In today’s edition of Anno Darwinii, I’ll give you the update on our rental empire and tell you about buying a 10 unit apartment building!

This post may contain affiliate links.

As our real estate empire turns one and a half, I feel that I’m finally starting to see an acceleration of our investing. Just like compound interest can cause traditional investments to snowball in growth over the years, consistent effort can yield similar effects for a real estate portfolio as well.

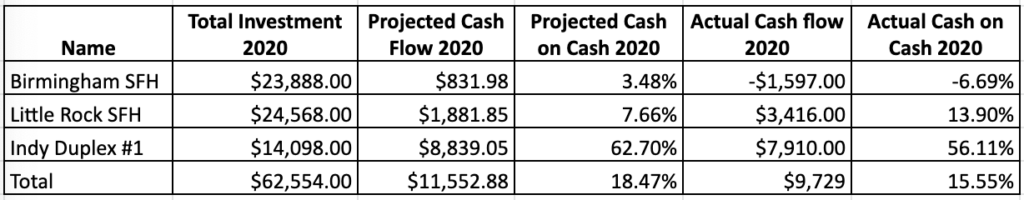

Here a visual update of our stabilized properties in chart form:

By “stabilized,” I mean that they’re renovated and fully tenanted.

We generated almost $10,000 in cash flow in 2020, and every cent was pumped back into our investing. It helped fund the purchase of the three new duplexes, and gave us the confidence to buy an apartment building as well.

I’ll give you a quick update on these stabilized properties before moving onto the rest of our Indianapolis portfolio.

Birmingham SFH

We continue to be dragged down by a non-paying tenant in Birmingham. I don’t really know the story, but I assume she’s like many others in this country that have been affected by the Covid-19 pandemic.

With the national eviction moratorium, there’s not much we can do about this for now. The lack of rent caused the property to return -6.7% for 2020.

Luckily, we have ample reserves to continue to pay the mortgage even without rent checks coming in. We may at some point sell this property to simplify our portfolio, but for the time being we are going to see how the pandemic pans out. It’s been a good lesson for us to always have plenty of reserves when investing in rental real estate.

Little Rock SFH

Our single family home in Little Rock has been the “rock” of our portfolio. Every month we get the rent checks deposited into our account, and there’s been absolutely no problems with the tenant, property management, or with big repairs (knock on wood). With our real world data, this property returned a 13.9% strict return in 2020.

Indy Duplex #1 – the “home run”

I highlighted this property recently as a true “home run” investment. After completing the BRRRR process, we projected it to return 62.7% in 2020. In the early winter, some building maintenance on the gutters caused the maintenance costs to be higher than projected. So with the real world data, it returned 56.1% in 2020. I still get a warm and fuzzy feeling whenever I think about this deal. As my first renovation project, it is the duplex that really launched the active phase of my real estate investing journey.

The buying blitz

Mid-2020 onwards was a crazy blitz of purchasing, renovating, and dreaming big. My wife, the Dr-ess, got fully on board with my vision and supported the investing both logistically and emotionally.

After a long dry spell, we purchased 3 duplexes in July. They’re finishing up the BRRRR process now (for the most part). As they started wrapping up, we moved swiftly on and spent the last couple of months buying an apartment building!

Here’s the update below:

Indy Duplex #2 – the dark horse

In my last edition of Anno Darwinii, I wrote about the challenges we had turning over one of our duplexes (Indy Duplex #2). Like the heralds of some real estate apocalypse, we dealt with leaks, fire, and pit bulls in rapid succession.

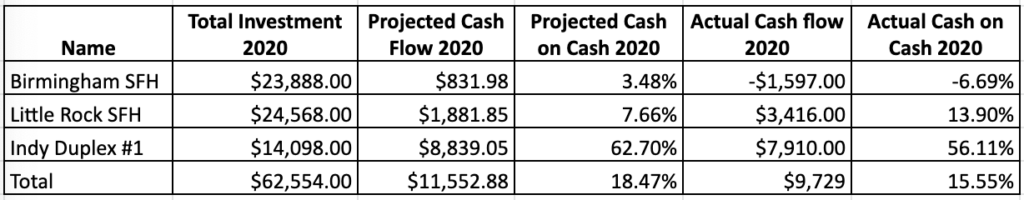

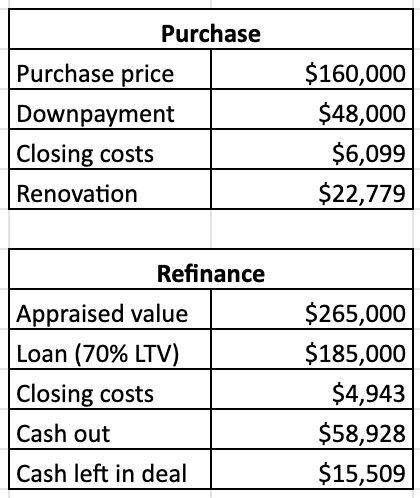

Since then, both sides of the duplex have had a facelift, and one side is rented. We recently got the property appraised and were surprised at the high valuation it got. The recent comparative sales in the neighborhood are quite strong, which bumped up the valuation of this duplex significantly.

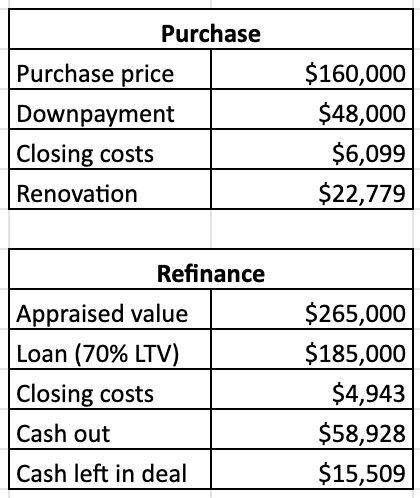

When I close on the refinance next week, we’ll pull out almost our entire investment, leaving only $15,509 in the deal (even with the extra plumbing repairs). Once both sides are rented, we expect total monthly rent of $2200 and a cash on cash return of 36.3%.

Here are the basic numbers in chart form.

So from the ashes of despair, this one turned out to be one hell of a deal!

Indy Duplex #3 – the troublemaker

Before

After

When I first posted about this property, I said, “…the property is in pretty rough shape and will need a big facelift. Cost overruns on the renovation could sink the deal, so I’m going to have to be careful with this.”

I described the transformation of the property in this renovation highlight. Since then we’ve had some setbacks. The appraisal came back quite low in the refinance. In fact, it came back so low that we decided to cancel the refinance and try again later.

We’re also having trouble renting the units. There were a couple of layout issues that didn’t seem like a big deal initially, but are proving to be a big turnoff to potential tenants. One issue is a steep staircase in one unit, and the other issue is having only one bathroom.

I have a bad feeling this duplex is going to be a long term financial loser for me. I’m giving it the benefit of the doubt for now, but suffice to say I groan whenever I think about the duplex. This property taught me lots of expensive lessons that I hope to teach to you later (for free).

Indy Duplex #4 – the beauty

Before

After

I’m really happy how Duplex #4 turned out. We transformed it from an old, run down building into a really beautiful property. It’s spacious inside and has a very warm, homey atmosphere.

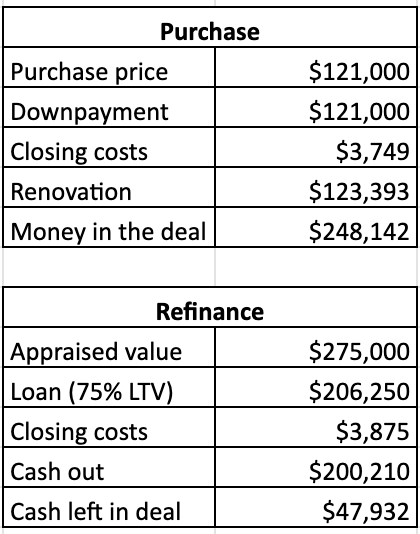

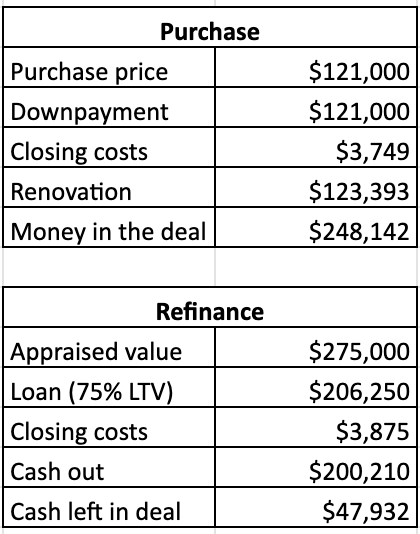

Between the purchase, renovation, and holding costs, we spent about $250,000. It appraised at $275,000, and I just signed the refinance closing documents yesterday. When I went through the documents for this post, I noticed that for some reason, they allowed me to take out 75% of the value, instead of the 70% that is usual. This makes the deal even better.

Here are the basic numbers of the deal, below.

One side is currently rented for $1400 a month, which is better than expected. Assuming both sides can get rented for a total of $2700 a month, we expect a cash on cash return of 19.6%.

While it’s not a “home run,” I think the property turned out really nice. I’m happy to sacrifice some return for having a nicer property in my portfolio.

Buying a 10 unit apartment building

And now, for the crowning achievement of this update. The Dr-ess and I spent most of December buying an apartment building! Just last week, we closed on an 8 unit apartment building in Indianapolis with space in the basement to create two more units. It’s currently 25% occupied and the rest of the units are in various states of disrepair.

We purchased it for about $430,000 and are tentatively projecting a renovation budget of about $300,000. It was challenging to find a lender for the project, but we found a local Indianapolis bank that was willing to fund 75% of both the purchase and the renovation.

Today I’m just introducing the project, but I’ll do an in depth property profile in the weeks and months to come. This building is going to provide tons of great material for the blog. I’m already learning so much about commercial loans, cap rates, and larger scale renovations.

Conclusion

Now you’re completely up to date on our real estate empire. It’s 1.5 years old and growing rapidly. Buying an apartment building was an exhilarating beginning to 2021. will be the crown jewel of our portfolio after it’s renovated and stabilized. But as we found out with Indy Duplex #3, things don’t always go as planned.

— TDD

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

13 comments

This is exciting news for you, I wish you the best.

I notice you have quite a few properties in Indy. I can imagine that having a great team to manage them is a real asset. But I wonder about diversification–what if something happens to the local economy? Are you planning to keep investing in the same city, or are you thinking of investing in other cities next?

Excellent question! There’s comfort in an established team, and it makes it increasingly easy to invest more money in one spot. But I certainly do consider risks of over-investment in one geographic area. If the city changes their laws regarding rentals, or its tax rates, this could have a huge impact. Some local black swan event can also be a risk.

So to answer your question, yes I’m considering branching out to another city soon. I’m considering my options, but will hopefully do this in 2021-2022.

As a busy doctor, it’s my opinion that you are over extending yourself. Focus on rental properties which either already have tenants or require only cosmetic (under $15,000) renovations. The reduced stress will thank you 🙂

You’re probably right about the reduced stress. But where are these nicely priced, already tenanted buildings that only need cosmetic repairs? I can’t find them!

Hey! ER doc from California but living in Houston. Own zero properties but plan on changing that before the end of 2021. Wondering if you are claiming REPS status now that you have this many properties? Both my husband and I work full time (also ER doc), it seems like it works out to 15hrs a week. Wondering how we’d swing that? I realize I’m probably getting ahead of myself but since you seem to be in a similar situation, figured I’d ask.

Hey Veronica, great question! REPS is an amazing tool for sheltering taxable income, but as you mention, it does mean that one spouse must spend more hours on real estate than on their normal job. This is really hard unless one spouse is not working or only works part time. But depending on the amount of money you intend to put into real estate, you may still come out ahead if one of you goes half time. It’s a big leap, though, and not possible in many work environments.

For me, I don’t really have an option to go part time now, and my wife has no inclination to do this either. So REPS isn’t in the cards for my family right now.

TDD,

You should feel incredibly proud of the ambitious portfolio you’ve accumulated over the past couple of years – it’s a feat of dedication and I can only imagine the extra bandwidth it’s taken. It seems with this as a project you and your spouse have worked on together, you’ve approached it with shared enthusiasm rather than fatigue, and that makes all the difference. Look forward to learning more from your journey!

Fondly,

CD

Thanks so much, CD! It’s been quite a journey, and I feel like we’ve only just begun!

[…] in debt. Now he is specializing in oversharing details about his finances while building a real estate empire to achieve morbidly obese financial independence […]

Hello from AZ.

I have really enjoyed following your journey into remote real estate investing and you have inspired me to take the leap. I am an anesthesiologist in PHX and have 4 local rentals but the prices here have become ridiculous over the past 2 years. My wife has been reluctant to invest OOT, because we have enjoyed the ability to visit our properties and be involved during improvements and renovations. More importantly we have developed a team we can trust. She has started to read along with me and is now interested in other markets. Her only concern is finding a team we can trust. Would you be willing to share your contacts, realtors, property managers, contractors in Indianapolis? We are narrowing down our focus to 3 areas and Indy remains at the top of our list based on the R/V ratio, tenant-landlord laws and economy as you described in your recent post.

Thanks for over-sharing and providing a very realistic picture of your journey.

Hey John, you literally have the same name as one of my contractors. I did a double take when I read your message. I’m happy to share, but I want to learn more about you — can you shoot me an email via the contact form?

[…] Last update, we only had 3 properties stabilized, which means they were fully renovated and tenanted. Together, they generated about $9,729 of income in 2020. This was less than projected, but not bad at all. Every cent was pumped back into our real estate fund. […]

I love reading your article. This is such an amazing post.