It’s the end of the year and the stock market is flying high. Seems like a great time for an investments update!

To recap, we started the year in a strong financial position due to some lucky market timing, generous in-laws, and over a decade of frugal saving by the Dr-ess while I was in medical school and residency. In early 2019, we had about $1,253,000 in investments and cash.

Our goal is to be financially free in 15 years or less with over $10 million in investments to support a moFIRE level of spending. This will allow us to maintain our lifestyle in a high cost of living area like Los Angeles, even without traditional employment.

As a disclaimer, I’m a surgeon, and the Dr-ess is also well paid for the non-profit sector. This allows us to pursue big financial goals while spending what most would consider a lot of money.

Don’t ever count on a recession

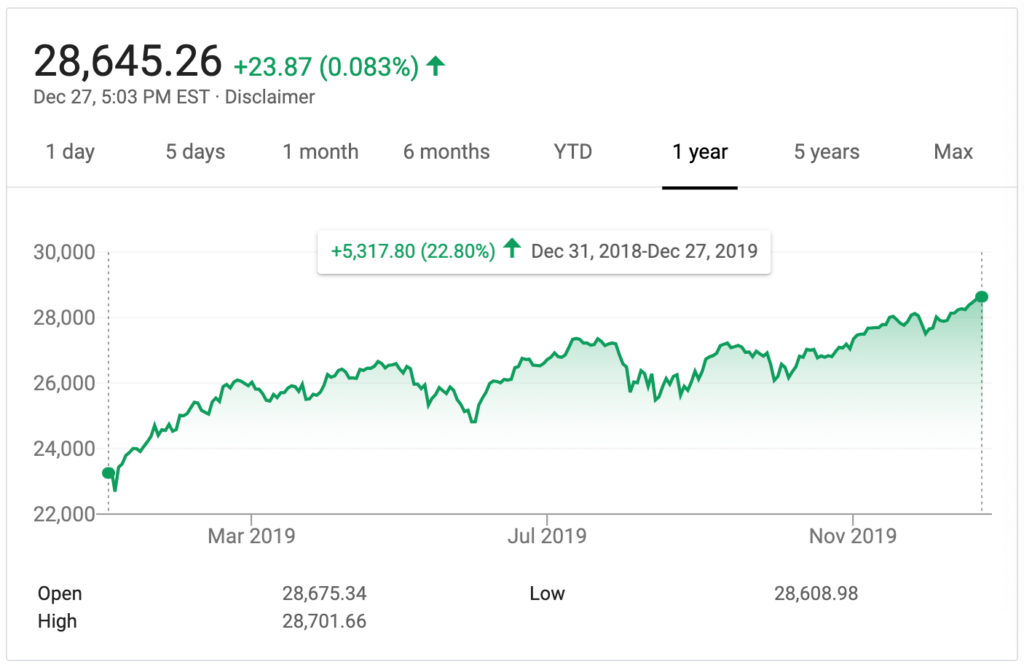

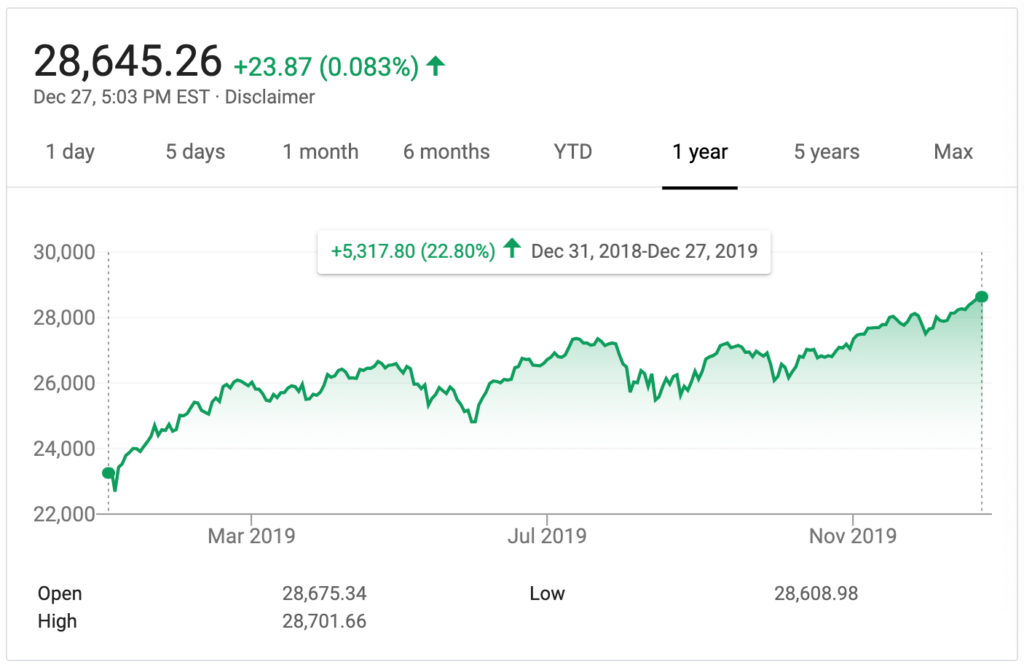

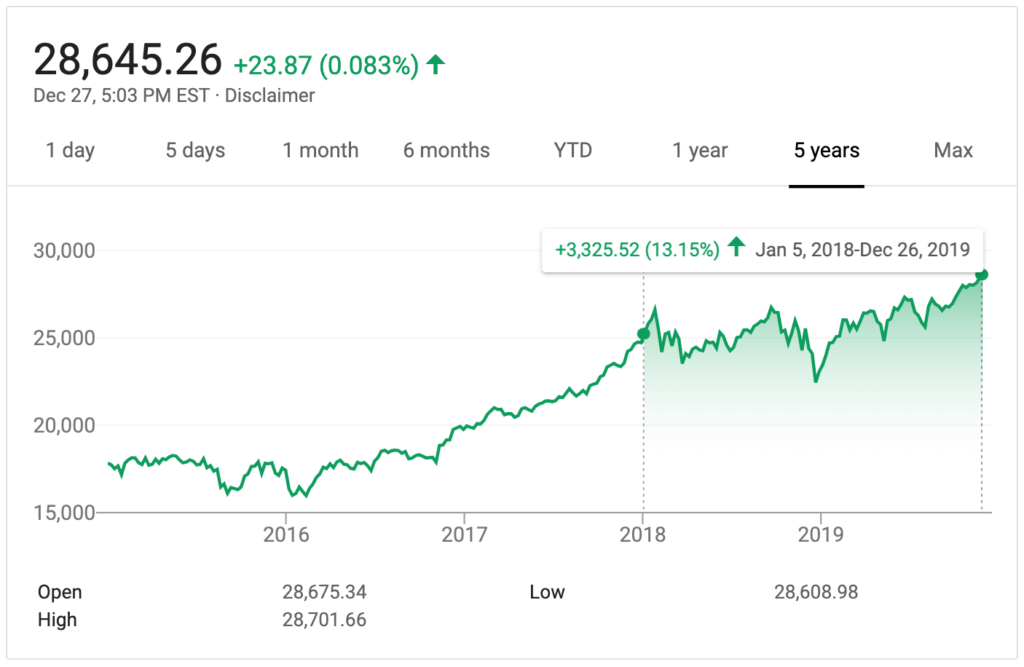

Despite constant fears of a recession on the horizon, the Federal Reserve and other interested parties have managed to stave off a recession for yet another year. This has made the 2010s the only decade in American history that started and ended without a recession.

Despite the great decade overall, the stock market languished for much of the year in fear of the American-Chinese trade war. It’s risen a lot since then, making 2019 a surprisingly good year for stocks.

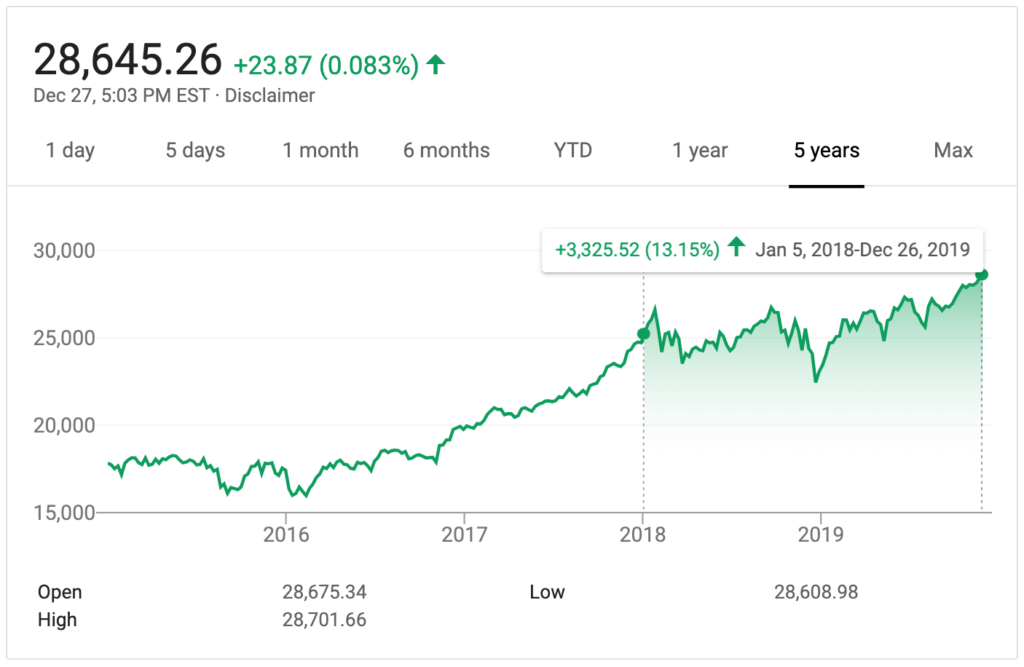

In fact, if we just look at 2019, the stock market (DJIA) has risen about 23%.

This makes the situation seem better than it is, since there was a sharp drop in late 2018. The total return in the market from Jan 2018 – Dec 2019 (2 years) is only 13%.

How did the Darwinians do?

I reported in July about our investments, and the news wasn’t good. Some large cash outlays for taxes and construction had put us significantly behind my projections.

But things didn’t end up as poorly as I feared. The recent rise in the stock market made up for much our cash hemorrhage from earlier in the year.

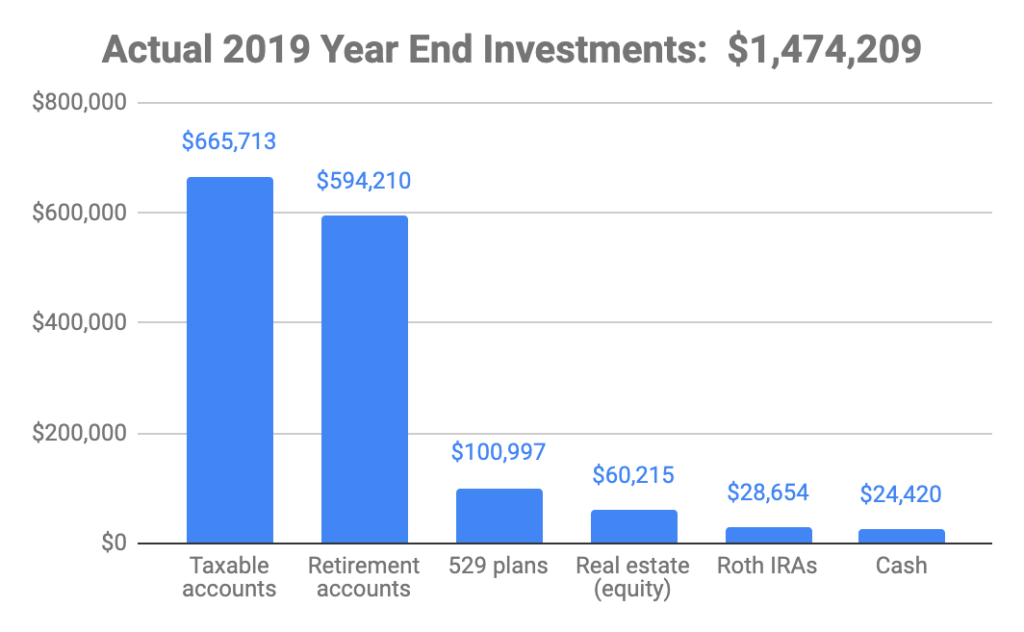

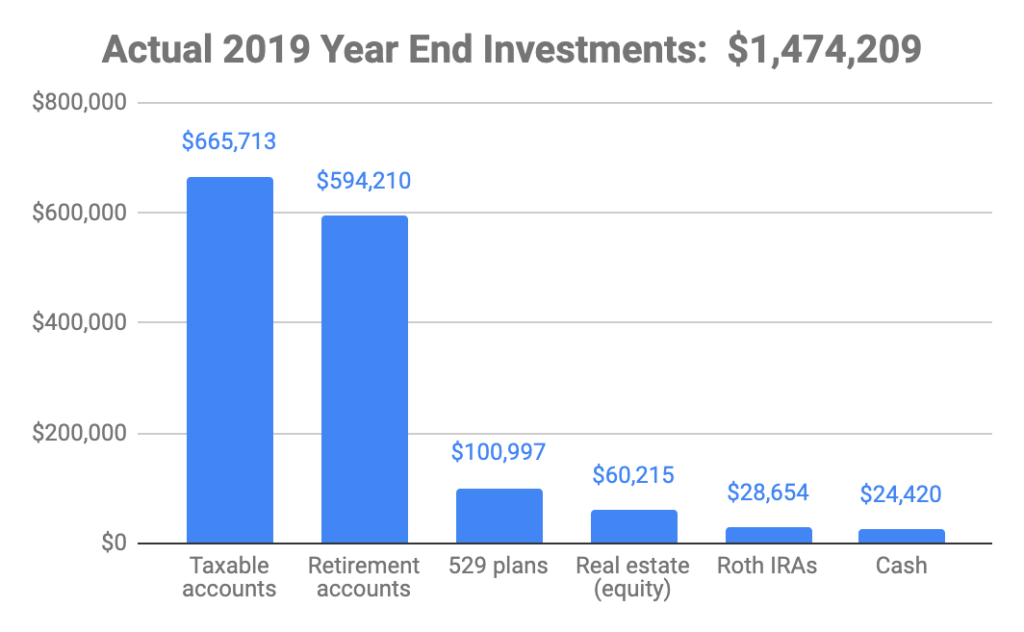

Here’s our investments update:

If we compare what I projected versus what actually happened, you can see that we’re short about $40,000.

The verdict

As you can see above, due to a strong rebound in equities, we ended up over-performing my projections in every category except for our cash stockpile.

So what happened to our cash? Well, basically 3 things:

- $50k to build an ADU to house my parents

- $40k to pay the IRS (under-withheld in 2018 + capital gains taxes)

- $9k for rent: we helped a sibling through a rough patch

Considering this extra $99k of cash outlay, I’m actually pretty satisfied about how the year ended financially.

In summary, our investment and cash portfolio grew by $221k (17.6%) instead of the $261k (20.8%) I had projected. (Please note that this is from both appreciation and brute savings, not just market gain.)

Conclusion

I’d say that we’re roughly still on track with our investment goals. We ended up about 3% below my projections, which is almost negligible in the expected variability of a mostly stock based portfolio.

If an actual recession hits in the next couple of years, rest assured that my numbers will start to look downright depressing. But don’t be fooled. I’ll be secretly excited for the opportunity to buy stocks at a discount.

Remember: As long as you don’t lose your job, a recession early in your investing career is a great opportunity to supercharge your portfolio.

Until that time comes, we’ll continue to stick to the plan, which is:

- Keep expenditures steady

- Max out retirement accounts

- Save increasing amounts in our taxable accounts

- New addition: purchase cash-flowing rental real estate.

Happy New Year!

— TDD

Related Posts

- How we amassed an investment portfolio of over $1 million

- My 15 year plan to financial independence, moFIRE style

- What is moFIRE (morbidly obese FIRE) and why do I want it?

- The Darwinian Doctor’s 13 Monthly Expenditures (with real numbers)

- Mid year investments and goals update | 2019

- Retirement via an accessory dwelling unit (my parental support solution)

- Update on the rental empire: Anno Darwinii 0.25

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

2 comments

Definitely a great year to be heavy in the market. We’re up 200% in our investment portfolio (of course the total value is less than your annual delta lol), not too shabby for first 5 months out in practice. Best of luck in 2020 and happy new year!

Wow great increase in your portfolio, congratulations! And certainly this is quite impressive just a few months into practice.

Thanks for the good wishes!

— TDD