Get the latest update on our real estate empire, including our latest wins and challenges, in this exciting edition of Anno Darwinii 3.75.

This post may contain affiliate links.

Stabilization

Aside from the purchase of our short term rental in Broken Bow, the past year has been all about stabilization of the larger buildings we purchased in 2021.

When I say “stabilization,” I mean doing what is necessary to fill the properties with happy, long term, reliable tenants who are paying market rate rent. This involved significant renovation for our 8 unit building (which we bought half gutted) and unit by unit renovation of our 7 unit building.

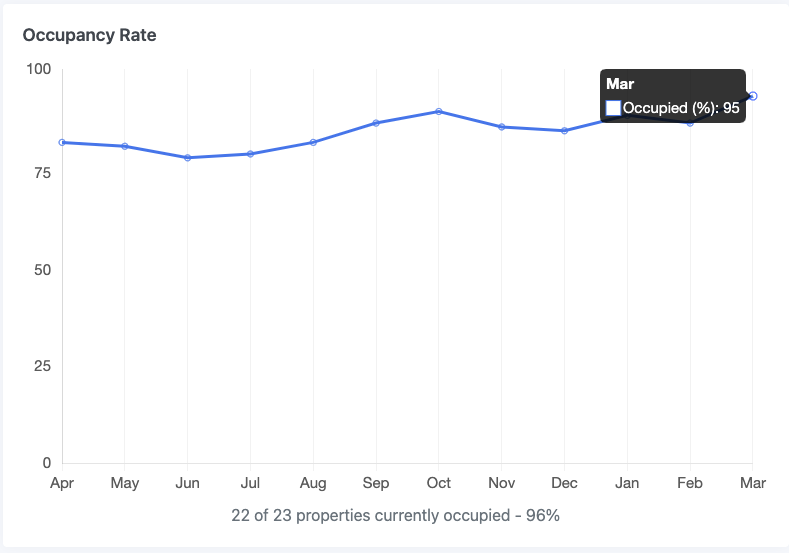

Getting to 95% occupancy

Though we ran into lots of surprises along the way, we finally finished the last of our renovations in late 2022. This included a main sewer line surprise in our 8 unit building.

We also ran into a series of unfortunate events with a medically ill hoarder in our 7 unit building. This coincided with a pest problem that took multiple treatments and months to address. This delayed leasing out the adjacent units for a few months past their renovation.

This last problem made me very thankful for property management. Since dealing with this issue on my behalf, they have been busy screening potential tenants and finally renting out the units.

Thankfully, at the time of this post in Indianapolis, we currently have 1 vacant unit out of 23 units. This equals an occupancy rate of 95.7%.

Expected income from the Indy Portfolio

When it comes to top of the line revenue, things are increasing nicely.

In 2022, even in the midst of stabilizing the portfolio, we received $254,800 of gross rental income from our Indy properties. Every cent of this income was used for expenses, mortgages, or renovations, though.

In 2023, our traditional long term rental units in Indianapolis should pull in about $21,500 a month. In addition to the LTR units, we have two units which are rented as furnished mid-term rental units. These should contribute an additional $2000-2500 a month, though this is less predictable. This implies an annual gross rental income of around $285,000, before expenses.

This implies about a 12% increase compared to our 2022 income, which is a nice bump.

Expected income from the other LTR units

As I mentioned before, we turned our primary home in Los Angeles into a long term rental when it didn’t sell last year. We also have a rental property in Little Rock, which was my second single family home purchase.

Together, these properties should provide an additional $11,000 of rental income every month. This will equal another $132,000 of gross revenue.

Read more: 15 Things to do When Your House Doesn’t Sell

Update on the short term rentals

The year continues to be unpredictable when it comes to our short term rentals.

As you might recall, we have two STRs. One is a beautiful 5 bedroom home in Palm Springs, CA. It’s perhaps the home I’m most fond of in our portfolio after our old primary home in Los Angeles, which is now a long term rental. My wife and I put so much sweat equity into the renovation of the Palm Springs home that we are very emotionally attached to the home.

Read more: Why Doctors Shouldn’t Paint Their Own House

Our other STR is in Broken Bow, OK. It’s a 4 bedroom cabin in the woods and is now a drivable distance from our new home in Memphis, TN.

Read more: Entering the Broken Bow Short Term Rental Market | Building the Empire

The winter holidays and spring break were great. Together, the properties grossed about $120,000 in the last 6 months.

However, we don’t have much in the way of bookings for the near future. There’s a lot of optimization I hope to do for these properties in terms of advertising and website SEO. I’d love a future where more of our STR income comes from our private booking site as opposed to platforms like Airbnb and VRBO. While these sites are great, they mark up prices over 10% for their platform fee and also take a significant chunk of the revenue from hosts as well.

Visit our STR private booking site and save up to 14% off Airbnb: Lux Life Vacation Rentals

Palm Springs STR regulations

One challenge with our Palm Springs property has been paperwork. I ran into a paperwork snafu which has temporarily halted our short term permit there. It was an unfortunate oversight that conceded with our move to Memphis. While I’ve been faithfully sending in monthly taxes to the city, there was an additional form that I forgot about.

Palm Springs is notoriously rigid in regards to their short term rental regulation, and did not hesitate to suspend our short term rental license for a few months. I’m planning to publish a guide to these regulations in order to help prevent similar problems for other hosts.

In the interim, I’m busy converting to longer term options like mid term rental via Furnished Finder.

If you’d like to rent out our Palm Springs house, feel free to email me directly at [email protected]. It’s even available next month, which includes the Coachella and Stagecoach festivals!

Growing pains and solutions

The Palm Springs permit issue is a symptom of a larger problem that I realized a few months ago. Including our former primary home in Los Angeles, which is now a rental, we have 28 units of rental property across 4 states. Our business has done $600,000 of revenue in the last 12 months.

And yet, until a month ago, it was being run by just one person: me. While my wife was an essential part of the team for the last few years, she is 150% occupied by her new job. So since late 2022, it’s been a one man show. But this has been a big impediment to both basic operations and our growth.

To address this manpower issue, I hired our first independent contractor to assist with our business operations. As a former accountant and Quickbooks expert, our digital business manager is helping to turn our mom and pop shop into a true real estate development company.

With every spreadsheet and workflow we create, I feel our company is growing more professional. In retrospect, I wish we had brought on help before our move to Memphis. This would have really smoothed our transition, and might have helped to avert our permit issues in Palm Springs.

Scale your business with a virtual assistant of your own at Onlinejobs.ph!

Business banking

I’m also completing a transition of our business banking to Chase Platinum Business accounts. We are properly sequestering our various LLCs into individual checking accounts. This will allow us to tie credit cards to each account that will make our bookkeeping much easier. (And hopefully we will rack up a lot of rewards points in the process!)

By concentrating my business at one bank, I also hope to build business credit that can be utilized in the future for business lines of credit.

Running a business yourself? Get yourself a Chase Ink Business Card!

Next projects

As we look to the future, my next exciting project is to develop a plot of land next to our 7 unit building in Indianapolis. After meeting with builders last week on our spring break road trip, there are two options. One option is a container build, and the other option is a traditional 3 bedroom home with a carriage house. Both options would be for mid term or short term rental.

This next week, I’ll be analyzing the options based on research via Furnished Finder and AirDNA. This is going to be turned into a series of posts that explain how I make the decision on what to build.

Future collaboration

Later this year, I hope to expand connections in Indianapolis and/or Memphis to start taking down larger properties with partners. I’ll be laying the groundwork for this as I work on the new build in Indianapolis.

Conclusion

Though we’ve certainly had growing pains, I’m proud of the progress in our real estate empire over the last year. We’ve stabilized our long term rental properties and will now do the same for our short term rental properties as well.

As a $600,000 annual revenue business, I am finally making the investments necessary to build a professional real estate development company.

This will pave the way for future growth and collaboration in the years to come.

– The Darwinian Doctor

Want to stay in touch and get all my future updates? Subscribe to the blog below!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

The PPhREI Network Mastermind is currently on a hiatus, but stay tuned for new developments and opportunities as they arise!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!