Here are the 5 steps I used to get a $105k tax refund via the cost segregation services of Engineered Tax Services for my short term rental.

This is a follow up to the post Amazing Tax Deductions from Your Short Term Rental. I strongly recommend you read that post first for a basic understanding of these concepts. Also — remember that I’m not a tax professional, so please consult with one before you make big decisions, thanks!

This post may contain affiliate links.

Summary:

- Buy a short term rental and fulfil material participation rules

- Use Engineered Tax Services to perform a cost segregation study

- Send the report to your CPA and utilize accelerated depreciation

- Deduct 20-30% of the building’s value from your income

- Get a refund from the IRS at tax time

Last year, it seemed like all of my friends were buying short term rentals. Granted, I have a friend group that skews very physician and investor focused, but it was still insane. (You can join the party in the PPhREI Network Facebook group.)

But there’s a reason why many physicians and high income professionals like owning short term rentals. Quite simply, it’s the easiest (legal) way for employed physicians to get massive tax deductions.

I’m going to keep the first part of this post quick and to the point. Stick around towards the end for some more background on all of this.

Step 1: Buy a short term rental and fulfil material participation rules

The first step is to buy a short term rental (STR). If you’ve got more money than time, purchase a property that was already a functioning short term rental. (This is what I did for my Broken Bow STR.) If you’ve got more time than money, buy a run down property and renovate and furnish it yourself. (This is what I did for my Palm Springs STR, discussed here.)

Get it up and running and make sure to fulfil the IRS material participation rules so you can qualify as truly running your STR business. The most easy rule (or test) to meet is that you must work at least 100 hours in your STR business (and more than anyone else).

Take a look at this post for a review of the material participation rules specific to this tax technique: Amazing Tax Deductions from Your Short Term Rental

Don’t know how to run a short term rental?

- Take a STR course! Check out my recommendations.

- Use management software like OwnerRez to automate your business!

These are pictures of the home I bought and renovated in Palm Springs, CA that is now a beautiful short term rental. We purchased this property for $1.075 million. My family loves having a vacation home in Palm Springs and we look forward to using it for a lot of amazing getaways. It’s a huge bonus that it can also serve as a great rental to serve both tourists and the city via tax income!

Step 2: Use Engineered Tax Services to perform a cost segregation study

Next, you need a cost segregation study. This is a special study of your property that “segregates” all of the various components of the home into different categories. This covers everything from the tiles on the floor to the copper wire in the walls.

Each category gets its own depreciation schedule, which is “usable life” of the items in your home. For example, the garbage disposal goes on a 5 year schedule and bathtub goes on a 39 year “class life.”

Various companies offer this service, but the best companies send someone to your property to do a detailed analysis in person. This makes the study defensible if your taxes ever get audited by the IRS.

The company will assign a depreciation schedule to every component of the home. Everything from the cabinets to the roof will be evaluated and put on schedule over its assigned life span.

This is different from the blanket depreciation schedule that usually applies to residential or commercial real estate (27.5 or 39 years, respectively).

For your cost segregation needs, I recommend Engineered Tax Services with Kim Lochridge. (This is an affiliate link!)

I found their cost segregation study thorough, efficient, and I just love working with Kim. She’s a longtime real estate investor and a wealth of knowledge in regards to advanced tax techniques.

Step 3: Send the report to your CPA and utilize accelerated (bonus) depreciation

Once your CPA has the report, they’ll take the first 15 years of depreciation and “accelerate” it all into the first year of service. The Tax Cuts and Jobs Act of 2017 stipulated that through the end of 2022, 100% of this can be used to offset income. After 2022, this bonus depreciation sunsets by 20% every year until this tax incentive is renewed by the government.

Step 4: Deduct 20-30% of the building’s value from your income

While there is no guarantee, I’ve found that a thorough cost segregation, combined with 100% bonus depreciation, will yield a deduction equal to about 20-30% of the building’s value. Note — you can’t depreciate land, since it doesn’t degrade over time.

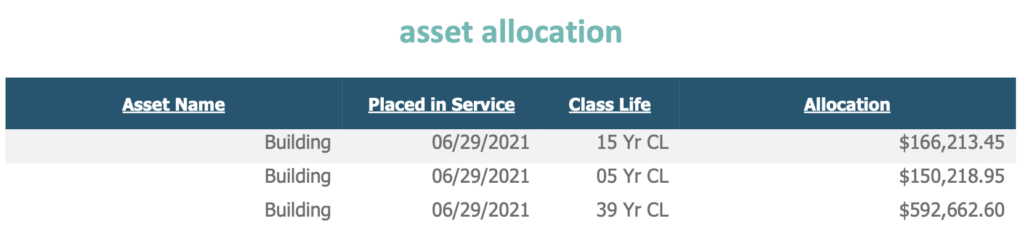

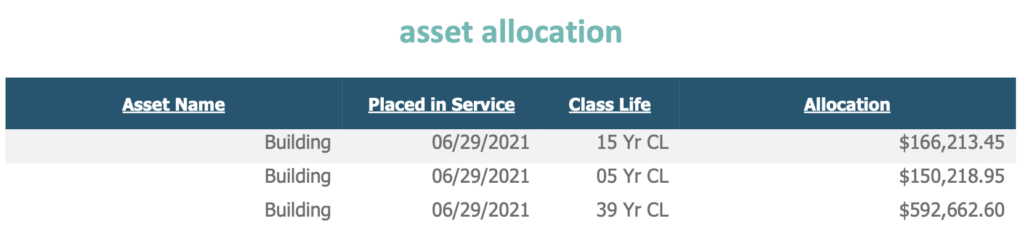

When it came to the cost segregation on our Palm Springs property, we determined that the depreciable basis was $909,095. The combined five and fifteen year class life items from the cost segregation together equalled $316,432.05.

Step 5: Get a refund from the IRS at tax time

When it came time to submit our 2021 taxes, our CPA used this cost segregation report to deduct the $316,432.05 from our income, since this amount was a paper loss from our business. Said in another way, this amount vastly exceeded the profit we made on the short term rental in the first year. Therefore, this loss was directly used to offset my active income as a physician.

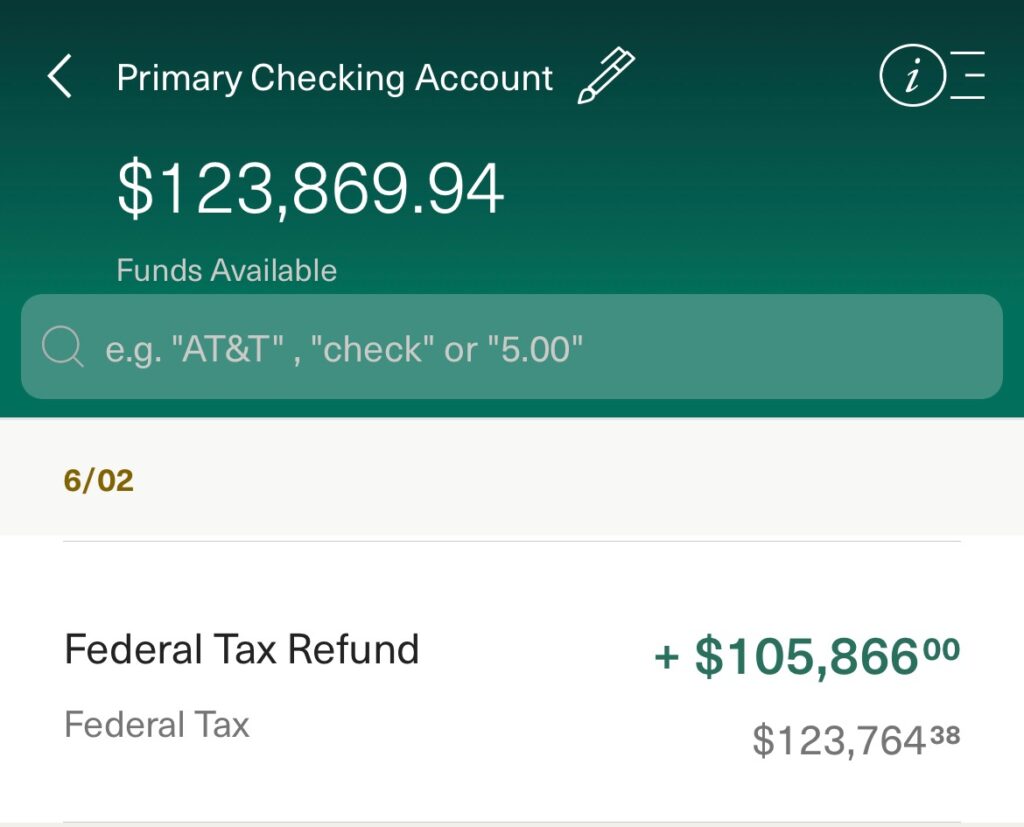

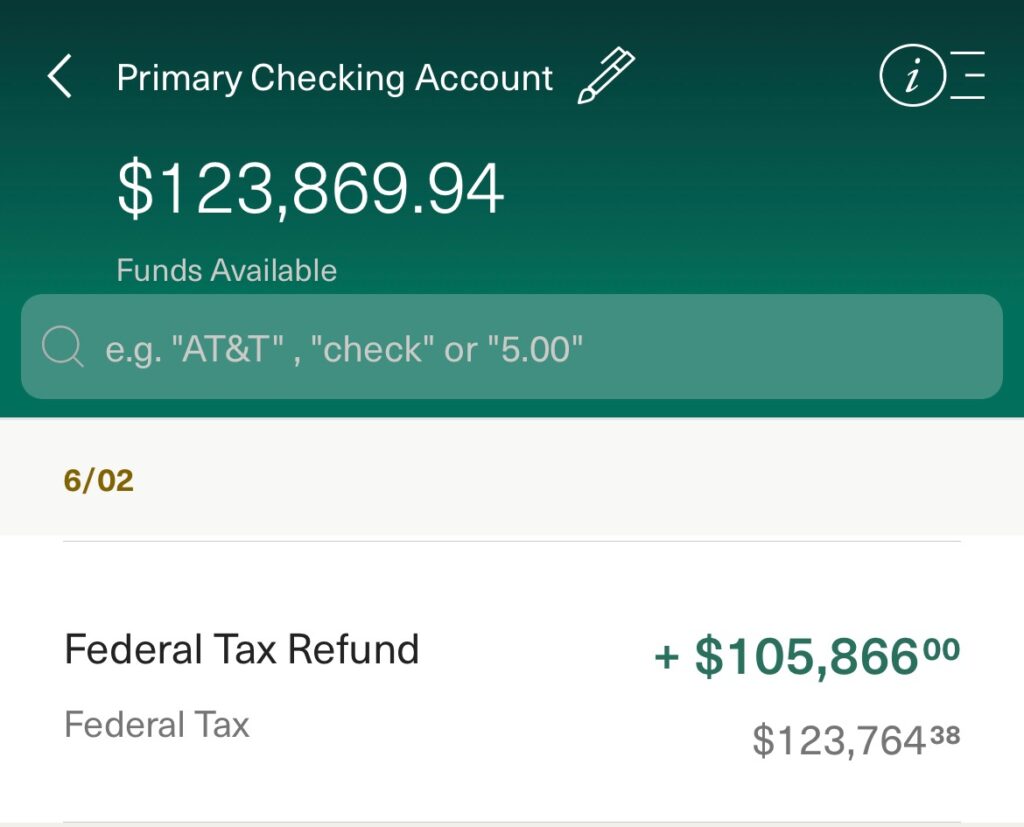

About 8 weeks after we submitted our taxes, I received a direct deposit from the IRS in the amount of $105,866.

Disclaimer: I shouldn’t have to say this, but please make sure to speak to your own tax professionals before making big decisions. Consider this information here to be for purely educational or entertainment value.

Employed professionals pay lots of taxes

Tax efficiency was one of the main reasons why I switched my investing strategy from stocks to real estate in 2019. I was tired of paying a third of our income to the IRS every year when I knew higher income (non-physician) friends who paid much less.

So I started looking around for 100% legal ways to save money on taxes. My realization was that starting a business is the best LEGAL way to save on taxes in a way that benefits our country’s economy and your bank account!

As someone once said, “It’s your duty as an Americans to pay Uncle Sam, but you don’t have to leave him a tip!”

Read more: Tax benefits | Why I’m investing in real estate over stocks – Part 2

Conclusion

Starting a short term rental business to reduce your tax burden might seem like a lot of work, and it is. But as I discussed recently, if you can make it work, you’re left with a real business that can generate life changing sums of money.

In our portfolio, this one short term rental purchase yielded a $105,000 tax refund via the cost segregation services from Engineered Tax Services.

When you’re deciding on who to use for your own cost segregation, I hope you give them a call (and ask for Kim Lochridge)!

– The Darwinian Doctor

What do you think about my experience? Are you feeling empowered now to start a short term rental business and save on your taxes? Let me know in the comments below, and please subscribe to the newsletter for more content like this!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

4 comments

So helpful! How are you able to manage a short term rental from far away? I live on the coast and can’t afford to get started with this strategy near where we live. (Seattle)

Thanks! The management of the STR requires a good local team including a cleaner, handyman, landscaping, and in some cases a local contact. Good management software is also key. I use OwnerRez.

I keep reading that there is a limit to how much loss you can claim against active income. Also that there is in income limit? When I brought this up to my CPA (non-real estate CPA) she told me that I made too much active income to use the tax benefits. Does that apply here? Is there an exemption? Thanks!

Hey Jet, I’m not a CPA, so make sure to talk to your CPA about this again. But I think this might be what your CPA is referring to: https://www.irs.gov/publications/p925

This publication defines the rules around converting passive losses to active losses, which does seem to have a limit of $25k. But as a real estate professional, losses sustained via real estate are by definition active.

“Special $25,000 allowance. If you or your spouse actively participated in a passive rental real estate activity, the amount of the passive activity loss that’s disallowed is decreased and you therefore can deduct up to $25,000 of loss from the activity from your nonpassive income. This special allowance is an exception to the general rule disallowing the passive activity loss. Similarly, you can offset credits from the activity against the tax on up to $25,000 of nonpassive income after taking into account any losses allowed under this exception.

If you’re married, filing a separate return, and lived apart from your spouse for the entire tax year, your special allowance can’t be more than $12,500. If you lived with your spouse at any time during the year and are filing a separate return, you can’t use the special allowance to reduce your nonpassive income or tax on nonpassive income.

The maximum special allowance is reduced if your modified adjusted gross income exceeds certain amounts.”

In regards to losses from a real estate business like a short term rental, this is a special category as the post discussed.

If this is confusing to your CPA, you should probably get a real estate savvy CPA.