Today’s post is going to explain the difference between your marginal tax rate and average tax rate.

This post may contain affiliate links.

Have you ever talked to someone who was unhappy about a raise because it pushed them into a higher tax bracket? If so, they’ve fallen prey to one of the biggest misunderstandings about income tax in the United States. This misunderstanding stems from our marginal rate system of taxation. Below, I’m going to go over this system and explain why you should never be unhappy about a raise.

Marginal tax rates

To put it simply, a marginal tax rate system taxes different parts of your gross income (total income) at different rates. Your entire income is not considered as one big pot of money. Instead, your taxable income is sliced up into different portions, and each successive “bracket” is taxed at a higher and higher rate. The brackets are adjusted every year (and oftentimes with every new president).

Average tax rate

Also known as the “effective tax rate,” your average tax rate is a simple calculation: tax paid divided by total income earned.

This percentage usually will be lower than your highest marginal tax rate.

To understand why we have this system that taxes higher incomes more than lower incomes, it’s probably helpful to review how we got to this point in American history.

A very brief history of taxation in the United States

Taxation has changed throughout the history of the United States. Early Americans enjoyed essentially no taxes. This changed after the Revolutionary war. After this, the American Constitution gave Congress the power to tax the public. Most of the taxes in this time period were on specific goods or services like alcohol or tobacco. These types of taxes are called “excise taxes.”

The American tax system became more formalized after the Civil War. The federal government created an early version of the IRS (Internal Revenue Service) and expanded the excise taxes to many more goods.

The first universal income tax came about in 1913 as the threat of war loomed. Even back then, it was a progressive tax system that only taxed 1% of income between $3000 and $500,000, and 6% thereafter.

In 1918 the threat of war was even closer, so the government imposed higher tax rates with the highest federal marginal tax rate being 77 percent!

Aside from Prohibition in 1919, the next major changes to federal tax law came in the 1940s. In this decade, familiar things like deductions, employer tax withholding, and standard deductions became law.

Reference: Historical Highlights of the IRS

Where we are now

At the time of this post, the American tax law is a bloated, complex system that takes over 2,600 pages to print out! The tax rates seem to change with every new president, as do the various loopholes, tax credits, and incentives. The Tax Cuts and Jobs Act of 2017 made sweeping changes to our tax code, but at the individual level the changes were less seismic.

At this level, marginal tax rates in general fell, the standard deduction increased, and there was generally less ability to claim tax deductions. Because of how this last change, some taxpayers actually saw their tax burden increase because there was less ability to deduct property taxes from their taxable income.

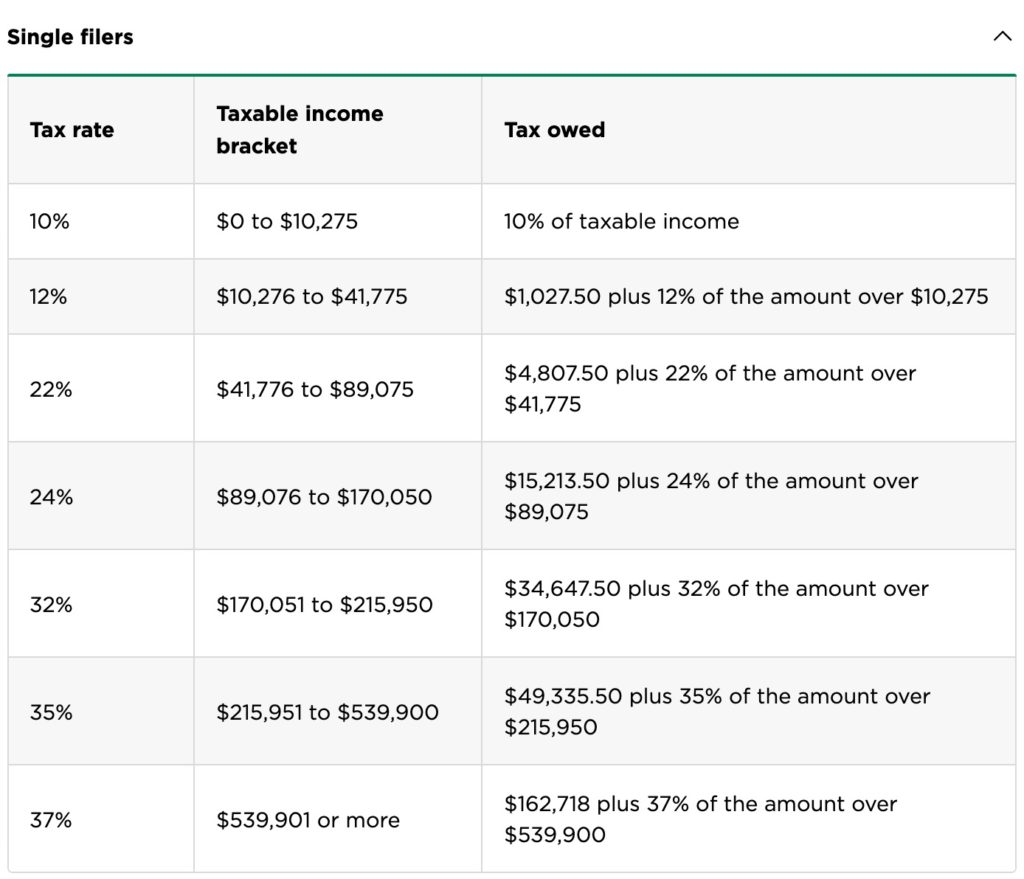

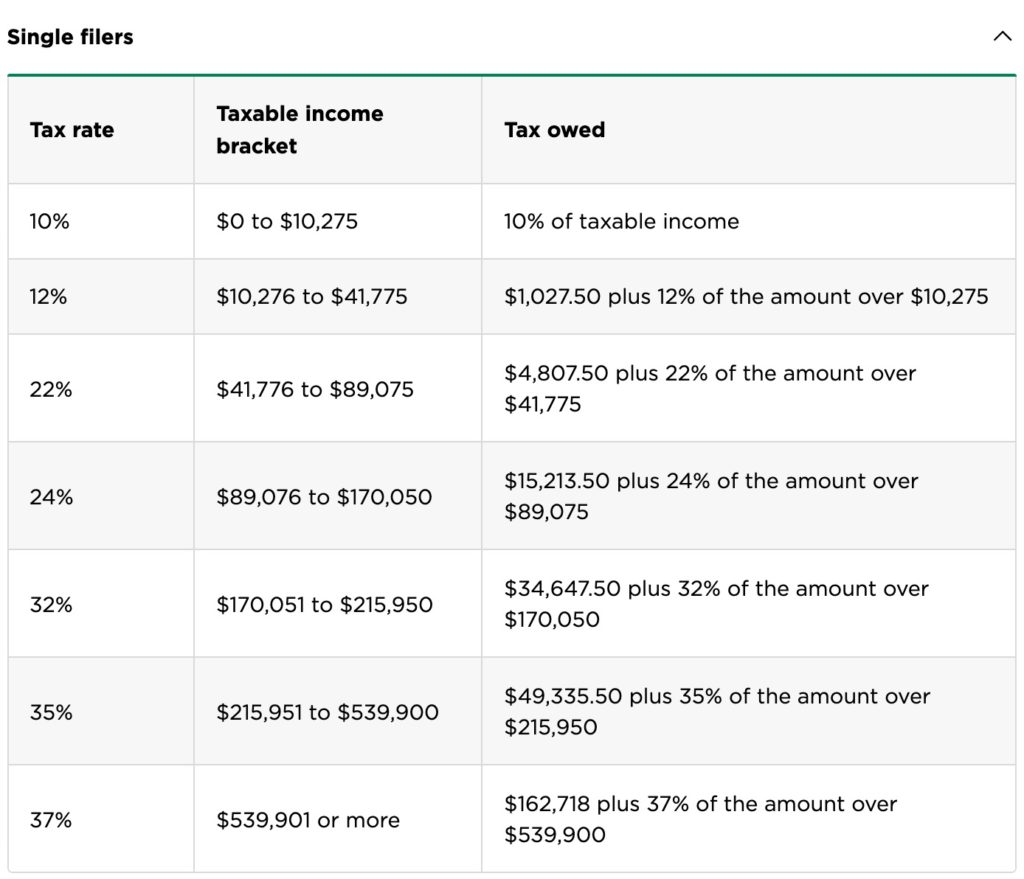

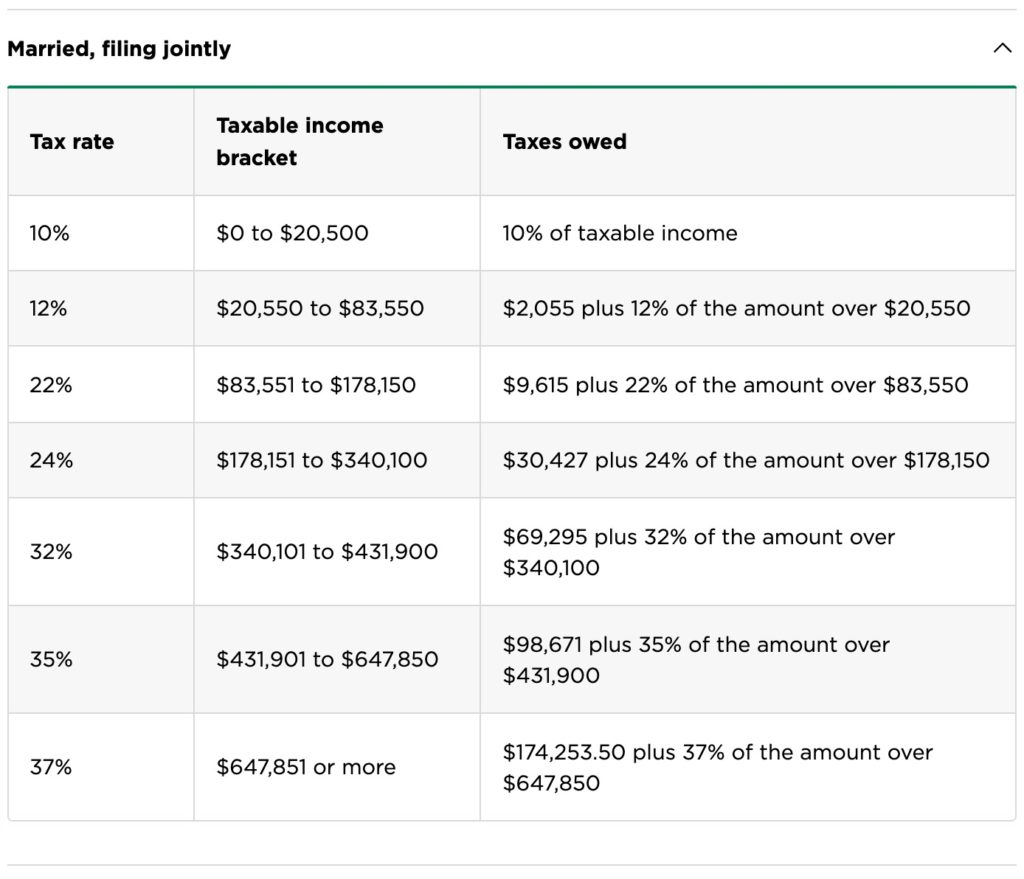

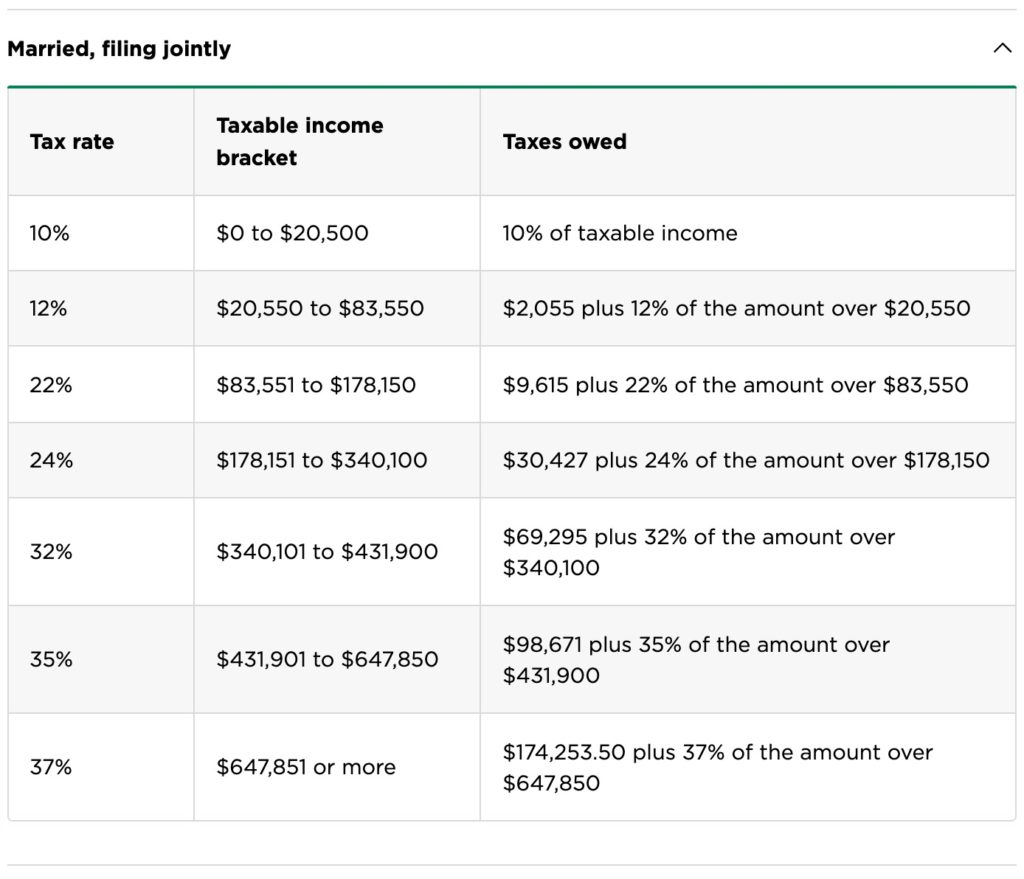

2022 federal tax brackets

You’ll pay different rates depending on if you’re a single taxpayer or part of a married couple. Our tax code unfortunately taxes single filers much more than married filers.

How to estimate your highest marginal vs. average tax rate

Follow these steps to find your highest marginal tax rate:

- Take your total income and subtract your tax deductions

- This number is your adjusted gross income

- Reference the tax brackets above to find your highest marginal tax rate

All your income in that highest bracket is taxed at this marginal tax rate. Income below the highest bracket is taxed at a lower rate, depending on which bracket it falls into.

An example

Let’s say you’re single and you have an income of $100,000. In 2022, the standard deduction is $12,950. If you don’t take any more deductions, your adjusted gross income for this tax year is $87,050. This pushes you down from the highest marginal tax rate of 24% to a rate of 22%.

What about the average tax rate?

- Take your total income

- Calculate your total tax paid

- Divide your total tax paid by your total income

- Multiply by 100

- This percentage is your average tax rate

Let’s apply this to the same example above.

- Total income = $100,000

- Total taxable income = $100,000 – $12,950 = $87,050

- Total income taxes paid = $4807.50 + 22% of the amount over $41,755 ($9,964.90) = $14,772.40

- Average tax rate = $14,772.40 / $100,000 = 14.77%

Disclaimer: This is your average federal tax rate. If you live in a state where you are charged a state income tax, your total taxes and average tax rate could be higher. If you also have additional income (like investment income), your average tax rate might be different as well. I’m also ignoring social security tax and medicare tax, which for most individuals takes away another 7.65% together until the social security tax phases out.

Average versus Marginal tax rate: which is better?

I believe the average tax rate is a better way of thinking about your tax burden. The most accurate way to figure this out is after you’ve filed your tax return. The tax return will take every deduction and extra governmental tax and credit into account to figure out the true picture. As I mentioned above, things like social security and medicare taxes can significantly add to your tax burden without you realizing it.

Editor’s note: There are a lot of extra sneaky taxes in your life that don’t even make it to your tax return. Here’s a few: sales tax, excise taxes on tobacco and alcohol, occupancy taxes on hotel and AirBNB stays. Almost all forms of spending gets taxed in some way.

The law of diminishing returns

If you take a look at the 2022 tax brackets, above, you’ll notice that the tax rate increases as your income rises. This is the whole basis behind our “progressive tax” system. It’s also the origin of the misconception that you can have your entire income pushed into some new marginal tax bracket just by making an extra dollar.

Most people will be relieved that our tax laws are smarter than this. Income in the lower tax brackets are taxed at lower rates. But the progressive tax system does create less and less incentive to increase your ordinary income. Because at the highest tax bracket, when you consider state, social security, and medicare taxes, essentially half of every dollar is going to the government.

Example of the law of diminishing returns

Let’s say you’re a mid-career single surgeon in California and you make $539,901. Let’s say you have an opportunity to add $50,000 to your income by picking up some weekend call-coverage shifts.

At first glance, that might seem pretty good. Almost a 10% increase in pay? But after looking at the situation through a tax liability lens, it’s not so clear that this is a good idea. Look at the tax brackets for Californians.

This is how much tax you’re going to pay on that extra $50,000, as a California single tax filer with an income of over $539,901:

- 37% to federal taxes (highest marginal tax bracket)

- 11.3% to California state (11.3% of the amount over $375,221.)

- 1.45% to Medicare taxes (social security tax already maxed out)

- Total taxes = 49.75% or $24,875

That’s right — about half of that money will go to taxes, absent some big increase in tax deductions. Taking this into account, those extra sleepless nights might not seem as worth it anymore.

This is why I like to say that extra income at the high end suffers from the law of diminishing returns. The more money you make, the less tax efficient it becomes to just add more income to your paycheck (unless you like giving half of it away to the government). Instead, perhaps you should be using your time to enjoy life or gain investment income, which is much more tax protected.

Conclusion

Your highest marginal tax rate and your average (effective) tax rate are very different. It’s really the average tax rate that tells the story about how much of your money is going to taxes.

The highest marginal tax rate should come into play when you’re considering taking on extra work for more pay. As we discussed, if you are at higher income level, it might not be worth it when you consider what you’re really taking home after taxes.

So what about the person who got a raise in the beginning of this post? They should be happy. Sure, their total tax liability will be going up. But their take-home pay will increase also.

Basically, if your total income goes up, you’re making more money, regardless of what tax bracket you end up in.

–TDD

Do you feel you understand the difference now between marginal and average tax rates? Comment below and please subscribe to my newsletter!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions