This post will spill the juicy details of our current net worth. Read on for the exact breakdown and commentary.

This post may contain affiliate links.

I’ve so far avoided tabulating my net worth on this blog. A few different concerns have stopped me.

First of all, I actually haven’t had a very accurate picture of this until we recently had to tabulate everything for a commercial mortgage lender. With the growth of our real estate portfolio, it’s become more and more complex to calculate our assets and liabilities. Services like Personal Capital are great for combining bank accounts, but they’re not as useful when you’ve got a lot of different mortgages floating around.

Also, you’ll read below that our net worth has risen over the last few years to a relatively high number. As a personal finance blogger, there’s some danger of alienating your readers if it seems like you’re writing from a place of overt privilege.

Imagine Jeff Bezos complaining about the cost of private school, for example. It just isn’t a very compelling argument.

Committing to brutal honesty

That being said, I think it’s time for more brutal honesty.

If I could describe this blog’s style, I’d say it’s brutal honesty mixed with mild humor and optimism. I think I firmly committed to this path when I first published a tabulation of our annual expenditures. In this seminal post, I counted up the full list of all the things that we spend our money on in a typical year. It came out to $340,000 a year.

The reception to that post was mixed. The Physician Philosopher famously reacted with concerned horror, which I found touching. The Financial Samurai later commented that he felt that he had found a kindred high spender in the world of personal finance writing.

The second response was generally shared by other high earners in high cost of living areas, where everything just costs a lot of money. I’ve identified these people as my target audience, but certainly I hope that a lot of what I write is generally applicable to any level of income and expenditure.

High earners should eventually amass a high net worth

I’ve also seen that any finance blogger with a high income will eventually amass a considerable fortune if they’re any good at managing their money.

For example, The White Coat Investor and Mr. 1500 Days both have multi million dollar net worths.

The Dr-ess and I have high incomes, and we’ve been aggressively saving and investing now for quite some time. So it actually would be odd if we didn’t have a high net worth by now.

What is net worth?

At its most basic level, your net worth is calculated by adding together all your assets and subtracting away all your debts. That number is what most would consider to be your “net worth.”

Depending on your financial situation and investing strategy, this can be a simple calculation, or pretty complex.

At the end of the day, it’s up to you to decide which things should be counted as assets. Do you want to include the resale cost of your cars in your net worth? Go right ahead. How about the value of your rare coin collection? Sure. Your “vintage” mom jeans from the 1990s? I dunno about that…

So without further ado, here it is:

Our net worth (September 2020)

| ASSETS | |

| Cash on Hand | $94,414 |

| Securities | $574,054 |

| Real Estate | $3,698,827 |

| Retirement | $702,911 |

| Total Assets | $5,070,206 |

| LIABILITIES | |

| Bank Notes | -$288,894 |

| Real Estate Loans | -$1,734,453 |

| Total Liabilities | -$2,023,347 |

| “Net Worth” | $3,046,858 |

Cash on Hand

This category consists of cash in our checking or savings accounts. It includes our personal checking accounts, and also cash that we have sitting in our business checking accounts. The latter accounts are the ones that we use for things like property renovation, and all of our day to day expenses come out of our personal accounts.

Securities: Assets

| Name of Brokerage | Ownership | Type of Account | Account Balance |

| Etrade | TDD | Brokerage | $33,635 |

| Vanguard | TDD | Brokerage | $41,738 |

| Vanguard | Dr-ess | Brokerage | $372,161 |

| Vanguard | Both | 529 | $81,353 |

| Vanguard | Both | 529 | $45,167 |

| Subtotal | $574,054 |

This category is a pretty large bucket that’s made up of our combined stock portfolio. I have some individual stocks in the Etrade account (mostly made up of Tesla) and a little money in a taxable brokerage account with Vanguard. I cashed out most of my taxable brokerage accounts over a year ago to focus on real estate investment.

You can see that the vast majority of this bucket is made up of the Dr-ess’ taxable Vanguard account ($372,161). This includes some money market funds where we keep cash sequestered for private school tuition and real estate taxes, but it’s mainly the place where we put the profit from the sale of our first primary home. Her account used to be much bigger, but we recently transferred over $200k to pay off a big chunk of our HELOC (see below).

The last category is money that we’ve set aside in 529 educational savings accounts for our kids’ education. We’ve been putting away $1000 a month since they were born. I count this as part of our net worth because it’s money we won’t have to spend later, and if worse comes to worst we can always pull cash out with a 10% penalty on the gains.

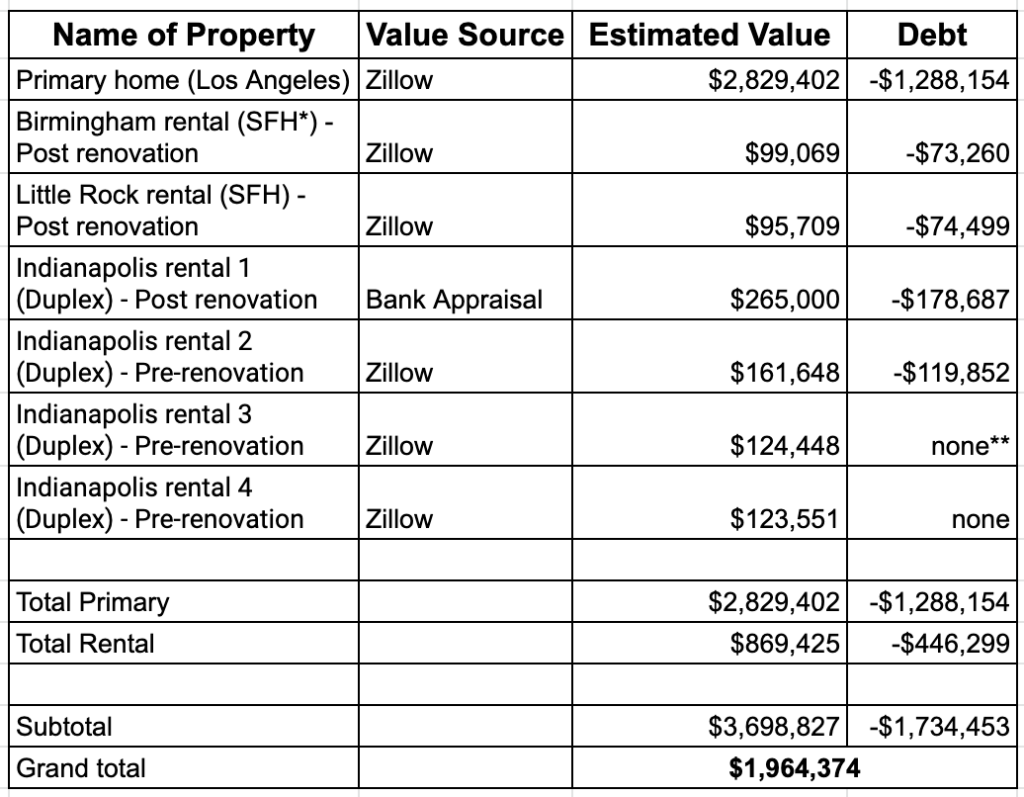

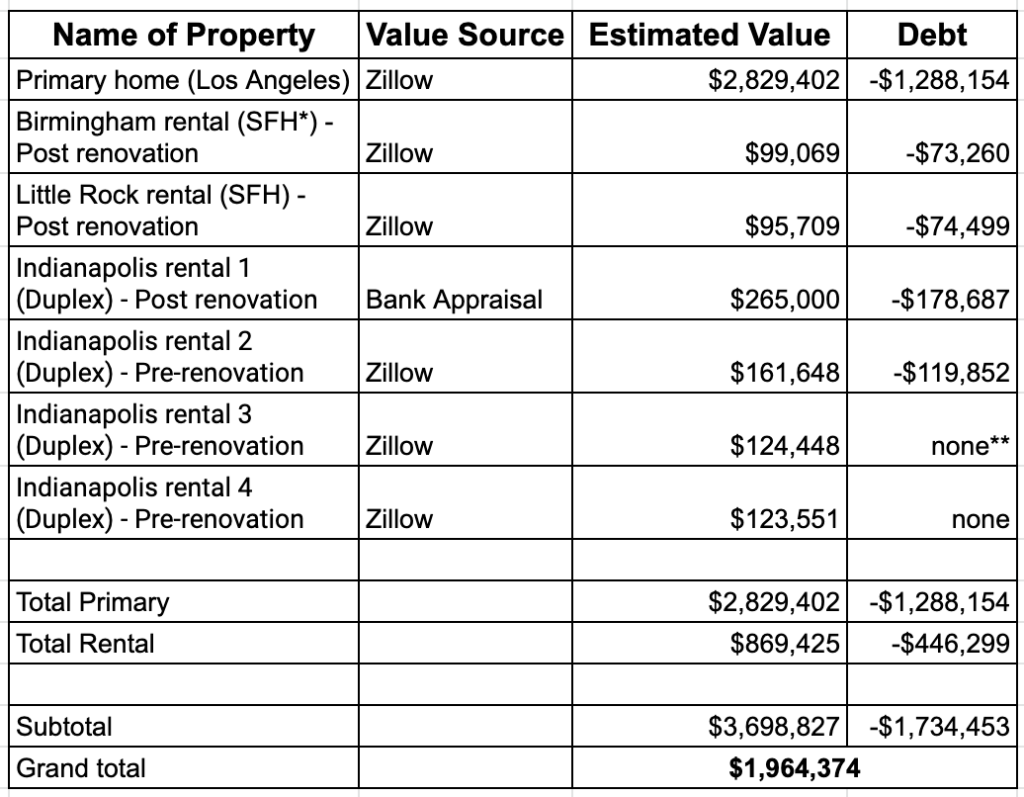

Real Estate: Assets and liabilities

As you can see, the vast majority of this category is concentrated in our primary home in Southern California (if Zillow can be trusted). We’ve theoretically had a good return on this purchase, but it eats up a big portion of our income to pay the mortgage and property taxes on it.

Our rental real estate portfolio is also a rapidly growing part of our net worth.

Read more about our recent acquisitions here.

Retirement: Assets

| Type of Account | Ownership | Account Balance |

| 457b, 403b, 401a | Dr-ess | $500,796 |

| 401k+Keogh | TDD | $202,115 |

| Total | $702,911 |

We have a real hodgepodge of retirement accounts between the two of us. What’s clear is that the Dr-ess has been working and saving for far longer than I have! Her retirement accounts dwarf my own.

Bank notes: Liabilities

| Type of Note | Account Balance |

| HELOC 4.5% | -$39,482 |

| Student Loan 3.5% | -$216,004 |

| Auto Loan 2% | -$33,409 |

| Total | -$288,894 |

The HELOC is against our primary residence, and allows us to access quick, low interest credit up to $500,000. We’re using it to take down competitive real estate deals with cash offers.

The student loan is my consolidated medical school debt. I’m paying it down slowly and have about 10 years left to go on the repayment term.

The auto loan is for my Tesla Model 3, which is the most expensive car I’ve ever purchased. I think it’s worth it.

Conclusion

When you put everything together, our “net worth” is $3,046,858.

About 10 years ago when we got married, our combined net worth was about $70,000. Soon after we got married, though, our wealth got supercharged with a generous donation of $200k by the Dr-ess’ parents for the downpayment of our first home.

Read about how we caught the last upswing in the LA real estate market and made an 11-25% compounding return on our money.

But the vast majority of our money came from a decade of earning and investing with the help of a historic stock and housing market bull run.

So did I just gain credibility or lose readership by appearing out of touch? Probably both.

Coming up soon, I’ll discuss why I don’t feel “net worth” is as great as everything thinks it is. Subjective real estate valuation and taxes are two big problems with the overall concept, but there are more.

Read the follow up post: Why your net worth isn’t as useful as you think

But in the absence of any other great measure of wealth, “net worth” will have to do for now.

— TDD

I’m sure you’ve got some thoughts. Please comment below, and subscribe for more brutally honest details!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

25 comments

Awesome! Thanks for sharing. I like your $2.8M primary residence value. Living large! And it makes me feel better about my home purchase as well 🙂

In times like these, a nice large home is much more valuable.

Cheers,

Sam

Thanks for the comment Sam. Stay tuned for an upcoming post, where I go into more detail on why I think this concept of “net worth” is pretty flawed. As a preview, I think that $2.8 million Zillow valuation is probably inflated by about half a million dollars. — TDD

TDD,

Thanks for the brutal honesty and I must say, I’m impressed with your net worth. Congratulations on the gains over the past 10 years. If I had your number now, I think I would give up formal paid work and just pursue gigs/projects out of interest.

I know you are going for MOFIRE, so I’m impressed with your focus.

I find these types of posts as good opportunities for self reflection. I have an aversion to liabilities and so don’t carry any debt. I think it is what prevents me from dipping in to real estate. How did you get past this when you first started acquiring properties? I’m assuming cash flowing properties make this worry go away fairly quickly?

Keep up the good work!

Hey Medimentary, thanks as always for the thoughtful comment. When our day jobs get tough, we often fantasize about selling our home and retiring to a low cost of living area. But we both love Southern California. For now, it’s enough to keep us rooted here and in the accumulation phase of our journey.

The liabilities of rental real estate are indeed frightening, and you’re right that the positive cash flow allayed these fears significantly. But to be honest, we found more comfort in the fact that even if we somehow lost all our tenants at once, we could service all the debt with the cash flow from our day jobs or dip into our cash reserves. So catastrophic bankruptcy seems unlikely as long as we have enough reserves.

[…] The Darwinian Doctor is far from bankrupt. He’s got more assets than this semi-retired physician, and with two incomes, I’m guessing they’re well on their way to eclipsing our net worth. The Darwinian Doctor’s Net Worth. […]

I like your honesty. It takes courage to share your net worth and all the details, so that folks can learn from it. I commend you for that. I am also squarely in the MoFire camp. I would be interested to hear about the process of managing all these investments yourself and doing your taxes at the end of the year. Although I am genuinely interested in managing my investments, I realize that as one accumulates assets, it takes me more and more time. I would appreciate if folks can provide some advice there.

Hey JF, thanks for the comment. Don’t give me too much credit, though. I still hide behind my veil of anonymity, and probably will until I’m ready to throw off my golden handcuffs and move on to the next phase of my life. My taxes are certainly getting more complicated, and I’m still searching for a good CPA to help me navigate all this. I post quarterly updates on my real estate portfolio, so I’ll make sure to comment about the time commitment also at some point. — TDD

I guess the bigger question is how much do you need to comfortably retire? We have about $2M in equities. Our house in North Georgia is worth about $550,000 but I don’t count that in my retirement nest egg since it’s not liquid. I’ve heard that 4% of your total cash value is what you can pull each most to stay even so we would have about $8,000 a month to live on plus Social Security. Any thoughts?

You’ve hit the nail on the head! Ability to retire is more about expenditures than a simple target nest egg number. $8000 + social security seems like a nice robust number, but it’s really up to you and your spending patterns.

When you’re trying to use the 4% rule, use the total value of your well diversified portfolio of stocks. The study that generated this rule relies on an well invested portfolio of stocks that continues to grow with the market as you pull out 4% of its value annually in retirement.

Feel free to read more here: Why your net worth isn’t as useful as you think

I like the honesty of posting your net worth. It takes guts to do that, but in a blog about finances, it adds great value to everything you discuss and write about. Good move!

Thanks a lot for the feedback!

JF, it helps to have a wife who is a financial partner. Each of you has to decide what you do best. My wife ran the business, both medical and investment and I was free to devote all my time to producing income. I did manage our stock portfolios. The nice thing about real estate is that you can keep at it after you retire. We have been retired 20 years and have averaged $250.000/year without really working at it. We have no rental properties and only pay cash. When your income stream shuts off you don’t want payments.

Congratulations on your success!

I hate bursting bubbles.

Technically, your primary home should not be calculated into the net worth equation. It may seem like an asset, but it does not increase your cash flow, and in fact, it does not count towards meeting the requirements to be an accredited investor in real estate.

The best thing about real estate, and why Trump only paid $750 in income tax, is the phantom losses that you may enjoy via depreciation. Plenty of great accountants/attorneys are around who can properly set up your properties to ensure they keep making money, avoid taxes, and protect you from lawsuits.

Thanks for stopping by, Christine, and I appreciate your frankness! I like your strict definition of assets — it’s very Robert Kiyosaki in its rigor. But I’d argue that in California, with so much equity locked into homes, it would distort financial pictures too much to leave out the primary residence from the calculation.

I’m with you on the tax benefits of rental real estate. It’s why I’ve chosen to use this as my primary investment vehicle going forward. I’d love to hear more about your investments and portfolio if you care to share!

Check out my thoughts on the tax benefits here: Tax benefits | Why I’m investing in real estate over stocks – Part 2

We all take vacations. Ask yourself why do I go to XXX on vacation. Is it popular with other high income people? If the answer is Yes consider real estate investing in your vacation destination. This is how we discovered the Florida panhandle (Seaside) 30 years ago In 98 we purchased a beach house for $600.000 and watched the value shoot up. We sold the property in 07 for $2.4 Mil plus enjoying a bundle of tax benefits. Plus every vacation was a tax event. There is a ton of money out there. 90% of vacation homes sold for over 1 million are cash sales.

Thanks for your thoughts Bob! I’m more focused on long term rentals right now, but I am also fascinated by short term vacation rentals. They offer some tantalizing tax benefits as you mention. I bet I’ll eventually add some of these to our portfolio.

I took a slightly different approach. No school loans for medical school- US Navy. Paid off three homes in less than 7 yrs each and maxed out my retirement every yr for 26 yrs. I have another equity portfolio funded with post tax dollars worth over 1 million. My current home and 118 acres is worth 1.2 million. I have a car loan for 12k at 0 % for two more yrs. Every bonus I earned went to pay off debt. I paid for 4 college educations for my children but they paid for any additional degrees. One veterinarian,one PA-C . And two masters degrees. I didn’t pay for any weddings. I don’t have any other debt. My children are all financially responsible because they were spending their money. In the end I think they will be better off. At age 61 I have approximately 4 million in retirement accounts with a net worth of 5.2 million. My children will get the money on the back end. I’m still working but I’m not sure why. When I retire in a few yrs my money will continue to work while I play. I read the book The richest man in Babylon several yrs ago and the plan has worked well.

Wonderful approach, congratulations! It’s clearly worked out well for you and your kids. I applaud you!

You gained my credibility. I have never learned so much about finance from anyone-else… If you keep putting it out there, I will keep reading and educating myself.

Thanks so much for the nice comment, Chris! It means a lot. — TDD

How old are you?

Old enough to have a mid-life crisis! FIRE: my mid-life crisis

Just found your blog. Congratulations on your body of work and appreciate the courage and honesty to write this particular post! Thank you!

Thank you! It was easier to write stuff like this when I was anonymous. Now that I’m in the open, it’s a little anxiety inducing, for sure.