Today’s post goes over the 3 best ways to estimate your home value, and why some methods are more reliable than others.

Just a couple of months ago, I broke down our net worth in gory detail. I revealed that as a homeowner in Los Angeles, a significant portion of this net worth is tied up in our primary residence.

My next post went into the problems with net worth, and highlighted especially the problem with real estate property valuation.

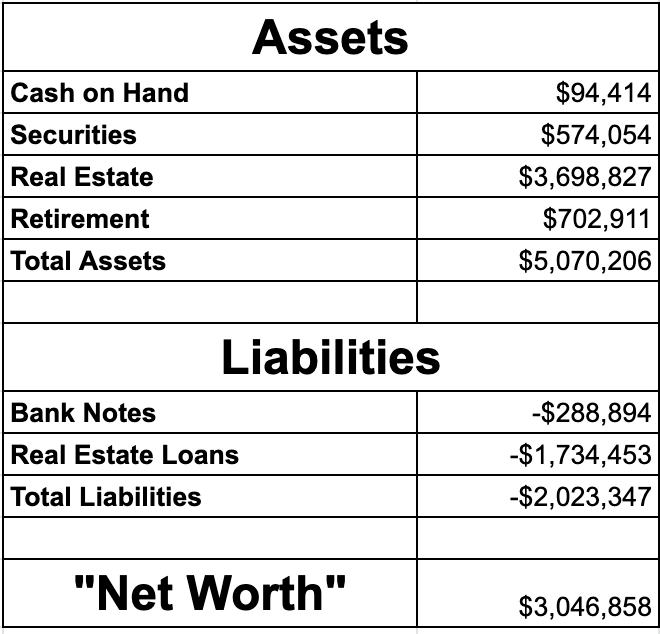

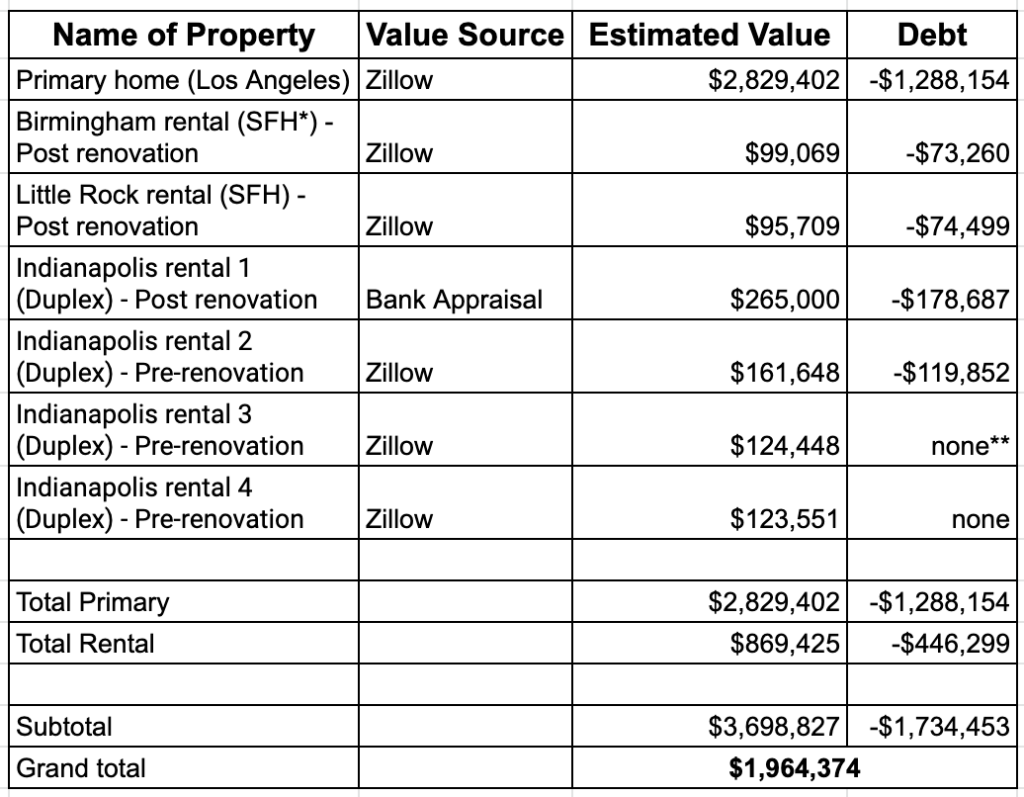

Our net worth (October 2020)

As you can see, a large portion of our net worth is tied up in real estate. In the October update, just two months ago, about 65% of our net worth was comprised of real estate equity.

Even though we are growing a rental real estate empire, the investment properties are still not a huge portion of this equity. The main chunk of this value is associated with our primary home.

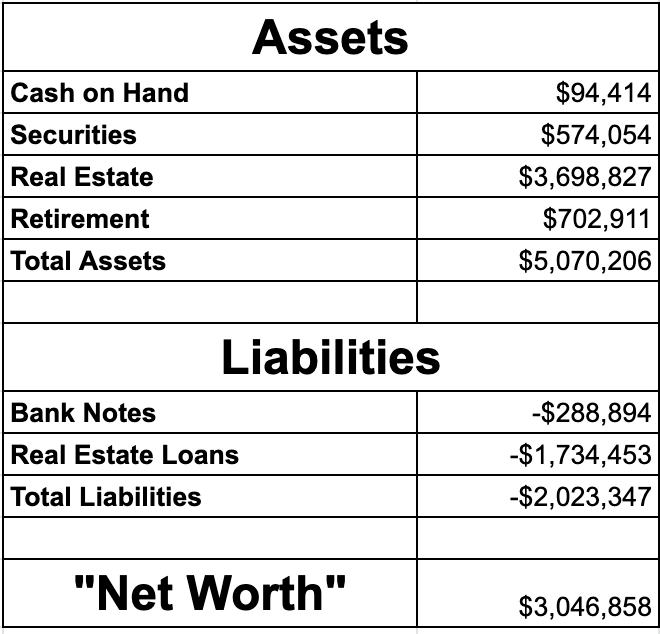

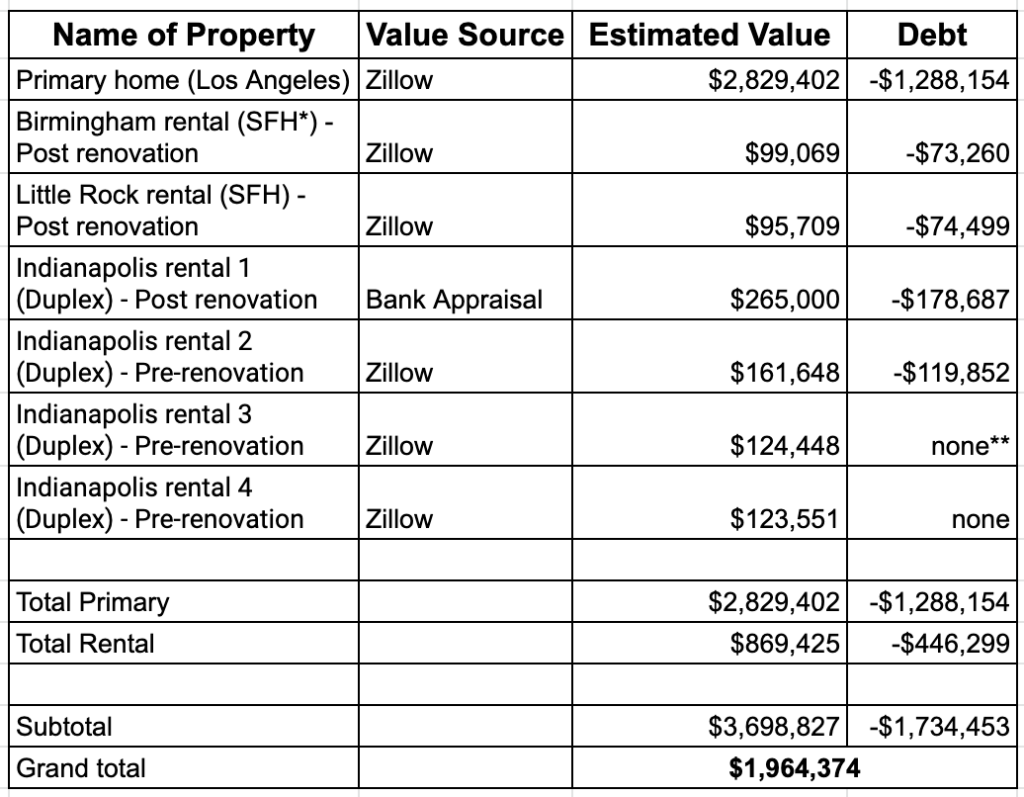

Breakdown of our real estate portfolio

In this chart, below, I estimated the value of our real estate portfolio mainly using Zillow valuations.

You can see that at the time of the post, Zillow estimated our primary home to be worth about $2.8 million. Therefore, our home comprised about $1.5 million, or a whopping 78%, of our real estate equity.

But is this really correct?

Zillow (over)correction?

As I mentioned in my post, when I looked into the exact “comps” Zillow was using to generate their valuation, I felt their methodology was flawed. It was including comps from a very exclusive neighborhood a few miles away called Fremont Place. In densely packed Los Angeles, a few miles away might as well be a different country. This gated enclave is home to celebrities and the very rich with average home values that at least double that of my neighborhood.

So I wasn’t too surprised to see the algorithm correct itself about a month ago. I was surprised at how much this correction affected their estimate of my home’s value.

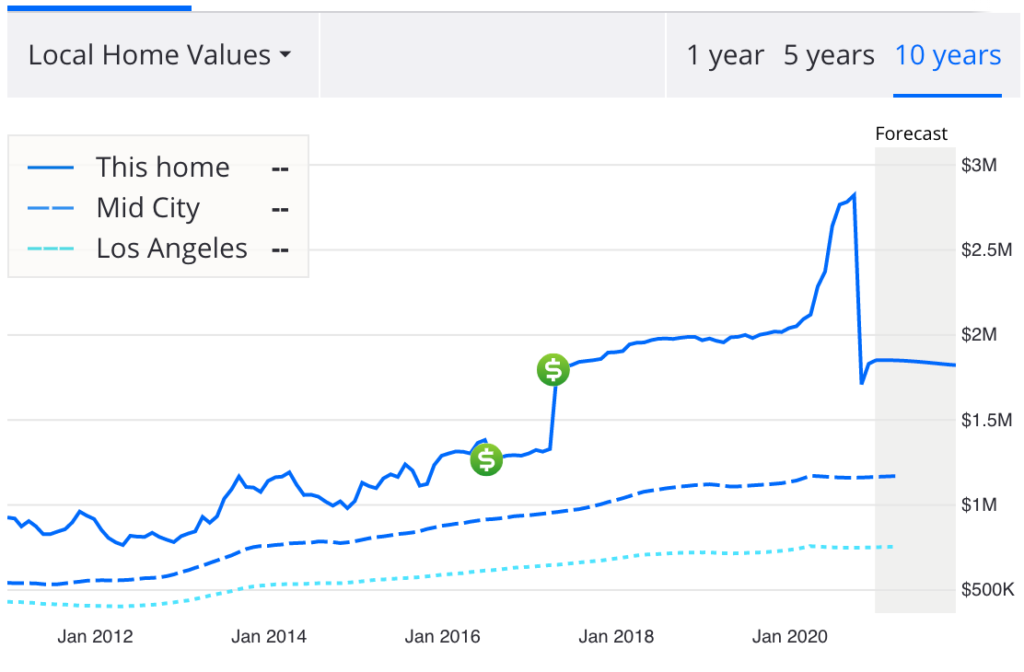

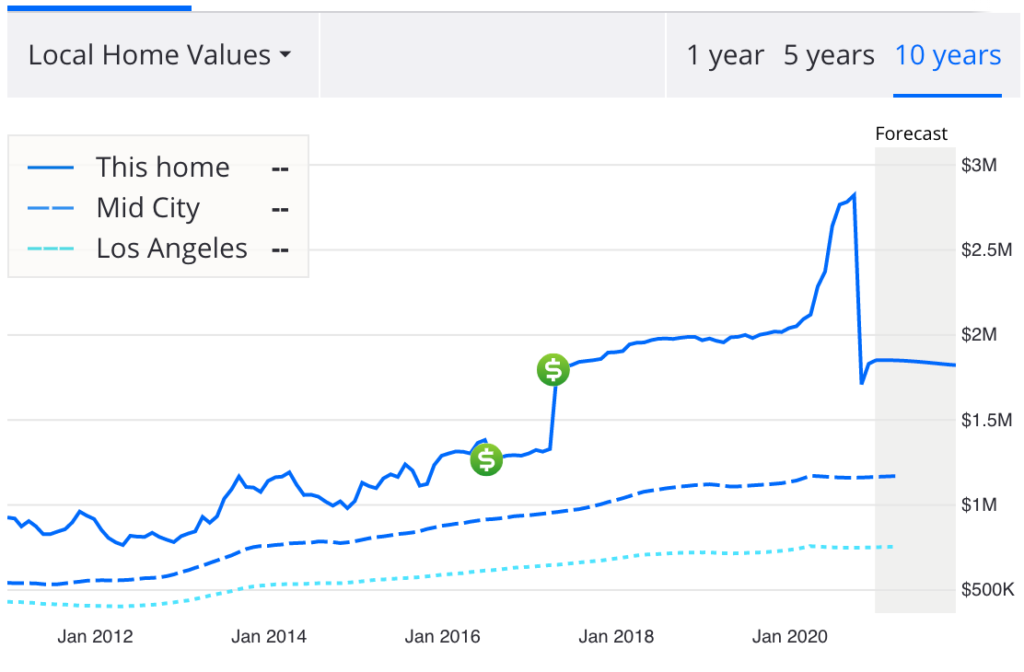

Here’s the graphical representation of Zillow’s estimate of our home value over time.

The change in the last month of 2020 represents a 35% drop in our home valuation, and a $1 million loss of net worth!

The three best ways to estimate the value of your home

So this begs the question, is this correct? How am I supposed to estimate the value of my home, anyway?

I think there are 3 options.

The 3 best ways to estimate your home value

- Sell your home

- Get an appraisal

- Use online home value estimators

Sell your home

I think selling your home is the best way by far to know the value of your home. At the end of the day, your home is only worth what someone else is willing to pay for it. The only way to know this is to let the market decide, and sell your home.

There are clearly times when this might yield an inaccurate valuation (like during a pandemic, or directly following a market crash). But in general, I feel the free market is the most efficient and truthful indication of your home’s value.

Get an appraisal

The second best way to find the value of your home is with an appraisal.

If you’ve ever bought or refinanced a home, you’ve dealt with an appraiser. These are licensed professionals who are trained to use all available information to value your home. For example, they’re supposed to take into account overall sales trends, neighborhood comparative sales, and an actual site visit to generate their appraisal of your home value.

The site visit (or visual inspection) is what sets this valuation method apart. Here is a small list of what an appraiser may take into account during the inspection:

- Curb appeal

- Fixtures

- Layout

- Location

- Proximity to desirable things

- State of repair

The danger of this method is that the quality of the appraisal is only as good as the quality of the appraiser. If you’re getting the appraisal through a bank, you won’t have any choice over who you get to appraise your home. And if they make wrong assumptions, their valuation decision may come out too conservative, or conversely, over-inflated.

An official appraisal can also be costly. This may run you anywhere from $200-600.

Online home value estimators

If you’re not planning to sell your home, and don’t want to pay for an official appraisal, you’re left with the third and worst option: online home value estimators.

The first and original example of this is Zillow. In many ways, it set the standard for this industry. It’s regarded by many as the best of the free options.

The obvious downside is that the algorithms powering these estimators are only as smart as their programming. They won’t take into account subtleties and are prone to errors.

The Zillow algorithm, for example, has no idea that we sunk about $175,000 into the creation of a nice 1 bedroom accessory dwelling unit in 2018, adding about 550 square feet of permitted living space to our land.

The good news is that there are now a number of popular real estate websites that have added a home value estimate to their functionality. So you don’t have to depend on just one estimate.

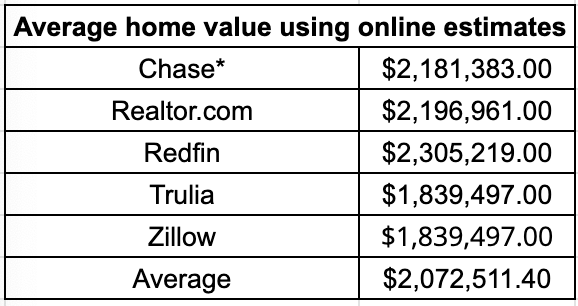

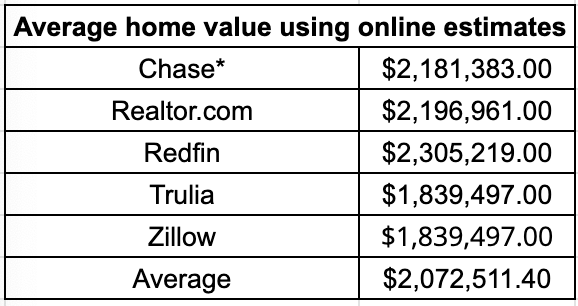

Our home’s average estimated value

If you just want to get a rough idea of your home’s value (for a blog post, for example), you can just average all the free estimates available.

Here’s our average value as of December 2020 from five free online tools:

Out of these 5 values, only the one from Chase changed when I updated the correct counts of bathrooms and square footage. It also seems the closest when I compared recent sales in the neighborhood.

Note: helpful readers let me know that Zillow and Trulia are the same company under different names. Keep this in mind when interpreting their information.

Conclusion

I hope this has been helpful in giving you some options to estimate your home value.

While I think the online estimator tools are useful, they’re prone to error and can’t take subtleties into account. And if you rely on just one, you might get a sudden shock when its algorithm drops your home value by 35% overnight.

If you really want to know your home value, go for an appraisal, but nothing replaces actually selling your home to know its worth on the free market.

Did I really lose $1 million of net worth overnight? I don’t think so. I’m hoping to have a better feel for this via the bank appraisal method as we try to refinance our mortgage next month.

I’ll let you know how it goes!

— TDD

Have you recently tried to estimate your home’s worth? What method did you use? Please comment below and subscribe for more posts of my journey to financial freedom!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

18 comments

Like you, a lot of my networth is tied to my primary residence since I also live in Southern California.

Good luck on the refi!

We recently (two months ago) refinanced our home and we are projected to save $250,000 over the life of the loan by lowering our rate from 3.625% to 2.5%.

Wow, you really got a killer rate! Good for you!

We’re locked in at a rate of 2.75% with a third of a point. Even this change is likely to save us about $500 a month for essentially no money out of pocket. It’s the silver lining of the Covid pandemic.

[…] your home an investment, but knowing its value can still be beneficial for many different reasons. In this post, The Darwinian Doctor breaks down a few ways to accurately determine your home’s value, and some […]

I think the most conservative way to value your house is to record what you paid for it. You can add any capital improvements to the “basis”, e.g. additions, remodeling, etc.

What you’re describing in this post are mark-to-market valuation methods, which are fine too, but typically give a sunnier estimate of the value. It’s probably also prudent to discount 10% for transaction costs.

As a conservative method, this seems like a great method, though I’d say 10% is a bit much for transaction costs. 6-8% is likely more realistic, and for more expensive homes, that 2-4% can be quite a big difference. I’d agree that underestimating home value probably is the safer way to go for most people.

Founded in 2005, Trulia is based in San Francisco, and owned and operated by Zillow Group, Inc.

It makes sense now why their valuations are exactly the same. Thanks for this information.

I just found your sight tonight and have much to catch up on. I too have found income producing real estate as a reliable way means to reach FI.

My question relates to your decision to include your personal home in your net worth calculation. Perhaps you’ve addressed it elsewhere (my apologies in that case). My understanding is that your personal home should not be included. You have to live somewhere and your personal home is not income producing. As the purpose of FIRE is income replacement in retirement, how does your personal home figure into this equation.

Of course, when one retires, after kids leave, the home could be sold and some of the equity appreciaciation could be realized and invested. Yet, you still have to live somewhere, even after you downsize. Would just like to hear your thoughts on this decision. Thanks again for the site, I look forward to taking a deep dive.

Hey Todd, great question. This is a topic of significant debate. I include my primary home in my net worth because it represents such a disproportionate part of our money. The real estate in Los Angeles is so expensive, that I think it would distort our perception of our net worth to NOT include it. To tap the equity, you’re right that we’d have to sell the property, but then we could rent someplace reasonable for much less than we’re paying for our mortgage and property tax.

But when it comes to net worth, it’s all about you. It’s a useful barometer to keep track of where you’re at compared to your goals. So include whatever you want!

After all: Why your net worth isn’t as useful as you think

Nice website of short term rentals, by the way. Thanks for stopping by!

Trulia & Zillow are the same company under different names.

Thanks for the reminder — I have to update the post to reflect this.

Thank-you for sharing this blog. And yes, this is really helpful as we can get to know about the worth of our home which is our duty.

I agree with value being determined by the free market when you sell. I think you can get the next best idea by doing your own comps. You live in the neighborhood so you know the best lots. Just use Zillow to outline your location preferably in same track without crossing any major streets (or 0.5 miles radius but not as good) looking for similar sqft , age and adjust just like appraiser does for bedrooms, baths, finish, premium lot. You can get an idea of local price adjustments by looking at your previous appraisals. In the end I think this is why it is better to buy in places you want to invest and rent where you want to live. Especially in high cola areas where the rent arbitrage is great. That way you can fully deploy any lazy equity and still take advantage of renting “cheaply” in high cola areas where rent to price ratio is in your favor

This is great advice, and I agree completely. Local comps within neighborhood boundaries are definitely going to be the most accurate ways to estimate your home value.

Renting (instead of buying) in a high cost of living area also makes a lot of sense, though you won’t participate in any big upswings in appreciation also. Getting lucky with the housing market was one big reason why our wealth increased over the last decade.

Interestingly I’ve actually read that in the long run over 10-15 years the “appreciation “ in a linear market like Detroit outpaces a cyclical market like Irvine (where I live). Certainly in the short term that certainly doesn’t seem the case when we have seen outrageous appreciation this past year. I’m curious how much this appreciation is attributable to the unprecedented 30% increase in money supply this past year which has also inflated other assets as well. In other words how much of that appreciation or asset bloat is actually just inflation as money pours into assets searching for better returns in today’s low interest rates.

I think you’re onto something, though it’s probably difficult to know exactly what % of asset appreciation this year is due to inflation. Certainly some of it is real inflation, and some of it is a side effect of inflation, as you note. There is also still the worsening housing supply problem in our nation:

Are we headed for another housing crash?

Your analysis of the three best ways to estimate home value is practical and informative. Selling your home indeed provides the most accurate valuation, as the market determines its worth. An appraisal, although dependent on the expertise of the appraiser, offers a more reliable alternative.

Probably you answer this question before, why you invest at Indianapolis and how you manage your rental properties from Los Angeles, thank you.