month. I can still afford the payments, but I see the WCI’s point a bit more clearly now.

Groceries: $1100 → $1260 a month

Our grocery budget feeds two boys and three adults (including our au pair). The Dr-ess and I have been spending significantly more time working from home, so we’re eating more of our food out of the fridge. I’ve written before how we also spend more to buy organic food, because of studies that show a lower cancer risk with organic diets.

I actually thought our food costs were going to be higher, so I was relieved to see that it’s only gone up 14% compared to our pre-pandemic costs. A lot of this increase is from delivery costs, since we now order groceries almost exclusively from Amazon. (That company is totally going to take over the world.)

Insurance: $780→ $1167 a month

We’ve got a lot of insurance. Here’s the full list, in no particular order: Life, disability, homeowner’s, earthquake, auto, and umbrella. The earthquake policy is new, which explains most of the difference here. Interestingly, our auto policies have refunded 20% of their premiums during the pandemic due to lower car usage.

Live in nanny (Au pair): $2240 → $1633 a month

I wrote recently how we solved our childcare problem by welcoming an au pair into our home. She’s actually significantly cheaper than the full time nanny that we employed when I last tallied our monthly costs.

But this is an expense I really hoped to eliminate at this point. Prior to the pandemic, we were getting by just fine without full time childcare. My parents were able to help out a few hours a day, and we used occasional babysitters to help with gaps.

But COVID-19 thew everything for a loop. The impossibility of working full-time while homeschooling two boys led us back to another live-in nanny within weeks of the lockdown.

Mortgage and Property tax: $7900 → $7860 a month

Our primary residence is by far our biggest expense. In 2018, 28% of our spending went to the mortgage and property tax payments. This is still true.

On the plus side, we recently refinanced our mortgage at a 3.5% interest rate, which dropped our monthly mortgage payments by about $500. But our property taxes went up significantly when we built an ADU in the backyard. (ADU = accessory dwelling unit).

All in all, we’re paying only slightly less every month for our house than we previously did. We’re appealing the huge property tax increase, so hopefully this will come down further if we win our appeal.

Other: $3200 → $3090 a month

This is the mysterious category that encompasses everything from birthday gifts and bedsheets to new pajamas and windshield wiper fluid. It’s always a few thousand dollars a month, and has stayed remarkably constant over the years.

Parental support: $1600 → $3080 a month

Since our last spending report, my parents have moved into our backyard ADU. They loaned us $150,000 to help fund the construction, and I repay them every month plus interest. So half of this expenditure is the loan repayment, and half is to help them cover living costs.

Private school: $1740 → $3830 a month

You can see from the graph above that our private school costs have skyrocketed. This is because our second child is now in an “early education program” (AKA fancy daycare). His older brother’s in kindergarten, so now we pay two private school tuitions.

Over the past year, I’ve waged a campaign in our household to move our kids to public school. I was making good progress on this front, but COVID-19 killed this campaign dead.

So despite a pandemic which has kept our boys home for the past few months, we are still paying through the nose for private school. This debate probably deserves its own dedicated post, so I’ll leave it at that for now.

Restaurants: $1120 → $219 a month

This is one silver lining. Since we’ve been eating at home so much, our restaurant spending has gone way down. We’ve still occasionally been getting take out to support our favorite local restaurants, but it’s still nowhere near what we used to spend on dining out. It’s going to be a long time until Sunday brunch and date nights are back on the menu, so I see this cost as staying low for the foreseeable future.

Savings: $4000 → $2000 a month

This has been one sad casualty of the pandemic. We’re still saving $1000 a month into 529 educational savings accounts for both boys, but we’ve stopped our extra savings for the time being.

For a little while before the pandemic, we were saving a ton of money each month to put towards real estate. I had set a glorious 5 year SMART goal to partial financial independence, and was rapidly accelerating towards this goal.

My lower paychecks have put a damper on this, but we still have capital to invest. Stay tuned for a report on what we’re doing in my next Anno Darwinii report.

Student loans: $2100 a month (same)

Like my auto loan, my student loan payment has not changed. I’ve got another 10 years of loan payments at my current rate, and still owe $220,000 at a 3.5% interest rate with First Republic.

I can’t wait to pay this off, but my stubborn analytical mind won’t let me spend extra cash on this. I still firmly believe that I’ll come out ahead in the long run if I continue to aggressively invest my extra capital.

Only time will tell if I’m right.

Utilities: $900 a month (same)

As far as I can tell, our utility bills haven’t changed very much. I’m charging my car at home now. This used to add about $200 in electricity costs a month, but we still came out ahead due to the fact that electricity is cheaper than gas.

Now that I’m spending more time working from home, my charging costs have gone down. The net effect is that our average utilities aren’t too different compared to a year and a half ago.

Total monthly expenditures: $28,000 → $28,360 a month ($340,320 annually)

I had to check my math a few times, because I’m amazed at how consistent this number is when compared to 18 months ago.

This translates to $340,320 a year of spending.

Yes, this is still a ton of money, and I feel both blessed and embarrassed to have this figure out in public. Thanks goodness the Dr-ess’ salary has stayed the same, so the only major sacrifice we’ve had to make is less post-tax savings.

Conclusion

So to summarize, the pandemic has caused a few major changes. My pay is down about 18% and our childcare costs are way up. Our monthly private school cost and parental support have both doubled since the last time I tallied our spending in 2018. To balance this all out, we’re saving less money and spending less on restaurants.

But we’re still spending a massive amount of money every month. It’s truly a frightening number.

Roughly 37% of our spending goes to paying back loans (car, private loan, student loan, and mortgage). While the Tesla will be paid off in a few years, my student loans are going to be around for another 10 years still. And the mortgage? I bet we’ll move long before that’s paid off.

I can fairly easily rationalize the wisdom of investing our extra money, rather than paying off all the debt. But does the debt keep me handcuffed to my job for the near future? You bet it does.

Stay safe out there, dear readers.

–TDD

How has your spending changed due to the pandemic? How much of your money goes towards paying back debt? How does that make you feel? Comment, share, and subscribe for more!

Related Personal Finance Posts

- How a mortgage refinance dropped my credit score 35 points

- End of year investments update | 2019

- What’s a hedge fund? I interview a hedge fund manager to find out

- Why I bought a Tesla Model 3

- How accurate are credit score simulators?

- Mid year investments and goals update | 2019

- Why the rich don’t feel rich

- You can’t buy avocado toast with VTSAX (Why cash flow is king)

- Inheritance and intergenerational wealth transfer

- Retirement via an accessory dwelling unit (my parental support solution)

- Increase your credit score by 25 points in 4 weeks

- Detours on the road to financial independence

- How we amassed an investment portfolio of over $1 million

- The fastest way to improve your credit-score

- A Darwinian Doctor origin story: the meatball sub

- My 15 year plan to financial independence, moFIRE style

- How to calculate your net worth and savings rate

- What is moFIRE (morbidly obese FIRE) and why do I want it?

- The Darwinian Doctor’s 13 Monthly Expenditures (with real numbers)

- Golden Handcuffs: Why I can’t quit my day job (for now)

- The great blessing of inflation

- Student Loan Management Mistakes: How one mistake added $10,000 to my debt

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

14 comments

Wowza! As a PCP in a lower cost of living region, I can’t quite wrap my head around your budget.

I wonder if you have thoughts about what you plan to do once the pandemic is over (whenever that happens). Will you continue to eat more at home? Will you say goodbye to the au pair? Do you think you will pay down your loans ahead of schedule? 37% of your monthly outflow is a huge burden.

Hi Physician in numbers,

I really appreciate the comment. The effect of living in a high cost of living area is very evident in my numbers here. The cost of our mortgage, childcare, and schooling are all greatly inflated compared to other areas of the country. Also, energy, water, heck, even HVAC repair is higher in Los Angeles. Where do you live?

It would be great if my salary was indexed to the cost of living here, but as a surgeon, this is actually not the case.

After the pandemic is over, we do hope to get by without our live-in nanny. Once school is back to normal, we’ll be able to manage the childcare without that much help.

I don’t plan to pay down any of my loans ahead of schedule. As long as I have a reasonable assumption of making more with my extra money with investments, I’m playing the numbers game and hoping to come out ahead in the long run.

Thanks,

— TDD

Thanks for sharing with such wonderful transparency. I understand you are a doctor and living in a HCOL bUt I can’t help wonder how long it will take you to become FI given you’re very expensive lifestyle.. This is my first time reading your blog (and won’t be my last) so maybe this is not a big goal of yours to begin with. I’m just thinking that at some point you will need to resolve the thin margin between your earnings and expenses.. In contrast, I earn on average $400,000 per year and drive a seven year old paid for Kia Sorrento. My current spending is around $100,000 per year and I save the rest. I Geo-arbitraged to the state of Florida from the DC metro area several years ago which has been a big boost to my monthly savings rate. I am completely debt-free and could stop working at any time – I am currently 51 with two adult kids that are off our payroll and well on their way to creating their own financial success story. I know we are not at the same lifestation but still. While I could definitely drive a nicer car and have a larger home I choose to live more simply because I know what really gives me peace and happiness – and it’s not things Or appearances, it’s relationships and empowerment to do what I want to do without being beholden to a job because of debt. In any event I don’t mean to sound critical but I’m very curious about your comfort level with your current lifestyle.

Hi Jules,

I really love this comment — thanks for taking the time to leave it! Your situation seems enviable indeed! Congratulations are in order. You’ve made all the right decisions, and you have the freedom now to live life on your own terms.

I invite you to check out some of my earlier posts, where I outline my 15 year plan to financial independence.

So FIRE is definitely a goal of mine. I had a somewhat elongated path to FIRE mapped out, but in the last year or so, I’ve endeavored to speed this up using real estate investment.

When it comes to our lifestyle, I admit that we have certain extravagances like the beach club and my car. Most of these extravagances came about before I decided to pursue moFIRE.

I’ve found it’s definitely hard to scale back, so this serves as a warning to others. I didn’t really see a need to scale back, though, as prior to the pandemic, we were saving almost $100k annually in retirement accounts, and over $50k annually for post tax investments like real estate. The pandemic has surely changed things, though, which prompted another hard look at our spending.

The amount we pay for our house always shocks me when I think about it. I’ll have to dissect this expense a bit further in another post.

Anyway, thanks so much for your comment — it’ll be a valuable counterpoint to the post.

— TDD

Thanks for posting this….

As a physician who makes 700k a year and spends similar to yours it is refreshing to hear from people who are financially aware but not trying to live on a resident’s salary….I am a bit farther down the path with one daughter who is a rising junior at the 7th most expensive college in the country and another who is a rising senior in high school. I am one of those “I have a investment portfolio of 6 million and the house is paid off do I have enough to retire?”

I am equally amazed at how people live on so little. My daughter just had to have her wisdom teeth removed which was 4k after insurance. We seem to always have some expense like that. We try and eat high quality food and organic, grass fed, pesticide free is really expensive. Just getting my daughter to and from Boston for school, paying for storage for her stuff over the summer letting her go out to eat with her friends is all very expensive. My wife and I consider our selves very frugal and our friends think we are cheap even spending what we do…I guess it is all relative but I do appreciate your perspective and feeling like there are others like us trying to live our lives and finding the balance.

Hi Jlo,

It’s really fun for me to read the different comments. As a finance blogger, most of the writing in this space is tailored to extreme frugality. It can be tough to find a tribe as a higher earner with large costs. I hope this blog is helping to create that tribe, and perhaps it can serve as a blueprint for others in a similar situation.

It seems you’re well on your way, so congratulations on achieving such a great financial position, despite your high costs. I bet that as soon as your kids are financially self sufficient, you’ll feel a lot more comfortable with your position. As you mentioned, I’ve got a long way before that happens for my family.

Sincere thanks for this comment!

— TDD

I’m enjoying your posts. It’s good to hear different views and your recent post shows just how personal finances can be for each individual. I think many of the finance blogs out there gravitate towards the more frugal side because most incomes tend to be lower than in medicine. It may be easier for many people to focus on the saving side than the earning side.

In general, I recognized our incomes are much higher than most fields and this offers me a point for reflection and gratitude.

It’s good that we recognize what we have and appreciate that others’ situations may be different than our own. Your blog posts will give you an opportunity to reassess your values and put words to them. No matter what you choose- lean FIRE or moFIRE, the journey, and self-reflection will serve you well.

Hey Medimentary, thanks for stopping by! I totally agree that writing allows us to critically think about various topics and come to conclusions. I love the process of thinking and writing.

I hope your own blog is serving this purpose for you as well!

— TDD

Absolutely fascinated by this post bc we have very similar earnings by my calculation but live on less than 2/3 of what you do AND I didn’t think we were on a path towards super early retirement! Maybe I need to go recalculate 🙂

My question for you is: do you ever consider moving to a less costly area? Part of why our expenses are so much lower is that your housing costs (and those associated) sound so high! Your same salary in a cheaper area with great public schools would be amazing and I can’t imagine the state taxes of Ca are helping in any way, either.

Yes, I think you should do your calculations again! You might be further along the road than you think.

We absolutely have debated moving. I think it’s widely acknowledged that for doctors, living in California definitely puts a damper on wealth accumulation. The state income tax alone can add 12.3% to your tax bill. And most doctors make less money here!

I’ve proposed a move to Florida, Texas, Nevada, and Washington state before. But for now, the Dr-ess feels that she has to be here in LA for her career. So here we will stay, for now.

I don’t think the pandemic will go on forever, so my income will likely rise back to where it was before. Spend less or make more money — these are the options to get to financial independence. We’re trying to make more money, and invest more aggressively. If that fails, though, we’ll have to work harder on decreasing the spending.

— TDD

I rarely chime in on blogs, but as a fellow SRMD course classmate, wanted to say thanks for sharing this! Refreshing to see some honesty and openness with budgeting, and huge kudos to you for supporting your parents! Not a lot of FIRE people share the same philosophy. And if it makes you feel any better, our budget is higher than yours (pre-COVID) in the VHCOL north…

Hello! This comment got caught in the spam filter for some reason. I’ve freed it now. Thanks for writing this!

I still hesitate about putting all my real numbers out there, because honestly there’s a lot to criticize about our spending choices.

I keep on doing it because there are many out there who are struggling with the same issues like you and me. Everything is relative. Even high earners and spenders need a tribe, and a path to financial freedom.

Thanks for commenting,

TDD

I’m sorry for you . I hope you really like your job and still can handle burnout well

Maybe read more and realize what your trading your time for … start with money or your life and mr money mustache and why not minimalism/zen etc ( it comes in a package if you think about it )

I’m a comfortable fire physician and I could make your choices but instead I’m working 0.75 – 0.5 relaxed…and I can actually spend time with my child and the way I choose to .

Good luck and think about it !

I agree with your Tesla but cash not financed !

Thanks for the good wishes and suggestions, Azi. We’re making some pretty big changes in the way we invest to achieve moFIRE in the not to distant future:

The real estate empire has grown! Anno Darwinii 1.0

The Dr-ess and I debate semi-regularly about moving to a lower cost of living area and living simply. I’d have to run some projections, but I bet we’d be very close to FIRE right now if we did this. But we’re trying to do it on our own terms, without sacrificing our lives in LA. We’ll see how well it works out! I might look back on this time in my life soon and laugh at our choices.

— TDD