Read below to learn how we’re hitting 17-50% projected returns from duplex #2 and #4 with the BRRRR method.

Today’s post is a follow up to my last Anno Darwinii post, where I gave an update on the state of my rental real estate empire. In it, I projected how I thought a couple of duplexes would perform when rented.

If you don’t remember what BRRRR stands for, read this article.

A couple of weeks ago, I had back to back closings for the cash out refinances on two duplexes. After putting the kids to bed, I met the mobile notary at the door and we sat down at the dining room table. Thursday night and then again on Friday night, I signed stacks of documents and finalized the “refinance” part of the BRRRR process.

Specifically, I completed the BRRRR process on Indy Duplex #2 and #4.

Here are the properties:

Duplex #2

Duplex #4

Completely rented!

Last week, my property manager in Indianapolis gave me the good news that both properties will be fully rented as of March 1st! This officially finished the “rent” part of the BRRRR process for duplex #2 and #4.

So now it’s time for a nitty-gritty analysis to finalize my numbers and give the official cash on cash projection for the two properties.

Indy duplex #2: purchase and refinance

I purchased this building through a wholesaler, so there were some extra fees that I paid to get the property under contract. But I got a good price for the property, and it appraised for much more than I expected after my light renovation.

Catching a neighborhood upswing?

Despite some degraded plumbing and an unfortunate issue with a neighbor, things finally seem to be going right for this duplex (knock on wood).

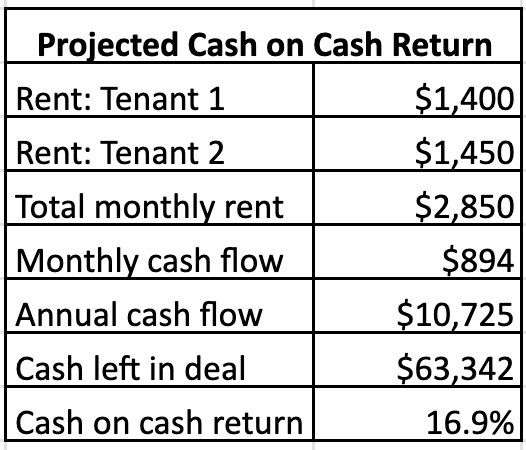

Both sides of the duplex rented for slightly higher than I expected, which increases our cash flow projections. Also, the bank appraisal took place right after three really nicely renovated duplexes sold nearby to duplex #2. This generated a surprisingly high appraisal value.

Are we catching the beginning of an upswing in this neighborhood? Maybe, but only time will tell. As you can see below, the stars aligned for a really impressive cash on cash return.

Indy Duplex #4: purchase and refinance

I also purchased this duplex through a wholesaler. However, this property needed a really extensive renovation, including new plumbing, HVAC, flooring, kitchens, and bathrooms. I also had to pay cash for the property (which is why purchase price = down payment in the chart below).

By the time the renovation was over, I’d sunk almost a quarter of a million dollars into the deal!

Too much renovation?

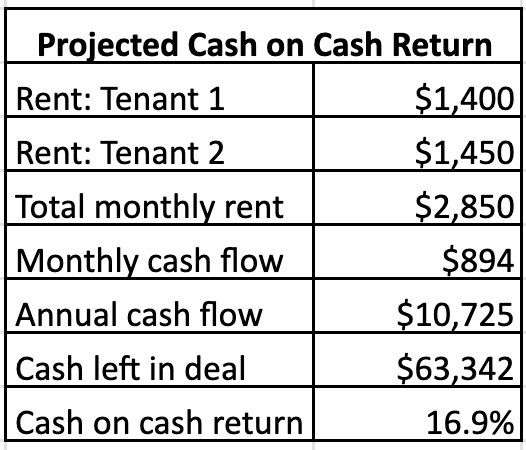

This deal was interesting. Because of the cost of the renovation, the property appraised for only $25,000 more than I had sunk into the deal.

The lender also caught an error where they’d originally planned to cash out 75% of the equity, instead of the 70% the duplex deserved. That’s an extra $13,750 that I had to leave in the deal, for a total of over $60,000 of cash left in the deal.

But in the end, I’m still walking away with a nicely renovated duplex at about a 17% cash on cash return.

Sweet liquidity

Last week, the funds cleared and roughly $250,000 flowed into my bank account from the lender. I directed the cash back into our HELOC, reducing our balance and priming the pump for our next project.

Considering the spread between our cash invested and the appraised value of the homes post-renovation, we created almost $100,000 of equity with these two BRRRRs. We should also get over $18,000 total cash flow from the properties annually after expenses, all while our tenants pay down our mortgages.

I still have Duplex #3 weighing on my mind. Also, the major renovation on the 10 unit apartment building is about to kick off. I’ve got stories to tell you about both properties, but I’ll save that for another day. Suffice to say, my once-in-a-while antacid is now a daily necessity.

GERD catalyst #1

GERD catalyst #2

Conclusion

Finally we’re done with the BRRRR process on duplex #2 and #4! Now, the Dr-ess and I are pondering what to do with our capital once again. We technically need to keep on going to fulfil the repeat portion of the BRRRR process. In the short term, I’ve decided to pause on new property acquisition until the apartment complex renovation is humming along.

Speaking of short term, I’ve become intrigued recently with the potential tax savings I may generate with the purchase of a short term rental.

PhREI Network partner Carpe Diem MD is a big proponent of this. His experience is making me wonder if it’s time for me to give this a try as well.

Much more excitement (and antacids) to come! Stay tuned….

–TDD

What do you think? Is gastroesophageal reflux disease a fair price to pay for two successful BRRRR deals? Comment below and please subscribe for more!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

8 comments

Very impressive, thanks for sharing! Can you comment on your experience working with wholesalers to acquire these deals? How do you handle inspections? Do you opt for after purchase knowing that you’ll be undertaking large rehabs anyways? Do you use a real estate agent to represent you?

Hey Jared, I’d say my experience with wholesalers is mixed. I should write a post about it. Only one wholesaler deal was exclusive, as in I had no competition. The other deal was heavily advertised and I needed to come in over asking price by $10,000 to get it. There was no formal due diligence period and I had to pay the full price in cash.

The other deal was more traditional, and I even got to use financing, but that’s unusual for wholesale deals. I used an agent to represent my interests both times, but her role was fairly limited. She mostly helped with paperwork and contracts, and stayed out of the negotiations. I did that directly with the wholesaler.

I’ll put this on the list of topics to cover in an upcoming blog post!

Comments fixed now!

TDD,

Great job implementing the BRRRR method and sharing your experience. You clearly demonstrate how one can use a HELOC as a bridge loan to acquire and rehab LTR property. I’m impressed how you were able to pull out significant capital via your cash out refinance for both properties while maintaining cashflow. Then being able to turn around and pay back your HELOC. Win win win. Nice work.

Thanks a lot Ian! I’m finding that each deal is unique, but I’m happy with how these turned out. I’m wary of floating long term debt on the HELOC, but for now I’ve been able to pull out the majority of my investment with each BRRRR.

[…] Is it cold in here or is The Darwinian Doctor just using a funky real estate acronym to describe his excellent investments? Returning 17-50% via the BRRRR method for Duplex #2 and #4. […]

How do you find reliable contractors?

I usually rely on referrals from trusted people. Realtors all know great contractors, for example. And if you’re in an investing community, you can ask your friends who invest in the same market! Aside from that, it’s calling around, interviewing, and trial and error.