In this special edition of Anno Darwinii, my real estate empire turns two years old and hits $3 million of property value!

This post may contain affiliate links.

Anno Darwinii is the report I publish every three months that documents the growth of my real estate empire. Loosely translated as “Year of Darwinian,” the Anno Darwinii calendar began in mid 2019 with the purchase of my first rental property. So today, this edition marks two full years of life for my real estate empire.

This is all in good fun, but I’m dead serious about using real estate as a tool to accelerate our journey to financial independence.

Last edition, I celebrated reaching $29,000 of projected cash flow for 2021, and also gave an update about our apartment building renovation.

Today, it’s my pleasure to announce that we now need to start numbering our apartment buildings, because we bought another one! We’re also on the verge of closing on a vacation home that may play a big role in our cash flow at some point as well.

I’ll do a quick update on our first apartment building, then I’ll introduce the new properties. Finally, I’ll finish up with a review of our whole portfolio and celebrate hitting a big financial milestone: $3 million of property value.

Indy Apt building #1

The good news is that our renovation is coming in under budget. The bad news is that this is true mainly because it’s been going so slowly.

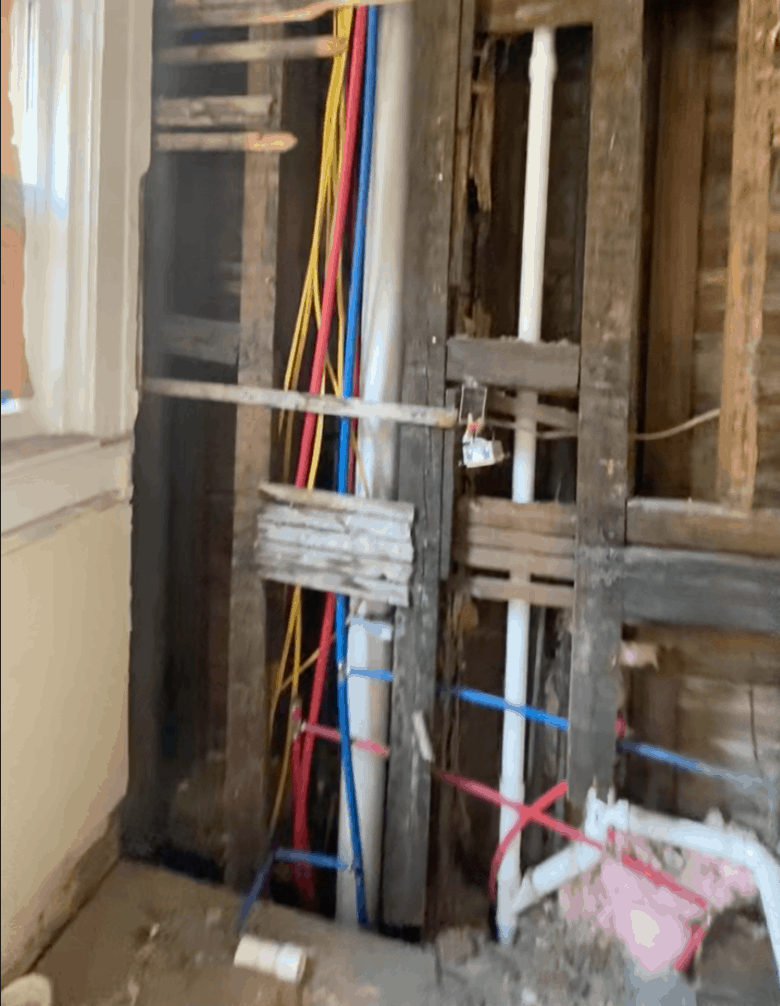

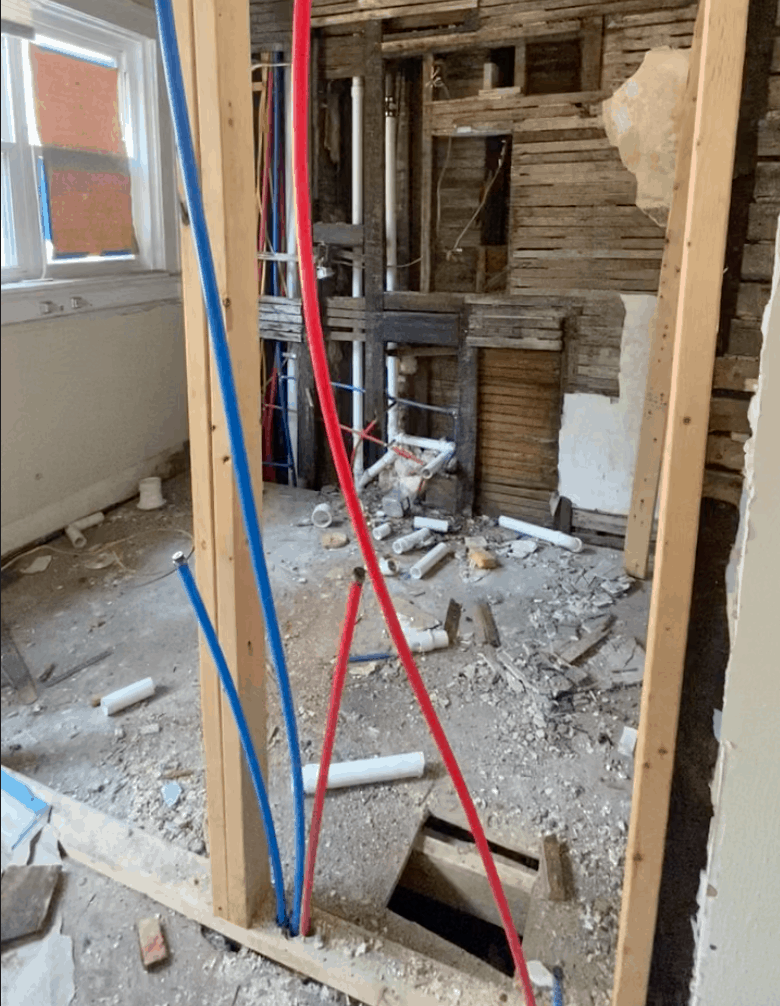

In the last update, I showed progress on the roof and the water heaters. Since then, my general contractor finished up with the plumbing rough-in and ran new electrical.

New Electrical

Pex water lines

He also obtained a permit to park a huge dumpster in front of the building on the street.

In the next three weeks, he promises we’ll be moving things into high gear; clearing out debris and readying the units for drywall. After that, it’ll be up to me to select flooring material, vanities, lighting, etc. I’m planning to spend some quality time on the Lowe’s website this week in preparation for this step.

This apartment building continues to be a source of anxiety for me due to the slow progress, but it’s just enough progress to keep me trucking along with the current GC. I’m hoping that the pace will accelerate enough to get some units rented by the fall.

I’m shooting to have it fully rented up and refinanced at a higher valuation in early 2022.

Indy Apt Building #2

And now, here’s an introduction to our newest apartment building acquisition: Indy Apt Building #2!

Indy Apt Building #2

Empty lot next door

Property description: this is a large duplex that’s been converted into a 7 unit apartment building. It’s on the eastern edge of a trendy and desirable part of Indy called Fountain Square.

Here are the essential details:

- City: Indianapolis, IN

- Unit composition: 7 units (Two 2-beds, three 1-beds, two studios)

- Includes the adjacent empty lot

- Purchase price for both: $510,000

- Valuation of building: $430,000

- Valuation of empty lot: $80,000

- Terms of loan: 30% down, 5.5% interest only loan x 1 year, then amortized over 20 years.

I purchased the building along with the nice tree lined lot next door. Since the building wasn’t purpose-built as an apartment building, many of the units are smaller and the layouts are unusual. However, this was reflected in the lower price of the building. The building overall is in great shape and well maintained. It has a new roof with updated plumbing and electric systems.

Many of the units have tenants who are paying significantly below-market rates, which represents a source of hidden value.

Arial view

Bathroom

Kitchen

Our plan for the 7 unit:

- Light renovations to the smaller units

- Heavier renovations to the larger units

- Turn over the units to achieve market rents

- Refinance with better terms after stabilization

If we carve out the empty lot from the deal and raise rents, our cash flow projections show 9-10% for the building as a whole.

Options for the empty lot:

- Hold as a non-cash flowing investment

- Build a property on the lot for sale or rent

Honestly, I’ve never owned raw land before, so I’m not sure what to do with the lot. My ideal scenario would be to build on it, but the costs might be prohibitive. At the very least, it’ll provide a lot of great blog content in the future!

The Palm Springs vacation home

In about two weeks, we’ll be closing on a classic 1940s Spanish style home in Palm Springs, CA. In terms of cash invested, this purchase officially represents the biggest real estate investment we’ve ever made (aside from our primary home).

Here are the essential details:

- List price: $1,200,000

- Purchase price: $1,075,000

- Five bedrooms, 3 bathrooms

- Year built: 1940

- Square feet: 2110

Lending terms:

- Jumbo second home loan

- 20% down

- 30 year fixed term

- Interest rate: 2.75%

Palm Springs

Palm Springs is a desert resort city just a couple hours outside of Los Angeles. It’s historically been associated with the mystique of the Hollywood elite and mid-century modern architecture. In modern days, it’s become a year-round destination for art, culture, and music festivals. It has a thriving short term rental market and is ranked as one of the best places to buy an investment home.

Palm Springs events:

The vacation home

This home has been with the same owners for 40 years. So while it may seem like we got a great deal, this reflects tough negotiation from our inspections.

We’ve got a big list of planned improvements including: new HVAC, adding a pool, exterior hardscaping, replacing some doors, and extensive painting. We’re also getting quotes on more extensive work like renovating the bathrooms and kitchens and moving around some walls, but this all might be cost prohibitive at this time. If we did everything we want to do to the house, we expect to spend about $200-300k on renovations and repairs.

In case the FBI reads this, I want to be clear that we look forward to using this home as our weekend getaway and our vacation home. But we also look forward to exploring opportunities to rent the home at some point to defray our holding costs.

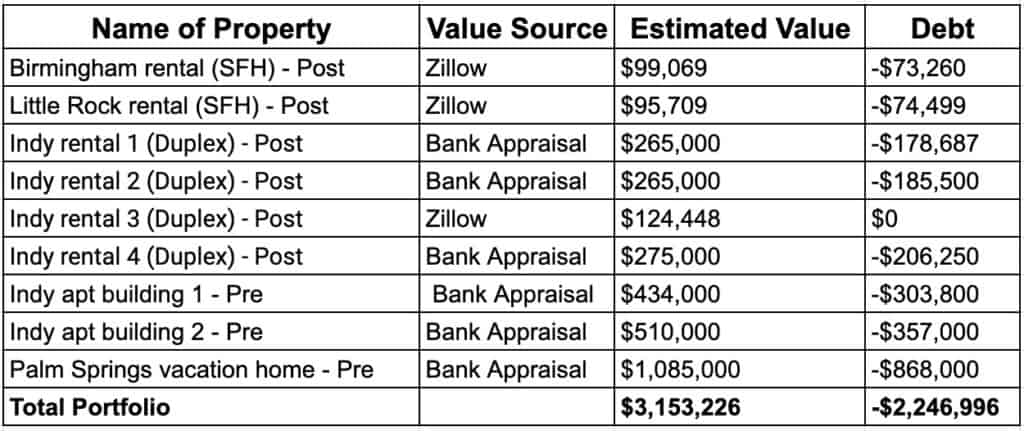

Summary of our real estate portfolio

The sum of the estimated value and the debt is our equity, and represents how much money we’ve put into these properties, plus value increases from appreciation.

As of mid 2021, we have $906,230 of equity in our portfolio.

Conclusion

I hope you enjoyed this update of our real estate portfolio in this edition of Anno Darwinii.

To recap, in 2020, we acquired approximately $1 million of investment real estate. We funded this with cash from stock sales and also a HELOC on our primary residence. We used the BRRRR method to stretch this money even further.

In 2021, the Dr-ess and I doubled this figure with the purchase of two apartment buildings and a vacation home. The last two purchases tapped out our HELOC funds, so we’re going to have to be imaginative about where to pull the funds to renovate the vacation home.

All together, we now have 28 units in our real estate empire.

We figure it’ll take the rest of the year and all our attention to ensure these last three properties achieve their full potential. I look forward to keeping your updated about our progress in the next edition of Anno Darwinii!

–TDD

Does this rate of property acquisition make you nervous? If not, don’t worry, we’ve got enough anxiety to spare, so take some of ours! Please subscribe to our weekly newsletter and comment below!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

You have been very busy building your empire, congratulations on your achievements so far! I don’t think there are enough PPIs in the world to allow me to emulate you, but I am so impressed with your progress.

Actually I cut back on coffee from five to one cups a day, and my GERD is so much better now!

Nice work Daniel, very impressive! Have you run into any issues getting mortgage loan approvals given the amount of debt accumulation?

Hey Jared, yes it’s become an issue, but more so for the sheer number of mortgages. I can’t qualify for a typical jumbo mortgage anymore because I have too many mortgages in my name. I think the limit is either 5 or 6. Luckily there are still products out there for my situation, but they’re harder to find.

I thankfully haven’t run into the debt to income ratio issue yet.

Hello Daniel,

Great work! Can I ask which brokerage house you are using for the mortgages? thanks

CM

Sure: US Bank

Congratulations. If there’s any time to beef up your real estate portfolio, it’s now with record low interest rates and record high price increases.

Maybe in a year we’ll see an update of “$6 million real estate empire?” 😉

I think that combination of factors was driving me to accumulate more rapidly recently. Now I can hopefully take a breath and stabilize everything!

Great update. Have you thought about mixing him a few passive deals too such as syndications? My wife and I started in 2016 and have focused on replacing our monthly expenses with passive income. I’m now only practicing 3.5 days a week at 46 years old.

Instead of focusing on accumulating a large LUMP sum of money, instead, we focus on acquiring multiple income streams to slowly back away from the practice.

Keep up the great articles!

Yes I think I’ll end up investing in a syndication in the near future, just to check out this option and write about it. Nice to read about your success, congrats!

Did you set up LLC for your rental properties? If yes, would you mind write an article about it? Thanks. I am debating about the pros and cons myself.

Yes! I’ve got a post in the works regarding my asset protection. It’s a big one, though, so it might be a month or two before it goes out. I’m in California, so I went with something called a Delaware Statutory Trust model. If you’re out of California, most seem to advise an umbrella LLC model for asset protection.

Thanks! Look forward to your new post.

Hi Daniel, for your Indy apartment building #2, may I ask what are the terms of the loan after the interest-only period? What’s its rate right now? Thanks!

It’s an unusual commercial loan, but after the interest only period, it remained at the 5.5% interest rate for the principal and interest portion of the loan, which is 20 years. I intended to refinance out of it to at least a 25 year term, but obviously that’s not an option right now.