It’s a common saying that “A fool and his money are soon parted.” Doctors are no fools, so why are doctors often such bad investors?

This post may contain affiliate links.

At any given moment, about half of the physicians in the US aren’t millionaires. While certainly this is true for most Americans in general, doctors make much more than most Americans. In fact, compared to the average income in the United States of $87,864, physicians make 3-4 times more income than the average. Specifically in 2020, physicians reported an average annual income of $243k and $346k, for primary care physicians and specialists, respectively.

So with such high incomes, how is it possible that all physicians don’t retire with millions of dollars in the bank? There are many reasons. Here are just a few:

- A relatively short earning career

- High student debt burden

- High lifestyle costs

- Bad investment choices

We could talk endlessly about these reasons, and I’m sure we will at some point. Today, I’m going to focus on this last factor: bad investment choices.

How to be a bad investor

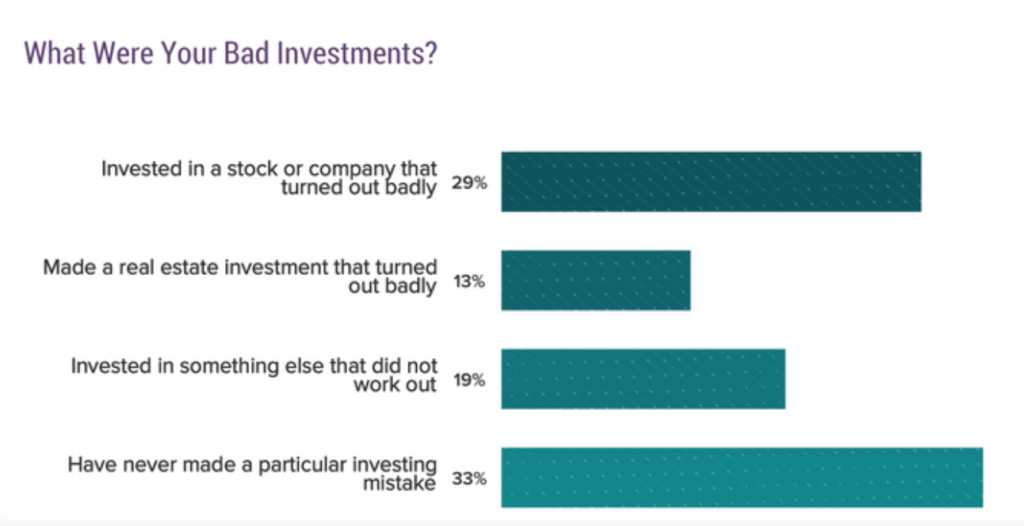

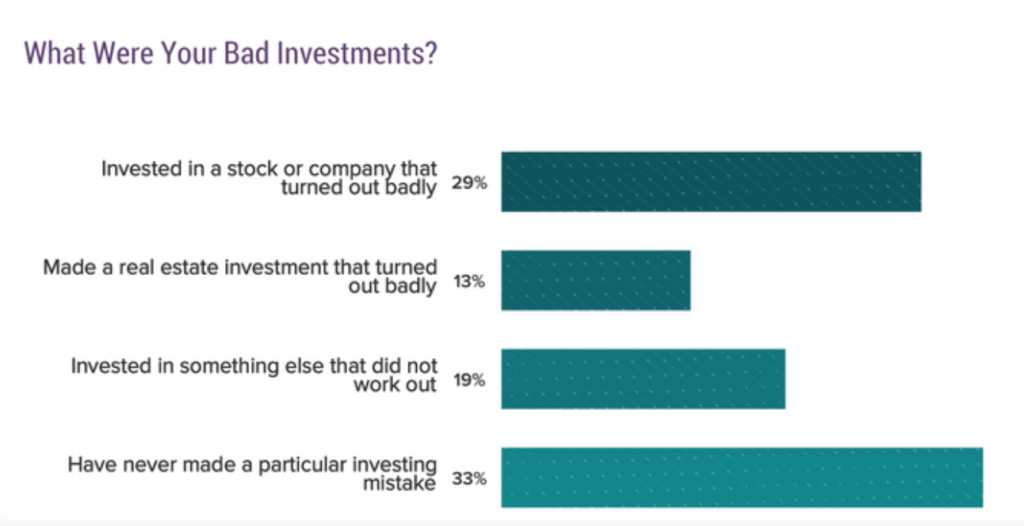

In the same Medscape survey that revealed the high relative income of doctors, it also showed that about half of them reported making bad investments in stocks or real estate.

When you think about the factors that may make it more likely for doctors to become bad investors, a few damaging beliefs come to mind:

- “I’ve got to make up for lost time”

- “I’m smarter than everyone else”

- “I’m too busy, you should do it”

Let’s review these one by one to understand the origin of these beliefs.

“I’ve got to make up for lost time”

By the time I finished residency training, I was 34 years old and $300,000 in debt. If not for the Dr-ess, my family would have started out earning money a decade after our friends who went into other professions.

It takes an incredible amount of education and training to become a physician, and especially a specialist. This takes a really long time. Including college, it was 17 years before I earned my first paycheck as an attending physician.

I remember the first couple years of my job. I had this frantic feeling that I needed to make as much money as I could, as fast as I could, to make up for lost time. I pushed myself to work more hours, but rapidly found myself on the brink of burnout.

This feeling crossed over to investing as well and is one of the main drivers behind my decision to transition from index fund investing to rental real estate investing.

Bigger returns, faster returns — now. This feeling, if not directed with care, can make doctors the perfect mark for bad investment choices and get rich quick schemes.

“I’m smarter than everyone else”

This is an interesting belief, because in many cases it’s true. As an aggregate, physicians have some of the highest IQs of various professions. The entire process to become a doctor selects for high levels of intelligence and motivation.

The fallacy is for doctors to believe that sheer intelligence will automatically make you a good investor.

A physician might be an expert at recognizing the difference between a cancerous or benign blob on a CT scan. But recognizing a great stock or a great real estate investment? Not necessarily.

“I’m too busy, you should do it”

Finally, many physicians are quite busy. The average doctor works about 52 hours a week. With these long work hours, it is quite tempting to offload financial management to others.

While surely the vast majority of financial advisors are quite ethical, there are certainly some that are salesmen masquerading as advisors.

Over time, high management fees and poor investment choices can have a significant impact on a doctor’s ability to accumulate wealth.

What should we do about it?

So how do we combat all these beliefs that can make doctors into bad investors? I have a few thoughts.

First of all, don’t panic. It’s true that most of us are starting behind the eight ball when it comes to wealth accumulation. But even with a shorter runway, physicians make enough money to make up for lost time. With a well constructed financial plan, you can hit your goals, whatever they might be.

Second of all, be humble. Recognize that vast scientific knowledge doesn’t always translate into financial wizardry. Take the time to educate yourself in any area where you plan to invest. I only started to accelerate my real estate investment, for example, after I took a formal real estate investing course.

Finally, take ownership. Realize that your financial future is your responsibility. Don’t offload all the details to an advisor without having a basic understanding of what is happening to your money.

Conclusion

So there you go. I hope this helps you understand why many doctors are such bad investors. If you’re hearing some of the damaging beliefs echoing in your mind, just repeat after me: “Don’t panic. Be humble. Take ownership.”

Hopefully this mantra will help you get on the path to success.

–TDD

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

15 comments

TDD,

I enjoyed the post. I’ve noticed a couple of themes among my colleagues- giving up control and exchanging money for time. Sometimes it works, sometimes it doesn’t.

Many of my colleagues have been sold expensive investments with high fees and just give up control to their financial advisors. They trust their advisors to look out for them.

I’ve also noticed a lot physician bloggers creating and selling courses to other physicians to quickly teach them investing principles, real estate etc. While they could be worthwhile, I’m amazed by how much these courses cost.

I encourage my physician friends to take back control and learn from a ton of free and cheap resources already out there- bogleheads, WCI forum, Physician on FIRE, books by Bogle, JL Collins, Bernstein.

Hey Medimentary, we definitely agree about the risks of giving up control of your investments.

It’s an interesting thing you note about the courses. I’ve noticed it too. I feel that some are great and worth the money (and some are not). For example, the real estate investing course I took was over $2k, but I feel that it accelerated my knowledge and investments immensely.

My review here: Review of the Semi-Retired MD’s Real Estate Investing Course

So True,

It is ever-so-slightly getting better though.

Thanks to blogs like yours!

And yours, WD!

Perpetuating the stereotype that “doctors are lousy business people” is self destructive to our profession and our colleagues. What is the evidence that medical professionals get less return on an investment portfolio than members of another profession?

https://www.linkedin.com/pulse/why-do-people-say-doctors-lousy-businesspeople-arlen-meyers-md-mba/

Respectfully, my post isn’t arguing that doctors are lousy business people. It argues that many doctors report bad investment choices, and puts forth a few reasons why this might be the case. This post further argues that high income earners should in general retire with significant assets, and explores why this often isn’t the case.

Thanks for commenting, and thank you for educating physicians.

Just 29% of active U.S. stock fund managers beat their benchmark after fees in 2019. That declined from 37% of funds beating their benchmarks in 2018, the average success rate over the past 15 years.https://www.barrons.com/articles/if-you-still-own-actively-managed-stock-funds-get-ready-for-some-bad-news-51579691701

When it comes to finance M.D. stands for mental deficiency.

Old money is always worth more than new money.

Standard and thoroughbred horse breeding and distilling alcohol being old money, along with some car dealorships.

You can’t get wealthy buying a new car every two years, and the most expensive house ever built in town won’t help when your X Spouse takes it, along with a monthly pet grooming fee. Whatever you can squirrel away is great, but just remember you can’t take it with you.

Not all physicians are poor investors. My suggestion, read “The only investment guide you’ll ever need” by Andrew Tobias as soon as you finish training. Then, read it again.

I’ll have to check it out, thank you for the suggestion!

[…] be poor investors. At least, according to the Darwinian Doctor–and it’s hard to disagree. In this post, though he sheds some light on why that can be the case, and what can be done about it. There’s a […]

TDD,

“Don’t panic. Be humble. Take ownership.” Is a great mantra. I think you did a great job pointing out the pitfalls that we can fall into. In general, physicians can retire comfortably by simply following standard retirement plans. However, Physicians just like anyone else can get into trouble by trying to speed that process up….. Don’t panic…. if you want to retire early or think your investments should grow more quickly then take the time to learn how to invest….that may be real estate, commercial, Multifamily or short term rentals. Or you may want to add more to your stock portfolio. Whatever avenue of investing you chose it is worth learning as much as you can about your chosen investment vehicle…. you can chose to do your own research or take a course. There has been a lot of criticism about physician courses but I would rather take a physician taught class then a financial “guru” course and I have taken a physician course. I would recommend that physician investors continue to max out their retirement…. these investments should be done with additional savings.

I love this, thanks for commenting, Carpe Diem MD! I agree that it’s helpful learning from a fellow physician. There’s something about that shared background and experience that seems to make the learning more effective. I’ve been toying with the idea of pulling from retirement savings to invest in real estate, but I haven’t pulled the trigger yet. It feels nice having the retirement funds there as a “backup.”

We can all generalize but everyone’s situation is different. That being said, let me GENERALIZE!

Docs tend to be more conservative than aggressive.

If you want to be above average: Spend less than what you earn.

If you want to be top 20%: Max out your 401K, pay off high interest debt first, and buy real estate prudently.

If you want to be top 1%: you have to LOSE a ton of money.

Invest aggressively in real estate, lost some but overall hugely positive gains especially if you hustle and accrue a decent size portfolio- along the way you experience huge repairs, tons of evictions, but over time your portfolio becomes very valuable

Don’t get stuck in analysis paralysis, make mistakes and learn from them.

Start a business – succeed or fail, it doesn’t matter.

Invest in a lifetime worthy company, invest a lot, invest often, WAIT.

Don’t use leverage + options at the same time.

I’ve done all those things and more. Made millions, lost millions and still doing better than 99% of all physicians I know.

Sage advice! I think that the prospect of losing money on the way to success is what stops a lot of us from taking those calculated risks. As you said, we’re a generally conservative bunch.