This post tells the saga about how I recently failed at refinancing my student loans, and what you can do to avoid my mistakes.

This post may contain affiliate links.

TLDR: My first refinance locked in a low rate, but it redefined my loan as a line of credit, which locked me out of future refinances. So I failed at refinancing my student loans a second time. You can use Credible to shop around for the lowest refinance rates out there. Use my special link below to get a $750 bonus when you refinance!*

My student loan saga

My story about student loans goes back over 10 years. (When you end up with over $300,000 of student loan debt, it tends to stick around for a while.) It wasn’t always such a large amount. After four years of medical school, I actually only owed about $200,000.

This is average for today’s graduating students, but over a decade ago, that was fairly high amount. My family wasn’t able to pay for medical medical school, so I took out loans for 100% of both my tuition and living costs. At about $35,000 a year for out of state tuition and $15,000 on which to live, my finances were pretty tight during those 4 years.

After I matched in Los Angeles for my surgical training, I consolidated my student loan debt with the federal government. This was a necessary step to enroll in the Income Based Repayment (IBR) program. This program rolled together my private student loans with my federally backed loans into one federal direct consolidation loan. There weren’t many options for repayment plans at that time, and the IBR plan was the best option for me.

This simplified my loan portfolio and also allowed me to make eligible payments towards the public service loan forgiveness program. This program (PSLF for short) will forgive the balance of your student loans after 120 monthly student loan payments while employed by a non-profit employer. The downside of this scenario was that the interest rate of my new loan was 6.8%. (This was just an average of all my previous loans.)

If this rate seems high, it was. But at the time, this interest rate was also pretty typical. I don’t know of any of my friends at the time with a lower rate.

Although my wife was working, we chose to file taxes separately so I could keep my monthly payments low. On my meager intern salary of around $45,000 a year, my payments were around $200/month. This rose over the years of surgery training as my income rose, until 2014 when I was paying around $300 a month.

The first refinance

In my last year of surgical residency training, I decided to consolidate my student loans with a private lender and start paying them off. I realized that I’d be joining a practice that was not a not-for-profit, so therefore I wouldn’t qualify for the Public Service Loan Forgiveness program. After I signed my employment contract, it was a no brainer to refinance my federal student loans.

I searched around with a variety of refinance platforms, and made an informal list with possible repayment options. While I found a number of competitive rates, the best deal seemed to be with First Republic Bank.

With a good credit score and my signed employment contract in hand, I refinanced my student loans with First Republic Bank at an interest rate of 3.5% and a 15 year payoff period. This equated to a monthly payment of $2094.

At the time, First Republic was offering some of the lowest rates around, and I think this is still the case. There were no origination fees and the eligibility requirements seemed fairly straightforward. My medical degree and the doctor contract were just as valuable as the standard requirements, like being a U.S. Citizen and having a good credit history. For most lenders, having an M.D. is seen as a virtual guarantee of a stable financial situation with a steady income.

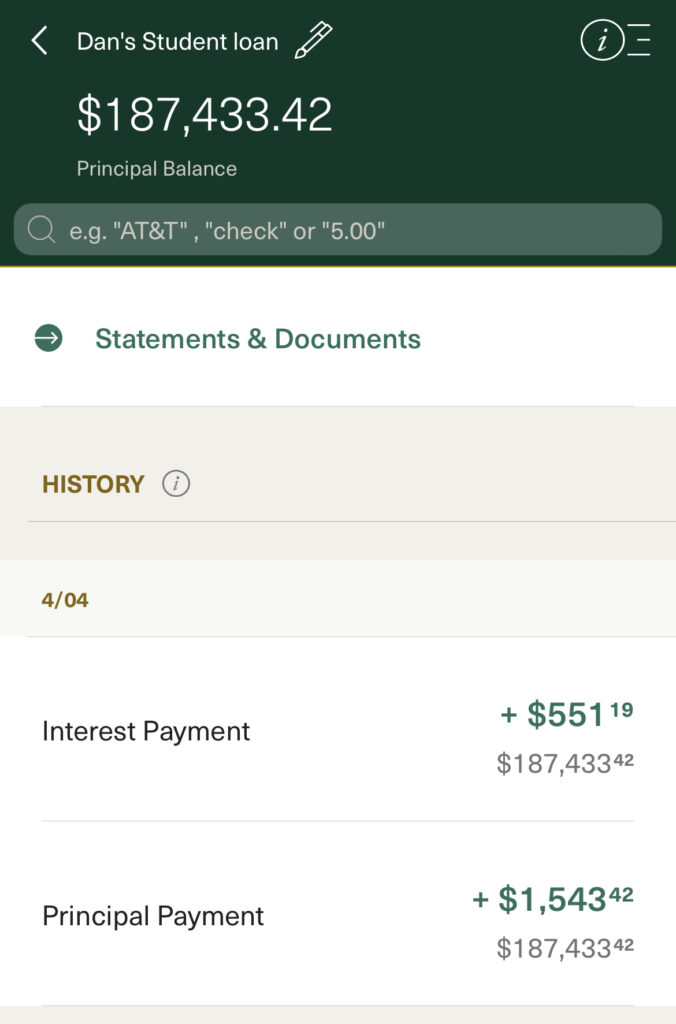

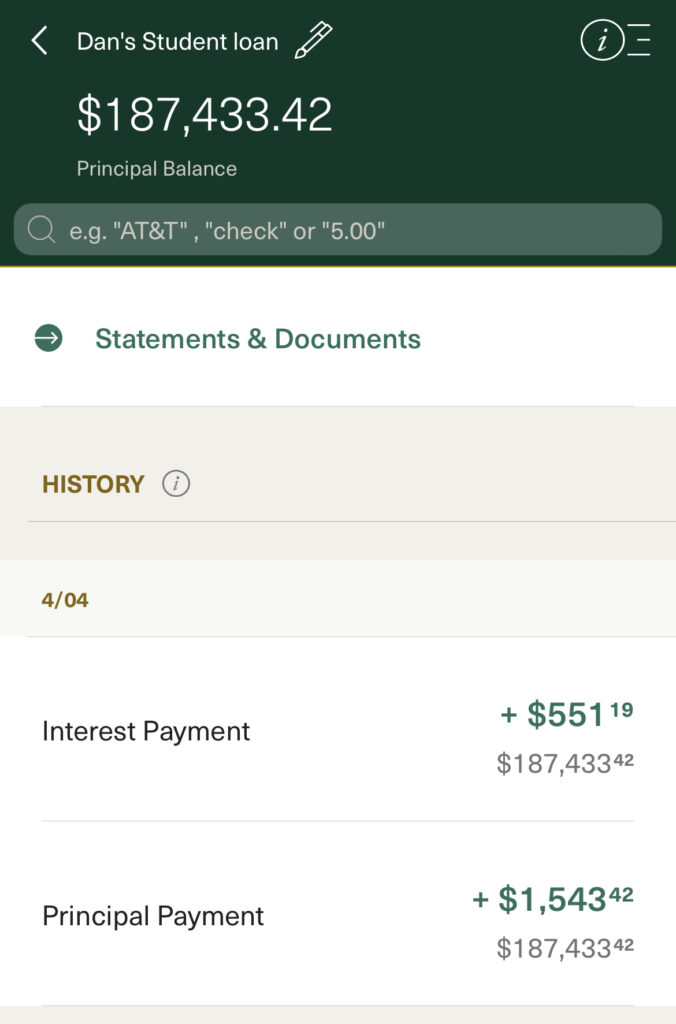

How it’s going

I’ve been paying off my student loans for about six years now. This is 40% of the life of the fifteen year loan. In that time, I’ve paid off about 38% of my initial loan balance. These days, out of each monthly payment of $2094, about $1500 goes to the principal. The rest goes to interest. Every month, about $4 more goes to principal than the prior month.

Although I could have paid off the loan years ago, I made the calculated decision that in the long run, I’d come out ahead if I invested my extra money, instead of paying down my debt faster than necessary. Hindsight is 20/20 and luck is blind, but I’d say that my calculated risk paid off.

Do you agree? The Darwinian Doctor’s Net Worth and Asset Allocation | Early 2022

The second refinance

About a year ago, student loan refinancing rates were even lower than the 3.5% that I locked in with First Republic, so I searched around and compared several student loan refinancing marketplaces. The one that I selected was Credible.

Why I chose Credible

Credible seems to be one of the best options to refinance your student loans. They have a super easy application process, they don’t sell your information, and they compare over a dozen top lenders to get you the best available rates. The application process requires only a “soft pull” credit report, so it won’t affect your credit score.

They found a much better interest rate for me than the rate I found on another popular online marketplace.

I liked my experience so much that I joined their team as an official affiliate!

If you refinance your student loans using this link below, you’ll get a generous bonus of up to $750, depending on your refinance amount. That’s a lot of money back into your wallet just for refinancing your loans!

So how did I fail at refinancing?

“This all sounds great,” you’re probably thinking. So where’s the failure?

My failure came to light when I formally submitted the refinance loan application and Credible checked out my student loans over at First Republic Bank. They found that my student loans weren’t actually student loans anymore. They’d been converted into a Personal Line of Credit!

When I brought my loans over to First Republic six years ago, my student loans were re-characterized as a line of credit. With this re-characterization of my debt, I lost the ability to refinance my loans any further.

When I went back to look at my paperwork, I clearly just missed this tidbit of information. It was stated on the First Republic paperwork. I was just too financially naive to understand the consequences of this terminology.

A line of credit has none of the special characteristics of a student loan. With a line of credit, you permanently give up your the ability to utilize deferment, forbearance, and forgiveness. More importantly, you can’t refinance your student debt anymore!

So ina sense, I failed at refinancing my student loans when I refinanced with First Republic.

Grading my failure

As financial decisions go, I think my refinance with First Republic was still a good option. They had the best rates at the time. I think they still do, especially for larger loan balances.

But as interest rates are on the rise, having the flexibility in the future to refinance your student loan with a new lender is not something I’d give up lightly.

The fact that First Republic re-characterizes your student loan as a line of credit basically makes it a one-way-street. Once you allow them to be your loan servicer, you’re locked in for the life of your loan.

This is in sharp contrast to other student loan servicers, who generally have no restriction on taking your loans elsewhere if you find a lender with a better deal and new terms.

Of course, trading my student loans for the line of credit was a lot better than staying with my federal consolidation loan, which was a much higher interest rate of 6.8%.

What I did right

By refinancing my student loans at a lower interest rate and elongating my repayment term, I ended up with a lower monthly payment. I’ll save almost $100,000 of interest over the life of the loan compared to staying with the higher interest rate of 6.8%.

But I hate feeling handcuffed, as my readers know quite well. And a line of credit definitely is more restrictive than your average student loan.

How you can succeed at your student loan refinance

I failed at refinancing my student loans, but you don’t have to do the same. There are a number of comparison shopping tools these days that will show you a variety of options. You can see which loan providers have the lowest interest rates, the best loan terms, and simply pick the best option that suits your needs.

As I mentioned above, my recommendation for an online marketplace is Credible. Use them to find the best option for your student loan refinance, and enjoy up to a $750 bonus when you successfully transfer over your loans!

Conclusion

Although I failed at my second attempt at refinancing my student loans, you can succeed. By reading this article, you know have the knowledge to avoid my mistakes.

I still like First Republic and their rates are low, but be careful — it’s a one way street. If you refinance your loans with them, they’ll stay with First Republic forever.

I’ve considered accelerating my payoff schedule many times. But I’ve been convinced by the past 3 years that it’s better for me to invest my excess capital and build my stocks and real estate portfolio.

Although I graduated residency training with $300,000 of student loans, I’ve managed to pay off over a third of that since then. It took me six years, but I finally dipped below the $200,000 mark!

— The Darwinian Doctor

*All bonus payments are by gift card. See terms

Credible was not responsible for creating or approving this content.

7 comments

Wife has $550,000 in student loans (all federal at 6.8%, currently all in forbearance). We are not eligible for PSLF as we are private practice. Would you recommend refinance now, or wait until after this loan holiday ends/once any is forgiven, if at all?

Honestly if I were you I’d enjoy the loan holiday while it lasts, but if it seems likely it won’t be renewed, I’d definitely refinance. The difference in interest rates will save you hundreds of thousands of dollars!

I went to Med School when tuition was cheap. PSU was $390 a trimester and Med School was $2,000-$3000 a year. I ended up with a debt of $3,100. HOWEVER, my daughter owed $165,000 for grad school. Her loans we at 6.8% and 8.4% which made me angry, so I took a loan on one of our invesment properties This was a bu at 5.1% instead of the 6.8% and 8.4%.

What a difference in tuition rates! I assume these loans are already paid off by your business loan, but if not, you can probably do much better by formally refinancing them via Credible.

We started paying back my Med school loans when I was a resident. Even then we did not live up to our means. My philosophy was if I want to buy a book then I am going to be able to buy it! My daughter’s loans have been paid off several years ago.

Thank you so much for this article! I wasn’t aware of this terminology either! I almost refinanced into First Republic when I got out of training thinking it was the cat’s meow at the time due to the great fixed rates (which turned into high rates after COVID!). They did want me to open up a bank account with $30,000 as well, which at the time I didn’t have. Now I’m thanking my lucky stars yet again for not having moved forward with them! Keep on educating, I’m learning things every day from people like you!!! 👍

You’re so welcome! I’m glad the article was helpful to you!