Today’s post is about SEPP plans (Substantially Equal Periodic Payments), and tells you how to access your retirement accounts early, penalty free!

This post may contain affiliate links.

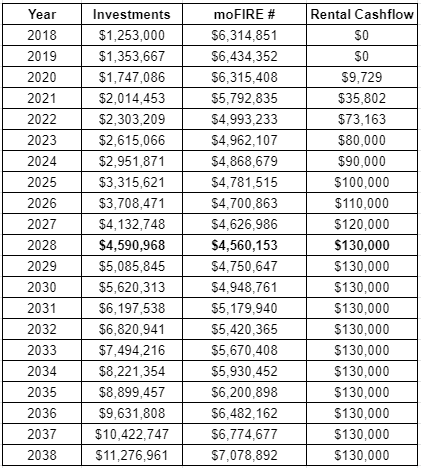

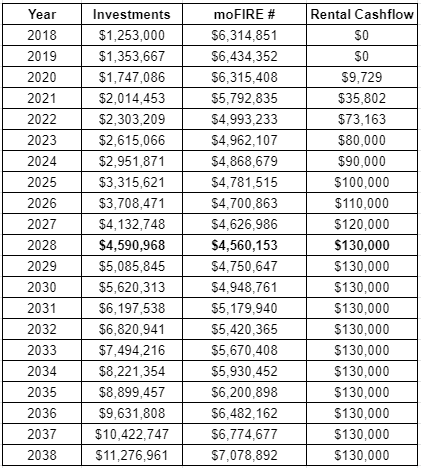

I’ve written before about my desire to hit financial independence in the near future. I originally had a 15 year plan to hit moFIRE using the power of brute savings and index fund investment.

After realizing the tax efficiency of real estate investing, I changed the plan. Now, I’m using the cash flow generating power of real estate investing to accelerate my timeline to financial independence. I recently updated my original plan to a 10 year plan.

If you study my plan, you’ll notice that I’m including our retirement funds in my FI number. In 10 years, we’re projected to have $130k annual cash flow from real estate, but this alone won’t cover all of our expenditures. We’ll definitely need the $4.6 million we’re projected to have in our retirement and taxable brokerage accounts to make up the difference.

Aside: You might be thinking to yourself that I’m throwing around really big, really specific numbers in a very casual fashion. That’s sort of a defining characteristic of this blog. I understand it can be a turn off to some, but I hope for others it makes my content more useful.

Relying on retirement plans

Though not specified above, the portion of my investments in retirement funds should total $2.7 million in 10 years. At that time, the Dr-ess and I will be about 50 years old.

The obvious question is: “How are you going to access the retirement funds before age 59 ½ ?”

(Age 59 ½ is when you’re normally allowed to start drawing down from your retirement accounts, penalty free.)

This is a great question, and one I’ve been pondering recently as a fatal flaw to my plan.

Money Jail

They don’t call retirement funds “money jail” for nothing. They’re specifically created to supply funds in the last third of your life, when most people aren’t making an income. Because of this fact, there are typically penalties if you try to spring your money out early.

But if you’re going to retire early, you’ll probably want to tap your retirement funds before age 59 ½.

Here are a couple of options to do this:

Option 1: Just take it out

I consider this the equivalent of a financial jailbreak. It’s quick, but it causes some collateral damage. For your typical pre-tax retirement fund like a 401k or regular IRA, you’ll incur a 10% penalty on whatever you withdraw prior to age 59 ½. Plus, you’ll be taxed on the money as income.

More info about regular IRAs from the IRS.

For a post-tax retirement fund like a Roth IRA, you’ll also incur a 10% penalty for early withdrawals of the gains. But since you fund Roth IRA with post tax money, you can withdraw the initial contribution at any time penalty and tax free.

There are special exceptions to this 10% penalty for Roth IRAs. For example, if you become permanently disabled, you can withdraw from the Roth IRA without penalty. You can also withdraw gains early if you’re using it to buy your first house.

More info about Roth IRAs from the IRS.

Option 2: Substantially equal periodic payments (SEPP)

This is the equivalent of a supervised early release program from money jail. I only recently learned about this option from Bonnie Koo from Wealthy Mom, MD.

A substantially equal periodic payment plan is a really interesting option for those interested in early financial independence.

Basically, it’s an IRS sanctioned method of accessing funds from retirement funds before the age of 59 ½ without incurring the usual 10% penalty.

You can set up this plan for any retirement plan you’ve got, except for plans you have with your current employer. In that latter case, you need to separate from your employer before you can set up a SEPP plan for those accounts. (AKA, enter early retirement.)

Sounds good, what’s the catch?

Once you start drawing down the retirement account via a SEPP, you can’t stop for at least 5 years, or until you reach the age of 59 ½ (whichever is later). If you do stop, you’ll incur the 10% penalty plus interest on everything you took out.

How much do you get?

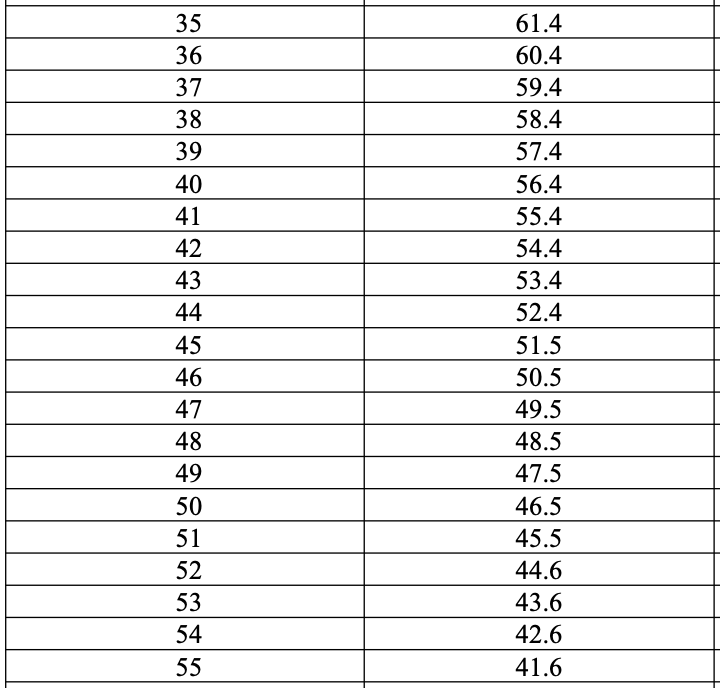

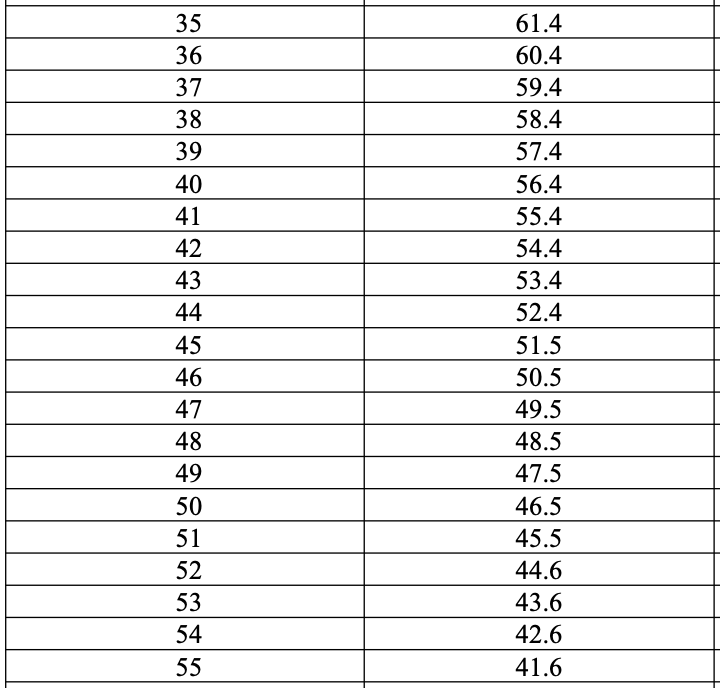

They have a few methods of determining this, and they’re all based on morbid tables that estimate how long you’re going to live. They take the estimated years you have left on earth, and divide your account balance by that number. That’s how much you get each year in a SEPP plan.

Here’s an example:

- IRA balance = $600,000

- 30 years of life expectancy left

- Annual payout = $20,000

Read more about SEPP plans on the IRS website.

Implications of a super early retirement

This is a snapshot of the actual life expectancy table the IRS provides for this purpose. You can see that it’s a pretty conservative table, and plans for people to live until age 96!

Ninety six years is considerably longer than the actual life expectancy in the United states, which is 78.7 years according to the CDC.

It makes sense for the IRS to be conservative, because they don’t want your money to run out before you die. But seriously, 96 years?

Applying SEPP to my plan for moFIRE

Let’s look at the implications of this conservative projection if I retire at the age of 50 and start drawing down our retirement accounts using a SEPP plan. The IRS table projects 46.5 years of life left at the age of 50.

(1/46.5) * 100 = 2.15%

If I want to start drawing down retirement funds at age 50, I’ll only be able to draw 2.15% of my retirement funds using a SEPP plan.

As noted above, in 10 years I project I’ll have about $2.7 million in retirement accounts between the Dr-ess and myself.

$2.7 million * 2.15% = $58,050.

This is about half of the 4% (or $108,000) that I used in my calculations to generate my revised 10 year plan to financial independence.

The % improves slightly at age 55 to 2.4%, but it’s still well below 4%.

How do I salvage my 10 year plan?

So with this new information in mind, I’ve got a few options:

- Revise my 10 year plan with lower draw rates from the retirement funds

- Plan to draw out more retirement cash and just pay the 10% penalty

- Draw preferentially from taxable brokerage accounts or the principal in my Roth IRA until the age of 59.5.

- Make up the difference in more cash flow producing rental real estate (or other income)

All of these options are reasonable, and we could devote a few posts debating which is best. Honestly I probably won’t really know until I get closer to actual full retirement. At lot can change in 10 years.

Conclusion

As we learned, you can get early access to retirement accounts, penalty free, with the use of a SEPP plan (substantially equal periodic payment plan).

There are some nuances to these plans, like the absurdly conservative life expectancy it assumes. But the mere existence of SEPP plans is a gift to the FIRE community.

— TDD

Did you know SEPP plans existed? Do you find them as exciting as I do? Comment below and subscribe for more content!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

3 comments

One of the better options:

“age 55 rule” allows you to take out $s of company plans with no strings attached.

That’s a great rule! Though as a 40 year old, even 55 is many years away for me at this point. Thanks for the comment!

yes, but at 50, the 55 rule is closer and for most people, it is age 54 and change when they may access.

Also for the SEPP, using the amortization method (implied in the post) you have to use an interest rate. Current rate is around 3% which puts your annual pymt at ~ $109k, which happens to be 4% of $ 2.7 M.