Today’s post will explain the 5 simple steps to contest a low home appraisal, using a success story from my own life.

![5 simple steps to contest a low home appraisal [my success story]. TheDarwinianDoctor.com](https://thedarwiniandoctor.com/wp-content/uploads/2021/08/2021-August-Low-home-appraisal-1024x1024.jpeg)

These are the 5 simple steps to contest a low home appraisal:

- Notify the lender

- Review the appraisal for errors

- Gather better comparative sales

- Summarize property improvements

- Communicate these to the lender or new appraiser

This post may contain affiliate links.

Whether you’re hoping to purchase a new home or refinance your current home, the home appraisal is critically important. The best real estate agent in the world can’t overcome a bad appraisal, and no mortgage lender will offer you a refinance if your home’s appraisal comes in too low.

This isn’t meant to scare you. I’m overjoyed if you’re considering a refinance or home purchase. Although today’s housing market is competitive, new home buyers can take advantage of historically low interest rates to lock in cheap debt for 30 years. Alternatively, if you’re considering a cash out refinance, you’ll benefit from high home values to consolidate debt or fuel your investments.

After you decide to move ahead with the home purchase or refinance, the next steps are to shop around for a good lender and find a good rate quote. With today’s strict lending standards, you will now spend the next month or so sending documents and letters to the underwriters.

Read more: Getting a mortgage is painful. Why this is a good thing.

Your real estate agent will help coordinate the home inspection and negotiate the asking price. They should be able to use information from comparable sales to give you a good sense of the fair market value of your home.

If you’re just going for a refinance, you probably have a good sense of what comparable homes are selling for in your neighborhood.

But your agent’s opinion doesn’t really matter. The only opinion that can truly justify the sales price and the home loan is the opinion of the real estate appraiser.

But what if you get the appraisal report and the appraisal significantly undervalues your home?

For a new home purchase, you’re protected by the appraisal contingency and can always get out of the purchase contract. But that’s not the only option. What if this is your dream home? Or what if you’re going for a cash out refinance and you were really counting on that cash?

You have options

For a home purchase, there are a lot of options here, like negotiating the offer price or trying to pivot to a different lender. Of course, you might have less options if you’re caught in a bidding war. Historically hot real estate markets have put buyers in a tough spot. You might have to agree to bring extra cash to the deal and increase the size of your down payment. This will make up for the appraisal gap and hopefully still beat out other interested buyers.

But today, I’d like to focus on another option: you can contest the low home appraisal. I’ve got good news for you — you can fight the low appraisal and win!

My experience

I ran into this exact issue with one of my investment properties. I wanted to perform a cash out refinance, but I ran into not one, but two low home appraisals. However, I was able to contest the low appraisal and win. It took some time, patience, and luck, but in the end I succeeded.

So today, I’m going to share the details of this experience and use it to explain the 5 simple steps to contest a low home appraisal.

The duplex

This is Indy Duplex #3. I purchased it as a pocket listing for $123,000 in mid 2020. I spent the next six months completing a fairly tortuous renovation that had significant cost overruns due to some nasty surprises about the plumbing and foundation. In total, we spent about $121,000 on the renovation, for about $246,000 invested.

Read more about the renovation here: Indy Duplex #3 – from run down to rent ready

One side of this duplex is a relatively spacious 3 bedroom, 1 bath. We found a long term tenant without too much difficulty. But the other side is a 2 bedroom, 1 bath with a slightly funky configuration. The second bedroom is up a bit of a steep staircase. We couldn’t find a long term tenant, but the unit’s been doing well as a short term rental.

As soon as we finished the interior renovation in late December, I decided to try for a cash out refinance. I worried a bit that the exterior landscaping still needed to be completed, but I was eager to complete the BRRRR to recycle the capital into another deal.

I was pretty disappointed when the appraisal valued the home at only $155,000!

I attributed this low appraisal to the unfinished landscaping and considered the following options.

Your options when your house receives a low appraisal

- Accept the low appraisal

- Change lenders

- Contest the appraisal

- Wait and then try again

Obviously, what you decide to do depends on the reason why you’re getting a home appraisal. If you’re going for a home purchase, a low appraisal could sink the deal. The bank will not lend the desired amount of money if the appraisal doesn’t support the purchase price. And if you’re going for a cash out refinance, a low appraisal will yield you significantly less money.

You could try another lender, but this is costly both in time and money. Also, there’s no guarantee that another appraiser will come to a different conclusion. You could certainly contest the appraisal, which I’ll discuss below.

Or you could just wait and try again. This is what I chose to do with the first low appraisal. I told my lender that the appraisal came in too low, and that I’d like to pass on the refinance.

I predicted that home sales would pick up in the spring, and I also wanted to finish the exterior landscaping. An inviting lawn would give the property much better curb appeal. While technically an appraiser is evaluating the intrinsic value of the home, they do take subjective factors into account as well.

I knew I was running the risk that I’d end up with a higher interest rate, but I hoped that time and a different appraiser would yield a better outcome.

The second appraisal

Spring 2021 saw a surprising real estate feeding frenzy across the nation. Low housing supply combined with low interest rates to create an explosion of real estate prices all over the nation (despite the Covid-19 pandemic).

Read how high home prices might be here to stay: Are we headed for another housing crash?

By May, I saw strong sales comparisons for my duplex, so I came back to my lender and said I’d like to try for another refinance.

Imagine my surprise when the appraisal came back even lower than the winter appraisal! Specifically, the duplex appraised for $120,000, or three thousand dollars less than the purchase price, and $126,000 less than what we spent on the purchase and renovation.

Time to fight

We considered our options again and decided to contest the appraisal. A few things were now different:

- We were pretty sure it was a bad appraisal

- We really wanted to get out our equity from the deal

As I’ll outline below, there were major errors in Appraisal 2 that gave us confidence that we’d be successful in a challenge. Also, we’d just purchased our vacation home and really needed some cash for the renovation.

Read more about the vacation home purchase: The real estate empire hits $3 million | Anno Darwinii 2.0

The 5 simple steps to contest a low home appraisal

Here are the 5 simple steps we used to contest the low appraisal. It allowed us to successfully cash out $222,000 from the duplex!

- Notify the lender

- Review the appraisal for errors

- Gather better comparative sales

- Summarize property improvements

- Communicate these to the lender or new appraiser

Step 1: Notify the lender

This seems like the obvious first thing to do, but it’s an important step. If you’ve decided to contest the appraisal, you need to let the lender know as soon as possible. If you think about it for too long, the lender will continue on the assumption that you’re OK with the appraisal figure. Their calculations will reflect the bad valuation, which could mean a lot less cash out. Or perhaps they’ll assume you don’t want to continue with the mortgage process for a new purchase.

Step 2: Review the appraisal for errors

This is the surest path to a new appraisal. If the appraiser miscalculated the number of bedrooms, bathrooms, or square footage of your home, this is an easy win.

This is what I found when I reviewed the $120,000 appraisal:

The appraiser neglected to explore a whole section of the duplex, which led to a low square footage, wrong bedroom count, and wrong floor plan. Square footage is one of the single biggest factors in the determination of a home’s value, so an error in this number can sink your appraisal.

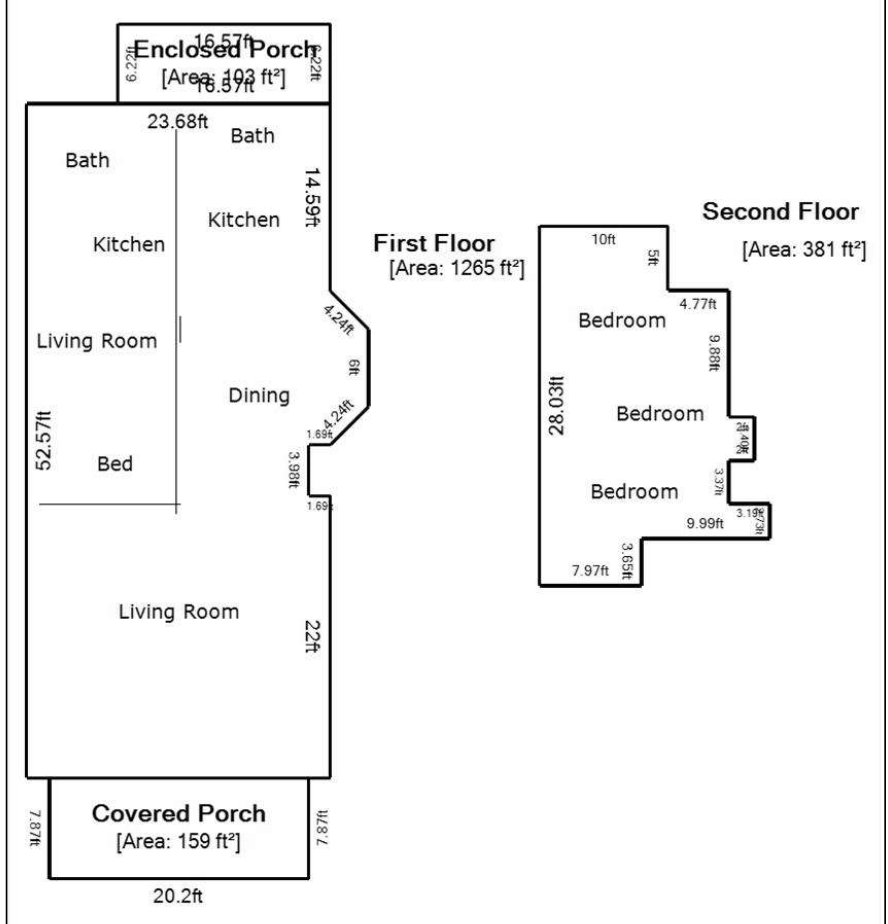

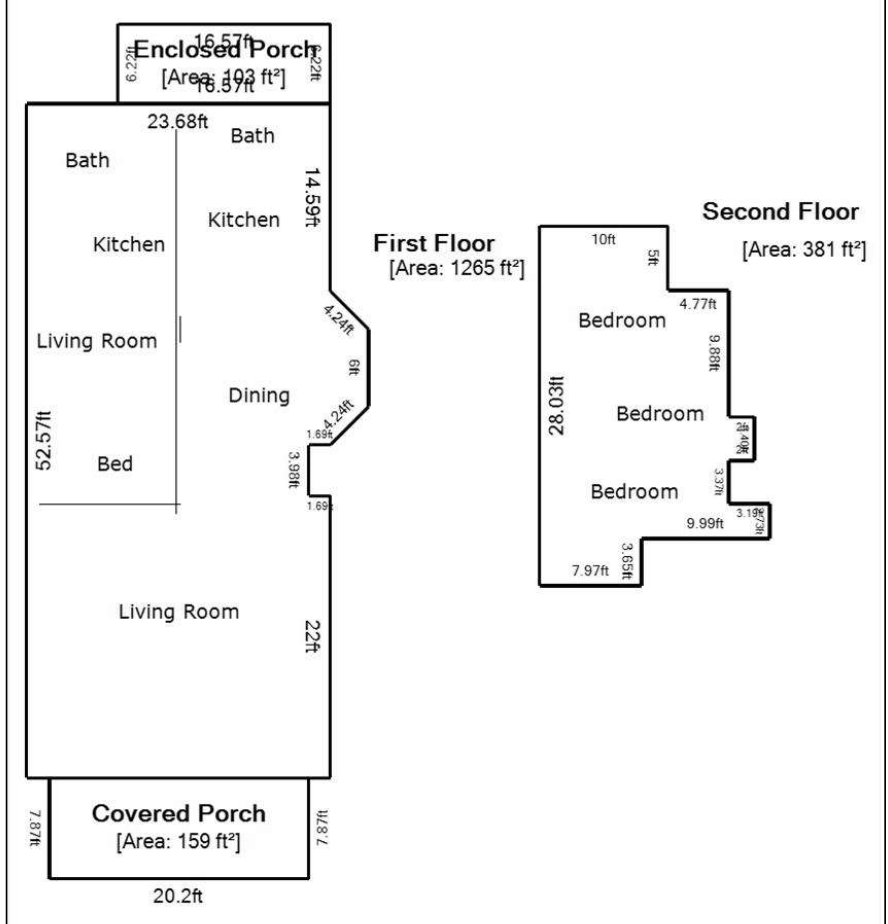

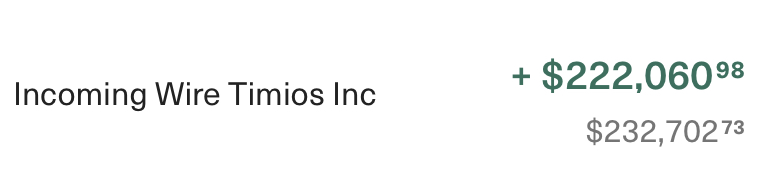

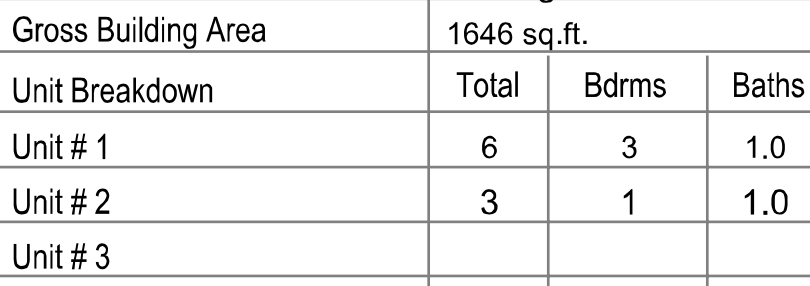

Here’s the square footage and room count of Appraisal 2 and Appraisal 3, side by side:

A good place to find this type of error is on the floor plan. It’s one of the last few pages of the appraisal. When I inspected the floor plan from Appraisal 2, I easily saw that they’d completely omitted the second bedroom in one of the units.

Here are the floor plans to show you this:

Step 3: Gather better comparative sales

Comparative sales are a major determinant of the appraised value of your home. The appraiser should find the geographically closest, most recent sales of homes that are similar to your home. Similarity is subjective, of course, but the appraiser should factor in the size of the house and lot, bedroom and bathroom count, and overall condition and level of finish.

Using a website like Zillow or Redfin, look up the comparative sales used in the appraisal. There will often still be information listed on real estate sites about the homes. Look at the information, the pictures, and the neighborhood. Are these houses similar in quality to your house? If not, you’ve got a case for an appeal.

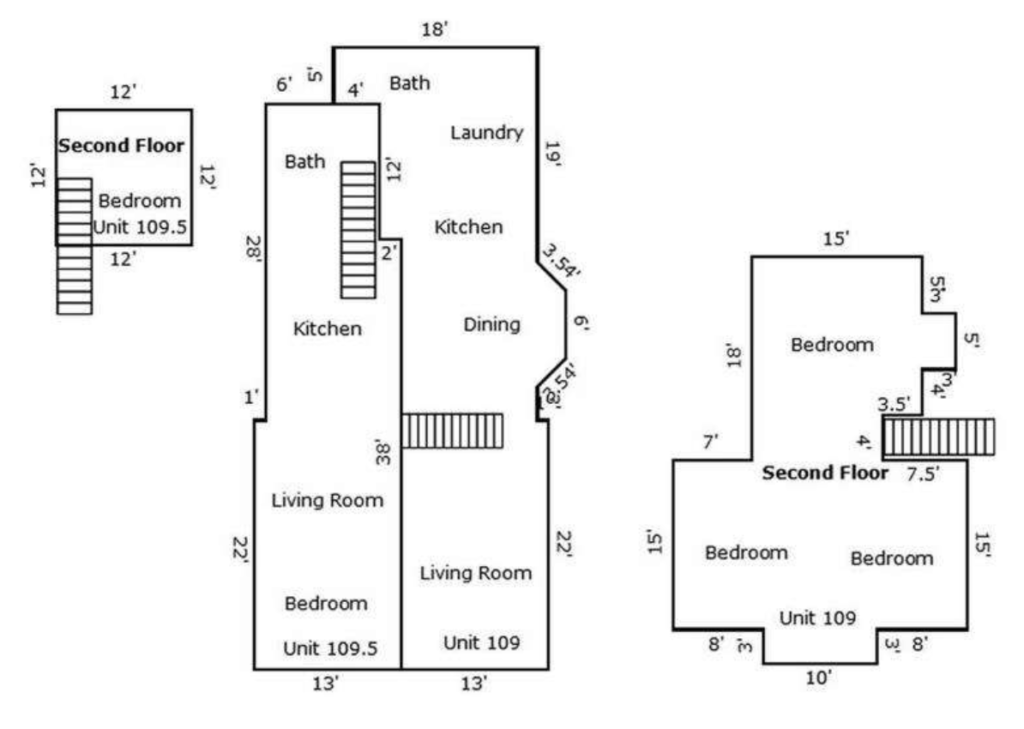

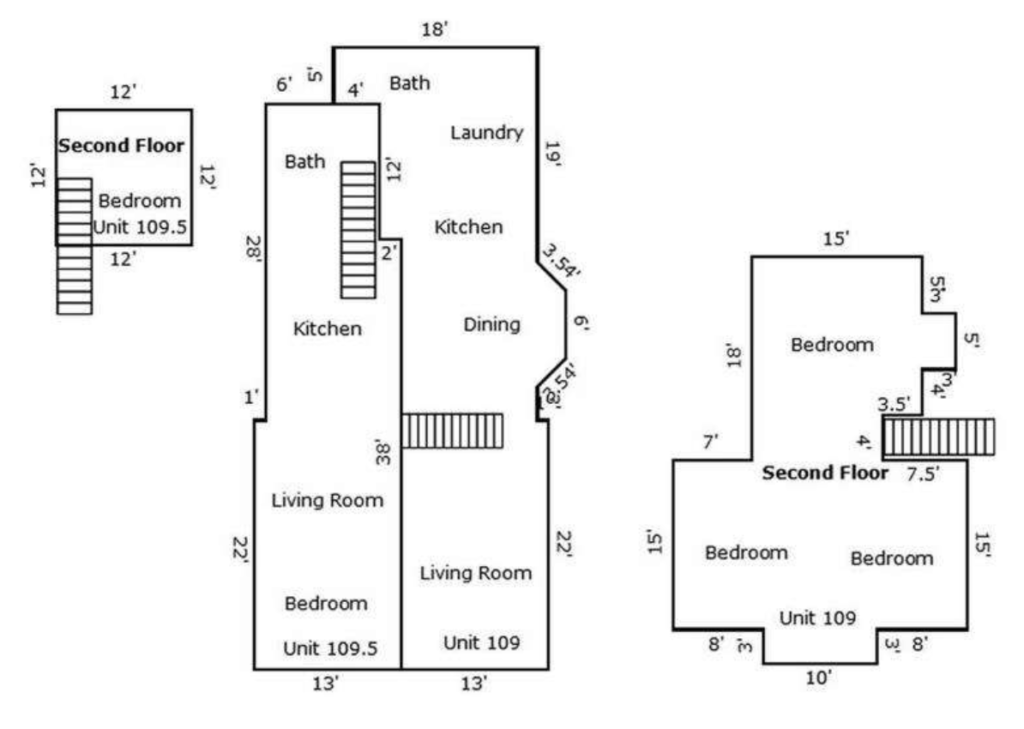

When I looked at the comparative sales used by Appraiser 2, I saw major issues. One comparative sale was for a house that was gutted. As in no kitchen. No bathroom fixtures. Nothing.

Here are photos of the kitchen and bathroom in a comparative sale used in Appraisal 2:

“Kitchen”

“Bathroom”

Compare this to the kitchen and bathroom on one side of my duplex:

Kitchen

Bathroom

I don’t think it’s a stretch to argue that these properties are in very different states of repair.

What if there are no photos?

No problem — look at the description of the home. You can tell a lot from the description. This other comparative sale had no pictures, but it clearly stated that this was a home that was DOWN TO THE STUDS.

So spend some time on Redfin or Zillow, and use the filters to look at the last three or six months of comparative sales near your home. Select three recent sales that roughly match your home’s condition, size, bedroom count, and level of finishes.

To formally contest an appraisal, you should select comparative sales that are all different from the ones used in the appraisal.

Step 4: Summarize property improvements

This step isn’t as important as actual mistakes in the appraisal, but I find this an effective step as well.

Make a list of the major improvements to your property, as well as how much this cost. Did you add hardwood floors? Maybe you upgraded the kitchen to granite countertops, or even better, created an addition with an extra bedroom and bathroom.

No appraiser will just add the cost of these improvements to the basis of your home and call it a day.

But the new appraiser should take all this information into account in the “condition” part of the appraisal, which can adjust the valuation.

For my duplex, I made a list of all the major renovation items (with cost) and got it ready for the next step.

Step 5: Communicate these to the new appraiser

This part can be tricky, but it doesn’t have to be. The first step is to communicate all of your findings to the lender. Write a polite and nicely edited email to your contact person at the bank who is handling your mortgage application. They will pass this to the underwriters and one of three things will happen. They may:

- Decline to adjust the appraisal value

- Adjust the value in your favor

- Order a new appraisal

If the contested appraisal is off by any significant amount, in my experience they will agree to a new appraisal. Now you’ve got your chance to play an active role in your home’s appraisal.

How do you actually get the information to the new appraiser?

To do their job, the new appraiser needs access to your property. So they have to coordinate the appraisal date with you. When they call you, you can spend some time on the phone with this person, communicating all your findings. But I find it’s more effective to email all your findings. So decline to schedule a date while on the phone, and ask if you can email them instead. I’ve never had an appraiser who isn’t willing to share their email.

Again, send a polite email to the appraiser with your findings.

The tone of the email is very important. You aren’t telling the appraiser how to do their job, but you are providing pertinent information that they might find helpful.

Cross your fingers and wait

After this final step, just cross your fingers and wait. If it’s your own property, make sure your home is clean, uncluttered, and well kept for the appraisal. If it’s an investment property, your property manager should be ensuring that the property is in presentable condition (though it can be difficult to manage the cleanliness of the tenants).

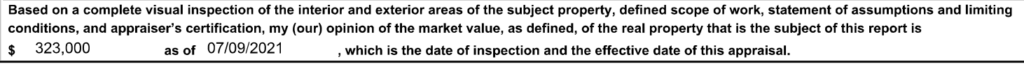

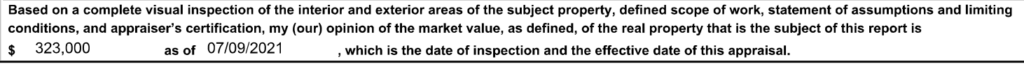

The verdict

If all goes well, your efforts will be rewarded with a higher appraisal that more accurately reflects the value of your home. In my case, the third appraisal was the charm.

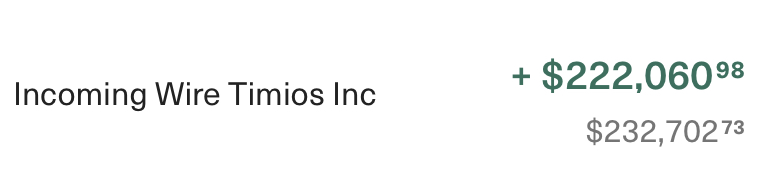

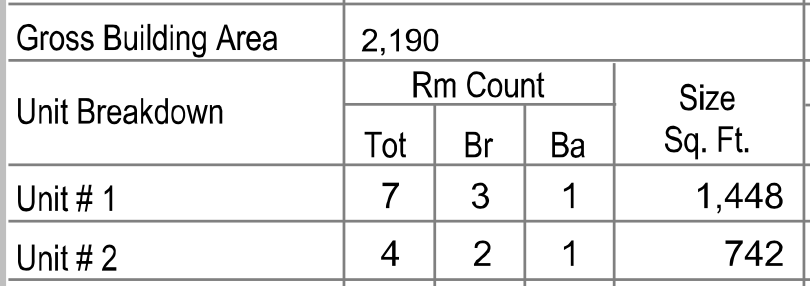

Indy duplex #3 was valued at $323,000:

When it comes to multifamily investment property cash out refinances, you’re allowed a 70% loan to value ratio for the loan amount. So a few days after the closing, the title company wired us over $200k!

Conclusion

I hope you enjoyed reading about the 5 simple steps to contest a low home appraisal. This advice is from my own personal experience, so take everything with a grain of salt. But if your home sale or refinance depends on a higher valuation, your best option could be to contest the appraisal. Now you know how to do that.

Indy duplex #3 has now completed the BRRRR process. After the third try, the home received an appraisal of $323,000. We cashed out $220,000 and are cash flowing about $800/month from the duplex. This brings this deal to about a 43% cash on cash return.

We are already putting this money to work renovating our vacation home in Palm Spring, CA. We hope to create an incredible weekend retreat for our family and a luxury short term rental for everyone to enjoy.

— TDD

Have you ever had a bad appraisal? What did you do? Please comment below!

Like what you see? Please sign up for my free weekly newsletter!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

1 comment

Thank you so much for sharing your valuable experience and insights on contesting a low home appraisal. It’s incredibly reassuring to know that there are options available when faced with such a frustrating situation.