In today’s Anno Darwinii post, I’ve got a cash flow update, a report on my problem properties, and pictures from the apartment building renovation.

It’s an interesting time to be a real estate investor. Housing demand is high and supply is low, which has created a perfect storm of dizzying prices. I’ve been approaching the market warily in my everlasting search for more property.

In the meantime, I’ve taken the time to stabilize our existing portfolio and move forward with renovations on the apartment building.

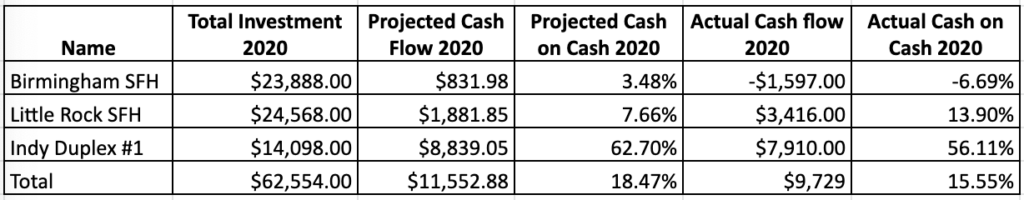

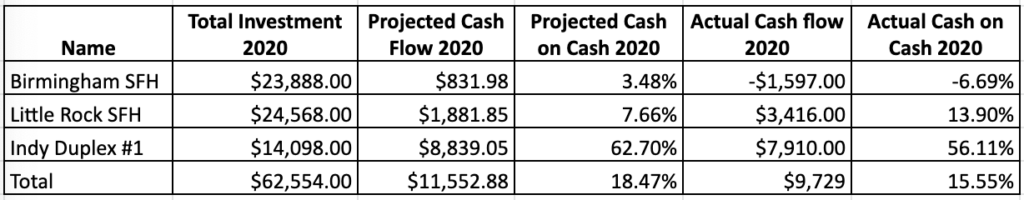

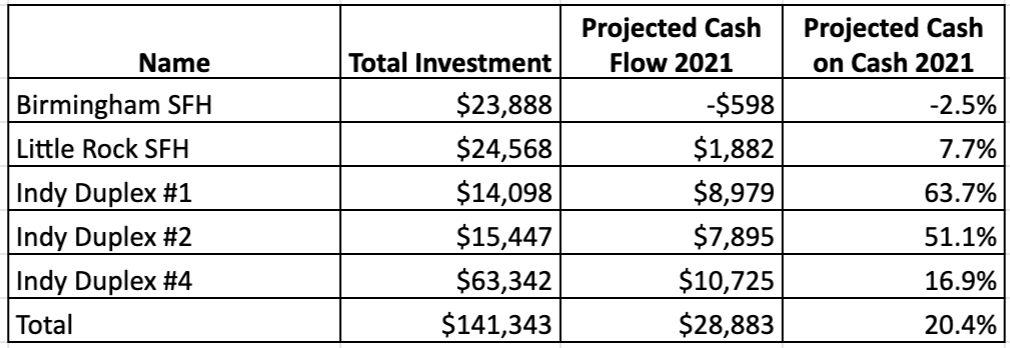

2020 cash flow: $9,729

Last update, we only had 3 properties stabilized, which means they were fully renovated and tenanted. Together, they generated about $9,729 of income in 2020. This was less than projected, but not bad at all. Every cent was pumped back into our real estate fund.

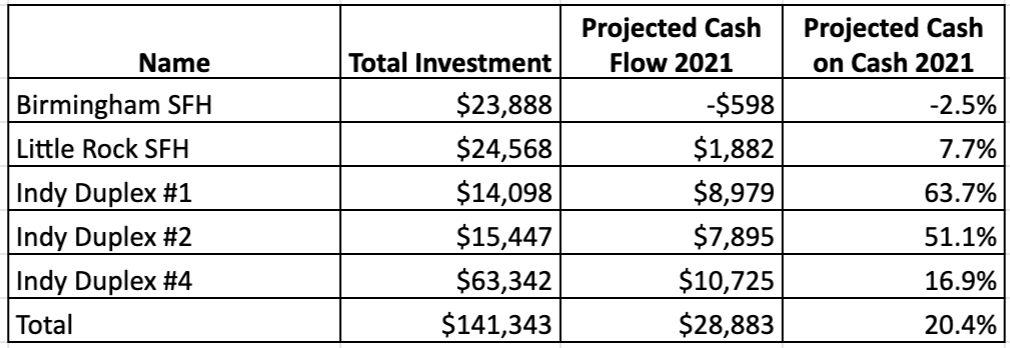

2021 projected cash flow: $28,883

In early 2021, we finished the BRRRR process on two of the three duplexes I picked up in 2020.

Check out this post for more on those two duplexes: Returning 17-50% via the BRRRR method for Duplex #2 and #4

With these properties now stabilized, rented out, and refinanced, the cash flow situation for 2021 is looking much more substantial.

Between these 8 doors, I project we should net almost $29,000 in 2021. That’s a big jump from 2020!

You may note that my Birmingham property is projected to be less negative this year! *Cue hesitant clapping* Here’s the update on that property, below:

The Birmingham turnkey

Last time I reported on this property, I was losing a lot of money every month. Even though I had a tenant in the property, she was either voluntarily or involuntarily not paying her rent. (This is called “economically vacancy.” This situation is different from normal vacancy, where there is no tenant living in the unit.)

Each month of economic vacancy cost me $830 of lost rent.

I’d like to assume that the tenant was just on hard times as a result of the pandemic. Certainly this is the unfortunate case for a lot of renters right now. Even if she was intentionally taking advantage of the national eviction moratorium, there really wasn’t much I could do about it.

Some good news

Then I got good news from my property manager at the end of February. The tenant disappeared!

While in most situations this would be a bad thing, I was happy. Why?

I had no real expectation that the tenant would ever have been able to pay me back for the missed rent. In total, the tenant missed about 6 months of rent, equal to $4980. What struggling tenant would ever be able to come up with that cash?

Not only did she leave without a fuss, she left the property in surprisingly good condition. There was minimal wear and tear, and I think she even mopped!

So in March, my property manager turned the property over with some minor repairs and paint. (We used the old tenant’s security deposit to fund the turnover costs.) Now, for the first time in over 6 months, the property’s generating income!

We were able to raise the rent from $830 to $875, and after all expenses are taken out, it’s cash flowing positive on a monthly basis! Well okay, it’s netting a whopping $84 a month. It’s not much, but it’s better than nothing.

I’m still a bit conflicted about what to do with the property. It’s not performing nearly as well as the BRRRRs I’ve done. Even assuming that the tenant stays the year, it’ll only yield 4% cash on cash for the term of the lease.

I’m increasingly tempted to sell the property and take the equity elsewhere.

The “problem child” duplex

I attempted to BRRRR this duplex also, but ran into a big appraisal shortfall. Rather than settle for leaving about $100,000 of equity locked in the property, I cancelled the refinance.

Since then, a few things have changed:

- We rented the right side for $1300/month in a 1 year lease

- We turned the left side into a cute furnished short term rental

- We added a fence to the backyard and seeded the lawn

Here are some pictures from the furnished side:

Visiting Indy? Come and stay in our 2 bedroom airbnb!

With all these changes, plus some good recent sales data in the neighborhood, we’re going to give the refinance another try.

Update on the 10 unit apartment building

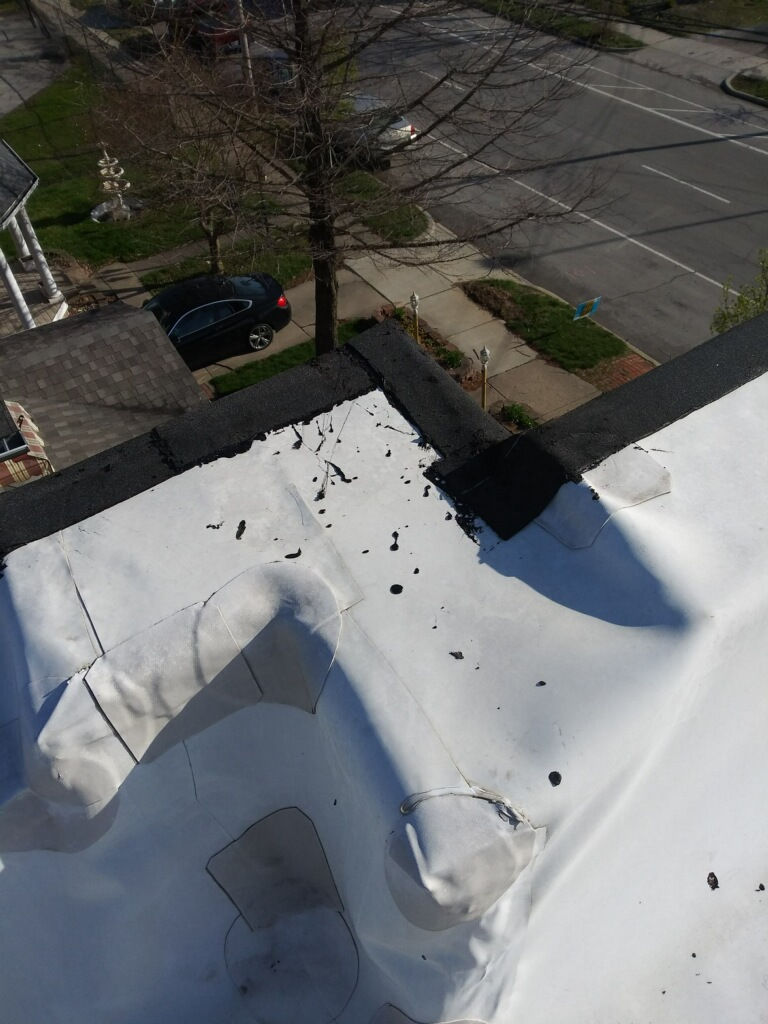

Finally, renovations at the apartment building are underway. So far, my contractor has addressed the following items:

- Water heater installation

- Plumbing rough-in

- Roof patch and repair

While these six water heaters may just be a small part of the renovation, they represented the first signs of progress. Therefore, I feel warm and fuzzy whenever I see them stacked nicely side by side.

The roof renovation is one of those things that no tenant will ever see, but if the roof isn’t sound, it’ll create problems down the road. So I was happy also to see the pictures of the roof remediation too.

Cracks sealed!

Water entry points patched!

Next up for the apartment building: electrical work!

Conclusion

I hope you enjoyed this Anno Darwinii update on my real estate empire. In 2021, I project we should net about $29,000 from our stabilized units. Hopefully I’ll be able to stabilize the other 12 units in Indianapolis before year’s end as well.

Despite being in a very “hot” real estate market right now, I’m trying to consistently find and pursue deals. It keeps my analysis muscles toned and keeps my realtor engaged.

I figure that as long as I consistently buy deals every year, it’ll be similar to “dollar cost averaging” investments into the stock market. Some investments will be huge winners and some will be like my Birmingham property. But in the end, the overall trend will be positive.

I’m currently in the midst of vetting another small apartment building in Indianapolis. I’m also educating myself on short term rentals, and hoping to enter this space as well in the near future.

Suffice to say, there’ll be a lot of great content coming your way, so stay tuned!

–TDD

How are you working to secure your financial independence? Comment below and don’t forget to subscribe!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

16 comments

Nice there is progress!

But man, that much work gives me a little bit of PTSD managing properties from my past. The most I can handle is three rentals, self-managed.

Ive focused on just buying, living, and renting out single family homes.

Btw, what is your thought as to why there are so many physician personal finance blogs? Wouldn’t it be best to just work until 60 and concentrate on making the big bucks until then?

Thx, Sam

I think a big reason with the explosion of Physician finance blogs and the reason why Daniel and soo many other physicians are working hard at creating alternate sources of income outside of medicine is primarily due to the changing landscape of medicine. More often than not we are losing autonomy which in turn makes it much more difficult to have sustainable work life balance. Another big reason that those outside of medicine might not fully comprehend the real damage that a job that requires sometimes multiple sleepless a week and a “day job” that requires 100% focus for 50-70 hours a week can do to ones ‘s physical and mental well being. I’m sure we all love the personal fulfillment that practicing medicine can bring, but doing a job like this until age 60-65 may just not be realistic these days.

Yes, burnout is real. But if it’s so difficult to spend 50+ hours of focused work making the big bucks… spending even more hours writing posts would be so difficult.

I’m exhausted writing 3X a week on FS, and I don’t even have a day job! But, I do have two little ones I take care of with my wife all day, so that’s quite tough.

If I was making, let’s say, $500,000+, I would just focus more of my energy on doctoring to make $29,000 more a year. But I guess the point is that doctoring may not be sustainable…

Sam

Sam,

At some point there is a law of diminishing returns. For many of us working say 70 hours a week in the practice instead of 60 might lead to poor patient outcomes and of course a higher chance of early burnout. Writing a blog and doing real estate on the side might be a good outlet from the rigors of an Intense medical practice which can provide big dividends and more personal freedom in the future.

I think it’s easy to romanticize a physician’s day to day. Although there’s a lot to love about practicing medicine, it’s still exhausting: mentally, physically, and emotionally. I find writing the blog and investing in real estate empowering and paradoxically refreshing, even though it does take up a lot of my spare time.

I agree! I don’t think anyone should depend solely on a single source of income. Growing additional streams of income is rewarding in terms of both personal satisfaction and your bank account.

Hi Financial Samurai,

Physicians in general are goal oriented and spend a significant portion of their lives in pursuit of becoming a physician. A goal that takes years to achieve… My personal theory is that the financial world and blogging allows physicians to create a new long term goal to achieve. A goal outside of medicine to keep them pushing forward….. it does not take away from medicine or the importance of their clinical activities but creates a new and different goal. Of course, there are all the scarcity mindset issues but really I think having a new long term goal may be at the core.

It is a fascinating phenomena to witness. I understand posting once in a while and having a creative outlet.

I just don’t know what I don’t know. I would think that if I had spent so much time studying and going to school, my long-term goal would be to be a doctor forever.

Our pediatrician and optho are retiring at 75, for example. So I’m biased by recent interactions with them.

As a doctor, I can imagine my writing more about doctor stuff. But maybe not!

An outpatient pediatrician is rarely called into the hospital to place an emergent ureteral stent for sepsis and acute renal failure from an obstructing stone. Ophthalmologists are rarely in the hospital at 2am also.

I imagine these 2 docs you know were part-time / semi-retired already. I doubt you’ll see any full time hospitalists working into their 70s voluntarily!

Thanks Sam! Luckily, I have property management helping to manage my entire long term rental portfolio. I still have to make decisions and push paper around, but it’s much easier than if I had to do it all myself. With good systems, though, I hear self-management can be doable as well.

In regards to physician personal finance blogs, I agree with James and Carpe Diem MD. I’d also add that many physicians are multi-talented, and writing is a great creative outlet.

I personally love having a blog to give myself a voice. And the overall goal of financial independence helps give direction to my days. Once I became an attending, I achieved the goal that I’d been working on for about 15 years. Now, I have the new and exciting goal of financial independence.

I agree with goal setting. After I became an attending, and then a partner, I had met my goals and hit a wall, so to speak. I’ve dabbled in administration a bit, but quickly understood I didn’t want to spend a great deal of energy trying to climb that ladder. Maybe I’ll try to start a real estate empire too!

It’s definitely a great side pursuit and has the potential to become a full time gig if so desired. That being said, it’s not for everyone. It should become apparent at some point in the process of the first deal (or during the research phase) if it’s a good fit.

I am impressed by the amount of work and effort you have put into building your portfolio. You have a great mindset when approaching the “bad properties” and the market as a whole. I like your “dolor cost averaging” approve to real estate investing. You will definitely win more than you will lose if you stay consistent in your real estate investing. In addition, maintaining reserves will help you handle any downturns.. I’m looking forward to watching your portfolio grow.

Thank you! Can’t wait to read about your progress as well!

I never got to ask how did you fund the downpayment for the Indy 10 unit apartment? Was it your own cash or from your HELOC? If it’s from the HELOC, how did you pay off the HELOC (variable interest only payments aren’t fun) from the cash out refi since you still left $47k in the deal? Just savings?

Hi Eddie, I used a HELOC and then folded the HELOC into my primary mortgage via refinance. The growth in equity in my primary home has been a big engine of growth for my portfolio overall.