I’m excited to share the best way to research and track your stock portfolio: Stock Card. My portfolio is live on the site!

This post may contain affiliate links.

The TLDR: Stock Card is a great way to both research and track your stock and ETF portfolio. Sign up for a free account and follow my portfolio to learn my winning ways!

On the journey to financial independence, my strategy has shifted over time to favor real estate investing. But stocks also form a large part of our asset allocation. My wife has been saving in her retirement accounts for almost two decades. I’ve also amassed a surprising amount in there as well in the past decade since I graduated residency.

Our investment success owes a lot to the stock market. In fact, my first duplex purchase was made possible by selling a bunch of individual stock in 2019. Specifically, I sold my holdings in Apple, Amazon, and Alphabet so I’d have enough funds to purchase and renovate this property. We did have to pay capital gains taxes on the sale, but I didn’t mind since it got my real estate empire rolling.

My stock investment strategy

I’m personally willing to allocate about 1-2% of my overall portfolio in risky investments. (And I put individual stocks into the category of risky investments.) You might feel comfortable risking more of your portfolio, but to each their own.

Therefore, the vast majority of our stocks are in the form of low cost index mutual funds, such as the United States total stock market index. But I’ve been known to dabble in individual stocks as well. In fact, one of my more popular posts is on my individual stock portfolio. Although I love real estate, I’ve stayed away from real estate investment trusts (REITs) and instead invest directly into real estate.

By the way: none of my stocks currently generate a dividend, but I’ve noticed that there are a lot of similarities between real estate investors and dividend investors. Just like a rental house, individual dividend stocks have intrinsic value and also generate cash flow. I can see the appeal.

My stock market returns

Since my holdings have changed so much over the years, I’ve found it tough to measure the total return of my individual stocks versus the market. I have a good sense that I’ve beaten the market, but I didn’t know by how much until recently.

Most of my individual stocks are in E*TRADE, which is able to roughly gauge the performance of single positions. But it can’t account for multiple trades over time. And it certainly can’t automatically track your stock portfolio performance versus the overall stock market.

For this, you’re going to need a tool like Stock Card.

Stock Card

I learned about Stock Card from the CEO of the company in an Uber ride to the airport in Austin. I learned that Stock Card is a stock research and tracking tool with five main features:

- Easy-to-understand stock and ETF research

- Automatic SEC-filed data refresh

- Unique screener and filters

- Timely and personalized alerts

- Stock picks by successful investors

I was impressed by the CEO’s description of the service, especially the principal stock research tool (the stock card).

The Stock Cards are clean and informative summaries of a stock’s performance. They also have extra information like a stock’s growth potential and investor sentiment.

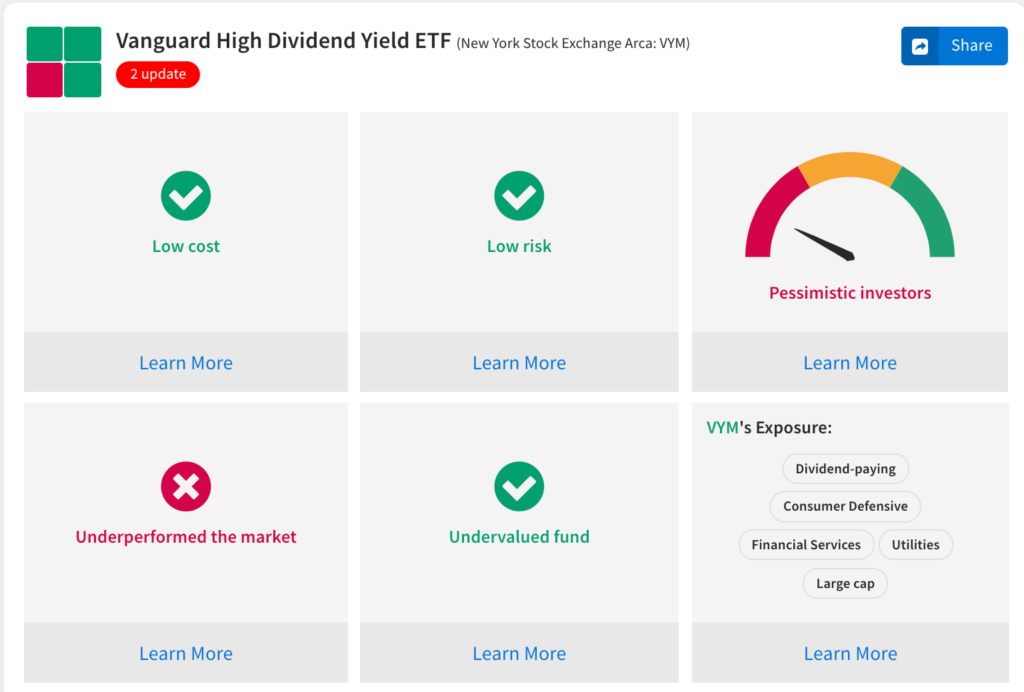

Here’s an example: the Vanguard High Dividend Yield ETF (VYM). This seems to be one of the best Vanguard dividend ETFs currently.

This ETF is supposed to track a mix of stocks that offer a high yield and dividend growth.

A note on VYM: After a little bit of research into the best dividend ETFs, I don’t know if I’d recommend this one. The average dividend yields for VYM seems to be about 2.8% annually, which is a lot lower than these other dividend funds that offer much higher yields. VYM does have a very low expense ratio of 0.06%, which is a tenth of the other ETFs I saw. This low management fee is a typical hallmark of a Vanguard fund. The other dividend ETFs had high fees in comparison. But I feel that most people who invest in dividend ETFs are looking for higher annual dividend payments than 2.8%. Amazingly, it looks like the highest dividend yield on some dividend ETFs can range up to 8% annually!

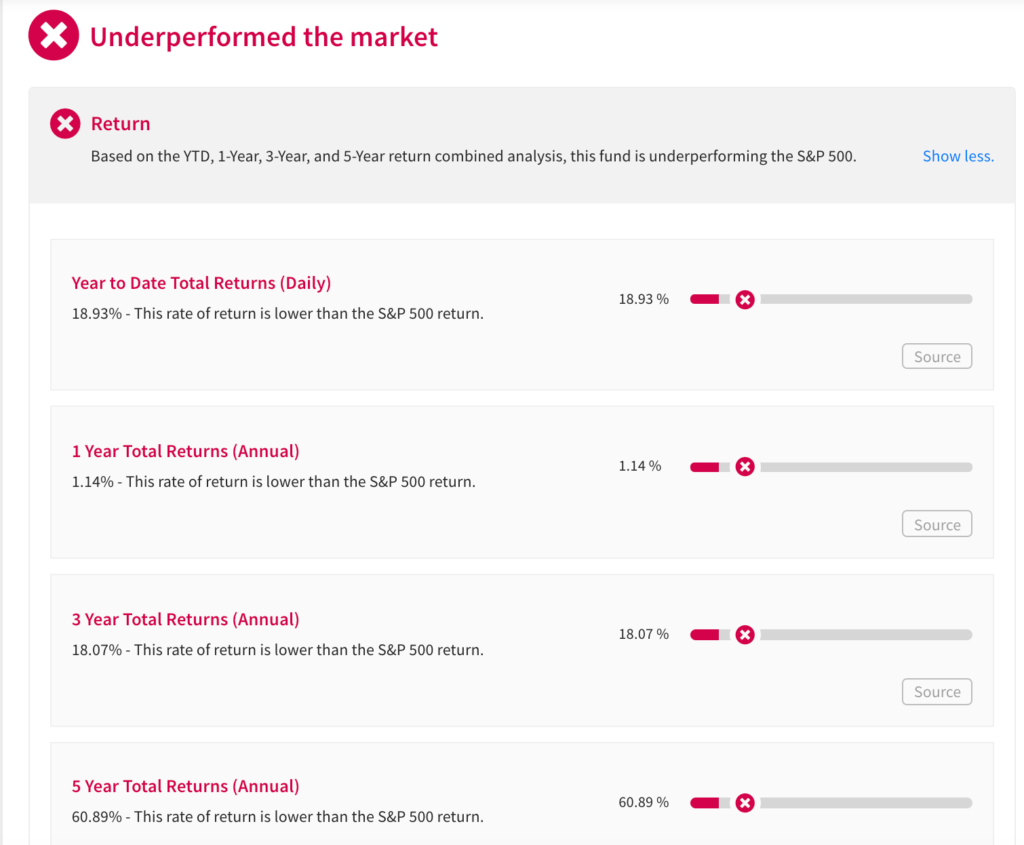

But let’s get back to Stock Card. If you click on any of the card categories, it’ll scroll down to more information cards.

Here are a couple of examples. I really love the way they present this info.

Prior to something like Stock Card, I was reading info about stocks on Google Finance. The information I found was scattered and it was hard to put together a good picture of the current performance of the company against the backdrop of the broader market. Stock Card collates all this information and also gives a way to evaluate the current market price of a stock or ETF.

I also like that Stock Card can track my returns even if I have holdings in more than one financial institution. Most of my stocks are at E*Trade, but I also have some at Fidelity.

But this next feature is the really fun part of Stock Card: Investor Portfolios.

Investor Portfolios.

With Investor Portfolios, you can study specific investors and their stock purchase and sale history. Stock Card will track their stock portfolio performance in real time. If you like their returns and investment strategy, you can follow them and be notified about their newest stock picks. It’s a “social media meets stock investing” interface that I find really new and interesting.

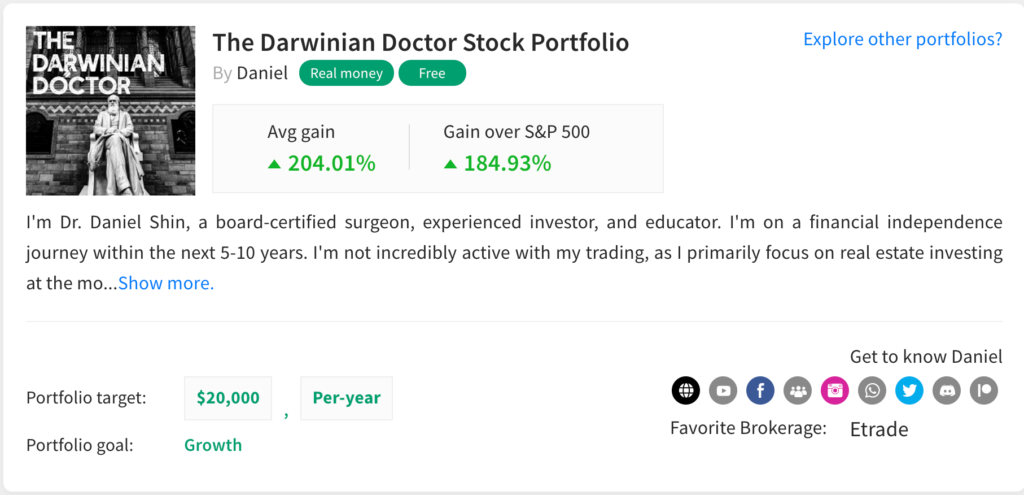

I like their interface so much that I applied as a contributor and now have my individual stock portfolio on Stock Card. Not to toot my own horn, but I have one of the highest portfolio returns amongst the 48 portfolios listed!

This shows me that the overall past performance of my portfolio is a 204% gain. It says that I have a 185% gain over the S&P 500. But on further thought, I think it’s just comparing my 204% gain to the S&P’s gain since my portfolio went live, which isn’t accurate. Over time it’ll even out I imagine.

As I mention in my bio, I am not the most active individual stock investor, but I do like buying stocks with high growth potential. Tesla is one of my top holdings. The past year has been very good for Tesla stock. My bet on Tesla powered the majority of my overall returns, but I also hit it big with some early investment into stocks like Palantir and Doximity.

Since my individual stocks trend towards tech, they’re very vulnerable to higher interest rates or a general downturn in general economic conditions. None of my stocks offer a dividend, so they’re only as valuable as their market value. (As an aside, this is why I love rental property — the asset has intrinsic value and also is a source of regular income.)

For now, it’s free to follow me on Stock Card, but it does look like most of these portfolios are part of their subscription service. So at some point in the future, it might cost money to follow me.

What you get for a paid subscription

You can access five stock card reports for free, but the site will prompt you to get a paid subscription after that.

At the time of the publication of this post, you can get a 14 day free trial of their “Full VIP” service, which allows you to have unlimited access to all their stock and ETF cards. After the free trial terms out, you’ll pay $25/month or $250/year for their service.

If you follow my portfolio and later sign up as a paid customer, I’ll get a small affiliate fee, at no cost to you.

Conclusion

I’d consider myself a real estate investor at heart, but my growing real estate empire owes much to the success of U.S. stocks over the past decade.

A lot of our net worth is still invested into the stock market via index funds, but my individual stock portfolio has also grown to about $85,000. It would be much higher if I hadn’t sold some of my early Tesla investment, but I bet that’s a pretty common complaint these days.

Bottom line: If you’re a fan of individual stock investing, you should probably check out Stock Card. It’s an affordable, comprehensive, and user friendly. I think it’s the best way to research and track your stock and ETF portfolio.

If you do check them out, make sure to follow my portfolio to see if I make any more investments!

— TDD

Yes I know, I’m a personal finance blogger but I still invest in individual stocks. Yell at me in the comments below!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

1 comment

[…] The Best Way to Research and Track Your Stock Portfolio: Stock Card […]