In anticipation of my upcoming income report for Rental Property #1, today I’ll teach you the 5 steps to estimating your Real Return from a rental property, while taking into account reserves and bonus return.

I’ve mentioned in a couple of posts that I’ve purchased one rental property so far, and am in the process of purchasing two more. While it’s very simple to see the return on your shares of a particular stock, it’s not so simple to figure out how much return you’re getting on a rental property. The main reason is that there are a lot more moving parts when it comes to real estate. But as long as you have all the information, it’s not too hard.

To calculate your return, follow these 5 steps

- Calculate acquisition costs

- Calculate profit with your Is and Os

- Set aside reserves

- Calculate your strict return

- Add in bonus return to get your Real Return

Let’s go through each of these steps to understand this a bit more.

Acquisition costs

Basically, acquisition costs are all the cash you have to outlay to buy the rental property. This varies like crazy depending on how you decide to purchase the property.

For example, if you buy the property outright with cash, it’s just the purchase price plus legal fees and any inspections you ordered.

On the other hand, if you decide to finance the property, there are a lot more costs involved.

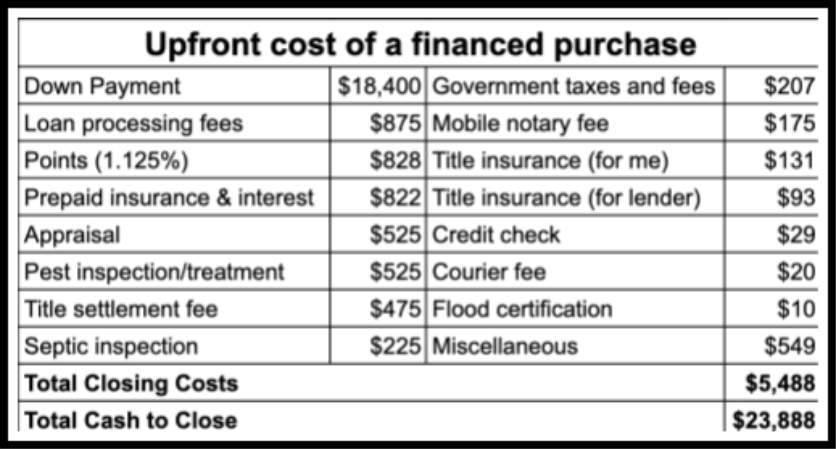

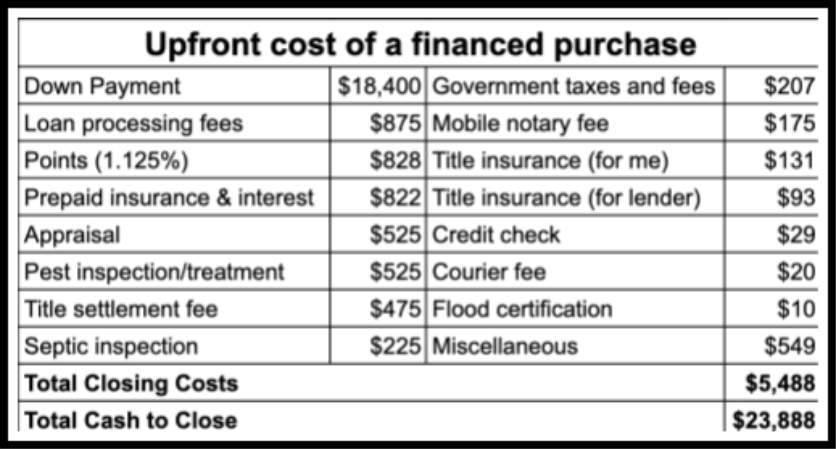

Check out this chart, which includes my actual costs to purchase my first rental property.

The good news is that all of these things are summarized nicely on your closing disclosure. Just take that final “cash to close” number, and it’ll be pretty close to your total acquisition cost.

Profit

To calculate profit, you just have to figure out your Is & Os (Ins and Outs). People in medicine will recognize this as an abbreviation for a patient’s total fluid Intake and Output over a period of time.

When it comes to rental property, Ins are usually comprised of just the monthly rent. If you’ve got extra income from coin operated washer/dryers, this could be a source of additional Ins.

Outs are many and varied. The biggest component is usually the mortgage payment (if you financed the purchase). But it also includes:

- Property taxes

- Homeowner’s insurance

- Maybe: utilities, landscaping, and snow removal

Just add all your Ins and subtract the Outs, and you’ve got your profit. Hopefully it’s a positive number, or you’ll have an issue with this next step.

Set aside reserves

This is an important step, and one that’s often neglected. Basically, you need to mentally set aside money that you’ll likely need to cover future costs.

Areas that should be covered by your reserve fund include:

- Vacancy: the time in between tenants

- Maintenance: the cost of leaky pipes, clogged toilets, broken appliances

- Capital expenditures: big occasional costs like a roof every 30 years or new HVAC every 15-20 years.

Reserves vary wildly by market and quality of the rental property. But a good rule of thumb is to set aside 8% of rent for expected vacancy and 8% for capital expenditures (equal to one month’s rent each). Feel free to set aside more if you’d like to be more conservative.

If you don’t do this, you’re going to greatly overestimate your returns, and then get a big nasty surprise when the HVAC goes out on you.

Calculate your strict return

To get your “strict return,” simply subtracting out reserves from your profit, then dividing this by the total acquisition costs.

Strict return = Profit / Acquisition costs

The strict return is an important starting point, but it doesn’t tell the whole picture of how much financial benefit you are getting from the rental property.

To understand that, you need to calculate your “Real Return.”

Add in bonus return to get your Real Return

“Bonus return” is the secret sauce that makes real estate such a good investment over time, compared to other investment options such as stocks or bonds.

Here are some elements of bonus return:

- Mortgage paydown: if financed, this is the amount the loan principal is decreased in 1 year.

- Appreciation: this is the annual increase in the worth of the home. If the home was leveraged (bought with a mortgage), this return goes up proportionally to the degree of leverage used.

- Tax savings: this is the difference between the taxes you’d pay on your real estate income (often zero due to depreciation) and the taxes you’d pay on a different type of income (like regular income or capital gains).

Some purists might argue that bonus return shouldn’t be counted in any calculations of your return, but I’d say this is shortsighted. To ignore such massive amounts of bonus return really twists the calculations in favor of traditional investments such as stocks and bonds.

It is certainly true that bonus return is hard to estimate and very variable. It takes a lot of steps to calculate principal paydown, for example. And estimating appreciation is notoriously difficult until you go to sell a property.

But my advice here would be to just stay conservative in your estimates, and definitely count bonus return towards your calculation of your Real Return.

Conclusion

I hope you now have a better idea of how to estimate your Real Return from rental property.

In many forums, this concept of estimating your return is summed up by the acronym “ROI,” or Return on Investment. But many ROI formulas completely ignore profit-negative factors like reserves and also profit-positive factors like appreciation and mortgage paydown.

This explanation of ROI from Investopedia is pretty good, but it still doesn’t address appreciation and tax savings. These are two factors that I feel are essential to getting a true understanding of your Real Return from real estate investments.

Keep all this in mind and stay tuned for my next real estate post, in which I’ll estimate my Real Return from rental property #1.

— TDD

Please comment, share, and subscribe for more great content!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

12 comments

That’s a good idea to plan for things like vacancies. I feel like that would let you make sure that you could still get a profit, even if you aren’t making any money for a little while. If I decide to invest in a rental property, I’ll keep that in consideration.

Hi Tyler, thanks for the comment! Vacancy reserves are all part of the strategy to build up substantial reserves so you can keep on holding onto your portfolio in times of turmoil.

— TDD

Thanks for writing. Worth reading. Liked the inputs. Keep Posting.

Thanks for the feedback!

— TDD

Return on investment(RIO) is the most important part of the business. Well, I must say that It was really a good read on this topic! Return on investment should be calculated & measured. Because people invest for profit. It’s good to see someone put forth recommendations on RIO. As you point out, there are plenty of tricks & strategies. Great selection! it was very useful. Thanks for putting top-notch content in the article. It will encourage entrepreneurs to work more effectively and gain potential results from it. I would like to be here again to find another masterpiece article.

Hi Halsey, thanks so much for the kind words. I’m glad you found it useful!

I agree that profit or cash on cash return isn’t the only factor that must be considered.

Thanks for stopping by,

TDD

I am really amazed by the look and feel of this website. It is important to calculate your ROI on any property and this article has almost accurate information on how to calculate the ROI.

Thanks so much for your comment! I appreciate the feedback and am glad you found it helpful.

— TDD

100% agree with you! “Calculate your strict return” is so important step. You did a brilliant job by sharing this helpful content with us. Thank you so much and carry on!

Thanks a lot!

— TDD

Experienced landlords know that one bad tenant can create legal and financial headaches. Another advantage of using a professional property management company is the ability to avoid legal problems.

I’m curious – how do PM companies allow the owner to avoid legal problems?