Compound interest is a major tool in building wealth. Do you understand how it works? Learn about it today!

This post may contain affiliate links.

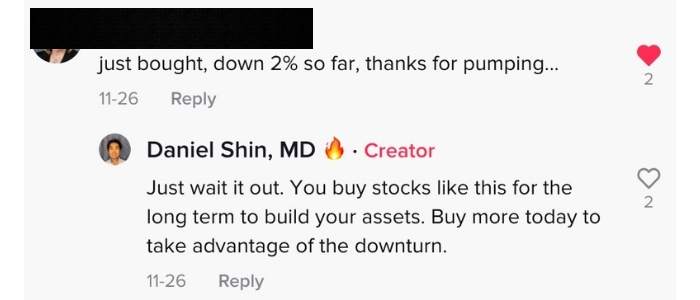

I recently had an interesting exchange in the comments of one of my TikTok videos. In it, I explained that index funds are a great way to start building wealth. I specifically recommended VTI, the Vanguard Total Stock Market ETF (exchange traded fund).

Social media, especially video content, is a unique innovation of the 21st century. Via social media, you can gain an instant connection with people. My 90 thousand Tik Tok followers (as of Dec 2021) have never met me, but they trust me because I seem knowledgeable and honest. It’s what makes social media so powerful and also so dangerous.

In this case, thankfully, I was dishing out really good advice. But in the span of a 40 second video clip, I can’t discuss everything. So I wasn’t too surprised at the following comment on the video:

This disgruntled viewer later quizzed me on my investment account and accused me of “pumping” the worth of the fund by posting my video. I admitted that I mostly hold the mutual funds version of VTI, aka VTSAX. I also replied that VTI has holdings of over $3 trillion, and that nothing I said in a random Tik Tok video was going to substantially change the value of the fund.

The concept that I wish I could have also communicated in this short clip is the concept of compound interest. I wish I could have added this:

To gain true wealth via stocks, you must combine index funds with the power of compound interest and hold for the long term. These elements together are the best way of building long term wealth in the stock market.

Since I’ve had an influx of new readers on this blog (from TikTok), I want to make sure that I have articles about basic personal finance concepts alongside my usual fare about doctor life and real estate investment. I’m also putting together a video about compound interest, but it will be nice to have a more detailed article as well.

So today, this post is about compound interest.

Compound interest defined

The definition of compound interest, according to Investopedia, is “the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods.”

This type of interest is in contrast to “simple interest,” which is calculated only on the initial investment.

Compound interest is the reason that continually held interest bearing assets will grow exponentially over time. This exponential growth is what caused Albert Einstein to say that “compound interest is the eighth wonder of the world.”

Reaching $1 million in the stock market

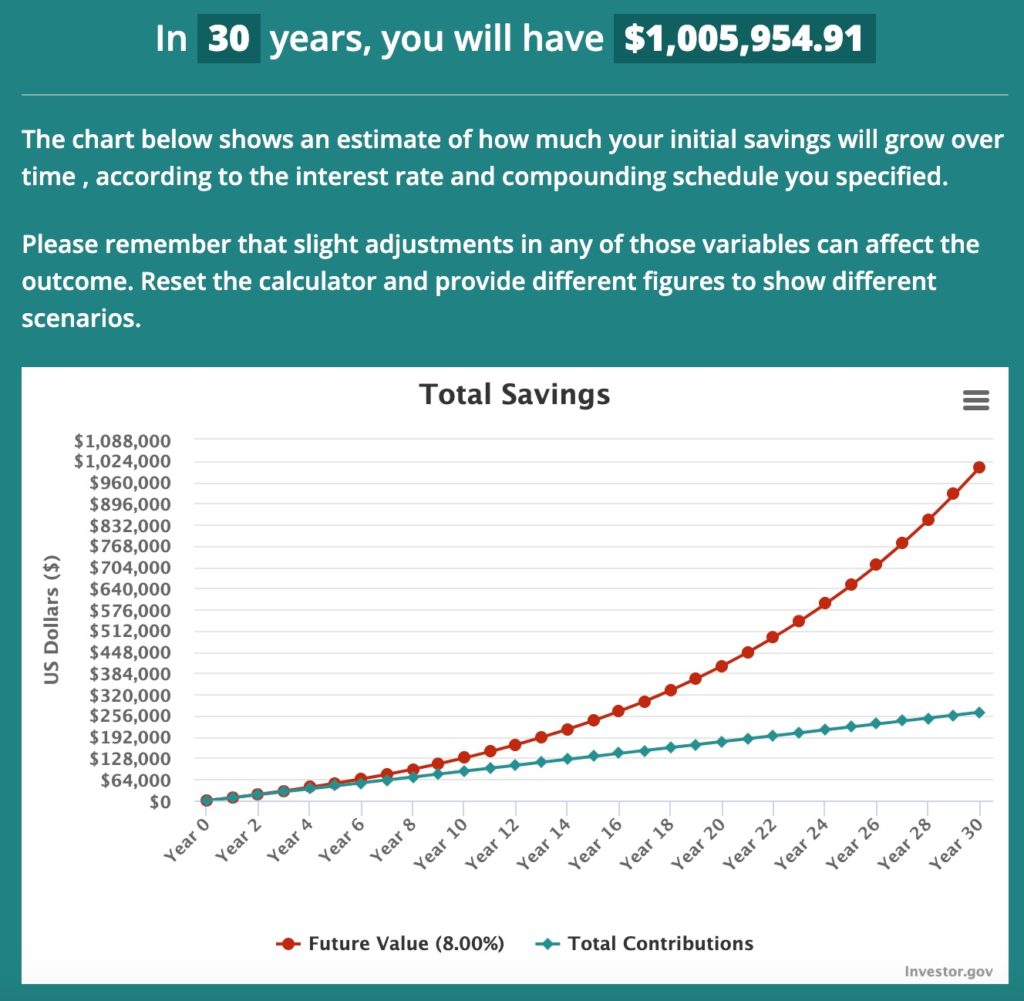

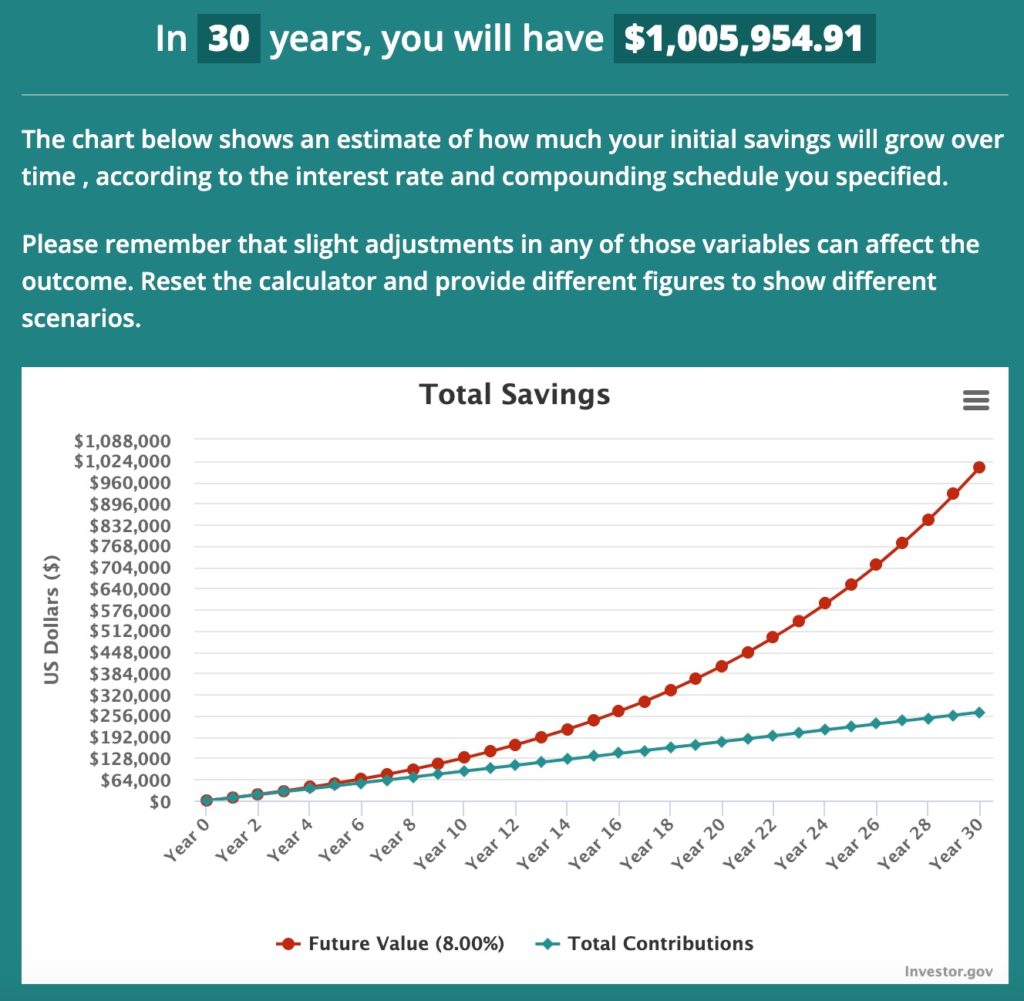

The power of compound interest really comes alive with a hypothetical example. Let’s look at a 30 year period of time and calculate how much money it takes to reach a million dollars by investing in the stock market.

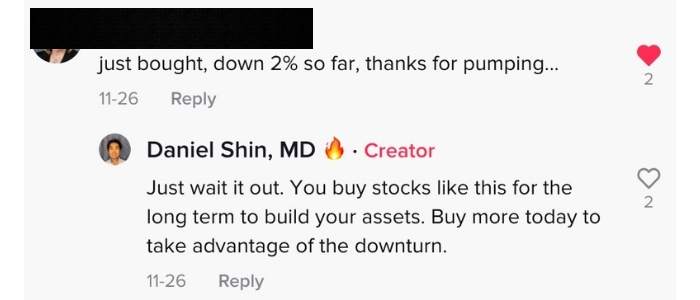

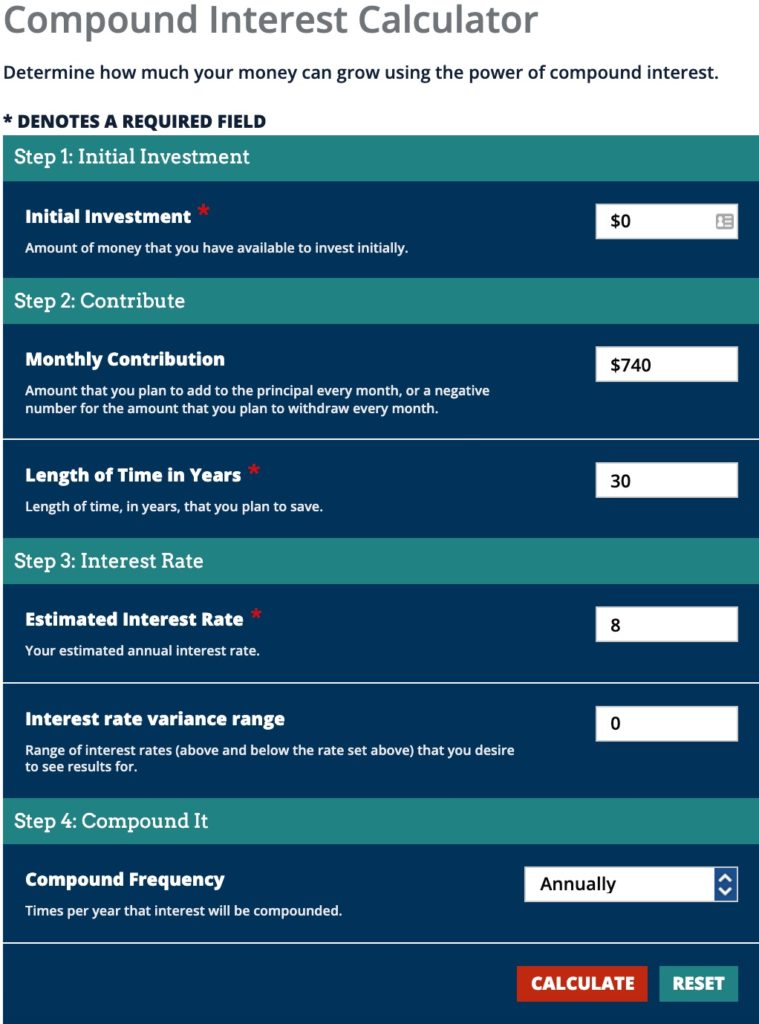

(I calculated this with a compound interest calculator on Investor.gov.)

If you play around with the inputs on the calculator, you’ll find that you it only takes $740 a month to reach a million dollar account value after 30 years.

Next, you can see the growth curve of your invested capital versus the actual future value (which takes compound interest into account).

Explanation

You can see above that over a 30 year time period, it only takes $740 invested every month to reach $1 million of future value.

The growth of the investment is relatively flat over the first decade, but it starts to get interesting around year 15. You can see from the curve that after 15 years of annual compounding, you start to see more of a snowball effect. The curve starts to go exponential as the magic of compounding adds more and more to your principal.

Future value versus total contribution

Below is the year by year calculation of how much money you’ve contributed versus how much value you’ve accumulated in your hypothetical account.

Let’s take a look at the numbers in more detail. In this image, you can see that after the first year, you’ve contributed $8880, which is the same as the value of your account. But you can see that after another 12 more monthly contributions, you’ve contributed $17,760, but the value of your account is $18,470.40.

Where did that extra $710.40 come from? It’s 8% of your original principal of $8880 from the year prior. That sum of money is your reward for investing in the stock market. It represents the growth in value of the companies in the stock market, plus inflation, plus a dividend return as well.

While $710.40 is a small amount compared to the $8880 of your initial investment your first year, here’s the magic: this gets added to your account and starts working for you. You start making interest on your interest!

The next year, you still contribute $8880. But you’re getting a return on:

- Your original $8880 from the first year

- The $710.40 of return

- The $8880 from the second year

So by the end of year three, your account has grown to $28,828.03, which is a full $2,188.03 more than your actual contribution of $26,640.

If you zoom out to year 30, the magic of compound interest is impossible to ignore.

- Year 30 future value: $1,005,955

- Year 30 total contribution: $266,400

- Difference: $739,554.91

That’s right. After 30 years, you’ve invested a little over a quarter million dollars into the stock market. But the power of compound interest has pumped the value of your portfolio to over a million dollars!

Real life isn’t the same as a calculator

It’s important to have a disclaimer here, and of course real life isn’t as tidy as a graph from a compound interest formula. Compound interest works differently in real life. The stock market doesn’t return a neat fixed rate every year like the bank pays when you buy a bond. It has years of lower returns and even negative returns (losses).

Let’s highlight also that all investments have a risk of loss. Take all my writing here as entertainment and for educational purposes only.

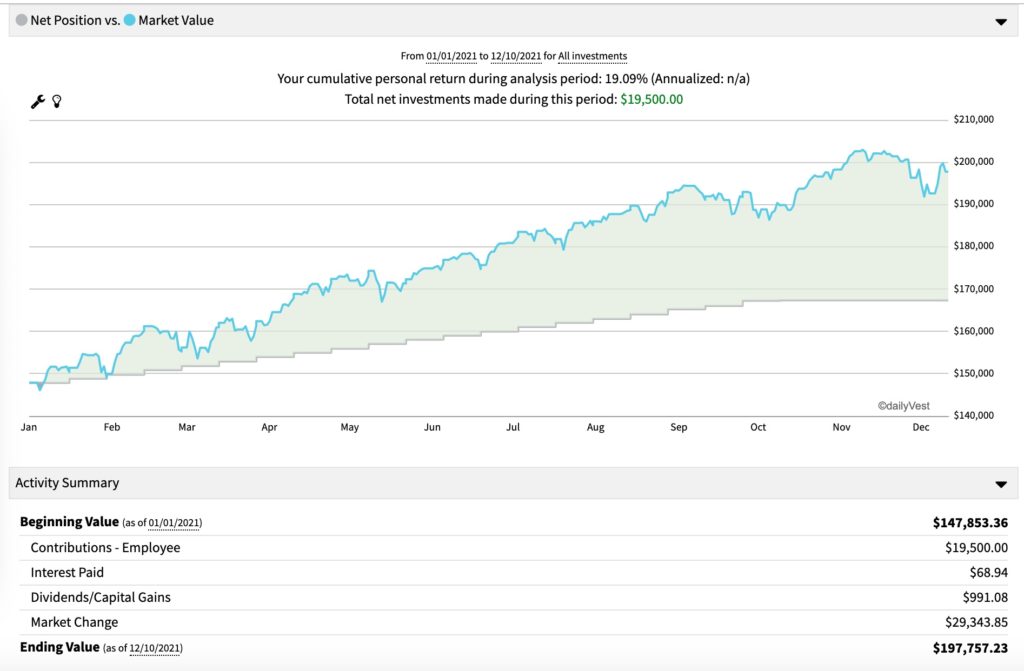

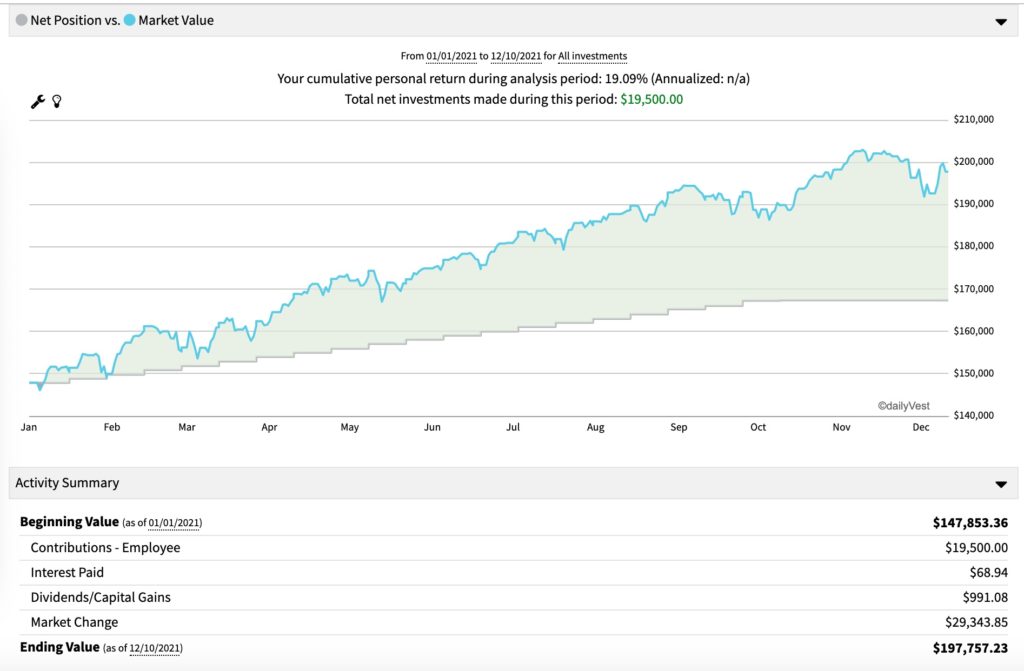

But some years are much better than normal also. Take a look at my 401k in 2021. (This is a screenshot from my actual account.)

I invested the maximum amount of $19,500 in 2021, which was added to my original principal amount of $147,853. But my market gain, interest, and dividends were $30,404, representing a whopping 20.5% gain!

So there will be years of lower return and there will be years with higher return. Historically, it all averages out to about 8-10% when it comes to US Stocks.

The stock market is a form of leverage

I won’t have time to do the concept of leverage justice in this post, but I want to just say that this example above shows the beauty of leverage. By taking advantage of the stock market, you’ll make money even if you get a migraine and take a sick day. If you buy an index fund like VTI, you’re leveraging the collective genius of thousands of American companies, even while you sleep.

You’ve uncoupled your wealth building from your time, which is the only way for most of us to really build exponential wealth.

Savings accounts are not for wealth building

I also want to point out that you can’t build serious wealth in a savings account. The annual interest rate of the best rated “high interest” savings accounts as of December 2021 are literally a half percent. You’re not going to build any wealth with that kind of interest rate. Savings accounts should just be for emergency funds and to prevent overdrafts from your checking account.

Money market accounts are not much better. These accounts are accounts that hold your cash as shares that are pegged to the value of the dollar. They used to offer a slightly higher interest rate than savings accounts, but these days they’re pretty similar.

Compound interest exists outside of the stock market

I have to put this here as well since I’m a real estate investor. You can take advantage of compound interest and growth in other investments as well. My first duplex BRRRR in Indianapolis was projected to give me about a 62% cash on cash return! After accounting for some extra repairs and an increase in property tax, it’s still pumping out a 49% return. I just take all those returns and pump them back into my portfolio’s growth. That’s not even counting the extra appreciation and principal paydown of the duplex’ real return.

Within a few years, the return from this one duplex will be magnified by compound interest in a major way.

Conclusion

I hope this post gives you a good insight into the magic of compound interest. It’s the path to true wealth in the stock market, but it takes consistent investment and time. It also exists outside of the stock market with real estate investment, but perhaps not with the same degree of reliability as stocks.

–TDD

What do you think about compound interest now? Are you a believer? Comment below and subscribe to my newsletter for more!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions