How accurate are credit score simulators? Read about my recent experience for the verdict! Spoiler alert: they’re pretty good.

This post may contain affiliate links.

A few months ago, I did a deep dive into credit scores to make sure I’d get the best mortgage rate possible on my first rental property purchase.

I found that I was damaging my credit score by keeping my credit card balances too high.

So I started paying off my cards weekly to keep my “credit utilization” below 30%. This strategy worked, and bumped my credit score by about 25 points after just one month.

Credit scores are really important if you’re considering applying for a new auto loan, credit card account, or home loan. A good credit score versus a bad score can make a huge difference in everything from the interest rate on a new loan to how much debt you can get.

How should you monitor your credit rating?

So how did I monitor my credit score during my experiment?

Well, what I wasn’t doing was checking my real FICO score* every week. That’s definitely not a good idea.

*FICO is the registered trademark of Fair Isaac Corporation, which is the most popular credit scoring company in the United States. Their FICO scores are used to assess credit worthiness by every big financial institution.

Why not? Because like the Heisenberg uncertainty principle, whenever you do a “hard credit pull” to check your FICO score, you make your score “wobble”. Usually, an isolated hard credit inquiry will drop your FICO score by 5-10 points for up to 12 months.

This comes into play when you’re thinking about making multiple changes to your credit limit in a short amount of time.

For example, perhaps you want a credit limit increase from your credit card company, but also plan to apply for a mortgage refinance soon. Well, you probably should wait until after the mortgage refinance. The hard pull from the credit card increase could have a negative impact on your credit score and affect your mortgage refinance!

So how should you monitor your credit rating without affecting your FICO score? You should use simulators to generate a free credit score estimate.

Credit score simulators

Credit score simulators are free services that use “soft credit inquiries” to generate estimates of your credit score. You can choose from services like Credit Karma, Credit Sesame, and the Chase Credit Journey tool. (I’ve personally used the latter two options.)

With your permission, these services gather your personal information like your social security number, telephone number, and credit history. They take this detailed information and combine it with your history of late payments and other factors to generate a fairly accurate “guess” at your FICO score.

Read more about how credit scores work: The fastest way to improve your credit-score

My score before I decreased my “credit utilization”

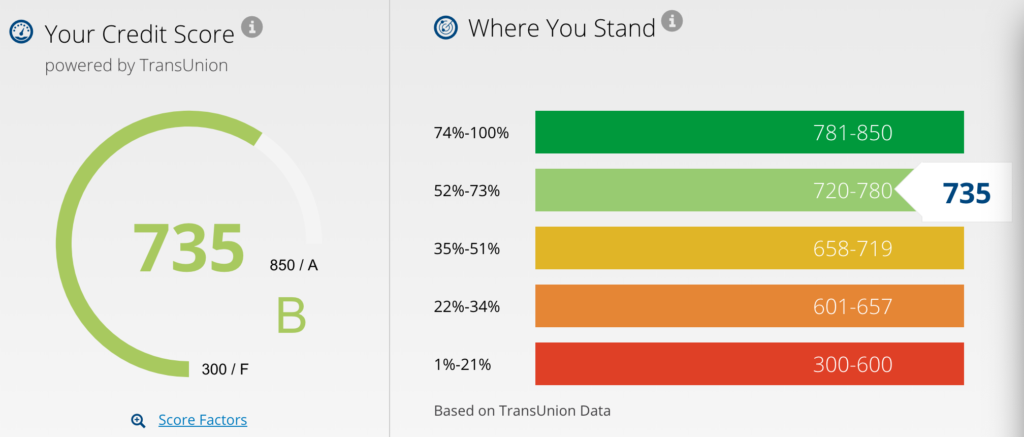

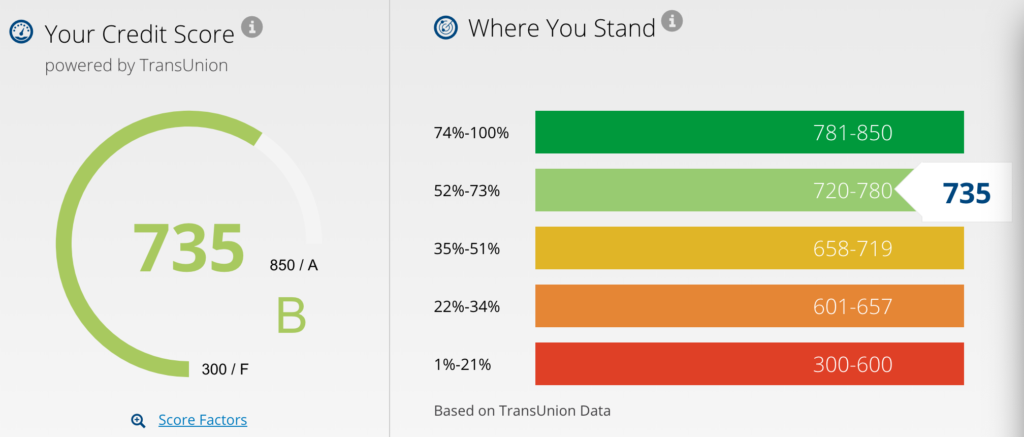

The Chase Credit Journey tool uses a different formula than FICO’s, called VantageScore. This slightly different system estimated my score to be 735, which is good, but not in the excellent category which would guarantee the best mortgage rates for those with the best credit.

The Chase estimate is based off of information from TransUnion, one of the three credit reporting agencies.

My score after I decreased my “credit utilization”

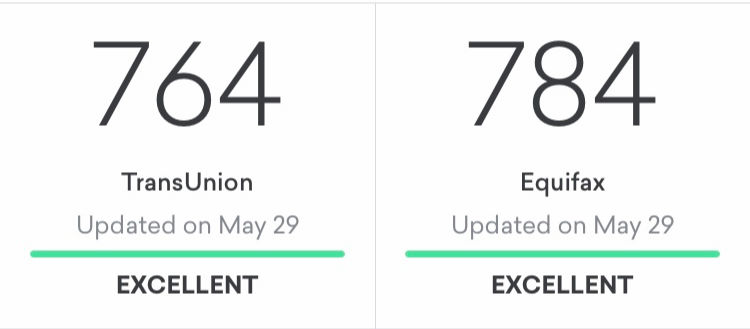

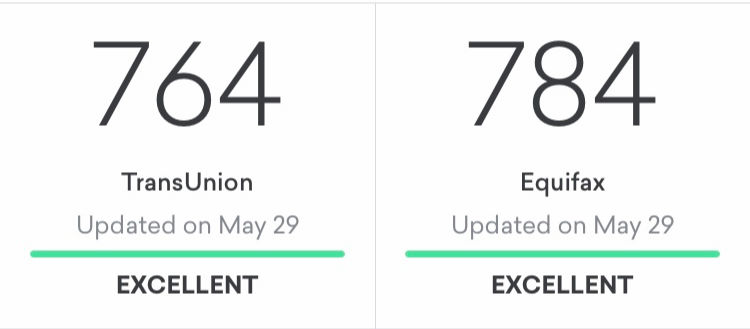

After keeping my credit card balances low for just 4 weeks, I was happy to see my simulated credit score shoot up into the best category.

This image below is from Credit Karma, which also uses VantageScore to estimate FICO scores from TransUnion and Equifax (but not Experian).

How accurate was the credit score simulator?

But how well did my estimated scores from Credit Karma match up to the official FICO scores that are used by almost all mortgage providers in their underwriting process?

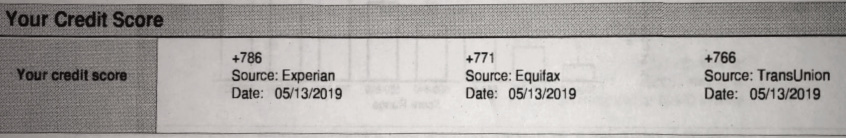

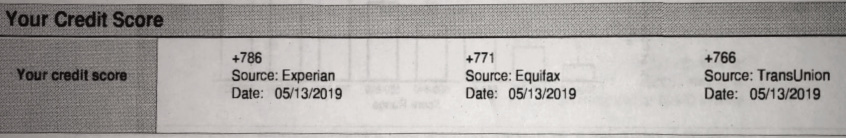

When my bank did a hard credit pull to get my official FICO scores, they sent me a copy of the scores generated from the three credit bureaus.

Here’s a side by side comparison of the VantageScores and FICO credit scores:

| Estimated score | FICO scores | |

| TransUnion | 764 | 766 |

| Equifax | 784 | 771 |

Update: Equifax value corrected. Thanks meowduchat for noticing this error!

As you can see, the estimated VantageScores were almost identical for Transunion, but off by about 13 points for Equifax.

What does this mean for you?

I think there are a couple of takeaways we can get from my experience.

First, it probably doesn’t matter too much if your credit score simulator uses the VantageScore or FICO formula. They seem fairly similar. I’ve noticed that banks will often throw out the high and low FICO credit score and just use the middle one, so the effect of outliers is lessened.

Keep in mind that for now, most banks still use the FICO score in their credit decisions, as opposed to the VantageScore.

If you want services that generate their credit score estimates using the FICO formulas, look at these guys:

- Discover Credit Scorecard (anyone)

- American Express (customers only)

- Bank of America (customers only)

Source: CreditKarma

Conclusion

So to sum up my experience, credit score estimators overall seem to be fairly accurate, but not perfect. If you’re improving your simulated score, your real FICO score is likely going up as well. But it’s definitely not perfect.

My estimated scores were off by 2 to 13 points from my true FICO scores.

If you want to increase your credit score, first you have to understand how credit scores work. You can make short term changes like decreasing your credit utilization for temporary bumps in your FICO score. But it’s really the basic changes that are going to make the difference in the long term:

- Make all your payments on time

- Keep your credit utilization as low as possible

- Don’t close old accounts to keep your credit history long

- Have a healthy mix of credit with both short and long term debt

- Don’t overload your credit history with too many unnecessary inquiries

So will the FICO score reign supreme for all time? Maybe, maybe not.

The Federal Housing Finance Agency just published new rules saying that Freddie Mac and Fannie Mae need to consider alternatives to the FICO score in the near future. This makes it possible that the VantageScore system will start gaining more legitimacy as a credit scoring system on par with FICO. Only time will tell.

— TDD

Have you found credit score simulators to be accurate for you? Comment below!

If you found this article useful, please subscribe to my free weekly newsletter (form to the right).

Are you a physician or physician spouse interested in real estate investing?

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

4 comments

That is useful information to know that the actual score and the estimated score are that close to each other.

I too use credit Karma to keep track of my score. Since they update it weekly I end up checking it that frequently. I like the ability to see if there is any unusual activity or any line of credit opened that I did not authorize so it is helpful that way too.

Hey Xrayvsn! Yes I like that it is essentially a credit monitoring service as well. I’m not sure if it’s as thorough as dedicated services, but it definitely notifies me whenever I open up new lines of credit. Their app is very mobile friendly as well. As long as you can ignore their incessant credit card suggestions, you’re good!

— TDD

Um…I think maybe you made a mistake in this article? The compared numbers are not from Equifax. Looking closely at the images, one score is from Equifax and the other is from Experian. The two Equifax scores aren’t nearly as close – 784 vs 771.

Thanks so much for noticing this error! I’ve updated the post and credited your discovery. Great catch. — TDD