Today’s post gives you three specific ways to evaluate and pick a real estate investment market: RV ratios, economy, and landlord/tenant laws.

One of the most common questions I get is how to pick a real estate investment market. To fully do this topic justice, I’ve started an educational series to walk you through the basics of the entire process of active real estate investing.

In the first post in the series, I presented three questions to help you decide between local or long distance real estate investing.

Here are the first few questions you should answer:

- What are your overall financial goals (and your Why?)

- Do you want cash flow, appreciation, or both?

- Will you self-manage or use property management?

If you’ve answered these questions, you’ve already decided on your overall financial goals, and you’re beginning to understand the differences between a cash flow and appreciation investment strategy. You’ve also got a sense of how you might manage your properties.

Now you’re ready to move on. Let’s figure out exactly where you’re going to invest!

How to pick a real estate investment market

For me, the viability of an investment market comes down to a mixture of the following characteristics:

- RV ratio (rent to value ratio)

- Economy and demographic trends

- Landlord/tenant laws

RV ratio (Rent to value ratio)

RV ratio is the most basic characteristic that will determine if a given real estate market is a good fit for you. This commonly used formula can quickly analyze a real estate market (or deal).

- R = Rent = one month’s rent

- V = Value = purchase price of property

- RV ratio = (Rent / Value)

Your ideal cash flow markets should have an RV ratio of 1%, give or take a couple tenths of a point.

Example of a cash flow market: Indianapolis

If you’ve followed the growth of my real estate empire, you’ll know that most of my portfolio is in Indianapolis. I’m a cash flow investor because I’m interested in early financial independence, and cash flow is really helpful in getting to FI faster.

As a cash flow investor, Indy is ideal. Let’s see why, below, with a three bedroom, one bath home I randomly pulled off of Redfin and Zumper. It’s just over 1100 square feet.

Three bedroom single family home in Indianapolis:

- Rent: $1200

- Purchase price: $111,500

- RV ratio: $1200 / $111,500 = 1.1%

Example of an appreciation market: Los Angeles

Los Angeles is an expensive coastal real estate market. It’s not a place to seek cash flow, but can yield incredible gains from appreciation. Just take a look at the appreciation we’ve had on our two Los Angeles homes over the last 10 years (through lucky timing).

Here’s an example of a three bedroom, one bathroom home in Los Angeles to show you a typical LA RV ratio. It’s slightly bigger than the Indianapolis example at 1260 square feet. Here are the Redfin and Zumper links.

Three bedroom single family home in Los Angeles:

- Rent: $4000

- Purchase price: $1.65 million

- RV ratio: $4000 / $1.65 million = 0.2%

How to use the RV ratio

Of course there are exceptions, but you want the RV ratio to be about 0.8-1% to ensure the property will be cash flow positive after accounting for costs.

In general, expensive coastal markets like New York City, Los Angeles, Seattle, and Boston will be appreciation markets. Even with regularly paying tenants, appreciation markets may still require you to infuse cash into the property each month. This extra cash infusion will help to pay for the mortgage, taxes, and maintenance.

If you’re looking for cash flow, you can look to the Midwest and Southeast.

Here are a few cash flow markets to get you started (by no means a comprehensive list):

- Birmingham, AL

- Cleveland, OH

- Detroit, MI

- Indianapolis, IN

- Kansas City, MO

Economy and demographic trends

After RV ratio, economy and demographics are very important in picking your real estate investment market.

You don’t want to buy a rental property in a city where the local economy is in a downwards spiral. No jobs = no tenants. Less industry also means less tax revenue for the city, which means they’re more likely to look for imaginative ways of raising revenue. Often times, this means they’ll come after landlords and business owners for more taxes and fees.

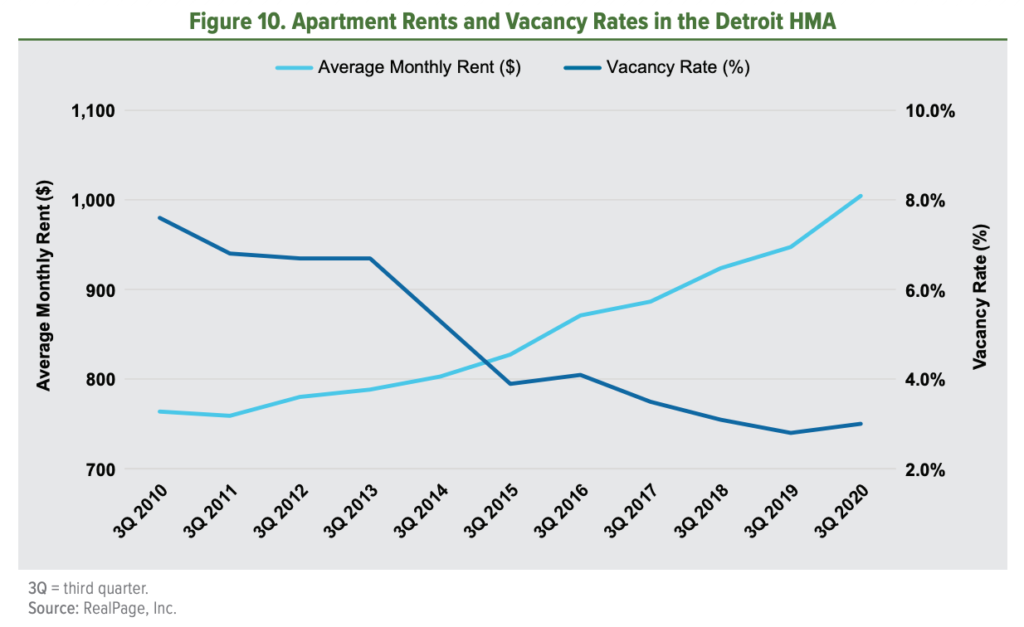

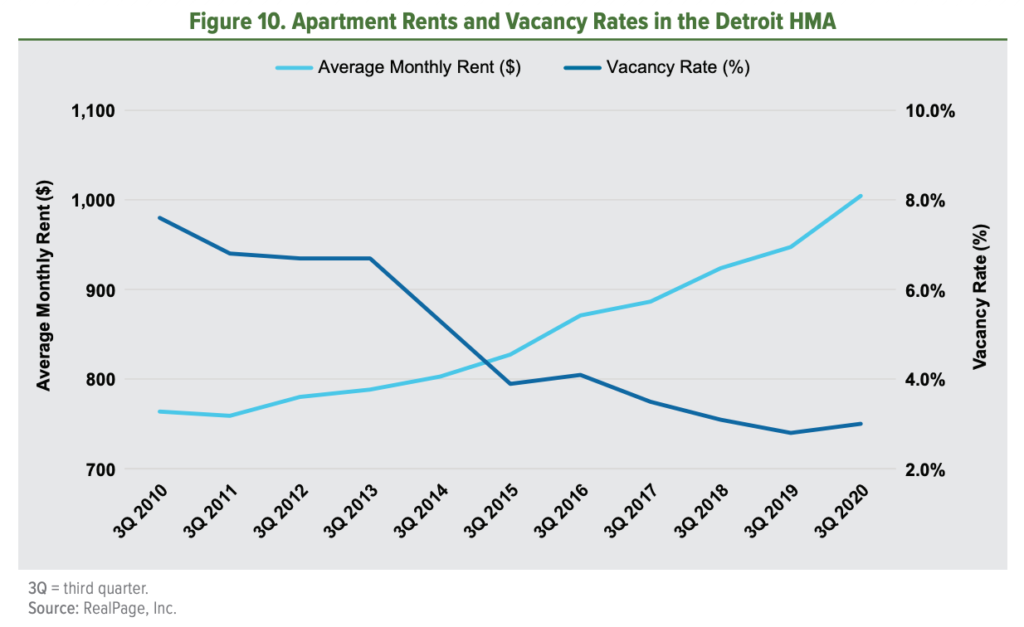

When I want to learn about a real estate market’s local economy, I turn to the HUD reports.

“HUD” stands for the US Housing and Urban Development department. They do many things, but for our purposes, we’re interested in their “Comprehensive Housing Market Analyses.”

If you can get over the dry, technical sounding name, these reports are pure gold.

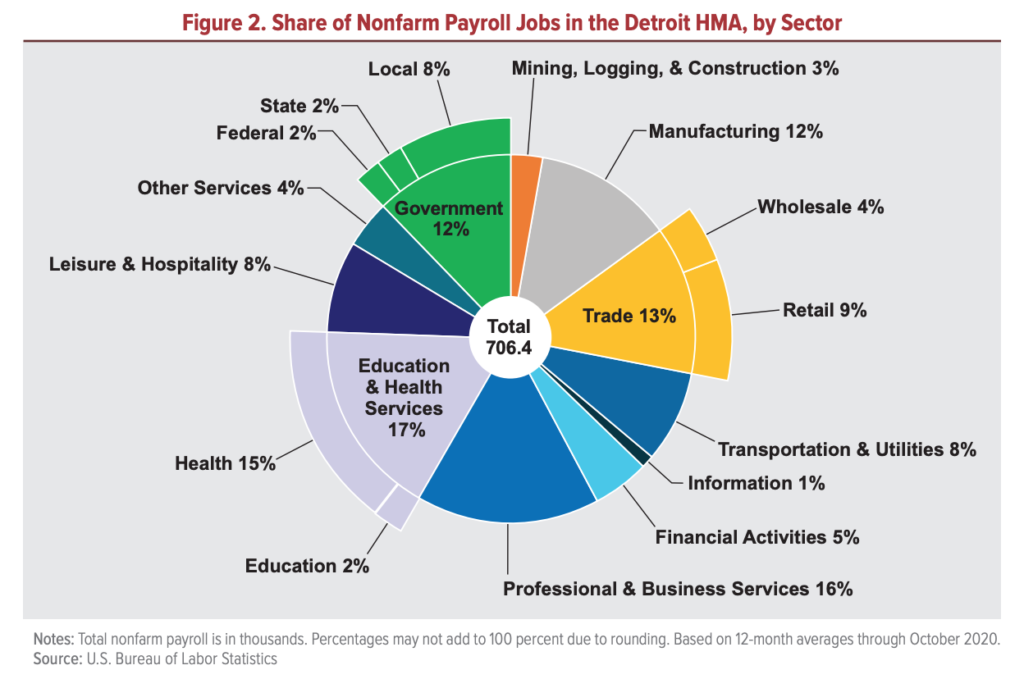

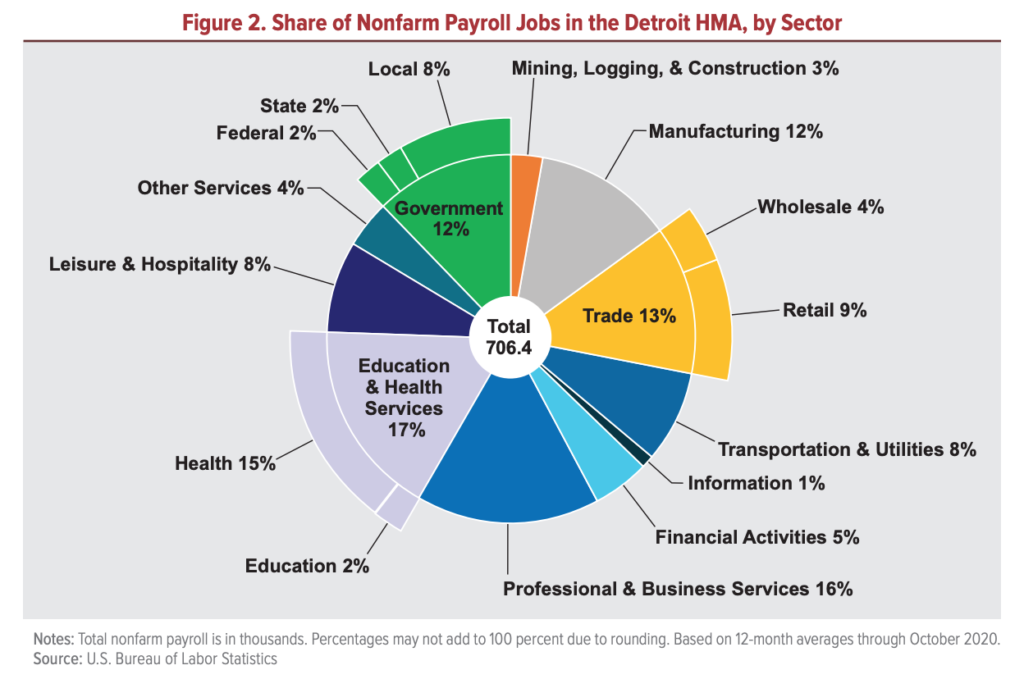

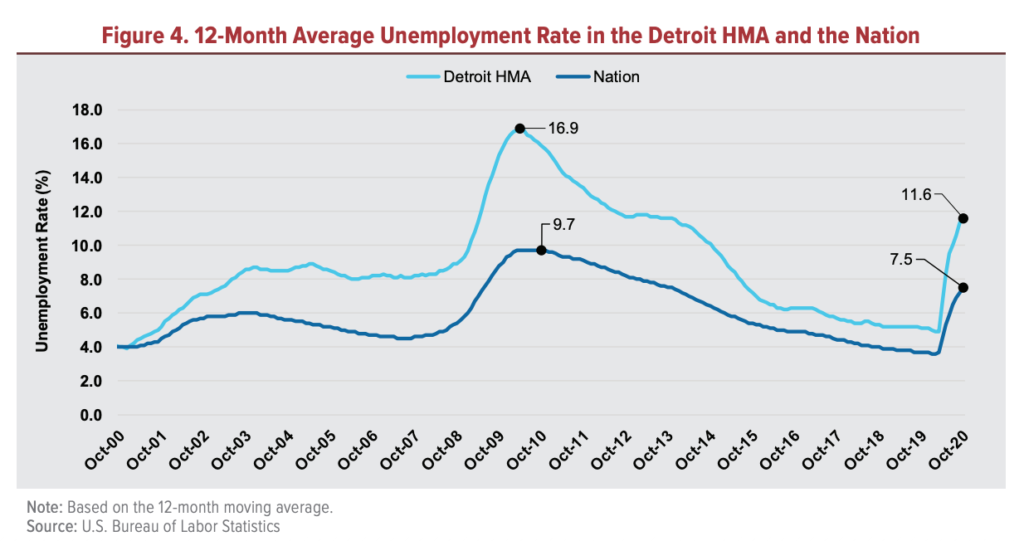

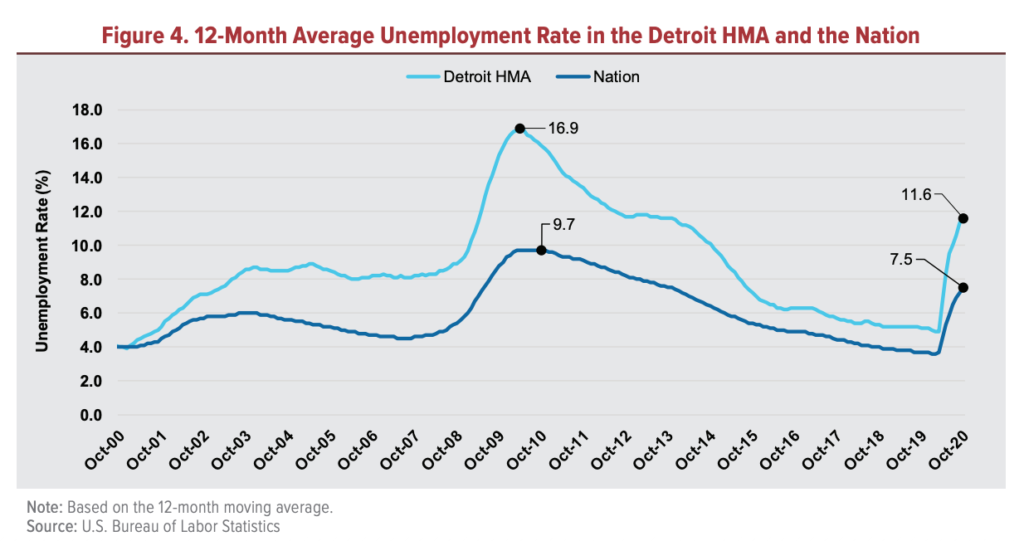

The economists rotate their analyses through all the major housing markets in the country, and update them every few years. These reports are packed with information and easy-to-read charts. Pretty much everything a real estate investor wants to know about an area is in these reports.

Here’s a partial list of the information you can find in these reports:

- Overall description of the market

- Economic trends

- Housing sales and rental trends

- Predicted demand for housing

- Employer and industry breakdown

- Unemployment trends

- Vacancy trends

- Population growth and migration patterns

Did I mention that the reports are all free?

If you’ve identified an interesting market, just go to the website and download the most recent report. Spend some time looking over the trends, and then make a truly informed decision about investing your money.

Ideally, a rental market will have relatively low unemployment, a stable and varied employer mix, and growing population.

Here are a few screenshots to show how amazing these reports are (I don’t own this material):

Landlord / tenant laws

Finally, let’s talk about landlord / tenant laws. If you’re going to be a real estate investor, this is one area of your life where you’re going to have to lean a bit conservative.

Landlords are often vilified in the media as an enemy of the common man, but don’t worry. You’re not going to be a slumlord. You’re going to:

- Provide quality housing at a fair price

- Keep your properties well maintained

- Support industries like banks, carpenters, electricians, plumbers, and roofers

With this in mind, if you have a tenant who is abusing your property or not paying rent (pandemic aside), you should have the right to evict that tenant. It’s also nice not to get taxed into oblivion by the local government.

This scenario above is more common in some states than others. These laws are ever-changing, but again, there are some generalities.

You’ll typically find these laws and policies skewed more favorably towards the landlord in parts of the Midwest, the South, and the Southeast.

This doesn’t mean that you can’t be a successful real estate investor in other parts of the country. Clearly many people do great being a landlord in California, despite tenant friendly laws. But, you may have to be more careful about tenant selection and screening, or budget for an occasional long eviction process.

(Obviously the pandemic has made the entire country tenant friendly with the CDC eviction moratorium.)

Conclusion

I hope you feel more empowered now to confidently pick a real estate investment market. To summarize, I first recommend you decide if you want to invest locally or long distance. You can do this by answering these three questions:

- What are your overall financial goals (and your Why?)

- Do you want cash flow, appreciation, or both?

- Will you self-manage or use property management?

Next, zoom in on a specific real estate market and evaluate that market using the three criteria we discussed above:

- RV ratio (rent to value ratio)

- Economy and demographic trends

- Landlord/tenant laws

Once you’ve picked your market, then the real fun starts. You can build your team, do a city tour, and start looking at properties!

— TDD

This is part of an educational series that shows you how to get started with real estate investing. Did you find it helpful? Please comment below and subscribe for my weekly newsletter!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

6 comments

Another factor which is not shown, but must be considered, is the propensity of natural disasters. Floods; hurricanes, earthquakes, wildfires, mudslides, tornadoes; can turn your investment property to a shambles pretty quickly. Often rent to value ratios are high precisely because of these natural events. Be careful!

Great point Mario, thank you. It’s a little tough to determine true risk from earthquakes, though. As a Los Angeles resident, I bought the insurance, but many people don’t. And it doesn’t seem to be affecting prices here!

Thoughtful and excellent advice.

Having decided to invest locally, I’ll keep you posted on how HCOL / landlord hostile So Cal investing works out 😉

Fondly,

CD

Yes! I want to know, CD!

Great blog! I am not a physician, but I do earn a relatively high salary in an expensive coastal city (NYC). I have been thinking of ways to invest beyond my index fund, and real estate investing looks to be a good way to have cash flow while avoiding some of the high tax rates here. I’m currently tossing up between buying a short term vacation rental outside NYC, or a long term rental in a smaller midwestern/southeastern city, and your blog is very informative. Looking forward to seeing how things develop for you.

Great job on your post about how to pick a real estate investment market! You do an excellent job breaking down the process and explaining it in simple terms. Your use of examples, such as the Indianapolis and Los Angeles markets, really help drive the point home. The RV ratio is a great tool for determining the viability of a real estate market, and your explanation of how to use it is very helpful. Additionally, your recommendation to consult HUD reports is a valuable tip that many readers may not have thought of. Thank you for sharing your expertise and knowledge on this important topic.