Are we headed for another housing crash? My conclusion is that it’s unlikely in the near future. Read below for my reasons why.

In my last post, we discussed how getting a mortgage now is painful. I argued that this is actually a good thing, because high lending standards are important to make sure only well qualified borrowers get mortgages.

But the all time highs in the housing market begs the question: Are we headed for another housing crash?

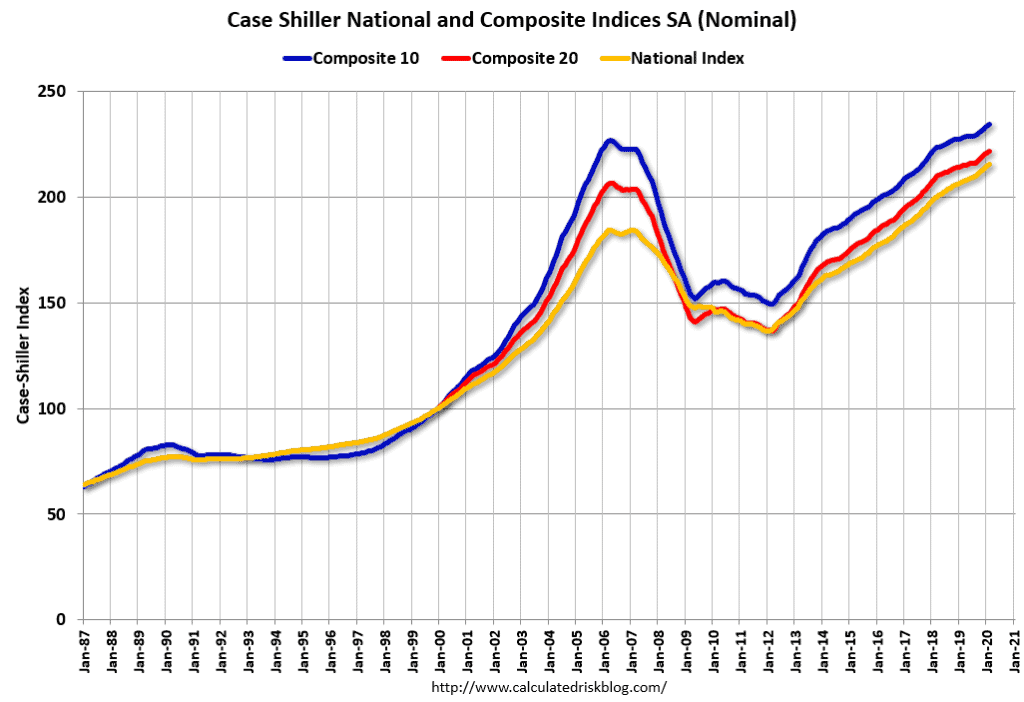

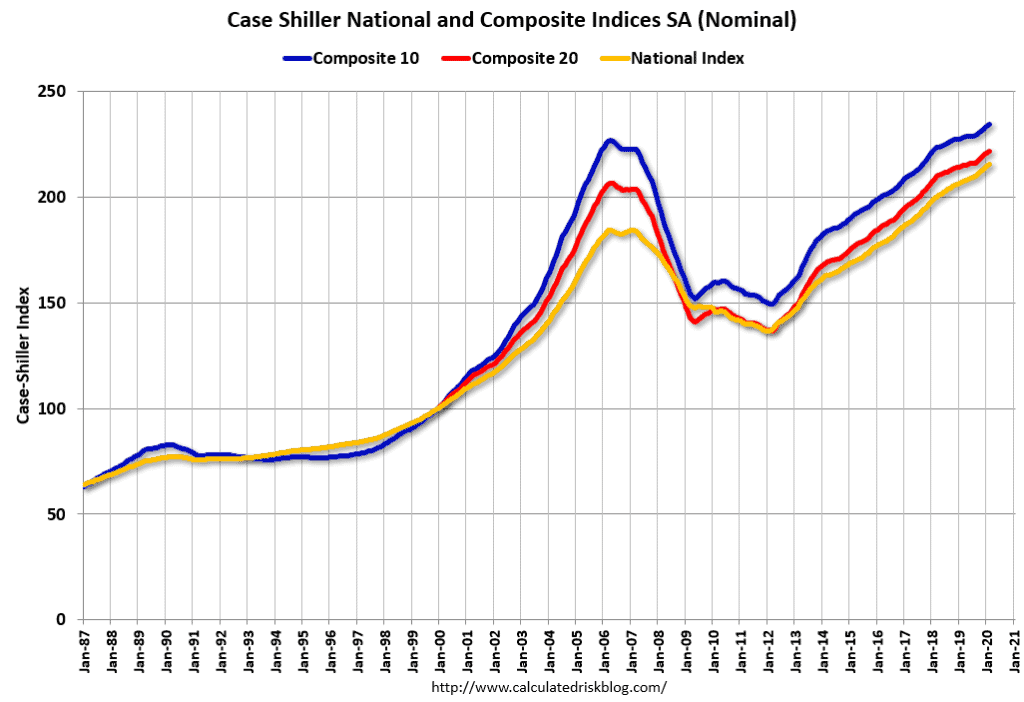

To help answer this, let’s take a look at what housing prices have done since the Great Recession.

Specifically, the graph above is the Case Shiller Index from 1987 through 2021. It shows that we’ve completely recovered from the crash of 2008, and in fact, the index has exceeded that level.

This means that the relative price of houses has risen to the highest level in recorded US history.

But does this necessarily mean that we’re going to experience a housing crash in the near future?

I have two thoughts about this:

- Housing crashes always seem to have a catalyst

- It all comes down to supply and demand

No catalyst, no crash

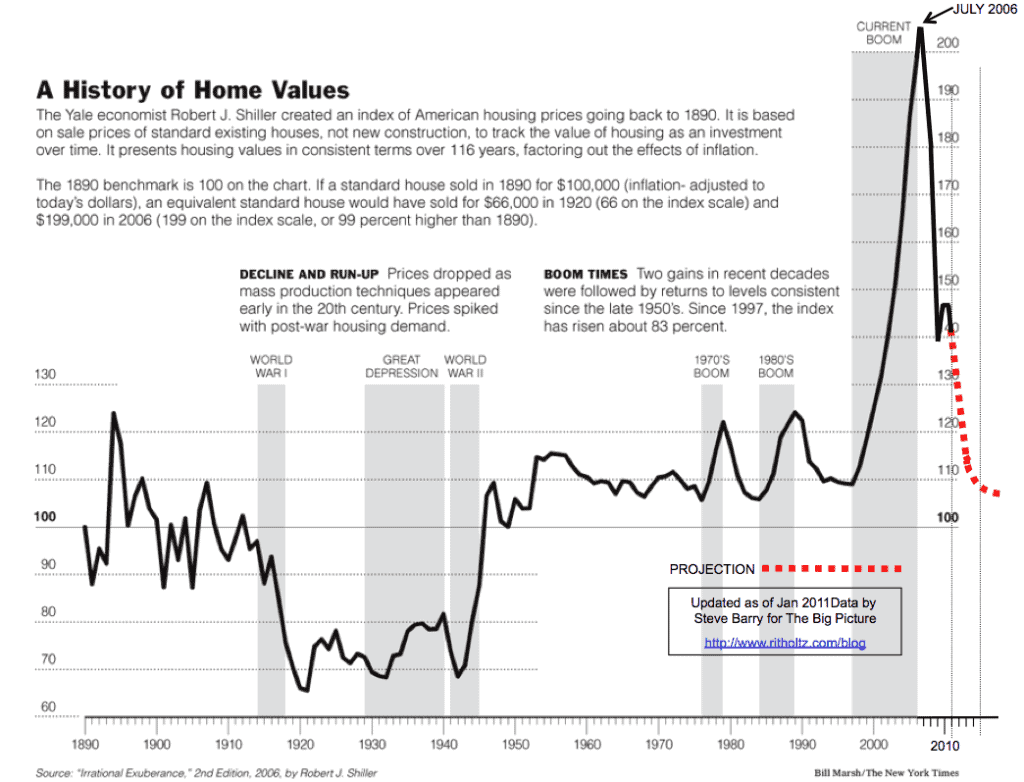

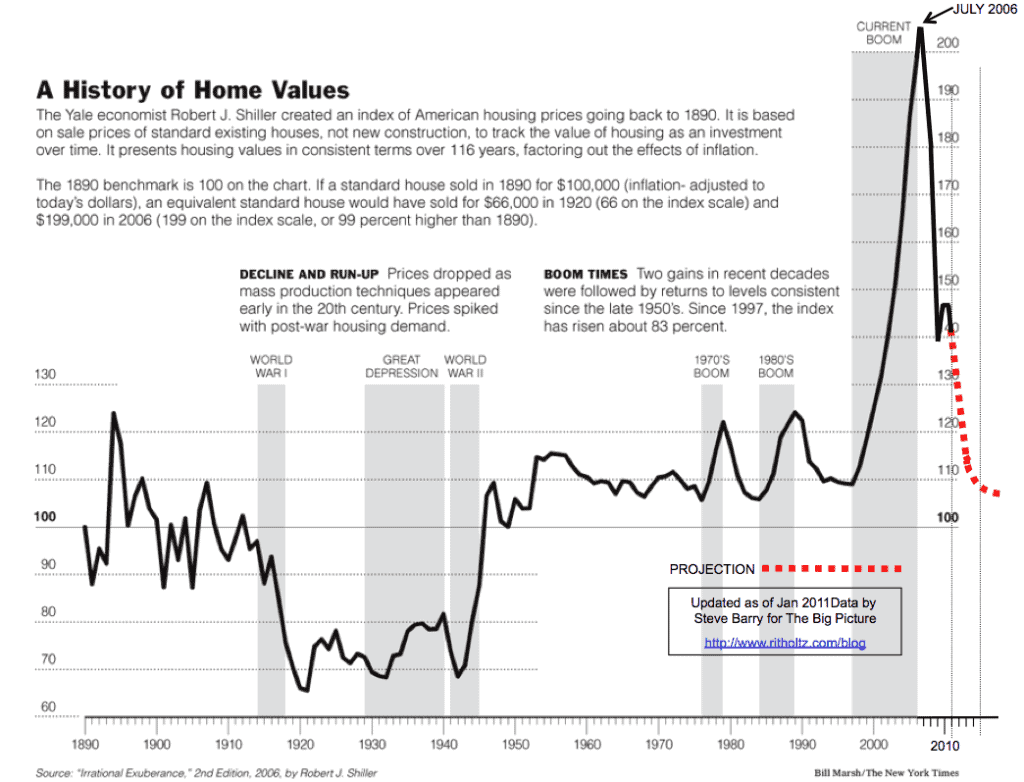

If you look up the Case-Shiller index from 1890, copied again below, you’ll note that all the major housing price declines seem to have a catalyst. For example: World War I sparked a huge drop, as did the subprime mortgage crisis.

Aside from these major corrections, the corrections in the market after the 1970s and 80s seemed to only push the index back to the mean value.

With the high lending standards put in place since the subprime mortgage crash of 2008, it seems unlikely that poor lending standards alone will be the catalyst of another major crash at this time.

But how about another catalyst? Perhaps, maybe a pandemic?

I thought for sure that the Covid-19 pandemic would cause a crash in housing prices, but it absolutely didn’t. As any recent house-hunter will tell you, it’s done the opposite. Low interest rates have pushed asset prices (including homes) to all time highs. These low interest rates are set centrally by the Federal Reserve, and are expected to stay low for the next couple of years.

Generous unemployment benefits also allowed many people to keep paying their mortgage, despite job loss. This was the goal of the benefits, and it undoubtedly helped to stabilize the economy.

But for the part of the US that survived the financial instability of the early pandemic and were already invested into asset markets, many saw their fortunes soar. Stocks and property values rose, allowing people to have increased liquidity. Many of these people are now looking for places to put their capital to take advantage of the low interest rate environment. As I’ve discussed in the past, mortgages are great inflation hedges, and let you lock in interest rates for up to 30 years.

So now, all these people are looking for new houses, which brings us to my next point:

Supply and demand

The second factor to consider is the severe constraint on housing supply. Home builders have been undersupplying the market ever since the Great Recession. Many home building companies went out of business after 2008. Also, many of the electricians, plumbers, and carpenters that helped fuel the last boom decide to retire or change jobs.

The current projected home shortage is a whopping 3.8 million units, up from 2.5 million units in 2018. Although home building is ramping up, it’ll be some time before there are enough homes to fulfill the demand.

So absent another big catalyst, the law of supply and demand means that there’s no obvious reason to expect a drop in housing prices in the near future.

Conclusion

So are we headed for another housing crash? I believe there’s no obvious reason why this will happen in the near future. There’s no clear catalyst for a housing crash, and demand for housing currently exceeds the supply.

I do see signs that the recent rise in housing prices is leveling off. We reported recently of our second home purchase in Palm Springs, California. Although we closed on the home last week, I still get notifications of all the listings and sales in that area. For the first time, I’m seeing price reductions and homes that are sitting on the market a bit longer than they did just a month ago.

This is anecdotal evidence from one local market, but it stands to reason that prices can only rise so far, so fast, before it taps out the buying power of home buyers.

Of course, no one can predict the future. But as an investor playing the long game, I feel pretty happy with our multiple real estate purchases this year.

— TDD

What’s your take? Do you think we’re going to see a housing crash, or are prices going to just level off? Please comment below and subscribe to my free weekly newsletter!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

5 comments

Paula Pant agrees with you in a recent podcast. There are differences in now and 2008 that she and you both found. I think that’s a comforting thought for many first time home buyers who are uncomfortably aware that they are buying in a rising market.

Yes, thanks for noting this! I chuckled when I heard her, since on this, I think we see very eye to eye.

I think we are in a much stronger position now as to before where they would just approve anyone with a pulse with a mortgage that caused the 2008 crash. The controls are much more robust now to where a huge and sustained bust of real estate is much more unlikely.

So the question is… What WILL cause the next crash!? If a worldwide pandemic can’t cause a sustained crash, what will?

If you figure that out, please let me know!

[…] than supply. If you combine this with historically low interest rates, it’s a perfect storm of dizzying home prices and bidding […]