Today’s post reveals my individual stock portfolio, and my thoughts about individual stocks in general.

This post may contain affiliate links.

Index funds

When it comes to stocks, most thought leaders in the personal finance world agree that diversified index funds are the best way to invest in the stock market. A great example is VTSAX, which is the Vanguard total stock market index fund.

By owning a share of VTSAX, you own a little bit of thousands of companies in the United States. The value of that share rises and falls in lockstep with the overall stock market and economy. The success or failure of one particular company is unlikely to greatly affect the value of the whole index fund.

Also, as JL Collins is fond of saying, the market is “self-cleansing.” Companies that go bankrupt are “cleansed” from the index, and replaced with another company. There’s a lot of volatility, but over time, the stock market relentlessly goes up about 8-10% a year in the United States.

Individual stocks

A far riskier way to invest in the stock market is by owning individual shares of companies. For example, you can buy shares of Apple or Microsoft. The value of that share is directly impacted by the performance of that single company (and how much people are willing to pay for that share).

The difference between an index fund and an individual stock is that the individual stock could fall to zero if the company goes bankrupt.

With greater risk, though, comes the possibility of greater reward.

I don’t own many individual stocks. But I thought it would be a fun post to go over the three individual stocks I do own, and my thoughts about stocks in general.

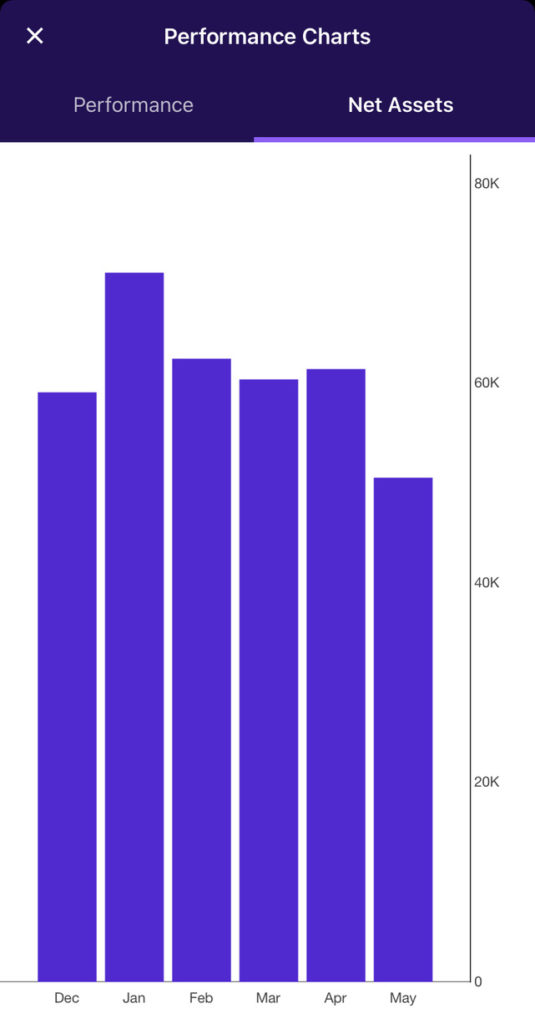

As of mid 2021, I own three individual stocks with a worth of about $50,000.

This is my current porfolio.

I would have a much bigger stock portfolio, but about 2 years ago, I cashed out the majority of my individual stocks. At the time, I had about $100,000 of individual stocks including Amazon, Apple, and Google.

Although I loved these stocks and expected them to rise in the future, I knew that in the long term, I wanted to transition to real estate. So I sold the stocks and paid somewhere between $10-20,000 of capital gains taxes to get the momentum going for my first deal.

Read more:

- Why I’m investing in real estate over stocks – Part 1

- Tax Benefits | Why I’m investing in real estate over stocks – Part 2

- Leverage | Why I’m investing in real estate over stocks – Part 3

Tesla

Around the same time, I became increasingly obsessed with a small car company with an improbable dream: to accelerate the world’s transition to sustainable energy. I was fed up with my commute, and made the decision to purchase a Tesla Model 3. It’s been one of the most costly purchases I’ve ever made in my life, but also one of the best.

It revolutionized my commute and gave me back precious time both in and out of the car. I use this time to see my family more, work on my businesses, and educate myself with podcasts.

Read more:

I also decided to purchase some Tesla stock.

Why I bought Tesla stock

I originally bought Tesla stock because of a few reasons. Here they are:

- I believed in their mission

- I loved their product

- I thought the potential upside was really high (if they didn’t go bankrupt)

The first two points are pretty self-explanatory, and I don’t want to get into a big debate about electric vs gasoline vehicles. I think the trends from major car manufacturers clearly shows the winner of that argument.

But the last point is important. I believe that it’s not a bad idea to risk a relatively small amount of assets in gambles that can have significant upside. For me, this was a few thousand dollars in Tesla stock. I was okay with losing it all if Tesla went bankrupt, as it almost did while ramping up production of the Model 3.

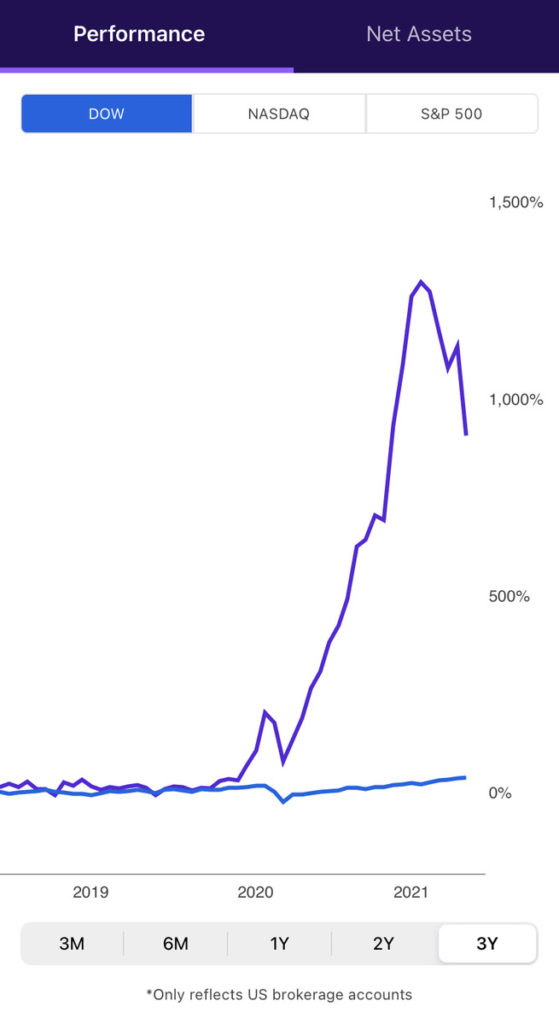

But once in a while, gambles like this can pay off. And despite slowly selling off about half of the Tesla stock over the years, it still gained value like crazy and ballooned to over $30,000. Etrade says I’ve returned over 900% since purchase.

I sold part of the Tesla stock to reduce my risk and move money into other interesting companies. With the amazing gains Tesla has seen over the last few years, I felt willing to make similar bets on other companies. In a way, I felt I was “playing with house money.”

I bought a small amount of Tesla stock before the big run up last year, but it came back to earth more recently. I’m still up 937% from my initial investment.

Palantir

I feel silly discussing why I bought this stock, but here we go.

Palantir is a company that builds “software that lets organizations integrate their data, their decisions, and their operations into one platform.” It’s a company that courted controversy because of the quantity of their business that was devoted to the US government and the military. The initial mystery surrounding the company led to a memorable NY Times article and a big pop after their direct stock listing.

I sold some shares of Tesla and bought 300 shares of Palantir at $10 a share on the day of its direct listing in September 2020.

I was inspired to buy Palantir stock after watching the most recent season of HBO’s Westworld.

SPOILER ALERT!

In season 3 of the blockbuster series, we learn of Rehoboam, a terrifying computer that is smart and knowledgeable enough to accurately predict and manipulate the future of mankind.

I thought that Palantir had a passing resemblance to this technology and therefore felt the company’s success was inevitable.

This reasoning illustrates the silliness that comes with investing in individual stock. I felt that Tesla’s run up was fairly silly, so I might as well risk it on a similarly silly company.

Palantir shot up like crazy for the first few months, and has been on a downwards trend more recently.

I decided to buy even more Palantir stock when it was trading for $29, so altogether I’m only up 8.8% from my initial investment.

Airbnb

Airbnb is an online marketplace for lodging that connects hosts with guests. After many years of operating as a private company, it underwent an IPO earlier this year at a valuation of $75 billion. This is more than the valuation of Hilton and Marriott hotels combined! Pretty amazing for a company that had yet to show a profit.

As a parent, I’ve preferred for years to stay in Airbnbs when I travel. Having the extra room, the kitchen, and the space of an apartment or house makes traveling with a family so much easier.

The platform seems to be clearly tapping an unmet need for accommodations like this. It’s the biggest platform of its kind, and is growing at an astonishing pace.

So when Airbnb made its stock market debut in December 2020, I sold my Beyond Meat stock (which I’d decided was a bad buy), and bough about $10,000 of Airbnb stock.

It did great for a couple of months, but has been on a downwards trend since then. I’m up 1.8% from my initial investment.

Overall performance of my individual stocks

These three stocks have together done really well over the the last two years, but the vast majority of their performance was driven by Tesla’s big run up.

The overall slump in tech stocks over the past few months has hit this 3 stock portfolio quite heavily.

Line graph of my stocks

Bar graph of my stocks

Conclusion

I hoped you enjoyed this inside look into my individual stock portfolio. I think it’s important to emphasize again that my reasoning to buy individual stocks is not very analytical. It’s based on things like feelings, hunches, and a resemblance to a fictional HBO computer.

That’s about as much thought I’m able to muster for my individual stock picking.

This is the principal reason that I only invest a small percentage of my assets into individual stocks, and I’m always ready for the possibility of this portfolio completely losing its value.

I put considerably more thought and analysis into my real estate investments, which is why I think I’ve enjoyed more reliable success in that arena.

The vast majority of my stock market exposure is via my retirement funds, where I keep almost everything in well diversified index funds.

–TDD

How is your individual stock portfolio doing? Do you put more thought into your stock picks than I do? Let me know in the comments below and please subscribe to my weekly newsletter so you don’t miss a post!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

6 comments

Thank you for sharing your experience with individual stock investing. Tesla was an amazing return. It can be tough when you see numbers like to not want to invest more in individual stocks. But I like how you point out that those returns can be tough to predict and can vanish if the company fails. VTSAX is definitely less exciting but more stable and where we should have the majority of our retirement accounts. With that said I agree that there is nothing wrong with investing some of your funds into companies you support when the upside can be so dramatic. Warren Buffet didn’t become the oracle of Omaha investing in VTSAX 😂

tsla and pltr fantastic long term buys. airbnb is risky. i personally manage airbnb homes as part of my real estate and im not bullish on abnb as a stock.

One asset class to fund another different asset class is one technique i have used but from real estate to stocks.

Only thing i would say is in regards to stock investing. Almost nobody gets rich on stocks unless you are buying regularly and accumulating large shares over time. Showing cost basis and returns are misleading. Nobody cares if you had 100% or 1000% gain if you only hold a handful of stocks. Key is to accumulate a large position so it can grow even faster over a long period of time.

Diversification in both real estate and stocks seems like a good move and it is a good move. warren buffet recommends that most investors invest most of their money on sp500 index tracking ETFs. But Warren does no such thing.

Those serious investors whether real estate or stocks invest heavily in things they know very well, asymmetric information advantage, economies of scale, or special leverage. For stocks, finding generational compabies that are disrupting their industry is the way to go.

Great insights, thanks Joe. I feel that I know real estate the best (for now), which is why I’m doubling down into real estate investment for the time being.

I found individual stock picking exceedingly stressful and time consuming! Reading all the news reports, listening into the shareholder meetings, etc.

But really interesting insights, thanks for taking the time to write this!

[…] Darwinian Doctor has bet on a few players, and one of them has performed spectacularly. My Individual Stock […]

Ah, good ol Tesla. I’ve been long since Tesla and it was a great ride. Bummed it has taken a back seat this year.

I’ve been thinking of buying Palantir and Airbnb as well. However, I’m looking at investing in hotel opportunities instead in great locations.

Hope Tesla gets back to $888!

Sam

The run up in Tesla last year was pure silliness. I’m almost glad it’s come back to earth a bit; it seems more sustainable of a valuation and will hopefully let the company’s reality catch up to its valuation. Very interested to hear about your hotel investing! I hope you write about it soon!