With the coming recession, I argue that apartment buildings are the best real estate investment class: recession resilience, value add, economy of scale, and price point.

This post may contain affiliate links.

As I’ve immersed myself in the world of real estate investing, I’ve come to realize that most people consider apartment buildings to be the holy grail of real estate investing. Honestly, I didn’t really get the allure until recently, but I think I’ve got it figured it out now. Especially with a recession likely around the corner, I’m taking a closer look at this asset class myself.

Here are some of the biggest qualities of apartment buildings that I’ve identified:

- Apartment buildings are recession resilient

- The value of apartment buildings is formulaic

- They offer economy of scale

- Apartment buildings are expensive, so everyone can “get a piece”

These reasons are supported by history, as well as my own experience as an apartment investor.

Let’s dive in and explore this. Disagree? Let me know in the comments below!

Recessions are brutal to all asset classes

First of all, let’s talk about how recessions affect most asset classes. Although the past decade has been a really good time to invest in everything from stocks to real estate, that tide has certainly turned in the last year.

Let’s take a closer look at how stocks have changed since the first quarter of 2022. The overall stock market typically falls by 34% in recent recessions, which is very large decline. Year to date, the Dow Jones Industrial Average is down about 20%.

Stocks always come back up, of course, which is why I still recommend investing in stocks to some extent for most investors. But especially for people nearing retirement, or who will depend on stocks for financial independence, recessions can be a scary experience.

Longtime readers will know that I’ve shifted the majority of my investment to real estate in recent years for a number of reasons.

Read more:

- Why I’m investing in real estate over stocks – Part 1

- Tax benefits | Why I’m investing in real estate over stocks – Part 2

- Leverage | Why I’m investing in real estate over stocks – Part 3

Home prices also drop in recessions

Home prices (and therefore home values) also typically drop during recessions. As home buying interest declines due to job loss or economic uncertainty, prices can fall due to decreased demand. Currently, the Federal Reserve is hiking interest rates to fight high inflation, which is spiking mortgage rates to the highest level in over 15 years. This is causing home prices to decline in many markets.

Read more: How the Federal Reserve Might Crash the Real Estate Market

Home prices fell on average 33% during the Great Recession of 2008, but this was pretty unusual. This chart shows that for the last 50 years, property values are fairly resilient in the face of recessions.

source: tradingeconomics.com

This information probably doesn’t stop people from being worried about the real estate market, given that 2008 is still fresh in many people’s minds.

Apartment buildings are recession resistant

The data on apartment buildings is not as straightforward. No matter how much I scour the internet, there’s no single tidy chart to visualize how past recessions have affected multifamily properties. Although this rental housing data on exists, it’s behind paywalls reserved for realtors and appraisers.

However, there’s reason to believe that overall economic conditions during recessions generally favor apartment units.

For example, this is the scenario we typically see in economic downturns:

- Increased unemployment

- Increased renter demand

- Less new construction of housing

These factors together generally favor the multifamily sector, as people generally lose the ability to purchase new homes during normal recessions. At the same time, the housing market’s supply of new rental properties decreases as builders lose funding and borrowing power. (I say “normal recessions” here because there’s good reason to suspect that we are entering a decidedly “abnormal” recession.)

So less home buying and less home building? This is why the multifamily market and apartment building sector overall is typically seen as a recession resistant asset class.

However, in studying my own portfolio, I believe another basic truth of apartment investing makes it especially resilient.

Apartment building value is formulaic

An interesting learning point came for me when I purchased both of my small apartment buildings. When I got the appraisal, I saw that they weren’t directly compared to recent sales over the past 6-12 months, as is common for residential housing or single-family homes. The first value estimate was based on a per unit cost from comperative sales.

For this estimate, the appraiser simply used historical apartment building sales in the area to generate a per unit value. Since initially planned on increasing the apartment building from eight units to 10 units, he generated the following post-renovation “Sales Comparison” value estimate:

For the second estimate, he estimated the typical income cap rates (capitalization rates) for similar apartment buildings from the site RealtyRates.com investor survey. This yielded a cap rate average of 6.5-7%.

The capitalization rate defines the rate of return that is expected to be generated on a property. Cap Rate = net operating income / current market value.

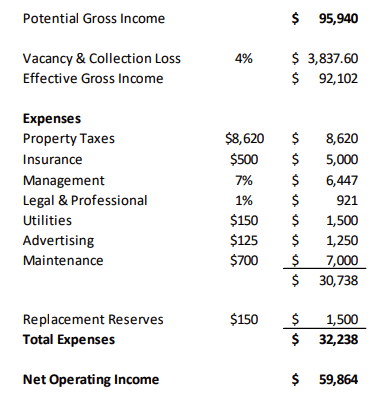

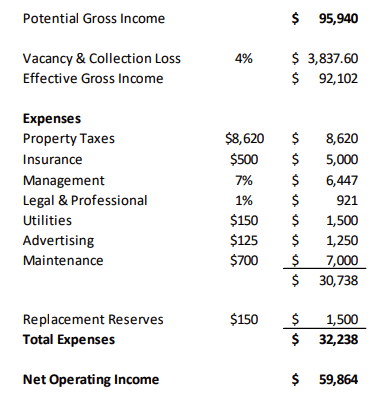

The appraiser then used that cap rate plus the projected rental income and expenses to estimate the projected value of the building. As you can see from the chart, this includes a whole lot of assumptions about the cost of expenses and income.

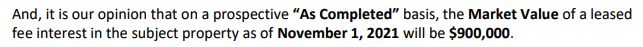

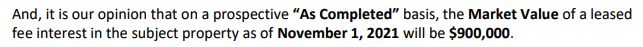

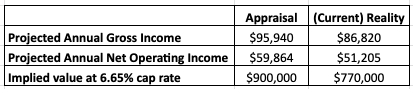

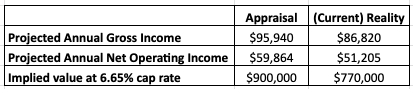

Based on the estimated cap rate, this yielded the following value opinion:

The bank took this post renovation value estimate to extend a construction loan to me to renovate the building to reach the projected value.

This formulaic method of valuation makes it easier to estimate projected values for apartment buildings. Instead of just going by comperative sales like for smaller unit properties, you can take the prevailing cap rate and the rent you plan to charge for your renovated units, and yield a reliable projected value. This computed value is then respected by banks to extend credit for purchases or refinances.

Building class matters

There are some obvious disclaimers here. Even though apartment building values are formulaic, an asset is still only worth what someone is willing to pay for it. This would apply to a bank for a refinance as well. Despite what a formula says, if the bank doesn’t believe the inputs of the formula, they won’t respect the result.

And even though a building appraises for a certain value doesn’t mean that value is the sales price. A lot of things come into play in sales negotiations, like vacancy rates, quality of repair, and class of apartment building.

For example, even if a portfolio of Class C buildings throw off great cash flow with robust rental rates, it’ll never command the same value as Class A luxury apartments. This is why Class A buildings will always command a much higher “cap rate” (capitalization rate) compared to lower classes of housing. This is where knowledge of building class and experience comes into play in apartment investing.

Economy of Scale

Another reason why apartment buildings are beloved is the theory of “economy of scale.” Basically, it’s cheaper to renovate 50 units at once than 50 units individually. That’s because materials can be bought in bulk and construction costs are more affordable per unit for the large apartment building.

Additionally, in an apartment building there is only one (large) roof and usually just one main sewer line. If you’re at a scale where you can hire an in-house handyman, the maintenance costs are generally lower per unit.

And finally, if you have large enough of an apartment building, you can hire an in-house property manager. In-house property managers are generally cheaper per unit when compared to third party property management.

These economies of scale can make apartment buildings more resilient in the face of a recession, when every dollar becomes more important.

Apartment buildings are expensive

The final reason why apartment buildings are recession resistant as an asset class is the fact that they’re expensive. This might seem counter-intuitive, but let’s take a common scenario:

- Purchase an apartment building for $5 million

- Improve the building for $2 million and raise net operating income

- Apartment building is now valued at $9 million

When you’re dealing with a potential profit of millions of dollars, there’s a lot more money to go around to reward investors and operators. This scale incentivizes everyone involved, and (theoretically) allows for everyone to profit.

This factor isn’t really related to economic cycles, but just illustrates why a lot of the media around real estate investing is centered around the large multifamily industry. It’s where the (big) money is at.

My own perspective

In my own portfolio, I’ve seen impressive returns from my duplexes in Indianapolis, especially when I’ve applied the BRRRR method. Using this technique, I added value to the buildings, then refinanced out the majority of my investment. I was then able to recycle this money into the next deal. Since I was leaving very little of my original capital in the deals, their cash on cash returns were really great.

Read more: Returning 17-50% via the BRRRR method for Duplex #2 and #4

But I’ve also seen that smaller unit properties can have one-off issues that wipe out months, if not years of profit. I recently wrote about a roof repair in one of our duplexes in Indianapolis. At $18,000, this cost will wipe out over a year of returns from this duplex. This same duplex’s water main is now leaking… but I’ll write about this another day.

When it comes to our own apartment buildings, it’s been a mixed bag. We’ve learned a ton from our 8 unit building in Indianapolis. Construction costs overruns prevented us from adding an additional 2 units in the basement, but this has been balanced by higher than expected rent from the units we renovated in the main building.

The building is almost completely rented out at this point, which is great. However, due to the decreased revenue from 8 units (as opposed to 10 units), the implied value of the building is decreased. While still profitable, the implied upside hasn’t been as dramatic as we hoped.

The good news is that there are always options for further value add. For example, we could revisiting the idea of adding basement units or additional storage. But for now, we are satisfied with an (almost) stabilized apartment building. In hindsight, I can see that many of this building’s challenges would have been lessened if it had been a larger, better condition building from the start.

Many of our cost overruns came from the fact that an eight unit building lacks the same economies of scale that you can get from a 50 or 100 unit building. This applies to everything from renovation costs to insurance and property management fees.

Conclusion

Apartment buildings offer a mix of factors that make this asset class attractive during tough economic times like the coming recession. From resistance to price declines and robust investor interest due to the scale, it’s likely going to continue to be a competitive market for investors during the next recession.

I’ve found mixed results with my own initial investments into apartment buildings, but can see that a lot of our missteps could have been prevented by going for better quality, larger multifamily investment from the start.

— The Darwinian Doctor

What do you think of apartment buildings? Let me know in the comments below!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

11 comments

I couldn’t agree with you more. And I’ll add one more you overlooked: why they are good in a period of high inflationary period. Given that rents will rise with wages and inflation coupled with the fact that you are paying off your debt with future cheaper dollars they make a great inflation hedge.

Great point! Real estate (especially rental real estate) is a wonderful inflation hedge. THanks for the comment!

Sage advice from someone who has a real estate portfolio with deep red cash flows. Brilliant investing that enabled you to move from sunny paradise to the murder capital of the USA. Ahhh financial independence… now you get to enjoy it in the worst city imaginable 😬

https://wreg.com/news/local/memphis-ranked-no-1-most-dangerous-city/

Fair comment that reveals a good knowledge of my blog — thanks for reading! But to be fair, most of the “red” in my real estate is due to continued renovations into my existing units. Let’s see how things are looking in my next edition of Anno Darwinii!

Also fair about Memphis — crime was the main reason we hesitated at this decision. The choice of city was more due to a great opportunity for my wife, but I’ll take the lower cost of living and lack of state taxes. We’re already seeing the effects of the geoarbitrage. As for the crime… I guess we’ll see! Los Angeles was no cake walk in terms of crime either.

Fair play. Hard to see how you can advise others on financial independence when your own portfolio is so red. But at least you are transparent about the lack of positive cash flow and all potential gains are projecting into an uncertain future.

Thanks. Let’s see how it plays out. We can only make the best investments we can at the time, with the best information we have. I’m confident the ship will right itself. We’ll find out together!

Wow great article. I agree that apartments are a great way against a recession.

So I think multifamily buildings tend to hold their value better than single-family homes in the housing market because they can be rented out at a higher rate.

Thanks a lot for your input!

Ask around and get a good long term price or rent index, specifically for apartment buildings

Yeah it definitely exists, but it’s a more protected data set than for smaller residential units.

You’ve really hit the nail on the head with this post! The detailed insights into the benefits of apartment buildings, especially during a recession, shed light on an investment avenue that many might overlook. Your experience and research provide a fresh perspective, making a compelling case for apartment buildings as a valuable asset class.