Today I summarize how after 3.25 years of growth, the rental empire hit $325k of annual gross income via a combination of long term and short term rentals.

This post may contain affiliate links.

Anno Darwinii is the quarterly report on the growth of my real estate empire.

As we head into the winter months (and a recession), it’s a good idea to take stock of your investments. I generally recommend against rash sale decisions, especially when it comes to stocks, since index funds will always recover with the economy.

But you can look at real estate investments as functionally equivalent (risk-wise) to individual stocks. It’s possible that some are just losers or bad investments and need to be cut loose.

For example, we made the decision to sell our first ever rental house (for a slight loss) for this reason. It had very thin profit margins, generally poor tenant quality, and a low quality of property management. There were a few options we could have considered to improve the situation, but we decided that our energy was better spent elsewhere.

Today, as I did with the Anno Darwinii from April, I’m going to go through my portfolio and critically evaluate which ones are performing and which ones are still dragging the portfolio. I’ll also review why that’s the case and what the future holds.

General state of the empire

The great news is that the majority of our properties are stabilized. By “stabilized,” I mean that they’re fully renovated and rented to tenants. The main laggards earlier in the year were our Palm Springs short term rental and our two apartment buildings in Indianapolis.

Now, about 6 months later, the Palm Springs property is available for rent and all of the apartment building units are renovated except for one unit. Occupancy in our 8 unit building should be at 88% by the end of the month, with the 7 unit apartment building not far behind.

Headed towards positive cash flow?

In my last Anno Darwinii, we celebrated a high revenue month with $50,000 of gross income. I said that “Soon, this gross income will yield actual positive cash flow as our renovation projects wrap up.”

So how close are we to this mark? Let’s do an analysis and find out.

For this analysis, I’m going to divide my portfolio into three sections:

- Residential units (long term rentals with 1-4 units)

- Apartment units (long term rentals with > 4 units)

- Short term rentals

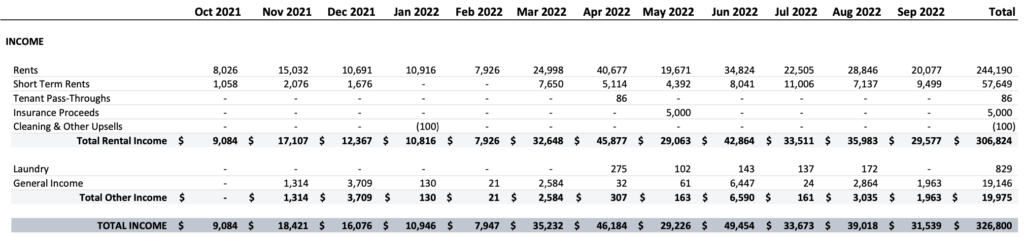

Residential units

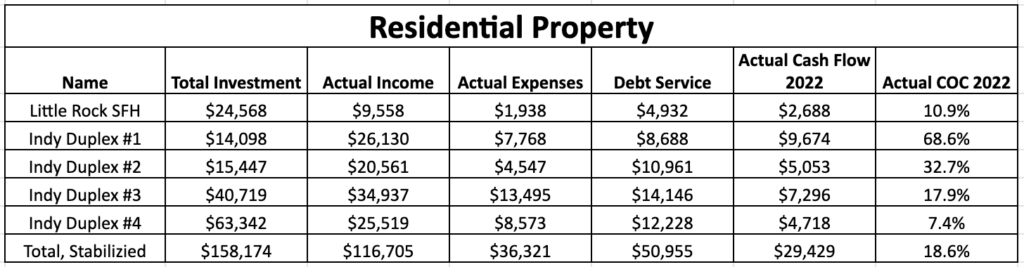

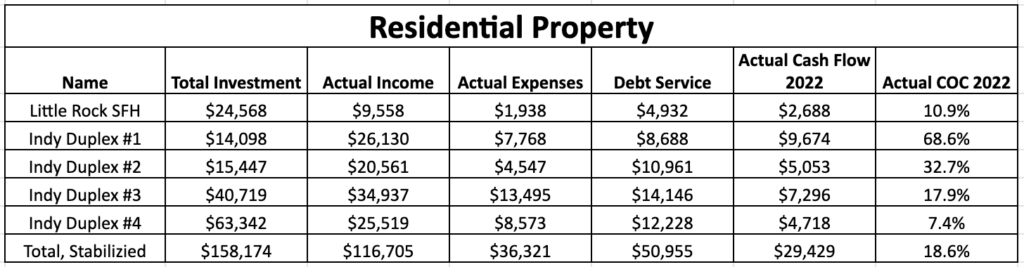

Our residential units have long been stabilized, though there is still typical tenant turnover and associated costs. Overall, as you can see below, our residential units are doing well and are profitable. Aside from our remaining single family rental in Little Rock, these are all duplexes which I’ve renovated and subsequently refinanced using the BRRRR method.

Read more: The BRRRR method: how we got a 62% return on our first duplex

One thing to note is that even “stabilized” properties can have large expenses. Not reflected in these numbers for Duplex #4 is a recent roof repair, which will wipe out the year to date cash flow for this unit (and then some).

However, it’s also just as important to note that since we purchased this duplex, its value has grown from the $275k appraised value at the time of the refinance. Similar condition duplex have sold for around $400k in the last 6 months in the neighborhood, indicating about $125k of net worth gain from this one property alone.

Thus, it’s always really important to remember that real estate grows wealth in many ways, not just via cash flow. The other important elements are: tax benefits, appreciation, principal paydown, and inflation hedge

Read more: The 5 ways rental real estate makes you money

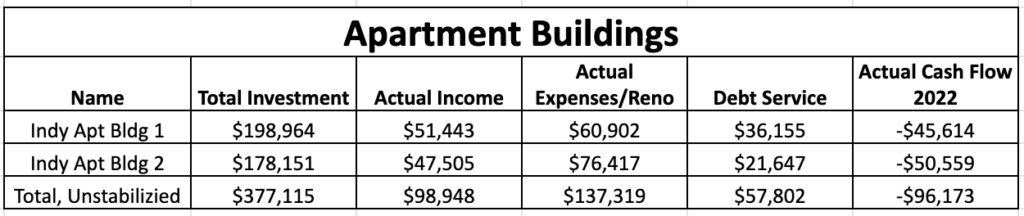

Apartment units

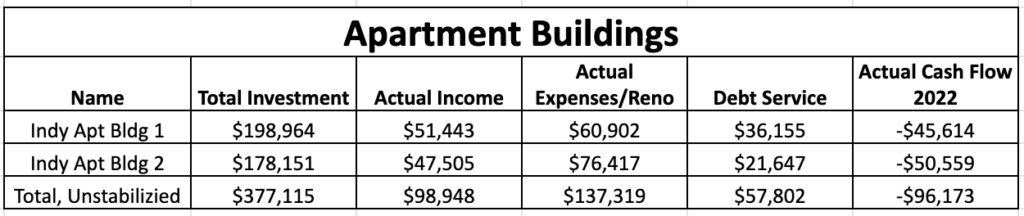

The apartment buildings in my portfolio are nearing stabilization, but aren’t quite there yet. The 8 unit apartment building is as renovated as I’m going to get it for the time being, but still has 1 more unit to fill. This apartment building had a significant expense related to a sewer line backup earlier in the year, which is weighing on the expenses for the year. After all was said and done, this sewer repair and the environmental mitigation totalled close to $30,000. Our insurance only covered $5000 of this expense.

Mentally, I chalked this expense up to infrastructure improvement for the building that we should have likely tackled during the general renovation.

Read more: Water is a Real Estate Investor’s Worst Enemy | Building the Empire

We’ve been slowly renovating and updating the 7 unit apartment building, unit by unit, as they open up due to natural vacancy. There is one more unit undergoing renovation now, and then we should be hopefully done with big cash outlays for that building.

Here is the cash flow picture for 2022, year to date:

Correction: “Total investment” really should include the renovation costs, which is currently lumped into column three. Looking at it this way makes my cash flow look really bad. But since the properties are still stabilizing, I’ll keep it in this unfavorable view until I completely finish renovations and can do a more in depth analysis.

Our stabilized income and cash on cash outlook will depend on where our expense ratio settles, and if I can refinance out of the current financing terms. I’ve currently got both properties on commercial loans which have relatively low fixed interest rates (5.5%). But they’re both amortized over 20 years, which decreases our monthly cash flow by about 50% compared to 30 year amortization.

On the flip side, twenty year amortization is great for increasing our wealth and equity through loan paydown.

I believe that apartment buildings are a great recession-resistant asset, as I wrote about recently. As I’ve renovated the units, the rental income has increased considerably from the buildings. This directly increased the value of the apartment buildings through the “cap rate” formula.

For more on the valuation of apartment buildings, read this: 4 Reasons Why Apartment Buildings are the Best Real Estate Investment in a Recession

Short term rentals

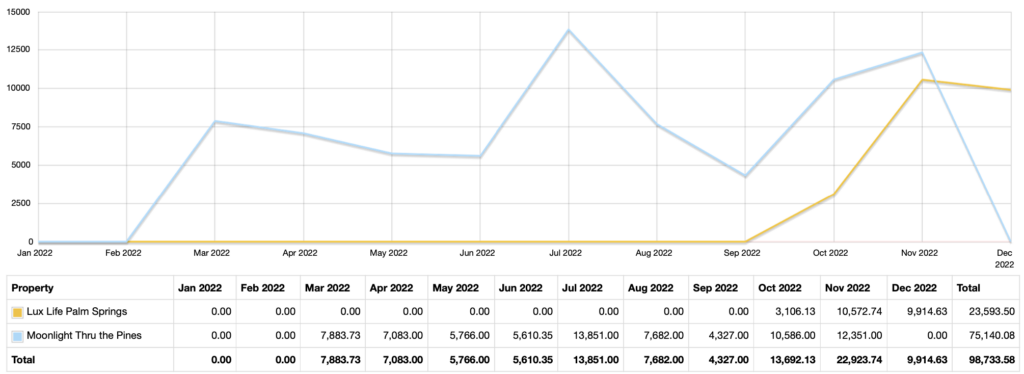

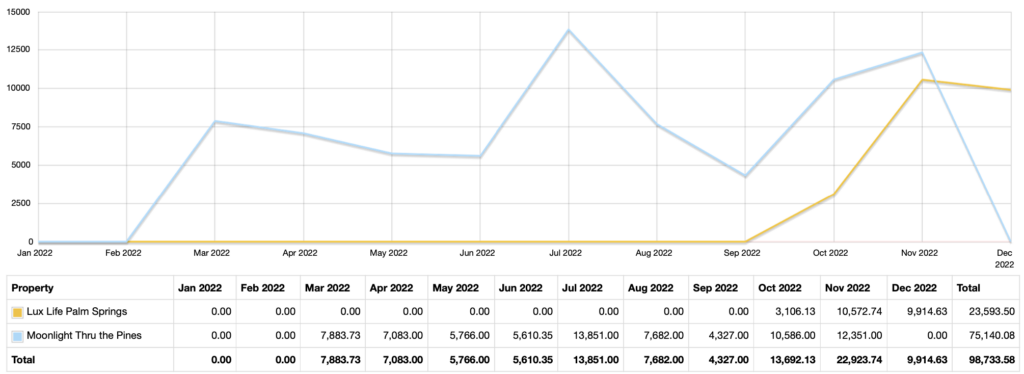

The potential cash flow from short term rentals is pretty massive, but they’re much more susceptible to market forces. We saw this first hand when the economy started going down the toilet in late spring. We also saw this again when kids (and families) got busy with back to school activities in August. The bookings for our Broken Bow, OK cabin (in blue) certainly reflected these fluctuations in demand.

But as you can see, our bookings and demand look fairly strong for the rest of the year, especially now that our Palm Springs property is up and running.

November in particular is looking to be a good month, with about $23,000 of bookings reserved between both properties. Overall, we are nearing $100,000 of bookings for 2022.

Just remember that this is not what we take home. There are significant costs with running a short term rental, from financing and cleaning costs to utilities. Once I have more data, I can talk more intelligently about the true cash flow.

Another thing to note is that short term rentals are amazing in terms of tax incentives. Wait until you read about my 2021 tax refund, which I’ll be describing soon.

Take a closer look at our short term rentals here on Airbnb:

You can also visit our private booking site to avoid the 14% Airbnb booking fee.

Heading towards some serious cash flow?

As I discussed in my previous episode of Anno Darwinii, I feel that we are turning the corner towards some pretty significant cash flow for our portfolio. It’s right on schedule to coincide with the end of 2022 as our apartment buildings stabilize.

We’ve learned a lot of valuable lessons from our small apartment building investments, much of which I summarized recently. I can see that most of our issues could have been prevented with better deal selection and economy of scale via larger buildings. We going to take this learning into 2023 as we ponder our next purchase.

Conclusion

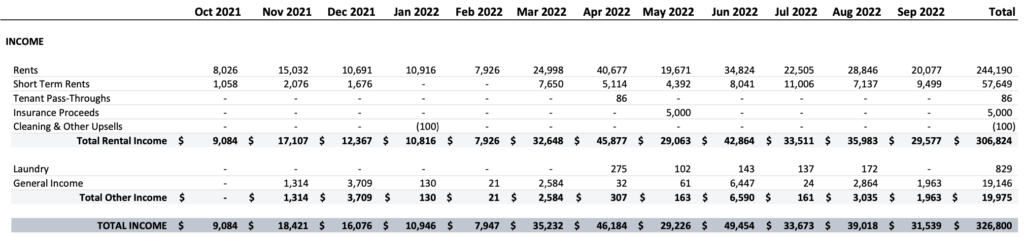

After 3.25 years of growth, our year to date income from the portfolio is over $300,000. The gross income over the last 12 months is over $325,000.

This is a significantly higher gross annual income compared to about a year ago, when we had $127k of gross annual income. Big numbers mean nothing without profit, but I still like to see them!

Currently, all of our profit has been recycled back into the rental empire in the form of renovations and other capital expenditures. I love recycling cash flow in this way, as it’s one way to ensure compound growth from the portfolio.

Read more: $127,000 of Gross Revenue | Anno Darwinii 2.5

It’s also important to remember also that the entire portfolio passively increases in value every month through loan paydown. Therefore, each month that goes by, even if my cash flow is flat, my equity in the Empire grows (as does my net worth).

Until next time!

— The Darwinian Doctor

You really should subscribe to the newsletter, so you can get these posts directly to your inbox!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

2 comments

I think next year will be a good shift on those apartments like you mentioned. I’m assuming your doing a cost seg on the apartments also which will have a huge benefit from a depreciation standpoint. I like the diversity you have with LTR, STR and MF. I have 4 LTRs and 1 STR with the goal to grow that plus add small MF in the next few years to get to a Fi goal of 50k gross a month.

A cost segregation would be a great idea, if I had REPS. However, that’s not looking likely for 2023, so there’s no great benefit from pursuing accelerated depreciation from the buildings (tax wise). Great job on your growing portfolio, and I love your goals!