Learn how to calculate your asset allocation as a real estate investor. Turns out we’re actually about 80% concentrated in real estate!

This post may contain affiliate links.

TLDR: As a real estate investor, you should calculate your asset allocation using the market value method (what you could sell your properties for), not by the purchase price or what your equity is in the portfolio.

The perks of being a blogger

Being a blogger is interesting. I write posts with the best available knowledge that I have at the time. After I hit publish, I often enter into a real-time editing process as I’m gently corrected by real experts in the comments section.

It’s actually a wonderful perk of finally having an audience and readership after all these years, and I’m very thankful for it. The comments section is another opportunity to learn and grow. In this case, the correction was in regards to my asset allocation.

It turns out that my family is about 80% concentrated in real estate, not 56% as I suggested last week.

The error

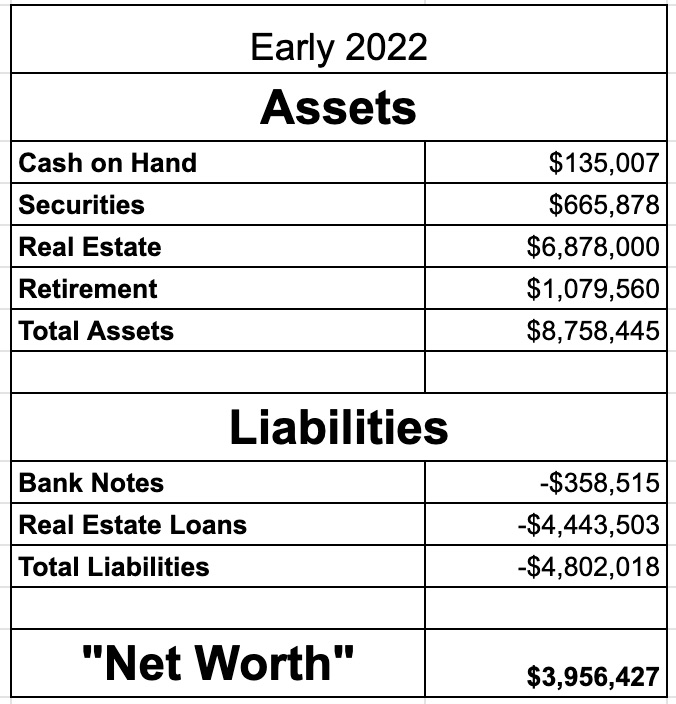

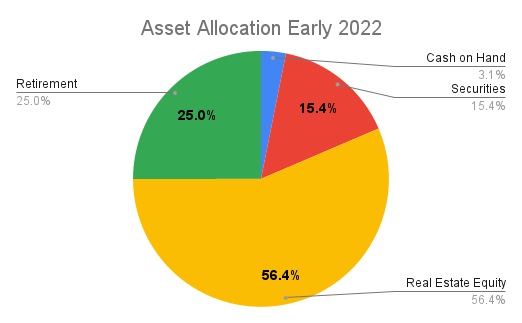

When I created my asset allocation last week as part of my early 2022 net worth update, I included a pie chart that showed that our net worth.

Bank Notes = student loans + SBLOC

I then took my real estate equity, stocks, and cash, and then put it into a pie chart which showed that our assets are 56% concentrated into real estate. In my mind, this made sense because if I went to cash out my real estate portfolio, I’d only walk away with the equity that I have in the properties, since I have mortgages on all the properties.

This mental gymnastic yielded the following asset allocation chart:

But as reader “PharmMedMD” commented, this understates the role of real estate in our portfolio quite significantly. (PharmMedMD is a corporate officer for a large company and knows a thing or two about this subject.)

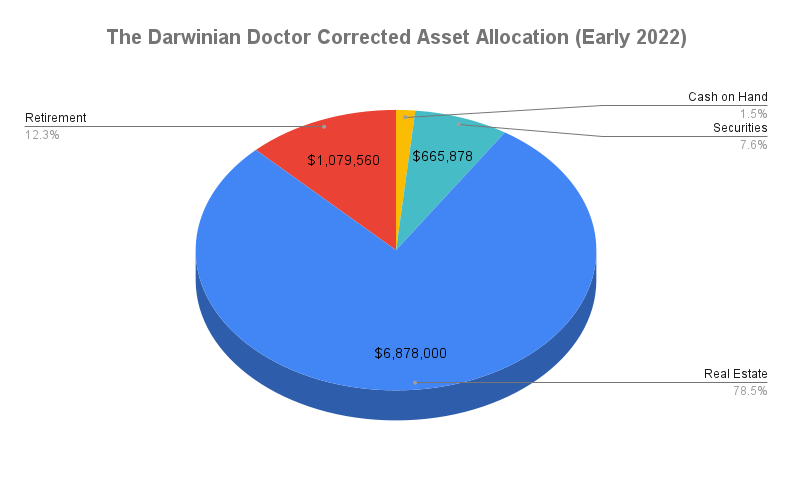

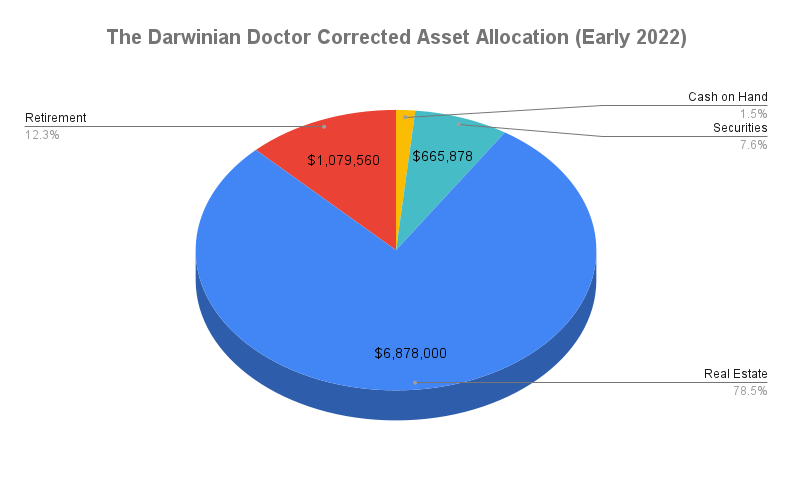

The Darwinian Doctor’s Corrected Asset Allocation

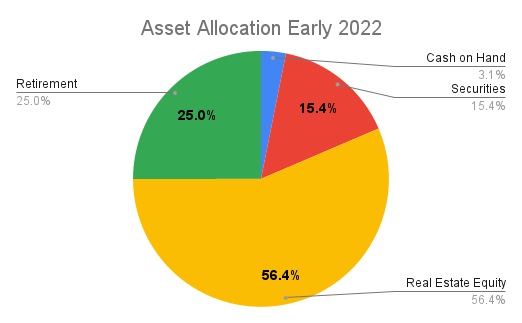

In actuality, here is my true asset allocation:

Our allocation in real estate is actually 78.5%! What led to this huge correction? Read on!

The correct way to consider asset allocation

When thinking about asset allocation, the correct method is to use the market value of the assets. Instead of just tallying up the equity I’ve got in my real estate portfolio, I should have tallied up the total market value of all the buildings instead.

This rule also applies to the mutual funds that comprise the rest of my portfolio in our taxable and retirement accounts. The value of these index funds fluctuate with the stock market, so their value is whatever they can be sold for in the public markets. Importantly, it’s not just the purchase price of the assets, because values can change significantly over time.

Due to market forces, your asset allocation will fluctuate with the stock market and as property values rise and fall.

Notably, this method leaves out debt, whether it’s mortgages on the investment properties or the SBLOC on our taxable account. While this debt is very important when calculating net worth, it’s less relevant when thinking about asset allocation.

Why should we only consider market value of the assets when thinking about asset allocation?

It’s because of risk.

Asset allocation is all about risk

As PharmMedMD pointed out, the true goal of an asset allocation chart is to assess your exposure to risk in various asset classes. This is very different from a net worth chart, where the goal is to track your general progress towards your financial goals.

An example of portfolio risk

Let’s say you’re looking for higher returns in your investment portfolio and really love Tesla. Against my recommendation, you decided to go for a 100% allocation in Tesla stock. Let’s say Elon announced yesterday that he’s going to retire and spend his days making garden gnomes instead. In this scenario, Tesla will take a huge beating on the stock exchange and probably plummet 50%. Since your asset allocation is 100% in Tesla stock, your portfolio will take a 50% hit as well.

My portfolio is heavily weighted to real estate

By showing my asset allocation with real estate only represented by the equity I have in my properties, it was greatly understating my downside risk.

Since I own $6.88 million of real estate, if real estate prices drop 50%, my net worth drops by $3.44 million, which is much more than the $2,434,497 of real estate equity I have.

This is because in this scenario two things are happening:

- The worth of my equity drops by 50%

- I’m still on the hook for half of the leveraged debt (mortgages) as well

Leverage = higher risk

This is as good a place as any to point out that the high investment returns of real estate investing are generally made possible by the use of leverage. By using mortgages to purchase real estate, I’ve been able to purchase a staggering amount of real estate in just a few years. This gamble has coincided with an era of high capital appreciation both for “traditional investments” like stocks and also “alternative investments” like real estate.

This led to the approximate $900k of net worth increase over the past year or so. I’ll readily admit these high returns are a mixture of smart buys and great market conditions.

Read more: Leverage | Why I’m investing in real estate over stocks – Part 3

Real estate investors are neglected

Let me take a second here to rant.

One major problem in the world of personal finance is that most of the published guidance out there is targeted towards securities investors. (Securities are financial instruments like stocks and bonds.)

When you Google “asset allocation,” all of the top hits discuss how a diversified portfolio is a mixture of stocks, bonds, and cash. There is very little writing dedicated towards how to adjust this to an investment strategy that includes real estate investing with assets such as residential real estate (like apartment buildings) or commercial real estate. The only exception is perhaps real estate investment trusts (REITs), which are basically a securitized approach towards investing in the real estate market.

If you grab any financial advisor off the street and ask about their recommended asset allocation, they’ll probably start discussing modern portfolio theory and risk tolerance, but completely neglect real estate. The “higher risk, higher reward” discussion is all well and good, but without a discussion of how this applies to real estate, a whole category of investors are just being ignored!

OK, rant over.

It’s also about your goals

As you look at this roughly 80% allocation towards real estate, you might question this choice. Join the club — it makes us a little nervous too!

However, my main financial goal is to gain a comfortable level of financial independence (moFIRE) over a short time frame. So for me, lower risk via long term investment opportunities doesn’t make as much sense. That’s why my wife and I purchased so much real estate over a relatively short time period. I feel investment property offers the highest returns, cash flow, and tax benefits in one tidy investment vehicle.

As long as economic conditions cooperate over the next few years, we should achieve this goal.

Read more: How rental cash flow cut 5 years off our plan to moFIRE

Conclusion

As you read above, my approach to calculating our asset allocation was all wrong. I shouldn’t have used just the equity I have in my real estate portfolio.

As a real estate investor, you should calculate your asset allocation using the market value method (what you could sell your properties for), not by the purchase price or what your equity is in the portfolio.

With this method, our asset allocation in real estate is almost 80%.

–The Darwinian Doctor

If you’re a real estate investor, how do you calculate asset allocation? Comment below!

And don’t forget to subscribe to the newsletter!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

3 comments

I am blushing but I think you have communicated this much more clearly than I did in our exchange. I really appreciate the openness and transparency of your blog.

Thanks for inspiring the post!

In this informative article, the author discusses the importance of asset allocation in real estate investing. They offer valuable tips on how to diversify and balance a real estate investment portfolio, ensuring a more stable and profitable outcome for investors. A great resource for those seeking to optimize their real estate investment strategies.