Today, I’ll compare a hypothetical portfolio of rental houses vs. a portfolio of stocks and show you a detailed projection over 25 years.

My inspiration for this post came from a post I saw on Passive Income MD (PIMD) from late 2017. This explored the concept of buying 1 rental property a year for 10 years. It was a great post, and one that galvanized my desire to start my rental real estate empire.

But given that it’s easier to invest in stocks, there had better be compelling evidence to invest in real estate to make it worth the extra hassle.

It took many hours of spreadsheet work and data crunching (like more than 12 hours), but I finally completed the projection! The results are very interesting! I hope you enjoy!

Note: After astute comments by readers, I updated my calculations in February 2020. Thanks for your great comments!

Key assumptions: the stock portfolio

- Every 6 months, invest $25,000 into VTSAX

- VTSAX = Vanguard total stock market index funds

- Total investment = $225,000 over 5 years

- Assume 8% return annually

- Allow returns to compound

Key assumptions: the rental house portfolio

- Every 6 months, buy a $100,000 rental house

- This will cost $25,000 ($20k downpayment, $5k closing costs)

- Houses are mortgaged at 5.5% interest fixed over 30 years

- Total principal invested = $225,000 over about 5 years

- Final cash flow after all fees and financing will be $100/month per house

- This continues until 9 rental houses are purchased

- Returns are used to pay off the mortgages

- Houses appreciate at 2% a year

- Rent increases at 2% a year

Tax assumptions: both

- I’m going for a moFIRE (morbidly obese) level of financial independence

- This is > $200k / year of expenditures

- The 24% tax rate used in these calculations is the long term capital gains rate based off of that level of income in California as of the Tax Cut and Jobs Act.

- This is a tax rate of 15% federal and 9% state taxes

I’ll list some charts summarizing my results below. Please keep on reading below for some reasoning and analysis.

| VTSAX index funds portfolio after 25 years | |

| Principal invested over 5 years | $225,000 |

| Portfolio value by year 5 with 8% appreciation | $311,355 |

| Portfolio value by year 25 | $1,451,212 |

| 4% withdrawal cash flow after taxes | $47,170 |

| 9 rental house portfolio after 25 years | |

| Principal invested over 5 years | $225,000 |

| Worth of houses by year 5 (2% appreciation) | $358,516 |

| Annual rental income after taxes (cash flow) | $56,981 |

| “Worth” of extra $9811 cash flow via 25x rule | $245,275 |

| Extra cash by year 25 from rent (post-tax) | $116,850 |

| Worth of houses by year 25 (2% appreciation) | $1,571,083 |

| Total worth of cash flow + houses | $1,933,208 |

- Strict value is the paper value of the portfolio (stock value for VTSAX, and combined equity for the rental portfolio).

- Total value is the same for VTSAX, but for the rental portfolio includes 25x the cash value of the extra annual cash flow provided by the rental portfolio vs the index funds, plus the extra rental income lying around from the rentals at the end of the time period.

VTSAX index funds portfolio, explained via the Socratic method

Why do you assume an 8% return?

- The historical return of the US stock market has been between 7-9%, making 8% a reasonable expectation for future average returns.

Why is the possible cash flow 4% of the portfolio value?

- The Trinity study states that over a 30 year period, a 100% stock portfolio can support a 4% withdrawal rate about 95% of the time.

- This is the basis of “the 4% rule” or the “25x rule”.

Where are you getting the exact cash flow number?

- This is based on how much principal versus appreciation is represented in the final VTSAX value.

- After 25 years, the principal is only 18% of the total.

- The rest of the value is from appreciation, which means that this part needs to be taxed 24%.

- See this chart for more details:

| VTSAX cash flow calculations | |

| Portfolio value by year 25 | $1,451,212 |

| 4% withdrawal from this (pre-tax cash flow) | $58,048 |

| Principal amount in this number (18% of total) | $12,720 |

| Taxable appreciation (82% of total) | $45,328 |

| Post tax cash flow | $47,170 |

The 9 rental house portfolio, explained

Why are you getting a mortgage on the rental houses?

- The use of leverage in real estate has the potential to supercharge appreciation returns.

- It also lets you collect more rental houses in a shorter time frame.

Why is the return from each house only $100/month?

- This figure will vary wildly based on the type of rental home purchased.

- But based on the turnkey house options I’ve recently explored, $100/ month after all costs seems like an achievable, realistic, and conservative number.

- Yes, this includes reserves of 8% for vacancy, 8% for capital expenditures, and 9% for full time property management.

Why only 9 rental properties?

- Current mortgage law lets each borrower have up to 10 government backed (“golden ticket”) home loans at a time.

- These loans are backed by the mortgage industry, and give you the best interest rates and terms.

- Your primary home loan counts, so that leaves room for 9 more houses at a time.

Why set the appreciation at only 2% a year?

- In cash flow markets, houses often do not appreciate much more than the national inflation rate.

- The federal reserve traditionally aims for a 2% inflation rate.

- While perhaps 2% is conservative, I don’t have evidence to assume a higher inflation rate.

Why set the rent increase at 2% a year?

- Based on the data I found, this is the average annual rent increase in Alabama.

Where is the final cash flow number coming from?

- This is based off of the final rent in year 25, after a depreciation deduction and taxes of 24% on the remainder.

- See this chart for more details:

| 9 rental house portfolio cash flow calculations | |

| Annual rental income (cash flow) at year 25 | $65,674 |

| Annual depreciation (deduction) | $29,455 |

| Taxable amount | $36,219 |

| Annual rental income after 24% taxes | $56,981 |

Conclusion

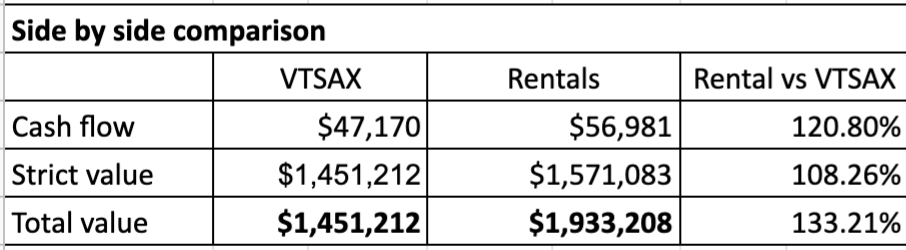

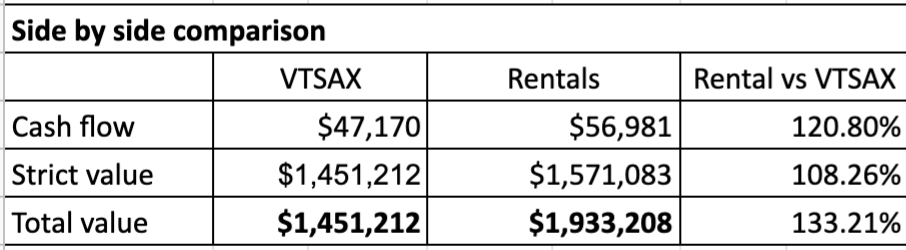

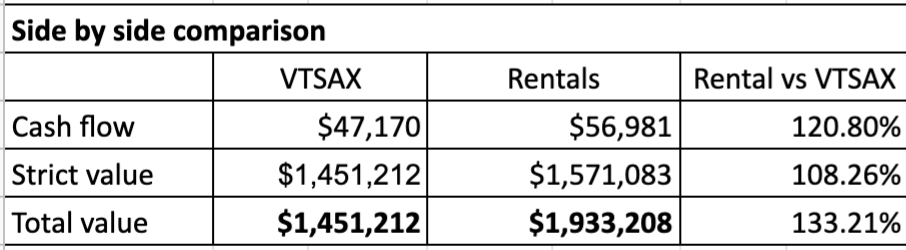

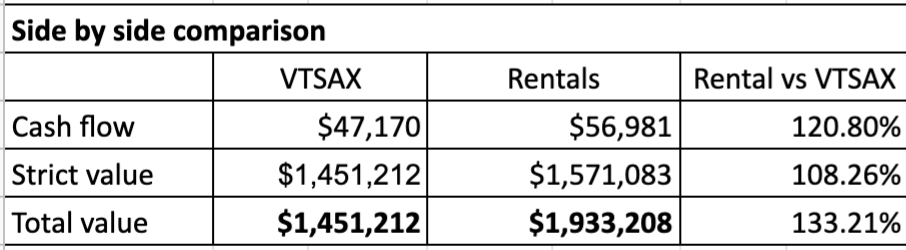

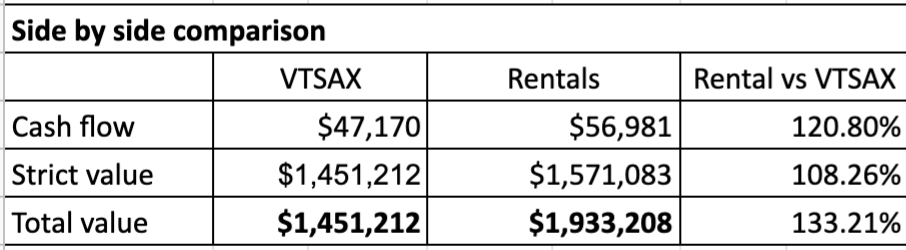

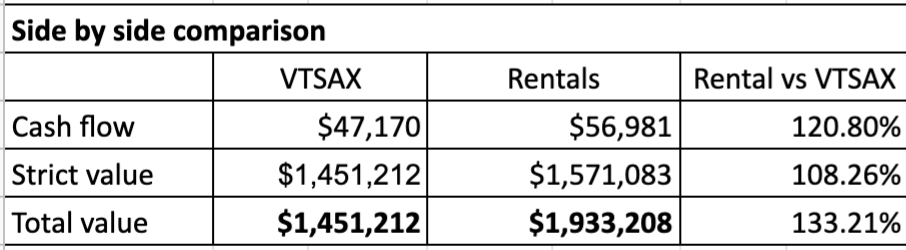

Let’s look at that side by side comparison chart again where I compare rental houses vs stocks:

After 25 years, a 9 property rental portfolio beats the equivalent capital investment into VTSAX on cash flow by about 21%.

When you compare the strict (pre-tax) value of the VTSAX funds (Vanguard total stock market index funds) versus the appreciated value of the 9 houses, these assets compare similarly. The houses are ahead only by about 8%.

But the basic difference here that makes the rental property much more valuable is what starts happening at year 26.

VTSAX in year 26

With the VTSAX, you start depleting the asset by 4% a year. This is the “safe” withdrawal rate found in the Trinity study to allow the assets to last 30 years with almost 95% confidence. But by definition, the asset’s growth starts to decrease as soon as you start pulling out cash.

The rental portfolio in year 26

With a rental portfolio, extracting the cash flow is part of the asset’s structure (rent), and doesn’t deplete the asset.

Edit: While I previously valued the total cash flow of $56,981 of rental income via the 25x rule as worth an additional $1,424,532, I’ve since been convinced that this is inaccurate.

The total value of the rental houses is $1.93 million, or about 133% of the VTSAX assets. This includes the worth of the houses themselves, plus an adjustment for the extra cash flow the houses provide (see above).

But you don’t have to buy this reasoning for the rental portfolio to win.

Even with conservative assumptions, the rental house portfolio comfortably beats VTSAX after 25 years on both cash flow and strict asset worth.

Rental property empire, here I come!

— TDD

Do you agree with my reasoning? Comment below and please share this post!

Go to this link to get the spreadsheet I used to do this projection. It breaks down each purchase and each year of compounding growth for the rental portfolio over 25 years.

And make sure to subscribe for more!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Related posts

- Why I’m investing in real estate over stocks – Part 1

- Tax Benefits | Why I’m investing in real estate over stocks – Part 2

- Leverage | Why I’m investing in real estate over stocks – Part 3

- You can’t buy avocado toast with VTSAX (Why cash flow is king)

- Rental house #1: Purchased!

- My 15 year plan to financial independence, moFIRE style

- What is moFIRE (morbidly obese FIRE) and why do I want it?

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

15 comments

Awesome analysis TDD.

There are of course Downsides to owning a rental empire with unexpected costs and maintenance issues. But with only a $100 cash flow per property you probably accounted for a lot of the reserves needed for these properties.

And your point about consuming the stock portfolio is one that I came to the same conclusion with a couple of years ago when I decided to go heavy on real estate.

The best thing to do is follow what the wealthy do and almost all ultra wealthy people have primarily real estate as the source of wealth.

Hey Xrayvsn! Yes, $100 cash flow a month per house is after accounting for reserves for capital expenditures, vacancy, and property management.

$100 a month of cash flow seems paltry, which is another reason why I was impressed at the final side by side comparison. This proved to me that for taxable money, rental houses are a great option to diversify investments.

— TDD

Interesting. Rentals come out ahead- especially for generational wealth.

I’d love to get into real estate but only if me and pause could be hands on, and it isn’t cost effective in my area (you should see what’s available in the 100k territory 😱).

But a nice breakdown to show how it works out for a long game.

I’m still sticking it all in VTSAX. Too much stress to consider properties at my income level and emergency fund size.

I do feel there’s a big mental barrier to getting into real estate, but as you note there’s also a higher cost of entry. VTSAX does great over the long run too, but it does seem like real estate does win in the end.

You’re definitely right that choosing the right real estate is also super important to cash flow. That’s why I chose to buy in Alabama, rather than Los Angeles.

Thanks for stopping by, and thanks for sharing the post!

— TDD

This is a very interesting analysis. It’s probably the extra push I need to start scooping up some properties.

However, I think the Total Value is somewhat misleading. While I understand the logic and rationale, you cannot ever actually tap the supposed +$3M total value for the rentals; you can either collect rents from the hypothetical cashflow base OR you can sell the actual assets — not both. That being said, I don’t have a better name for it either, so ¯\_(ツ)_/¯

But, as noted by Xrayvsn, the generational wealth afforded by rental property the further you live beyond Year 25 in this scenario cannot be ignored considering, in a simplified sense, that the Strict Value of the rental assets should continue to climb while any Vanguard appreciation that occurs will do so at a decreasing rate relative to past returns.

Semantics aside, this was a truly insightful and helpful read. Thanks for performing such a thorough analysis and laying it out in a meaningful and comprehensible manner.

Cheers,

Dave

Dave! What a thoughtful comment, thanks so much.

You’re absolutely right. My analysis comes apart a bit if we are considering exit strategies.

This thought experiment was motivated by looking for more efficient ways to generate cash flow. The thing about accumulating stocks that has bothered me is the generally poor cash flow (dividend) from most index funds. So using stocks to pay living costs in “retirement” requires a very low withdrawal rate of 3-4%.

Before the analysis, I recognized that the cash flow from rental properties can be much better than stocks, but I worried about the growth of a real estate portfolio as compared to a stock portfolio.

My analysis showed me that not only does the rental portfolio slightly exceed the stock portfolio in strict value, but it also provides a lot of cash flow, which in retirement is even more valuable.

But you’re very right that the “total value” is somewhat of a contrivance. It’s more like “total value to me in retirement.”

Thanks for stopping by!

— TDD

After 25 years you can absolutely tap into that cash. Refinance the property. Tax free windfall and back to paying off the property.

Sounds like a great plan! I’m already putting the portfolio to work via the BRRRR method: Returning 17-50% via the BRRRR method for Duplex #2 and #4

Hey,

I stumbled upon this recently. I think your Total Value comparison is misleading. Consider it this way:

1) Under the Stock Portfolio option, you have a stock portfolio worth $1.45mm which you can draw $47K / year based on the 4% rule (all per your math in the post). That portfolio should remain at $1.45mm given the 4% rule.

2) Under the Rental Property option, you have real estate portfolio worth $1.57mm generating $57K / year (again, all based on your math)

In both scenarios, you have a portfolio of assets + annual cash flow stream.

Adding the “Worth of cash flow via 25x rule” to the Rental Property Total Value makes it apples-and-oranges to the Stock Portfolio Total Value. You should also have the same addition to the Stock Portfolio Total Value (or just compare the “Strict Value”). Because, again, in both situations you have a portfolio of assets worth X and annual cash flow streams worth Y. There is no reason to calculate the “total value” differently, no matter how you define “total value”.

I would correct this logical error in this article, because it may sway people to make decisions based on exaggerated information; rental properties do not have 2x the return of the stock market. Rental properties are only marginally better than stocks even in your example at Year 25 – ignoring the additional headache from owning rental properties as well as lack of liquidity.

Granted rental properties will only get more attractive post Year 25 (given the real estate portfolio + cash flows will both grow at 2% while the stock portfolio + cash flows will be flat), but still not justifying the $3mm vs. $1.5mm headline takeaway

Thanks for taking the time to write this comment.

As noted in my response to another insightful comment, I do admit that the term “Total Value” is somewhat of a contrivance. It’s more like, “Total Value to me.”

I would, however, disagree with you that there is no intrinsic difference between cash flow from a stocks portfolio and cash flow from a rental portfolio.

Let’s examine the definition of success in the Trinity study that led to the 4% rule: “The withdrawal regime is deemed to have failed if the portfolio is exhausted in less than thirty years and to have succeeded if there are unspent assets at the end of the period.” It’s basically a death match — will the portfolio or the investor outlive the other?

This is a much looser definition of success than I think most realize. Over a 30 year period, the 4% rule gives us a 95% chance of having assets left over at the end of this time period.

Over this same 30 year time period, a well maintained rental portfolio not only increases in value from appreciation, but in my opinion should have little to no chance of depletion.

But I acknowledge that the conclusion may be a bit misleading. I’m pondering a revision or clarification. We will see!

— TDD

Right, I called this out in the last paragraph of my original response. My point was just that while rental properties do have an advantage, the magnitude is not anywhere close to the 2-to-1 insinuated by this article.

In your example, the advantage of rental properties is only $120K after 25 years ($1.57MM – $1.45MM for the stock portfolio when comparing “Strict Value”).

Thanks! — Definitely pondering a revision or clarification here.

— TDD

I wanted to thank you for your comments again. I went back and adjusted my calculations. In the new version, I am only adding additional value to rental portfolio equal to the difference in the cash flow generated by the two models. In the new model, after 25 years, the rental portfolio beats the VTSAX portfolio by 33%.

I invite you to subscribe and get the spreadsheets I used to come to my conclusions. Thanks again for your role in these adjustments!

— TDD

Property managers know how to negotiate with tenants. Fielding phone calls from prospects, showing them the best features of a unit and answering questions. Explaining complex legal jargon in lease agreements builds trust. Negotiations go smoother using property managers.

Absolutely! My real estate investing strategy couldn’t exist without good property managers. Thanks for what you do!