There’s something different about millionaires today — they aren’t what they used to be. Read below to learn why!

This post may contain affiliate links.

Introduction

Millionaires aren’t what they used to be. I turned 41 years old last year, which means that I grew up in the 1980s. I’m from a small town in suburban New Jersey, and I remember vividly that the term “millionaire” meant something very different back then than it does today.

My family didn’t have much money when I was young, so I was used to the feeling of being poorer than most of my friends. But I can remember the knowledge that there were a few families in town who were different. They seemed to be really well off.

We’d whisper at school that so-and-so’s dad was a millionaire. We’d all widen our eyes as someone would describe their expensive cars, swimming pool, and mansion. These lucky kids were always wearing the trendiest clothes. They seemed better groomed and more attractive than the rest of us. They vacationed out of state over the winter and summer breaks, instead of just heading “down the shore” to the beach.

The thought of one day becoming a millionaire ourselves was never something that seemed possible.

There are a lot of millionaires now

Now, 40 years later, the term millionaire means something very different. In 2020, the number of people in America with investable assets of over $1 million rose 10% to 14.6 million people. Fueled by the asset price surges of the early pandemic, more millionaires were created in that one year than any time ever in US history.

In 2021, the number of “net-worth millionaires” rose to 22 million Americans, according to a survey by Credit Suisse. (This is inclusive of non-liquid assets like your house.)

If you were lucky enough to be a homeowner in 2020, you probably saw the value of your real estate shoot up. I was living in a big house in Los Angeles at the time, and I remember looking at the value of our home go up seemingly every month. It was a strange feeling, since the amount of money in our bank account stayed pretty much the same. But our paper, our wealth made a huge leap towards our goal of financial freedom.

Read this post for a net worth report from late 2020: The Darwinian Doctor’s net worth

Millionaires in 2020 are different

In 2020, around 1.3 million people in America became new millionaires. But if you asked a lot of those newly rich people how they felt about their financial situation, I bet you’d be surprised about their answers. Millionaires aren’t what they used to be. Now, millionaires don’t stop worrying about money.

There are a lot of reasons for this financial anxiety, including things like student debt, wage stagnation, and the hedonic treadmill.

While we could write a blog post about each of these topics, I want to focus on just inflation for the time being.

Inflation

I think good old inflation is the main reason why millionaires aren’t what they used to be. Your average millionaire is not like Bill Gates or Elon Musk. Your average millionaire is a “net-worth millionaire.”

The rise in value of their retirement funds or their home pushed them into 7 figure net worth territory, but their day to day life hasn’t changed. They still drive the same car and in most cases still worry about financial stability, just as they did before they crossed that arbitrary threshold.

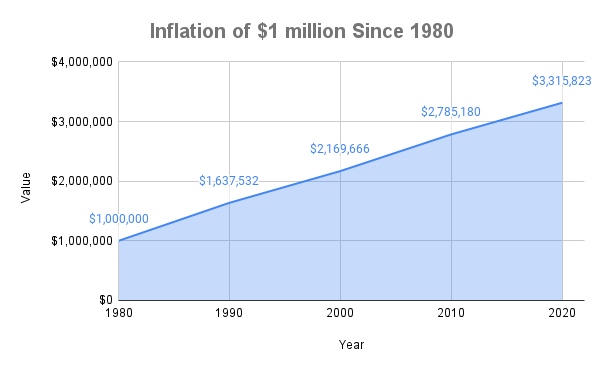

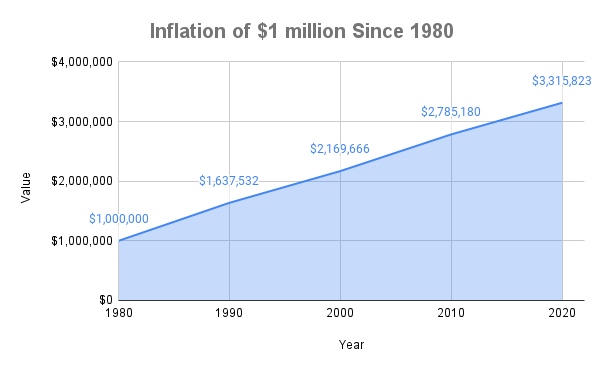

Because it is arbitrary. The cold hard fact is that inflation has devalued the term millionaire over the last 40 years. Take a look at the inflation adjusted value of one million dollars from 1980-2020.

That’s right. If you adjust for inflation, a 1980s millionaire would be worth at least $3.3 million today. When you take the inverse situation, a newly wealthy person with $1 million today has the same buying power as someone who had $301,584 in 1980.

When you look at those figures, it can make sense why millionaires aren’t what they used to be. The dollar just isn’t worth as much after four decades of inflation.

The number of millionaires in 1980 supports this math. Back then, there were only 500,000 millionaires in the United States. Now, as I mentioned above, there are about 22 million.

High inflation is scary

The numbers above are even more startling when you consider that the rate of inflation that produced this scenario was only 2.9% over that 40 year period. Given this fact, it can make sense why the Federal Reserve is freaking out over inflation that hit 9% in 2022. Can you imagine the cumulative effect of several years of inflation near ten percent? As a result of this rampant inflation, anyone with simple savings in the bank will see their wealth evaporate before their eyes.

Read more: Why is the Federal Reserve Raising Interest Rates?

To prevent this, you could move wealth into inflation protected assets like stocks and real estate, but this is not a fool-proof plan either. To really survive high inflation, you need some magical mix of pre-existing wealth invested in the right assets, plus a high income in an inflation protected sector.

While I’m going to guess most doctors will be okay in this doomsday scenario, the rest of workers in this country probably won’t be as lucky.

Read more about how I invest in real estate: Anno Darwinii Archives

The financial anxiety of the rich

As an average American, you might think that your financial worries might go away as you move up the ladder from the lower income brackets to upper-middle class to upper class. But you’d be wrong.

Financial anxiety doesn’t just go away once you hit some magical number of net worth. If you believe this, you are going to have some serious feelings of disappointment when you finally reach your financial goals. This “arrival fallacy” is a big reason why a lot of wealthy Americans continue to worry about money no matter how much they have in the bank.

As sung by the Notorious BIG, “mo money, mo problems.”

Wealth disparity

Despite this, I’m not going to sit here and say that $1 million isn’t objectively a lot of money. There’s a reason why amassing $1 million is still a goal for many people, even though we’ve proven that it doesn’t mean what it used to. Even though millionaires may feel poor, they’re not poor. That’s the bottom line.

And with increasing income inequality tied to the Covid-19 pandemic, it’s getting harder for the average person to jump up the rungs of the wealth ladder. A recent survey by the Census Bureau showed that this change is being driven by loss of income at the bottom, which will cause entrenched poverty.

Simply put, it’s getting harder than ever for poor people to join the ranks of the self-made millionaires without something special. You need an edge like an advanced degree or help from wealthy family members.

In my own history, I went the educational route. I graduated valedictorian in high school, went to an Ivy League school, then became a urologic surgeon. But I’m not so arrogant to think that I did it on my own. Despite our own financial struggles, my parents were still able to somehow maintain a suburban existence in a good town.

After I married my wife, the assets she brought to our marriage supercharged our wealth building.

Read more: How we amassed an investment portfolio of over $1 million

It’s not all gloom and doom

While it might be depressing to realize that $1 million is the same as only $300,000 in 1980, it’s not the end of the world. Amassing $1 million is still a rare feat and something that only 11% of Americans households were able to accomplish in 2020. Even though millionaires feel poor now, they’re not poor.

A million dollars is more than enough to buy a new car, a big house, and a nice lifestyle in most parts of our country. But that doesn’t mean that you should do all that if you’re a millionaire.

Wealth maintenance and growth

I think the financial anxiety of the wealthy comes out of the worry about maintaining, growing, and perpetuating their wealth. This is very different than just having a particular net worth on paper. This anxiety comes from the knowledge that hard work doesn’t automatically cause financial success.

Read more: Inheritance and Intergenerational wealth transfer

If you live in Silicon Valley, where your average home costs more than $1 million, having just a million in the bank might not seem like enough money to guarantee financial success for your family or offspring.

When you spend hundreds of thousands of dollars a year or owe a half million in student loans, even a six-figure salary doesn’t guarantee long term success.

To do that, you have to make intentional financial decisions to grow your wealth over time. You have to be able to ignore the cars that the neighbors have next door, and only buy a second home if you can turn your home into an asset. But more importantly, you have to be literate in personal finance and committed to building wealth through investing.

This is collectively the topic for another blog post, but if you’re interested in a primer on this subject, take a look at this post: How to Save, Invest, and Become Rich

Conclusion

The moral of this story is that $1 million today isn’t worth what it used to be when a lot of us were young. This is why millionaires aren’t what they used to be. A new millionaire in 2020 has money equivalent to only $301,000 in 1980.

When I look at the statistics, actual millionaires are still pretty rare in America. It takes more than just a good work ethic to get there. It takes some combination of luck, privilege, and hard work.

America has a lot of problems. Our healthcare has a ton of issues too. But I think it’s still one of the best places in the world to rise through the socio-economic ranks through education or ingenuity.

Good luck on your journey!

— The Darwinian Doctor

3 comments

There will always be something to seeing an extra comma next to your invested assets, regardless of how many digits that number includes. I’m yet to achieve 1980s 300,000 status, but it’ll be a nice moment to celebrate when it comes to fruition (and subsequently dips back below due to market fluctuation). Being a millionaire will always mean something, even if it’s diminished significantly due to inflation. Enjoyed this post!

Thanks so much! Yes, a million dollars is still a LOT of money. Just a lot less than in the 1980s.

I think it’s fascinating to see how the concept of a millionaire has changed over the years. It’s surprising to hear that despite the growth in the number of millionaires, many still worry about their financial stability. Inflation seems to be the main culprit for devaluing the term millionaire. It’s scary to think about the cumulative effect of high inflation, and it’s good to know that there are options for investing in inflation-protected assets.