This is an update on my family’s net worth and asset allocation in early 2022.

TLDR: Our net worth rose over $900k and our assets shifted more towards stocks despite purchasing $3 million worth of real estate in 2021!

This post may contain affiliate links.

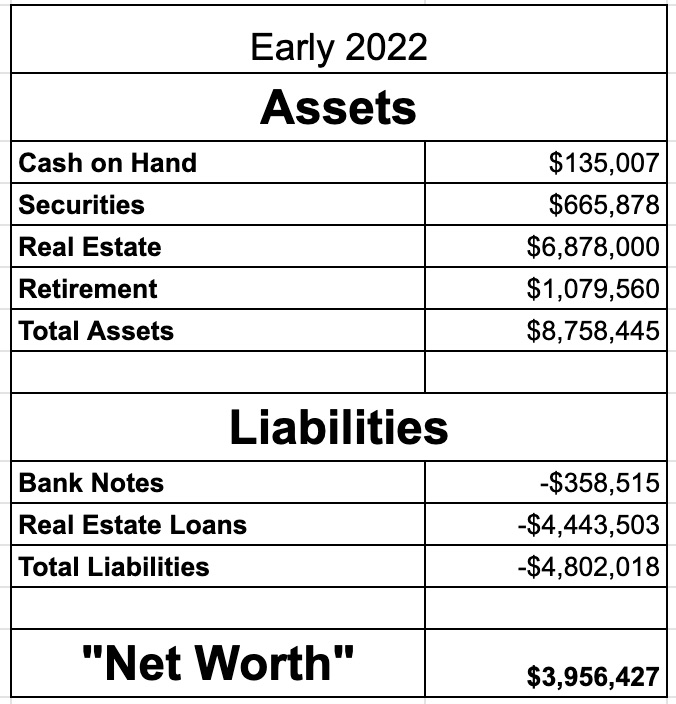

In late 2020, I published an update on my family’s net worth. It was the first time that I’d formally tabulated our net worth and it was when I was still blogging anonymously. But in the spirit of transparency and following in the footsteps of other personal finance bloggers, I crunched the numbers and put it all out there.

Despite our society’s general taboo around money, I think there is a real hunger out there for transparency.

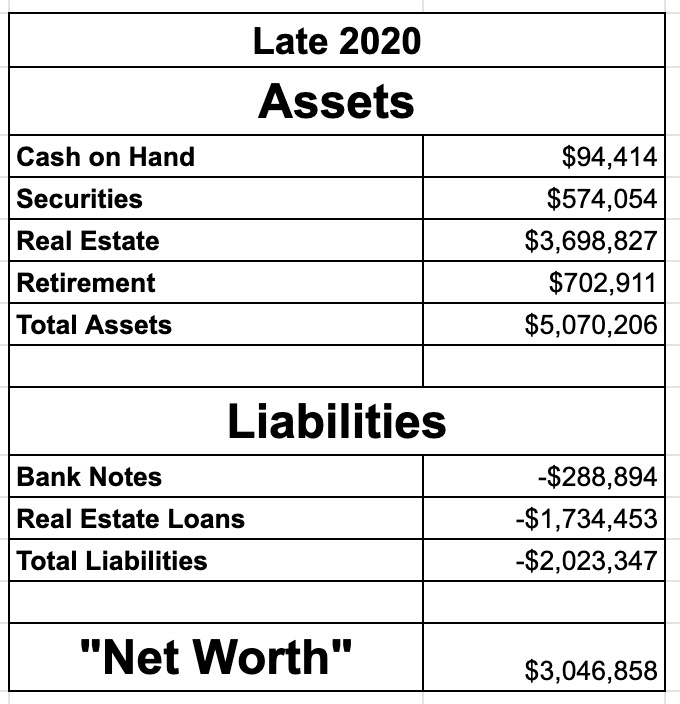

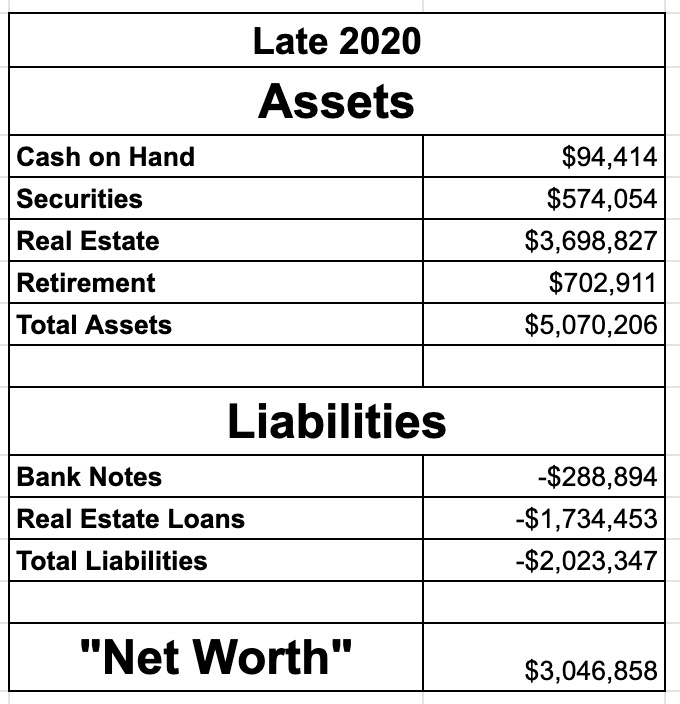

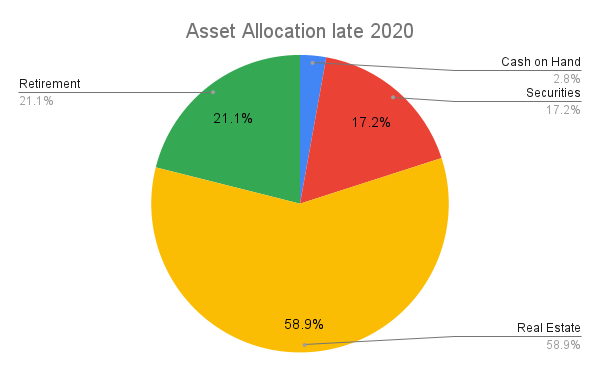

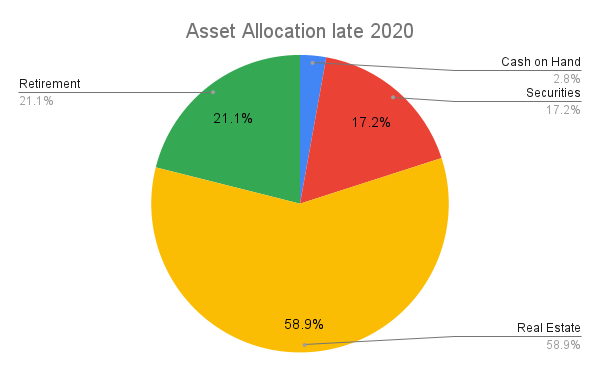

Here was my chart from late 2020:

Securities = stocks. Bank Notes = student loan + car loan + SBLOC. Real Estate Loans = mortgages.

After I published this post, I wrote that your net worth isn’t as useful as you think. Although it’s one way to keep track of general trends, I believe net worth becomes less and less accurate as your wealth grows.

History proved this to be quite right, as my primary home value estimate in late 2020 was shown to be inaccurate. Our primary home had a Zillow valuation of $2.8 million in late 2020. Only months later, the Zillow value dropped by $1 million! I described this in this post, where I summarized the 3 Best Ways to Estimate Your Home Value.

When we finally got our house formally appraised in late 2021 for a refinance, it was appraised at $2.6 million. While we were really happy with this number, it was still $200k lower than the value estimated by the online calculators in late 2020.

The recent implosion of the Zillow fix-and-flip business is another data point that those free estimates aren’t so accurate. I still feel that formal appraisals are the best way to estimate home value, short of actually putting a property on the market.

Net worth in early 2022

As I mentioned, one value of net worth updates is to see general trends and asset allocations. Basically, it can be a general barometer to make sure you’re headed in the right direction. I feel it’s also both interesting and educational for you, my readers, to see this analysis. It’s also an important reality check for me to do this on an annual basis.

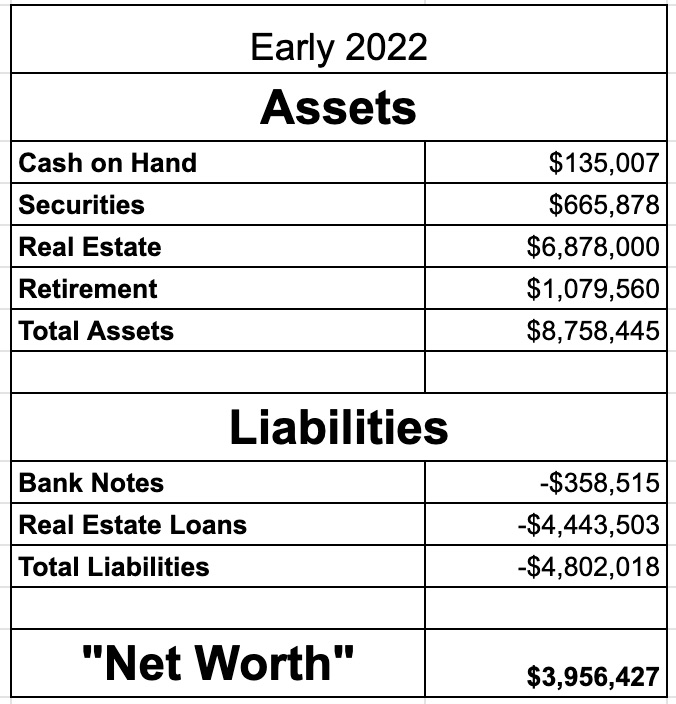

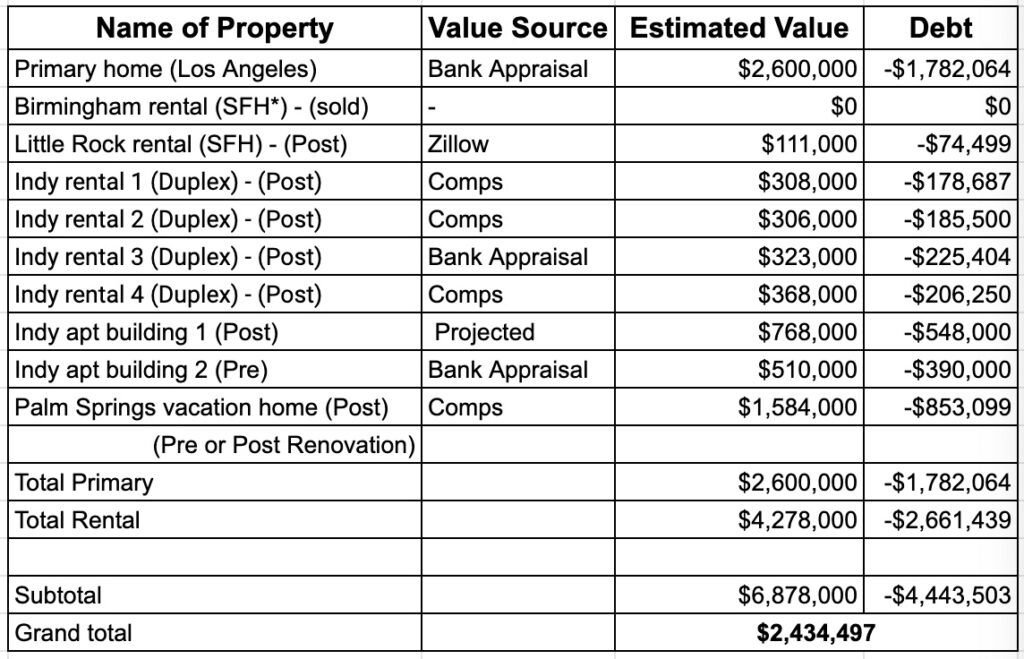

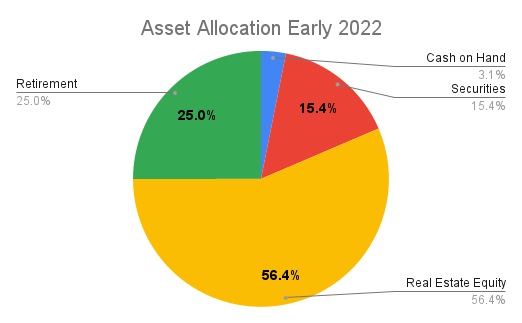

Without further ado, here is my updated net worth as of early 2022:

Securities = stocks. Bank Notes = student loan + car loan + SBLOC. Real Estate Loans = mortgages.

A few things jumped out at me as I compared the numbers to my late 2020 numbers.

Edit: this chart was corrected on 2/15/2022 to reflect an error I noticed in my mortgage balance on my vacation home. I incorrectly had this mortgage balance about $400k higher than it actually is. After correction, our net worth in fact increased by approximately $900k since late 2020.

Our net worth increased

I was happy to see that our net worth increased over the last year. This analysis indicates that my family’s net worth has risen about $900,000 since late 2020. (Corrected value as of 2/15/2022)

I make an average full time surgeon’s salary and my wife also pulls in a good non-physician salary. So our income during the past year was very high by most standards. In fact, we are in the top 1% of incomes for California. But we also have very high expenses that eat up the majority of our post tax income.

Throw in an approximately 38% average tax rate, and I estimate we were able to invest around $200,000 of cash from our salaries over the past year or so. This was evenly split between retirement accounts and real estate investment.

We bought a LOT of real estate

Another big takeaway is that we purchased a ton of real estate in 2021. In total, we purchased three major properties: a 7 unit apartment building, an 8 unit apartment building, and a vacation home.

With these purchases, we’ve effectively doubled the value of our real estate portfolio since my last tabulation.

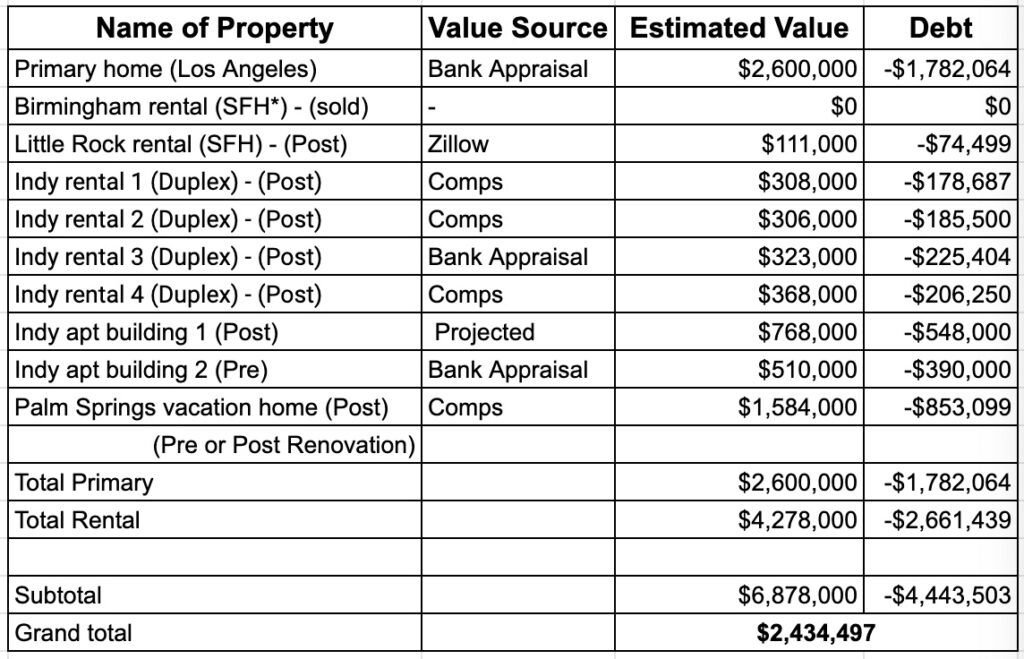

Here is a summary of our real estate portfolio as of early 2022:

Read the most recent update on the Real Estate Empire: $127,000 of Gross Revenue | Anno Darwinii 2.5

Our asset allocation in real estate decreased?

Although I initially thought that our asset allocation in real estate fell over the last year, this turned out to be an error in one of my calculations (specifically the mortgage amount for our vacation home.)

Due to appreciation of our properties, our equity in real estate increased by $470k over the last year.

We also picked up an additional $3 million of real estate, mainly using equity from our primary home and other properties via cash out refinances and HELOCs. We also funneled approximately $100k of money from our jobs into real estate purchases or renovations.

In the same time period, the value of our stocks in our retirement, taxable brokerage, and 529 accounts rose sharply. Although our real estate equity increased significantly, the value of our stocks went up so much in 2021 that our asset allocation in real estate actually fell slightly to 56% from 59%.

Big Correction: I’ve been convinced my approach to asset allocation is flawed. Read this article for an updated approach to asset allocation: How to Calculate Asset Allocation as a Real Estate Investor

The math is getting fuzzier

The final observation I’ll make about our net worth is that it’s harder to calculate now. The worth of our real estate portfolio in Indianapolis, for example, is estimated by me based on comparative sales in the past 3 months. Due to a paucity of data, these are pretty rough estimates.

And the value of our apartment buildings might be very different in a year when we have the buildings fully rented out and hopefully refinanced. I’m estimating their value based on a 7% capitalization rate, but this is tough to do when the buildings still aren’t fully stabilized.

Finally, one small error can make a big change in my numbers. The initial version of this post had our net worth gain since late 2020 at around $500k, not $900k as it correctly stands. This was due to an error in my mortgage value for our vacation rental.

Conclusion

In conclusion, our net worth in early 2022 rose over $900,000 compared to late 2020. We purchased about $3 million of real estate in the last year by investing money from our jobs and repurposing equity from our real estate portfolio.

Our real estate equity grew via appreciation in 2021, but our stocks did even better. Because of this, our asset allocation in real estate actually fell 3% when compared to our numbers in late 2020. We have about 56% of our assets in real estate as of early 2022.

I hope this helps put my lifestyle and investing moves in perspective.

–The Darwinian Doctor

It always causes me some anxiety to publicly post financial information like this. Net worth posts can be controversial. Let me know your thoughts in the comments below and subscribe so you don’t miss another post!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

22 comments

Love this article! Thanks for sharing

Thanks Param!

I think its fantastic that you are being so transparent about your finances. Real numbers are so very helpful in answering some questions I didn’t even think to ask. Many thanks for being brave!

Thanks — hopefully the good will outweigh the possible negative consequences of this transparency.

I commend you on being willing to post your NW

I agree there is a social stigma attached to it, but I don’t see much of an upside to posting the info. Only a downside as it exposes you to the anonymous and sometimes capricious trolls of the web

Thanks – I think it’s likely interesting to see how wealth can grow over time, but I agree that I do worry about being targeted. It’s something I’ll ponder as I progress in my journey.

nice. Interesting to note that your primary home is appreciating faster (total $ amount) than all your rental real estate.

Congrats on continue success and growth.

Yes my primary home’s appreciation is responsible by itself for a large amount of our net worth increase over the past 2 years especially. Utilizing it’s equity is allowing up to expand our real estate portfolio in a way that would have been impossible without it.

Very impressive Capital accumulation!

Are you worried that the more debt you take on, the more you may feel the need to work for longer?

As long as the rental properties are covering the mortgage payments (plus more), I’m not going to feel the need to work longer to pay off this debt.

thank. an interesting article might deal with how you manage your multifamily apartments.

Thanks! I’ll write this up in the near future!

Congratulations on an outstanding year of investment performance. I think you are calculating asset allocation by counting the net equity in real estate instead of creating a pie chart of the “Assets” table of your holdings. This is not the way I would think of this because the risks and strengths of your portfolio are not accurately reflected by that method since it artificially lowers your relative exposure to real estate. I know that the mortgages are tied directly to real estate properties (and those might even be non-recourse loans) but the way I would think about asset allocation is that it is best reflected by taking the current purchase value (the same values shown on your Asset table) and seeing how that shows your exposure to each asset type. In the same way liabilities can be considered as having different characteristics but the house mortgages are leveraging everything in your portfolio, not just the houses. (That isn’t meant as a criticism but an observation of how we evaluate assets and liabilities in my job as a corporate officer for an exchange-listed multinational company.)

This is really interesting. So to make sure I understand, you’d put the purchase price of the rental properties as a whole into the asset column (not the market value and not just the equity)? I suppose my hesitation with that is the value of the properties (if I were to sell them), is only my equity in the properties.

This all makes me want to also calculate a Liability pie chart too! It’s going to look pretty frightening.

I mean you calculate asset allocation using the current value of each asset (which might be more or less than original purchase price). For instance, if your current real estate could be sold right now for $4 million and your stocks for $1 million you have an 80:20 allocation of real estate to equities and all of that is supported by $2 million in debt which is mortgages on the real estate so your net worth is $3 million. Then you know that a 50% reduction in stock prices (all else equal) means a $500K hit (-17%) to net worth while a 50% reduction in real estate prices is a $2 million (-67%) hit to net work (to take an extreme example). When you just use the current equity in the real estate, thinking you have a $2 million real estate and $1 million equities 67:33 allocation you understate your vulnerability to changes in real estate prices.

You make a great point in regards to vulnerability to downside risk. It still feels strange to me to think of a real estate asset in terms of the purchase price, and not just the equity, but the more I think about it, the more I believe you’re absolutely right. The value of the stocks in my asset pool is independent of the SBLOCK debt that I have on some of it.

I think I’ll go ahead and recalculate in a new post…

Thank you for considering my comment. You also of course benefit more from upside so this isn’t a criticism of the investments you have chosen or even the use of debt. When you adjust the representation of the portfolio allocation to current prices (instead of net equity) it’s easier to calculate the net effects of changes in one part of your portfolio because it will be = (% increase/decrease) x (allocation %) x (total leverage) with the total leverage just the total value of the assets divided by the total net equity of both real estate and stocks/funds. That also focuses attention on how total leverage magnifies all of the gains (or losses) and that it does it for both the real estate which is attached to the debt and the stocks which are not.

Wonderful guidance, thanks so much! You inspired my newest post! Let’s see if I got it right: How to Calculate Asset Allocation as a Real Estate Investor

Liking the back and forth on these 2 calculations. I just want to point out they are mutually exclusive. OP’s way gives a much better picture of investment. Your way is the traditional net worth calculation and does downshift investment risk as OP mentioned. Great discussion.

Thanks so much — yes it’s interesting considering this from both sides.

Interesting that your real estate net worth would be practically the same if you had just worked to payoff your primary residence based on current estimated value.

What I would like to see is a “control” scenario where that annual $200k was just put in index equities by starting whenever your real estate empire started. Your current route would probably be ahead by using equity leverage, however the difference may be worth the less stress of no property ownership including time cost and increased risk of leveraged buying.

I really get a lot out of the real numbers you use, thanks!

That is interesting… though I used the leverage and equity in my own home to purchase all my real estate and force appreciation in my rental properties. I wouldn’t have had the capital to pay down my primary residence in the last 3 years. I do have what I consider an interesting comparison between stocks and real estate here:

Rental houses vs. stocks: a 25 year portfolio projection

This might be interesting for you, though it’s not 100% specific to my numbers. I’ll put this on the list of things to map out in the future!