In this post, we’ll discuss why the Federal Reserve is raising interest rates and how this might affect your life.

This post may contain affiliate links.

Unless you’ve been living under a rock for the past six months, you’ve probably heard that the Federal Reserve is raising interest rates to fight inflation.

It’s one thing to know that these two concepts are connected, and it’s another thing to understand it all. In this post, I want to lay out a few concepts and connect the dots about this phenomenon. In later posts, I’m going to connect this all back to real estate and stock market investing, and discuss how this is shaping my strategy over the next year or two. Take from this what you will!

What is the Federal Reserve?

I don’t think I’ve formally explained this before, so allow me to briefly explain the origin of the Federal Reserve.

The Federal Reserve system as we know it was born in 1913 when President Woodrow Wilson signed the Federal Reserve Act. This officially created a national financial regulatory agency that was separate from the federal government. The purpose of this national bank was to balance the competing needs of private banks with the monetary needs of the country as a whole. Despite being a “central bank,” the Federal Reserve is actually comprised of 12 regional banks, each responsible for a different geographic area.

There’s a LOT more to the story of the Federal Reserve. If you like that sort of stuff, I recommend you read this book: The Creature from Jekyll Island: A Second Look at the Federal Reserve.

What does the Federal Reserve do?

History, wars, and depressions have shaped the Fed into what it is today. The current duties of the Federal Reserve include:

- Establishing national monetary policy

- Supervising and regulating banks

- Maintaining financial stability

If this sounds like a tall order of business, it certainly is. In times of economic stability, no one cares about the Federal Reserve. But when times are tough, the Fed officials get put under incredible amounts of scrutiny. The current leader of this organization is Fed Chairman Jerome Powell. I bet if you ask him, he’d love a little less attention these days.

The Fed conducts its business in many ways, but one of its major tools is the “federal funds rate.” This is the base rate of short-term interest rates used by banks to extend overnight loans to each other. (This is the so-called “overnight bank funding rate.”) This affects everything from mortgage rates to the price of auto loans. It indirectly but powerfully affects things like stock prices, the bond markets, the unemployment rate, and the rate of inflation.

I won’t go into how all of these things affect each other, but it’s pretty interesting. If you want to learn more, here’s a free course from MIT on Macroeconomics.

Federal funds rate (pre-pandemic)

In the decade prior to the pandemic, the economic policy from the Federal Reserve was really characterized by a reaction to the financial crisis of 2008. This was triggered by a banking and housing market collapse and the following “Great Recession.” This drove the Fed to lower interest rates and increase the money supply to spur economic growth. In fact, for most of the past decade the federal funds rate was held around zero percent.

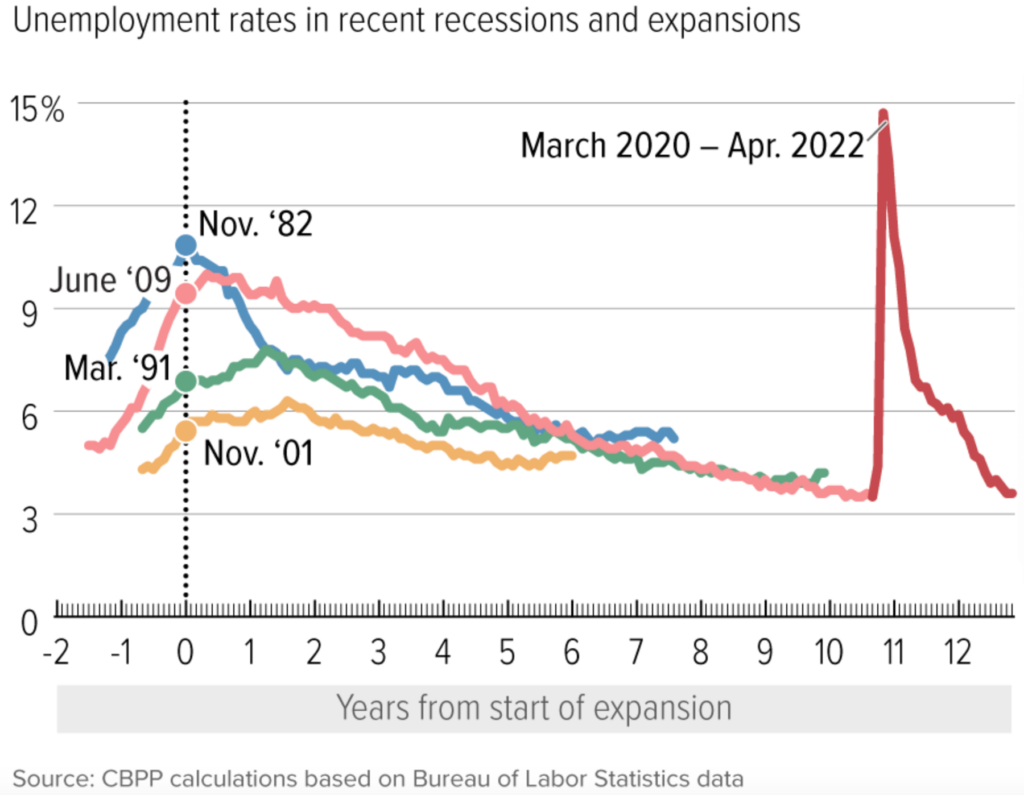

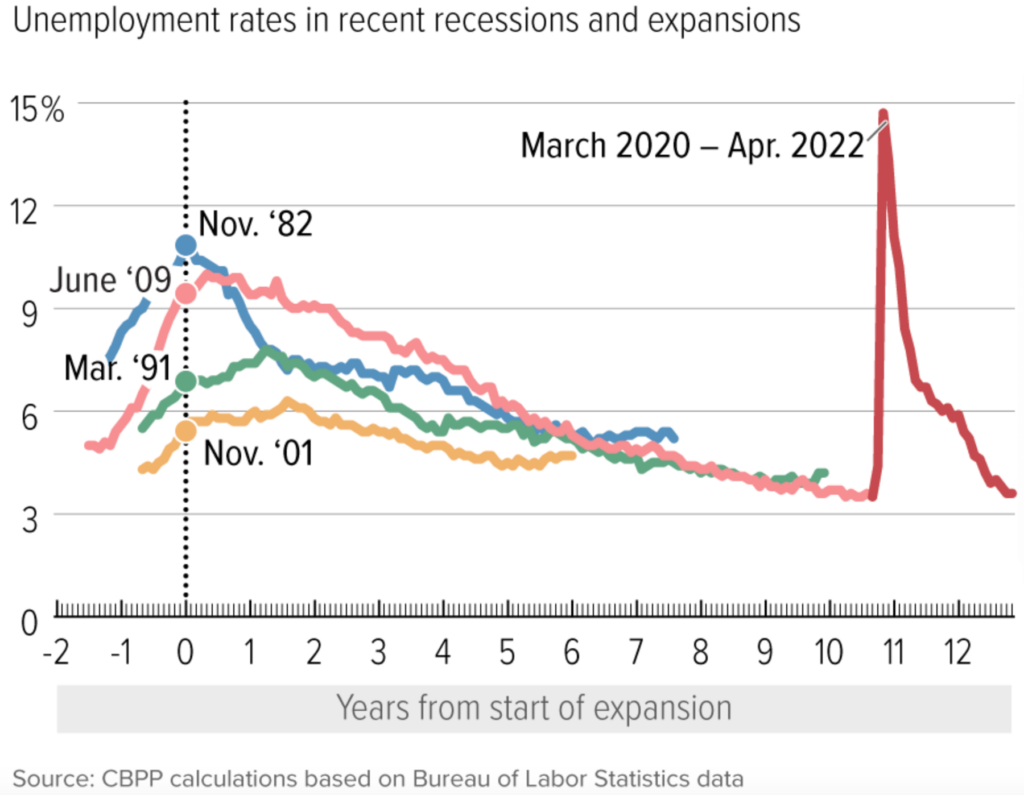

The effects of the Great Recession lingered for many years from the perspective of unemployment and stagnant wage growth. However, from a narrow view of the stock market, the recession officially ended in 2009 as the stock market started it’s historic rebound that ended in 2020 with the explosion of Covid-19 around the world.

During this period, low interest rates caused slow but steady growth of the US economy. Financial markets, like the stock market and the housing market, made steady impressive gains over this time period as well.

The effect of low interest rates

Low interest rates make it cheaper and easier to access credit. Almost everyone needs credit (whether you realize it or not). It helps to do everything from buying homes and cars to building businesses. It greases the wheels of our economy in a big way.

After the U.S. housing bubble popped in 2008, we entered the Great Recession and our economy needed a shot of adrenaline. Low interest rates was one of the things that allowed the nation to crawl back out of the recession.

With low interest rates stimulating business growth, unemployment rates steadily improved until Covid ruined everything.

Although there’s always a risk of an “overheated” economy, inflation rates over this time period stayed remarkably low. The stated inflation target range by the Federal Reserve is around 2 percent. As measured by the consumer price index, our nation inflation rate actually was mainly under 2% for most of the last decade.

Inflationary pressures

Things all changed during the pandemic. As Covid-19 started ripping around the globe, this set off a bear market and recession to end the long period of economic growth. Fed Chair Jerome Powell responded quickly with stimulus measures to stabilize the U.S. economy. In response to this, markets recovered and started an upwards climb after only 1 month of freefall, as you can see from this chart of the Dow Jones industrial average.

Over the course of the pandemic, the IRS sent stimulus checks directly to Americans affected by the pandemic, totaling up to $3200. This physical cash was in addition to a sharp increase in the money supply by the Federal Reserve. The stimulus checks had the effect of injecting extra money into the free market. This increased demand for everything from household goods to building supplies.

At the same time, various supply chain disruptions upended worldwide commerce, sharply increasing the price of many goods and services. The cost of used cars spiked 26%. The pay for traveling nurses rose 25% as well early in the pandemic, as the nursing labor market got squeezed by demand.

Many people decided to leave cities for single family homes in less dense areas of the country, setting off a housing boom. The national home price index soared to the highest levels ever seen.

2022 Russian invasion of Ukraine

Then in February of 2022 the invasion of Ukraine began, sending gas prices skyrocketing almost overnight. Russia’s invasion also disrupted national supplies of staples like wheat, corn, and other grain. As a result, world food prices spiked 20% year over year.

This all led to record high inflation in the United States that spiked in March 2022 to around 8.5 percent. This is the worst in 41 years. High inflation erodes the value of savings accounts and runs the risk of causing a chain reaction of higher costs, higher prices, and higher wages.

To fight this high inflation, the Federal Reserve used their most potent weapon: higher interest rates.

The effect of higher rates

The real goal of higher interest rates is to cool the economy and combat inflation. Higher interest rates decrease economic activity and cause decreased demand for goods and services. Less demand means lower prices, which decreases inflationary pressure.

One way this happens is due to higher borrowing costs. As the benchmark Fed rate percolates through the banking system, it gets more expensive to borrow money. This quickly drives up the cost of most leveraged purchases. (Leveraged purchases are when you put down a small payment and borrow the rest for a purchase.)

A good example of a leveraged purchase is a car loan, which is used to buy a car. If paying for car loans becomes more expensive, this decreases demand for cars. This decreases average prices in the automobile market, cooling down that market.

Another good example is the housing market. Interest rate hikes cause mortgages to become more expensive. If monthly payments on mortgages are more expensive, people can’t afford to buy as expensive of a house, which leads to less competition for homes. Less bidding wars means lower sales prices and less price inflation in the housing market.

Higher rates also decrease the ability of businesses to easily expand their operations. Big business expansions usually involve borrowed money, so if borrowing money is more expensive, it’s harder to invest in expansion. This means less job openings (and unfortunately higher unemployment rates).

This same equation plays out in almost all markets, leading to generally less demand for goods and services. This causes less production of goods and services, less commerce, and decreased general economic activity. The end result (if all goes well) is lower rates of inflation.

The danger of raising interest rates

Raising interest rates is risky, though. If the Federal Reserve raises interest rates too quickly or too much, we run the risk of pushing the pendulum too far in the other direction. If demand for goods and services falls too much or unemployment increases too much, things can spiral out of control. The nation can fall into a recession.

A recession is defined as two consecutive quarters of decreased economic activity, but its effects are more than just numbers on a spreadsheet. A recession causes far reaching negative effects on education, poverty rates, investment, and income inequality. There’s even evidence that recessions cause increased mortality rates. So the side effects of recessions can literally kill people.

A recent survey of economists reported on Bloomberg put the risk of a recession at around 30 percent.

Conclusion

I hope you understand a bit better now why the Federal Reserve is raising interest rates. Your basic takeaway should be that higher interest rates are meant to lower inflation. But this is a risky process, and we have a fair chance of a recession in the near future. There’s also a chance that the Federal Reserve can manufacture a “soft landing,” where inflation moderates while avoiding a recession.

I personally find all of this fascinating, because it helps me understand what’s going on in the world. I believe that if you understand these general concepts, you can better predict what’s coming and react to it all in a way that yields the best financial outcome for you and your family.

In the coming weeks, I’ll discuss how this is all affecting my real estate and investing strategy.

— The Darwinian Doctor

Do you feel like you have a better understanding of what the Fed is doing? Note: I’m not an expert in this subject, so I welcome corrections and criticism down in the comments below.

Don’t miss a post, join the mailing list!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions