How I made lifelong memories with my family and negated $280k of taxable income using our short term rental cabin in Broken Bow.

This post may contain affiliate links.

Introduction

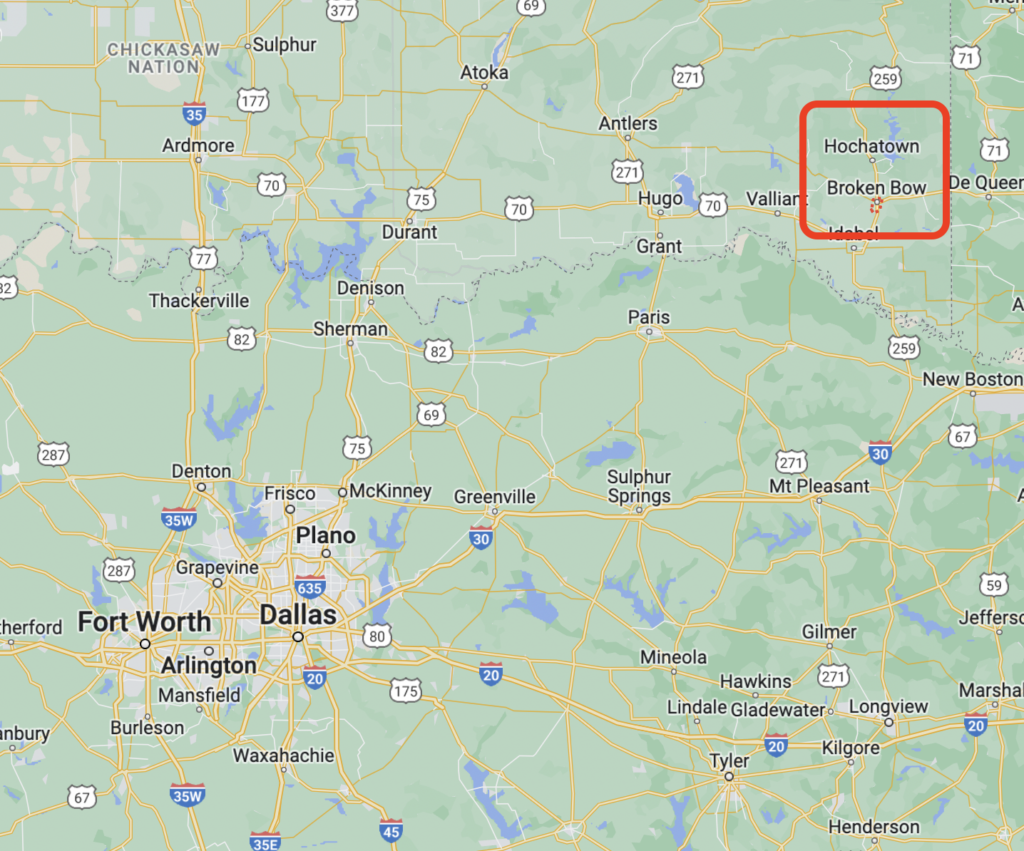

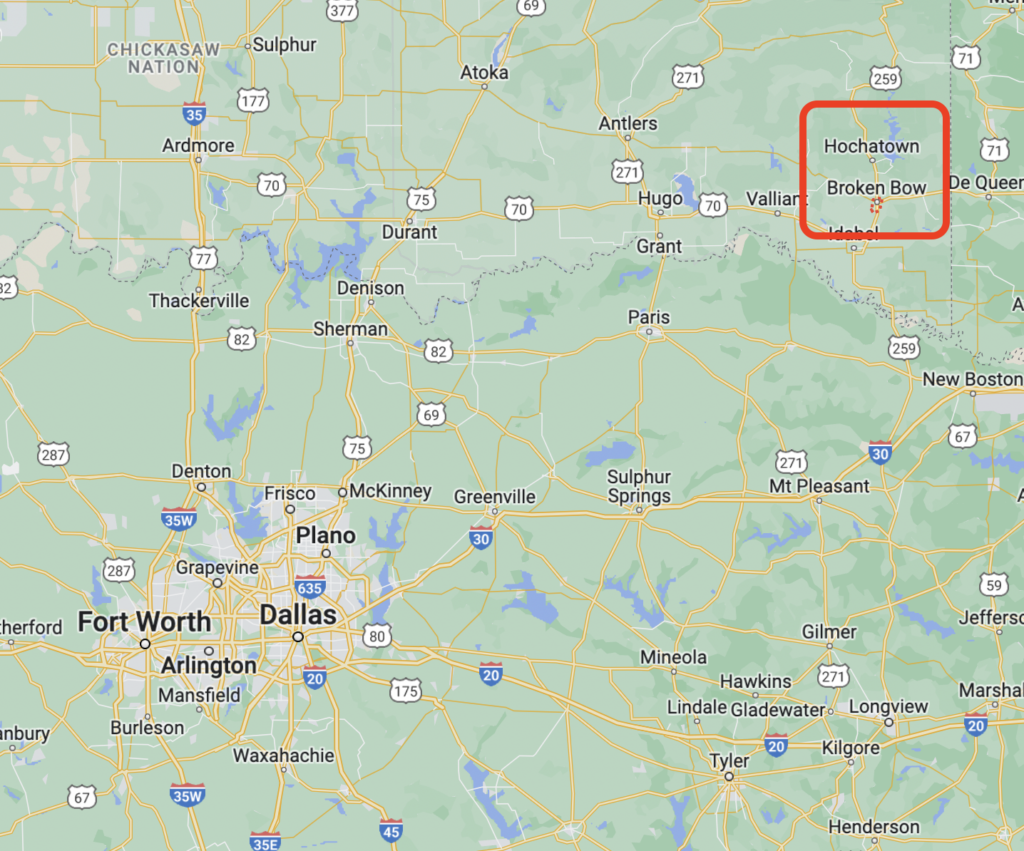

A few weeks ago, I packed up the Darwinian clan into the car along with a trunk full of tools and supplies. After leaving Memphis, we drove west into Arkansas and then crossed into Oklahoma. Finally, after about a six hour drive, we ended up in Broken Bow, OK.

We were visiting my short term rental cabin, which is a luxury cabin in the woods in the Hochatown region near Broken Bow Lake.

Check out the cabin on our private booking site: Lux Life Vacation Rentals

The cabin

When my wife and I purchased this short term rental in early 2022, we did it purely for investment reasons. At the time, Broken Bow was one of the highest revenue short term rental locations in the United States. Just a few hours drive from Dallas-Fort Worth, it seemed like a perfect place to acquire a profitable short term rental.

Read more: Entering the Broken Bow Short Term Rental Market | Building the Empire

That was before the recent downturn in short term rental revenue that owners have experienced this year, but that’s a story I’ve told before.

We went live on Airbnb, VRBO, and our private booking site in March of 2022. Before long, we were Superhosts on Airbnb with 40 positive reviews and a 4.88 star rating. Our bookings accelerated as 2022 progressed, until early 2023 when the economy started to feel the pinch of the Federal Reserve’s campaign against rising inflation.

Since then, rental rates and guest traffic have fallen for Broken Bow. With the uncertainty of the economy and intense travel overseas, the springtime and summer were both unusually slow for the cabin.

Read more: Why is the Federal Reserve Raising Interest Rates?

Tax benefits

While the cash flow from the cabin has not been great so far in 2023, that doesn’t mean that the cabin hasn’t performed financially for the Darwinian family. As expected, the cabin has performed just as expected to provide amazing tax benefits.

In fact, one of the major reasons I decided to purchase this short term rental was to access tax deductions. My wife and I are high earning professionals, which makes us part of the most aggressively taxed groups in the US.

Before 2023, I was fully employed, so I was unable to access the benefits from “real estate professional status” (REPS). REPS is a special tax status that allows you to write off real estate paper losses against your active income.

Luckily, there’s still the short term rental loophole.

The short term rental loophole

In 2022, I performed a cost segregation on our Broken Bow cabin and accelerated 15 years of depreciation into one year.

Since I just filed my 2022 taxes, I have the final figures in hand. By actively participating in the business of our Broken Bow short term rental, my family legally deducted $280,804 of income from our federal tax return. This effectively wiped out $104,000 of taxes!

This is the same strategy that we used In 2021 with our Palm Springs vacation rental to get a $105k tax refund.

Pretty amazing, right?

Read more: Amazing Tax Deductions from Your Short Term Rental

Time for some upgrades

Owning a short term rental is a bit different than a long term rental. To attract guests, a good short term rental requires constant upkeep, restocking, and evaluation. From rental rate adjustments using Pricelabs to big restocking orders from Simple Goods, there’s always something that needs attention.

This makes my short term rental portfolio a lot more time intensive than the rest of my properties, which are long term rentals with property management.

For the physical maintenance and repairs, I have a team on the ground in Oklahoma. But I also like to go out to the property at least once or twice a year to assess the cabin’s condition myself.

Putting on the toolbelt

As my CPA has told me, it’s important to separate business and pleasure when it comes to real estate. To keep our short term rental business firmly in the business category when I travel to real estate properties, he recommends that we make sure to have the primary goal of the visit be for repairs, maintenance, or other real estate focused business.

Luckily (or unluckily), the cabin needed a good amount of maintenance.

Over the course of our three day trip, this is a list of what my family accomplished.

- Changed the lock on our storage closet

- Built wall shelving in the closet from scratch

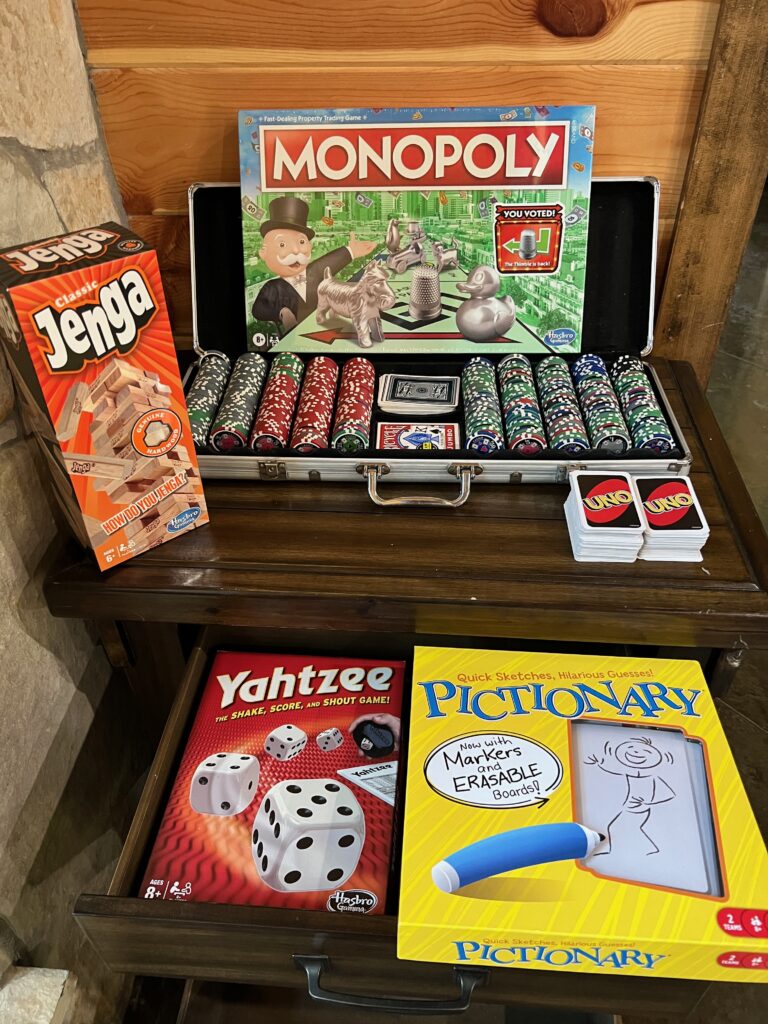

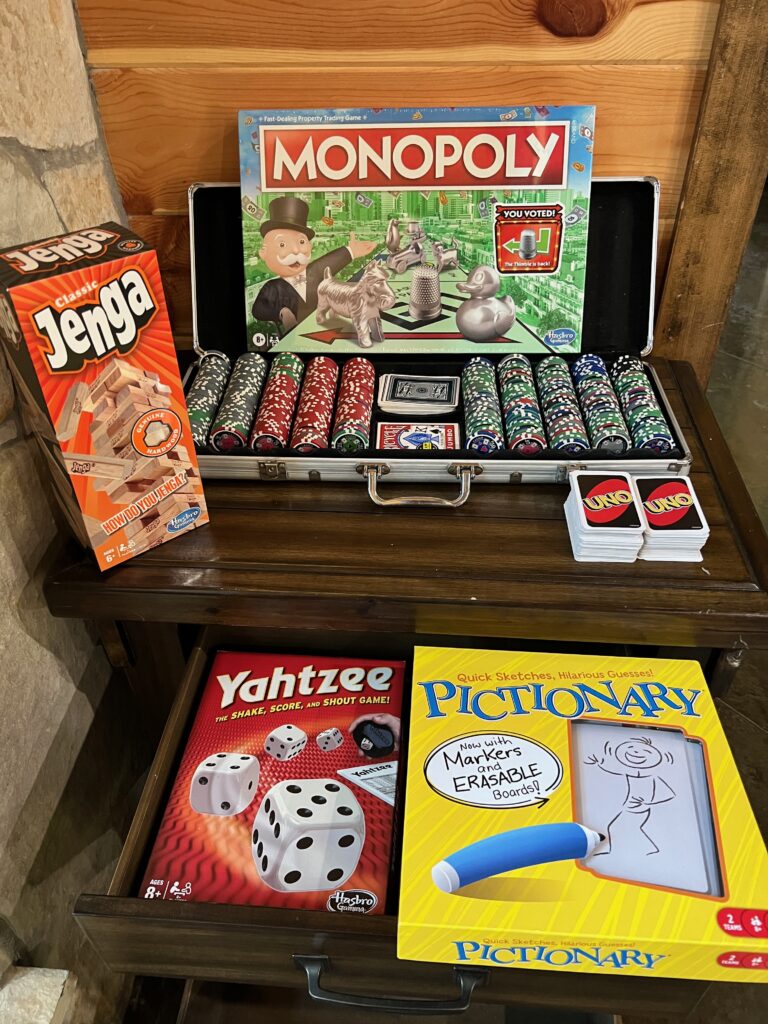

- Refreshed our game cabinet

- Reinforced the bunk beds

- Replaced and restocked kitchen equipment

- Located our water main shut off

- Touched up the paint on some pieces of furniture

- Re-oriented the Eero wifi extenders

- Added a back up digital lock to the side entrance

My favorite part of the trip was when my sons watched my father and I work together on a repair. I like to think that one day they’ll have kids of their own and I can similarly help out in their lives.

Broken Bow Lake

In addition to the repairs, I finally explored the swimming hole at Broken Bow Lake, which is the nearby freshwater lake for which the area is named. My son and I waded in the refeshing water and rented a kayak for a fantastic outing.

Conclusion

I love multi-generational trips. My kids are lucky enough to have a great relationship with my parents, but it’s not often that we get to travel all together. During this brief trip to Broken Bow, we upgraded the short term rental and made some lasting memories along the way.

Our cabin is currently dragging down the cash flow for our overall portfolio, but it’s a strange time for short term rentals nationally. I’m optimistic that this will reverse next year. While this cycle plays out, we’ll take solace in the $280k legal tax deduction produced by our short term rental.

Moving forward, I hope to involve my kids more in my real estate business. I’m looking critically at a variety of larger scale apartment deals in Memphis and beyond. As our portfolio continues to grow, I want to teach my kids about the unique benefits of real estate to provide financial freedom and effect positive change in communities as well.

– The Darwinian Doctor

Make sure to subscribe below so you don’t miss a post!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!