Today’s post explains why you should invest in stocks all the time, even when the market is down.

This post may contain affiliate links.

I’ve been immersed in the world of personal finance for over five years. Before I turned my attention increasingly towards real estate, I spent a couple of years learning about the stock market and the history of stock investment in the United States.

It didn’t take too long to learn some basic principles that will allow me to beat the returns of 80% of investment advisers over the long run. Today, I want to share these principles with you and explain why it’s so important to invest into stocks even when the market is down.

These concepts are simple but incredibly important, especially in 2022 as stock prices have been creeping towards bear market territory for the first half the year. Investors are running scared. And judging by the chatter on social media, many skittish investors are about to make some bad decisions that will haunt them for the rest of their lives.

I’d like to add my voice to this chatter, in the hopes that I can help pivot some investors from short term to long term thinking (and prevent them from losing a lot of money).

Here on the Darwinian Doctor blog, I want to accelerate your path to financial freedom. It’s hard to do that when so many of you are about to throw away tons of money with bad choices in the stock market.

One rule to live by

I’ll sum it up with one rule to live by: Invest in stocks all the time, even when the market is down.

Let’s start out with some basic concepts, and then I’ll connect everything into a central, easy-to-understand thesis.

Bear markets and bull markets

First of all, let me explain what these terms mean. A “bull market” is basically a period of time when stock prices are rising or expected to rise. Many would specifically define this as a rise of 20% after a period of time when stocks were falling in value. On the other hand, a “bear market” is when average stock prices have dropped 20% and investors are feeling pessimistic about the stock market.

If you think about these types of market conditions, you might come to the following conclusion: “I should only invest money during bull markets.”

This thinking comes into play when people stop investing money when they see their stock prices dropping. When people see the total value of their investment portfolio dropping, the initial instinct is to stop investing money. This might be a natural instinct, but I argue that it’s the wrong move for the vast majority of people.

It’s an even worse move for people to sell their stocks altogether when the market is dropping. This behavior comes from the powerful human desire to avoid loss, but let me be clear: don’t fall prey to this desire. If you do, you’ll be missing out on the true power of the stock market.

You can’t time the market

To understand why I am making this argument, you have to first understand that it’s hard to consistently time the market. By “time the market,” I mean selling your stock when the market is at the all time high, and then buy it all back when it’s at the lowest.

Many people think that they can do this, but it’s very tough to do consistently.

This is the reason why index funds (diversified mutual funds) like VTI or VOO tend to beat the performance of 80% of active fund managers. This is a finding that continues to be true whenever it is studied. So if you’re confident in your ability as a market timer, you’re essentially saying that your investment strategy is better than 80% of the financial experts that are getting paid tons of money to beat the market.

I have full confidence in our intelligence, but I think it’s unlikely that we’re smarter than the average Wall Street fund manager.

Watch a short TikTok video about my favorite index fund: VTI

Lighting has to strike twice

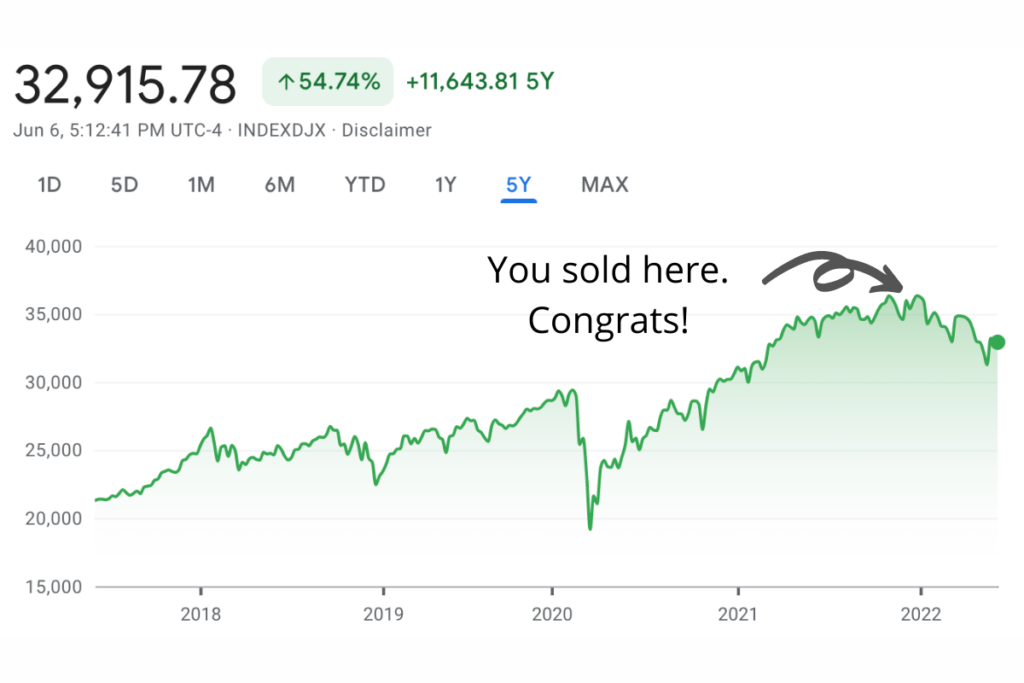

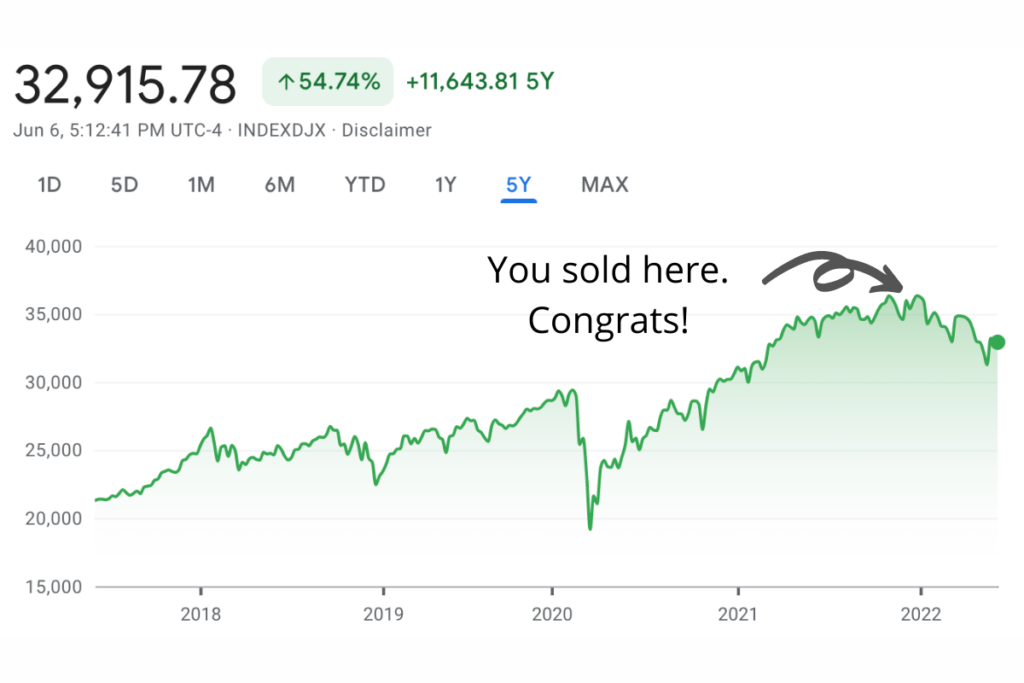

Let’s say for the sake of argument that you got lucky and accurately called the peak of the U.S. stock market early this year. Since you knew it was the peak, you sold all your mutual funds and individual stocks at the top of the market. Congratulations! You picked a good time to sell.

But now you’ve got a big lump sum of cash, some looming capital gains, and an agonizing question: When do you buy back in?

As you can see below, if you pick the wrong time, the consequences can be dire.

Missing the best days of the stock market

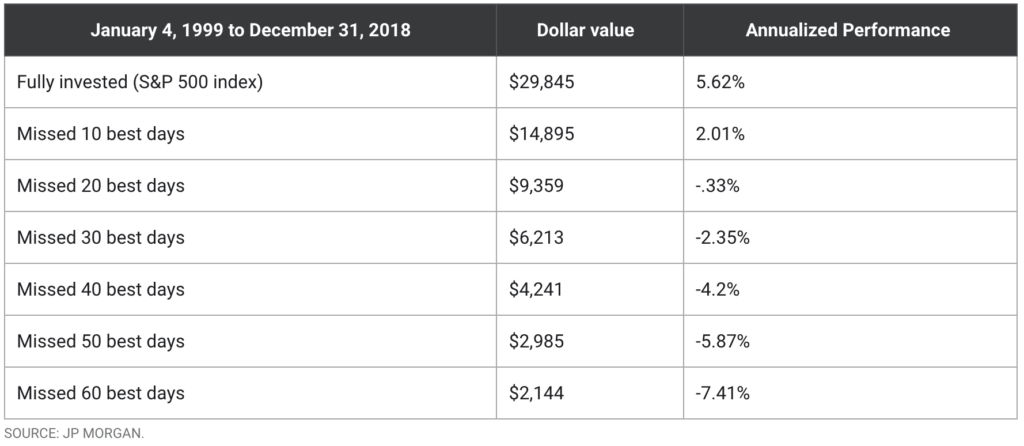

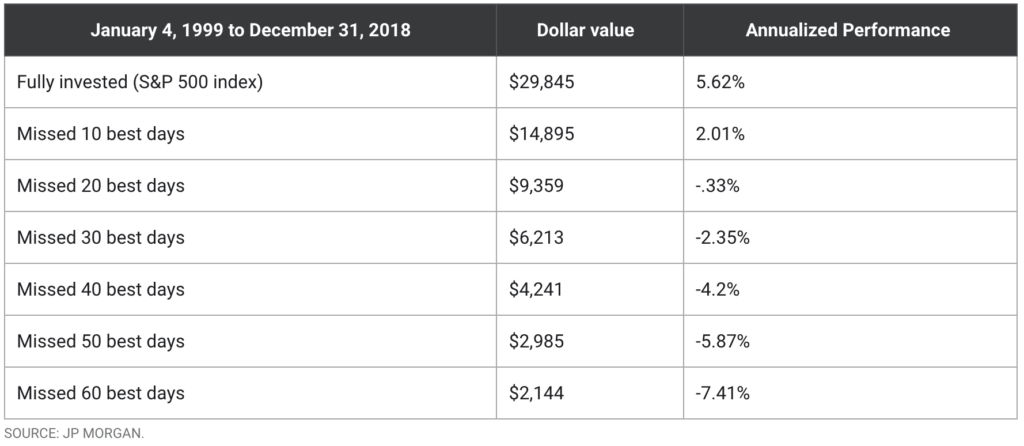

J.P. Morgan did an interesting study that looked back over the last 20 years of the stock market from 1999-2018. As summarized by the Motley Fool, if you had $10,000 invested in the S&P 500 index for the entire 20 year time period, you tripled your money to $29,848. That’s a nice investment return.

But if you missed the 10 best days of gains over that 20 year time period, your return was cut in half! You’d only have $14,895. If you missed the top 20 days, you’d only have $9,359, and so on.

Your money has to be invested in the market when it starts recovering from a downturn so the value of your stocks rises along with the market.

So this teaches us that to be great at market timing, you need three magical things to happen. You need to:

- Sell at the top

- Buy everything back at the bottom

- Make sure to be invested when the market makes big jumps in value.

This is very tough to do.

So what should we do?

Given all of the data above, the conclusion to me seems clear: We should invest in stocks all the time, even when the market is down.

Specifically, we should buy low cost index funds like VTI or VOO and use dollar cost averaging to spread out our investment risk over time. We should stick to a regular investing schedule so that every month, we purchase these funds no matter what the market is doing. In this way, we’ll be adding to our investments on a regular basis at regular intervals. This will also ensure that we don’t miss those rare days when the market makes those rare and sudden pops in value.

Don’t take your money out of the market

In fact, I recommend that you should never take your money out of the market, unless you have a specific use for that money that aligns with your long-term financial goals. (For example, I’ve cashed out stocks a number of times over the past few years, but it’s invariably been to fund real estate investment.)

To actually follow this advice, you have to have the appropriate mettle (or risk tolerance) for stock market investing. But if you want to take advantage of the higher returns possible from stocks, you have to accept the greater risk of volatility.

Aside from real estate, I believe that stocks are the best type of investment for long term growth of your capital. They’re certainly the most passive option available. But you have to be able to accept a lot of short-term volatility.

Perhaps it’ll help you withstand the volatility if you understand that the market always goes up (eventually).

The market always goes up

This is another essential truth of stock market investing. For you to have the strength to withstand market downturns, you have just accept this as a fact.

Over the long term, the US stock market has always shaken off the volatility and risen. This is elegantly illustrated by JL Collins in this post. I recommend you read his stock series, but the major relevant point is this: the trend of the overall stock market “is relentlessly, thru disaster after disaster, up.”

Conclusion

In conclusion, if you want to have the most wealth possible in the long term, you have to continue to invest in the stock market, even when the market is down. You should use dollar-cost averaging via regular investments into diversified, low cost index mutual funds like or VTI or VOO. Shake off the temptation to sell when the market is falling, and instead think like a long-term investor.

Market downturns are opportunities to buy stocks when the share price is low. Don’t sell. Instead, invest when the market is down!

— The Darwinian Doctor

If you want to start investing in stocks, you should consider using Webull, an affiliate of the Darwinian Doctor blog. They offer a compelling package of commission free trading and fractional investing to make investing accessible to anyone. Use my referral link below to get up to 6 free stocks when you sign up and deposit even just one cent! Seriously, it’s like free money.

Don’t forget to subscribe to the newsletter!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

3 comments

“Buy low.” But since you don’t know when “low” is, buy all the time. Hold for 15+ years. Market will be “high” compared with when you bought. Even better for those periods where the market fell when you were buying.

You got it!

I’m spending more time reading (more on that below), which is very enjoyable.