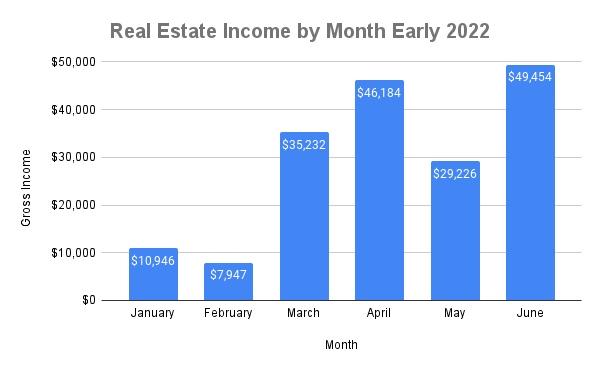

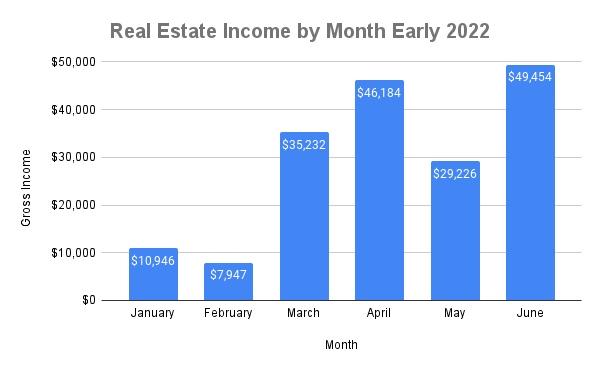

In this 3 year anniversary episode of Anno Darwinii since the start of our Real Estate Empire, our monthly gross rental income hits $50,000.

This post may contain affiliate links.

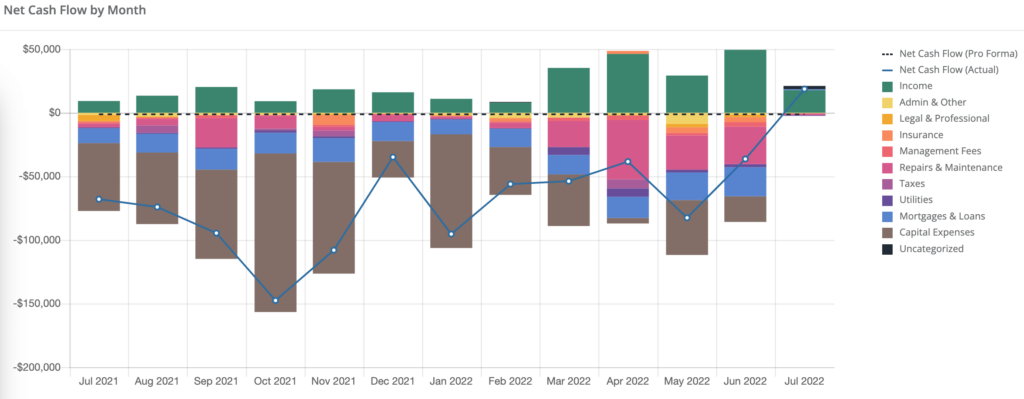

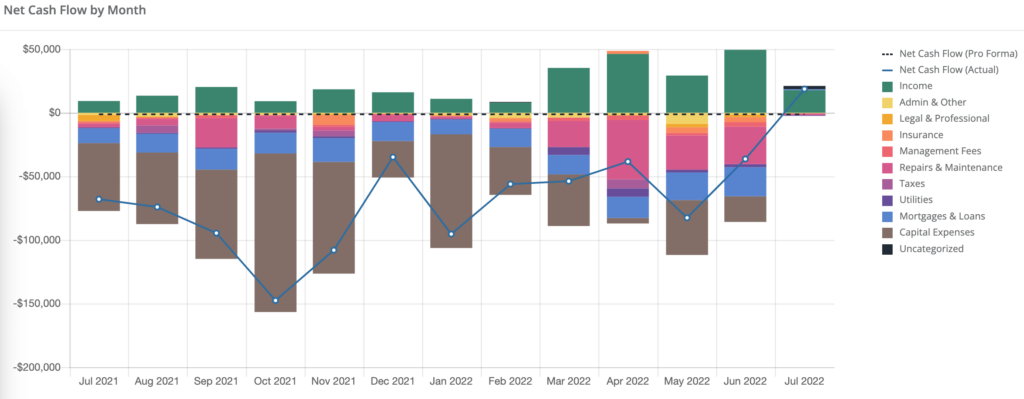

Anno Darwinii is the quarterly update on the status of my real estate empire. In the last episode of Anno Darwinii, I wrote that my empire was bleeding. I was dismayed by high maintenance costs and our enormous ongoing outlay of cash every month. The majority of this outgoing cash was going to our Palm Springs short term rental. There was also a good amount going to renovations and repairs in Indianapolis.

Over the last three months, I estimate that we were contributing roughly $25,000 a month towards renovations, which is a major improvement from the previous three months. In the latter part of 2021, there were months when we were spending north of $100,000 a month! The majority of this was going to the renovation of our Palm Springs house, but some of it was also going to unit upgrades in our Indianapolis portfolio. You can skip down a bit to see the specific details of the month to month changes in our cash flow.

I’m looking forward to the cash flow turning positive now that the renovations on our Palm Springs house are complete. We’ve also had good success in slowly tenanting up our 8 unit apartment building in Indianapolis and replacing non-paying tenants in the rest of our portfolio.

Finally, as I outlined recently in this post, we’re seeing improved income from our luxury cabin rental in Broken Bow, OK.

Overall, across all 26 units of rental property, our gross rental income hit about $50,000 in the month of June!

Gross Rental Income Trend

Here is the month to month gross income from across our portfolio over the last 6 months:

In terms of profit, we are still spending more on the real estate empire every month than we are taking in. Here is what our numbers look like when you factor in our continued capital improvements and renovations, as well as carrying costs like mortgages, insurance, and property management:

However, you can see that our rental income is starting to take off. We are finally finished with the renovation of our vacation rental in Palm Springs, so I’m looking forward to a much better profit picture for late 2022.

(By the way, I track all my rental cash flow on Stessa. It’s a free, cloud based resource that automatically tracks your income and expenses, and even stores documents! I’m a huge fan of this service. This is an affiliate link to Stessa below if you want to check it out!)

Next, I want to highlight a few big developments for our Empire over the last three months.

Big Events from the Empire

- The IRS paid us $105,000

- Back rent is the sweetest rent

- The 8 unit building is almost stabilized

- Palm Springs gets ready to hit the short term rental market

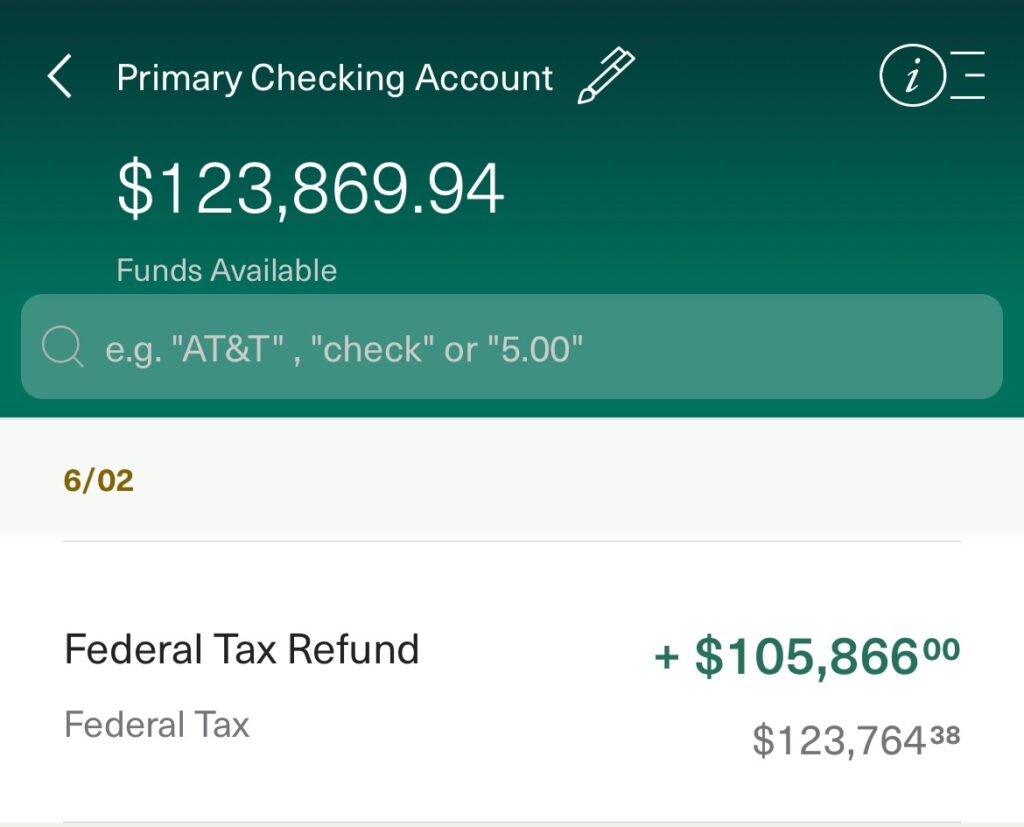

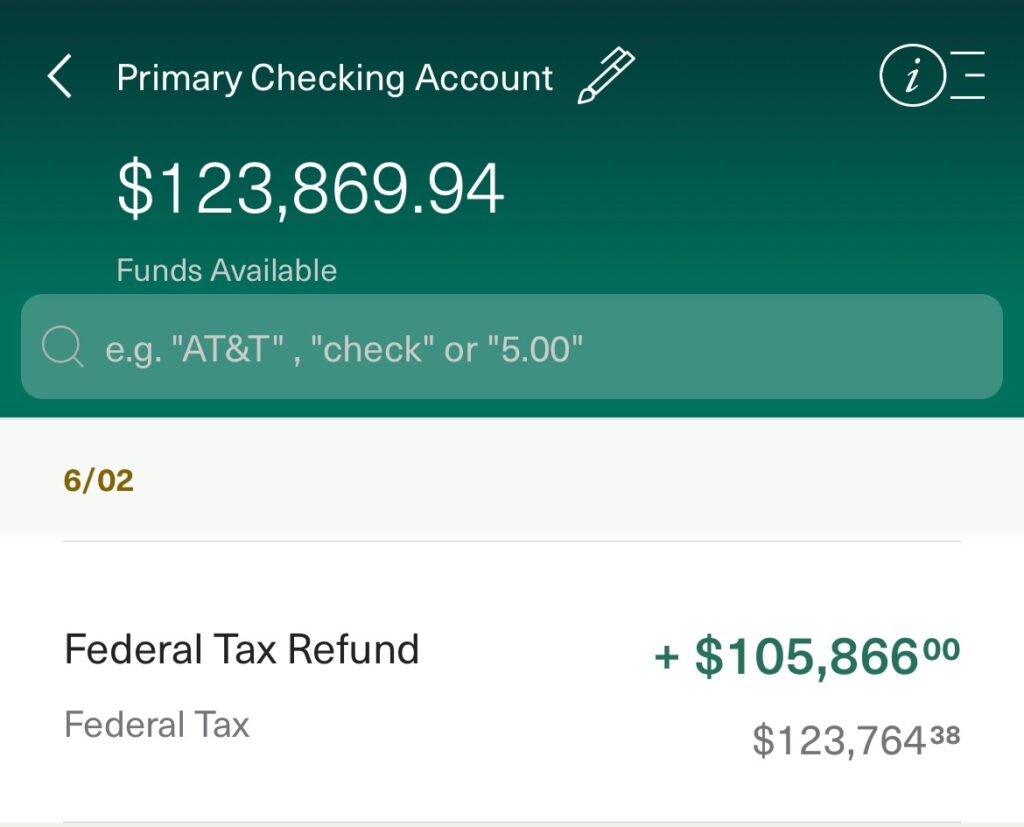

The IRS paid us $105,000

The biggest swing in our finances came when the cost segregation and accelerated depreciation process came full circle for our Palm Springs vacation rental. Since we purchased this home in 2021 and put it into service, we were able to apply about $300k of tax deductions to our 2021 tax return. This yielded a tax refund from the IRS of $105k. The transfer came through in early June and allowed us to refill our monetary reserves, which honestly were running a little dry.

I’ll outline all the specifics of this process in a dedicated post in the near future. It will help you understand exactly how to take advantage of this powerful tax strategy. One essential part of the equation is a cost segregation study.

Back rent is the sweetest rent

One of the biggest surprises of the last few months involved one of our duplexes in Indianapolis. The tenant in one side of Indy Duplex #2 fell on hard times during the pandemic. She had an injury, lost her job, and stopped paying rent about a year ago. She was protected by the national eviction moratorium for most of the year. As this protection ran out earlier this year, we worked with her for the better part of six months to try to come to an arrangement. Unfortunately, we did have to eventually begin the eviction process.

However, this tenant got assistance from a lawyer that took advantage of a rent assistance program called IndyRent. Through this program, if you fulfil certain criteria, you can apply for rent assistance from the city of Indianapolis.

To my surprise, she was quickly approved for this program. In all, the program paid off 8 months of back rent! After property management fees, we received about $10,000. As part of the deal, this tenant will be allowed to stay in her unit for a few more months while she figures out her next move.

This was a startling turn of events because we never expected to see any of that back rent and I had no idea that rent assistance programs like this actually existed.

It’s a good lesson for all real estate investors to look out for these programs in situations like this.

The 8 unit apartment building is almost stabilized

The next bit of news comes from our 8 unit apartment building in Indianapolis. It’s a bit of a mixed bag, as you’ll see below.

We currently have 6 units rented and generating income. One unit is pending a signed rental contract, and 2 units are vacant. Here is the income breakdown on a monthly basis:

- 4 units rented at $850/month

- 2 units rented at $900/month

- Laundry income: $100/month

- Total currently monthly income: $5300

If all units are rented, the total monthly income should increase to $7100. After paying the mortgage, insurance, and accounting for expected maintenance and vacancy, this would bring our monthly cash flow from this building to about $665 a month for an annual income of about $7800. This is a lower profit margin than for my duplexes because the debt on this property is amortized over 20 years (as opposed to 30 years for the 1-4 unit properties).

The big bad news from this building came in the form of a major sewer line backup.

Sewer line backup from hell

Since this is an Anno Darwinii, my goal is to succinctly summary what’s going on with my entire real estate empire. Therefore, I’ll spare you the full details of this sewer line debacle for now. (If I can muster the mental energy, I’ll go into the full story in a “Building the Empire” post.)

The short explanation is that a major sewer line backup led to a sewage leak into the basement of this building. The fix required a full environmental mitigation cleanup and the need to demolish the garage to access the main sewer line.

This story isn’t fully complete, as I’m still trying to decide on the most cost effective way of refinishing the back lot behind the building. This is where we had to demolish the garage to access the sewer line. So far, the cost of this problem has totalled about $30,000, with only $5000 reimbursed by insurance.

I learned a few expensive lessons from this months-long ordeal, and here they are:

- Act quickly with sewer line issues

- Be proactive with tenant outreach

- Know insurance coverage details in advance

- Have sufficient reserves (or access to cash) to cover big emergencies

The Palm Springs vacation rental is coming online

I’ll round out this Anno Darwinii update with a preview of the finished product from the renovation of the vacation rental in Palm Springs. This property has truly been a labor of love, with a renovation spanning over a year and plagued by supply chain and labor issues.

The scope and cost of the renovation ballooned over the year, as is common with large renovations. As we eclipsed our $300,000 target for renovation costs, I convinced my wife that we should paint the house ourselves to save money. I’ve since decided that this was a bad decision, as I outlined in this post: Why Doctors Shouldn’t Paint Their Own House

All good things must come to an end, and we finally finished up with the major items related to this renovation last month. Just a couple of weeks ago, we finally received our short term rental permit and got professional pictures taken.

We plan on listing this home on Airbnb within the next few weeks, and I’ll outline the property a bit more in a dedicated post soon. I think that with time, this property will likely be one of the cornerstones of our rental Empire.

Conclusion

In conclusion, despite a $30,000 sewer line setback, we have reasons to celebrate as well. Our major capital improvements are wrapping up. We got a $105k tax refund from the IRS, an unexpected $10,000 payment of back rent, and are about to bring another luxury short term rental online.

Our gross income from the rental portfolio is about $50,000 a month now. I hope to see this grow as the income from the Palm Springs vacation rental gets added to the mix. Soon, this gross income will yield actual positive cash flow as our renovation projects wrap up.

What’s next for our real estate empire? Well, it depends. I’ve been watching the real estate market closely and am seeing a lot of side effects from the Federal Reserve’s war on inflation. Our next move will depend on if these changes push real estate prices low enough to make new purchases make sense despite very high borrowing costs.

In the meantime, we are gathering access to cash to prepare for our next move. We recently closed on a HELOC of $427k, with another HELOC pending that should bring our total access to credit to around $750k. This should give us a lot of flexibility going forwards, no matter what happens to the market.

— The Darwinian Doctor

We’ve learned a lot from our rental empire over the last 3 years. What have you learned recently from your investing? Comment below!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

10 comments

Your Palm Springs house looks gorgeous! Will you and your family get to enjoy it (without having to paint or do other onerous chores), or is it for rental only?

Thanks! It’s for both purposes!

whicH lender gives you HELOC for investment properties? What are the rates and terms?

The one lender I found recently is California Bank and Trust. It’s pretty rare for banks to offer HELOCs on investment property, and they’re one that I found. We are not closed yet, but the rate is pretty typical: interest only, prime plus 1%, LTV of approx 80%.

When buying multifamily, ALWAYS get the sewer pipes scoped during the due diligence period. You would likely have seen the bad pipes, and been able

to negotiate a discount in the purchase price.

Great advice and one of my new mantras: “always get a sewer scope”

I like that despite all the initial setbacks, you didn’t give up on your real state journey. Many would have. Great job and it’s definitely inspiring.

Thanks so much! It helps to have a strong income to buffer the setbacks.

How did you develop your team for long distance real estate investing?

I found a realtor first via referrals from fellow investors, and then referrals from my realtor helped build the rest.