This post explores how the Federal Reserve might lead to a crash in the real estate market. I’ll review the evidence and outline my opinion that a correction is likely, but a crash probably isn’t going to happen.

This post may contain affiliate links.

If you’re not actively buying real estate right now, it can be hard to understand why investors are so obsessed with interest rates. But as an active real estate investor, let me tell you that interest rates are one of the most important elements of a good deal.

The Federal Reserve just raised its benchmark interest rate 0.75%. This brings their benchmark federal funds rate to around 1.5-1.75%. While this might not seem like a lot, this is the largest rate increase in 28 years.

“Only three quarters of a percent? What’s the big deal?” you might ask.

What’s the big deal?

One thing to understand about this interest rate business is that the pure interest rate isn’t as important for long term real estate investors like me. What is more important is where people think the interest rate is likely to go over the next year or so. Since most people use a 30 year fixed interest rate mortgage to purchase homes, banks need to somewhat predict where the wind is blowing to offer mortgages that make sense for their bottom line.

Based on what Jerome Powell has said, there is widespread belief that the federal reserve will raise interest rates up to 3.4% in 2022. Since current rates are hovering around 6% for a 30 year fixed mortgage, this implies that by the end of the year, we might be looking at rates of up to 8-8.5 percent.

This is pretty remarkable, given that in the beginning of 2021, average 30-year rates were below 3 percent!

In this post, I’m going to run a few numbers to illustrate how higher rates affect the borrowing power of homebuyers and investors. I’ll then discuss how this might tank the housing market (and why it also might not do this).

The Fed’s Effect on Mortgage rates

Let’s start with a quick refresher about the Federal Reserve. If you haven’t already read this post about the reasons why the Fed is raising interest rates, I highly recommend you check it out.

But basically, the Federal Reserve (or the “Fed”) is the central bank in charge of setting the monetary policy of the United States. It uses this power to maintain financial stability. Recently, the main task of the Fed has been to combat high inflation by raising its benchmark interest rate. Higher interest rates increase the cost of borrowing money in our country.

The Federal Reserve is a separate entity from the federal government, but they will generally work closely to try to avoid financial disasters (like the Great Recession).

While there’s not a 100% correlation between the Fed’s benchmark lending rate and mortgage rates, they’re closely related. Increases in the benchmark rate ripple throughout the nation, increasing the cost of both short term and long term debt. When the ripples push up the interest rate on long-term interest rates like the 10-year Treasury bond, mortgage rates also rise.

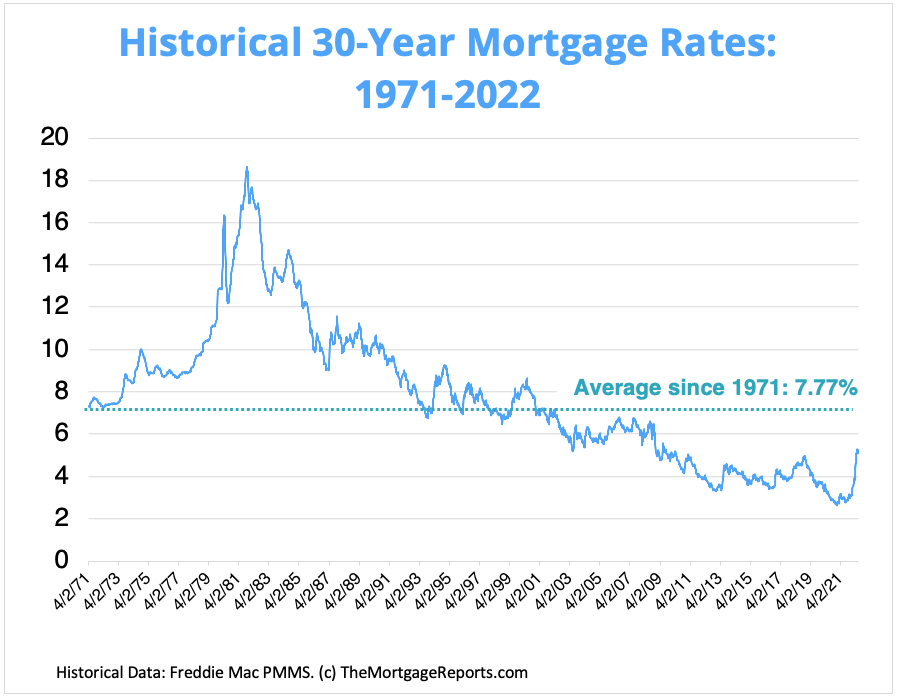

Mortgage rates are still historically low

Even though this post is all about how mortgage rates are rising, it’s important to realize that the rates are historically fairly low. Look at this graph of mortgage rates in our nation over the last 30 years:

You can see that even though mortgage rates for most people are above 5-6% currently, this is still below the historical average of 7.8%.

The fact is that the mortgage rates that many of us consider normal since the housing market crash of 2008 are in fact crazy low.

Over the last decade, this low rate environment encouraged investors and homebuyers in general to deploy capital into assets like stocks and real estate. This is because with such low interest rates, there’s no incentive to keep money chilling in a bank account. In a low rate environment, disposable income is much better off deployed into rising assets like homes and equities (stocks).

The low-interest rates also give potential homebuyers incredible borrowing power.

Low rates fueled the housing market boom

The combination of low interest rates and a big shortage of single-family homes led to a big mismatch in housing demand and housing supply. As always happens when there’s more demand than supply, this led to higher house prices, aggressive speculation, and even signs of exuberance in the housing market.

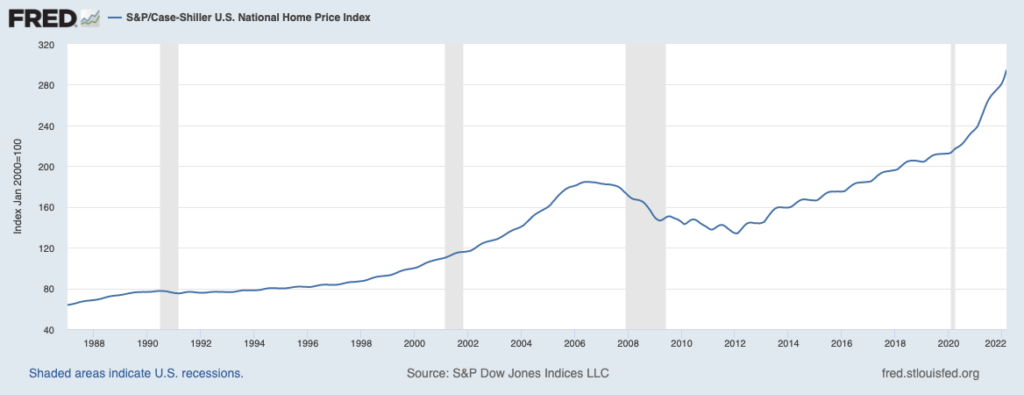

As you can see from the Home Price Index graph below, home prices became more affordable after the Great Recession and bottomed out in 2012. Since then, our country has seen a rapid rise in prices leading to less affordability.

Investors and existing home owners were rewarded during the pandemic, when houses saw double-digit price increases of up to 15%, depending on where you live.

As a homeowner and investor myself, I saw my net worth increase about 30% in the first half of the pandemic, mainly due to appreciation of my previously existing assets.

This all came to a crashing halt earlier this year as the Federal Reserve started to raise interest rates to combat inflation.

Are you interested to learn why? It’s all about borrowing power.

How mortgage rates affect borrowing power

Let’s talk about how mortgage rates affect the ability of prospective buyers to borrow money for houses. In my opinion, this is really how the Federal Reserve might trigger a housing correction or even a crash in home prices. Read below, but the small increase in interest rates seen over the last 6 months has led to a 25% decrease in the borrowing power of your average home buyer!

Let’s think about the purchase price for a first time homebuyer in the US. On average, it’s about $350,000. This represents a $280,000 mortgage with a traditional 20% down loan.

In 2021, when mortgage interest rates were about 3%, a 30 year fixed mortgage payment would cost you about $1180 per month.

In mid 2022, with rates for the same mortgage product around 5.4%, the same home will now cost about $1572 per month.

That’s a 33% increase in mortgage costs in just a 6 month time period!

With the average household income in the United States being $67,521, this means that the increased housing costs ($4704/year) will now eat up an extra 6.9% of that income. That’s a big chunk!

For that average homebuyer to keep the monthly mortgage payments the same, the price of that average home ($350,000), would have to drop to $262,500.

Overall, as I mentioned above, this 2.4% increase in mortgage rate represents a $87,500 or 25% drop in the borrowing power of your average home buyer!

The worst case scenario

If Jerome Powell keeps on course and raises interest rates as expected, average mortgage rates might rise to 8-8.5% by the end of the year. This means the same buyer I discussed above will only be able to afford a $161,000 home if they want to keep their mortgage payments the same. This is 54% less than the average home in today’s market.

It’s clear that the average home buyer will be locked out a new home purchase while this interest rate escalation is taking place.

Check my math using this amortization calculator.

Will the Federal Reserve crash the real estate market?

All the math above boils down to one simple fact: higher interest rates makes it tougher for people to afford a home. This is going to price a lot of people out of the housing market. It’s also going to make it tougher for people to borrow money to build new homes.

(As I discussed in this previous article, these are all intentional consequences of the Federal Reserve’s actions.)

This is most likely going to affect the housing market is some predictable ways:

- Decreased demand for existing homes

- Increased supply of homes for sale

- Decreased home building

- Decreased home sales and home values

- Decreased demand for new mortgages

- Decreased home price growth

Taken to the extreme, these effects can cause a drop in home values.

But will the Federal Reserve actually crash the real estate market? I don’t think so.

Correction likely, crash unlikely

What does a “real estate crash” even mean? If we put it in terms of the stock market, a real estate crash could be something like a bear market, when stock prices drop by 20%.

While there are some early signs of a softening housing market like decreased price increases and greater housing supply, our baseline is one of tremendous demand that outpaced supply a long time ago.

We’ve had a red-hot housing market for so long due to chronic underbuilding of homes since 2008. This is meeting a huge wave of home demand from millenials, who now constitute 43% of homebuyers. Lending standards are also much more stringent now than in 2008, which means the banking industry as a whole is in better shape to withstand downward economic pressure.

Overall, this creates a set of market fundamentals that will support the housing market despite higher interest rates.

So while I do believe we are looking at a likely plateau or slight correction in home prices, I do not think we are due for anything close to a “crash” in the near future. People will definitely be spending more of their money on mortgage payments while interest rates remain elevated, but in most markets, there will be sufficient demand to overcome that pressure.

Read my explanation of this in this post from mid 2021: Are we headed for another housing crash?

Conclusion

I hope you now understand how the Federal Reserve might crash the real estate market. It might do this if it pushes interest rates so high that no one can afford a mortgage. While the increased rates have certainly impacted borrowing power, I believe there is enough pent up demand still remaining in our nation to keep housing prices stable for the short term.

I don’t think there will be strong home price appreciation in the near future, but a crash? I don’t think so.

— The Darwinian Doctor

What do you think, is the Federal Reserve going to crash the real estate market? Lemme know in the comments below!

And don’t forget to sign up for my mailing list!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

2 comments

I think that the Federal Reserve will increase interest rates and remove liquidity from the system until we have Lehman Brothers moment, ie a very large financial institution declares bankruptcy. Then the Fed will go back to easing interest rates and generating QE. It has happened before and will continue to do so.

Banks have been required to keep a lot more liquidity on their books in comparison to 2008, which will likely protect from this scenario. However, a recession would likely prompt the Fed to ease up on the interest rate hikes.