Today I reveal the surprisingly simple steps to achieve FIRE (financial independence, retire early): spend less, make more, and invest the difference.

This post may contain affiliate links.

There are a lot of things in life that we intellectually know how to do, but find hard to achieve. Losing weight is a good example. We all know that if we eat less food and exercise more, we’ll lose weight. It’s simple, but why do most attempts at weight loss fail? More on this below.

FIRE (Financial independence, retire early)

Financial independence is a similarly simple goal, at least on paper. Just follow these three steps to achieve FIRE:

- Spend less money

- Make more money

- Invest your excess capital

It’s that simple. Keep working on each of these three steps, and you’ll eventually achieve FIRE. You can even get to FIRE by just doing two of these three items! So what makes it so tough?

To figure this out, let’s review each element separately.

Spend less money

This is the mainstay of many followers of the FIRE movement, especially those who trend towards minimalism. It’s the step to achieve FIRE that’s most under your immediate control, and therefore the most actionable.

The most zealous of the “spend less crowd” keep their homes at fifty degrees in the winter and ninety degrees in the summer. While this can certainly help with minimizing heating and cooling costs, the most effective way to cut down spending is usually to focus on these three areas:

- Housing

- Transportation

- Food costs

It can be a painful exercise to change these items once you’ve gotten used to a certain lifestyle.

But it might be worth it.

Here are two scenarios to illustrate how different spending levels can dramatically affect your timeline to FIRE:

John

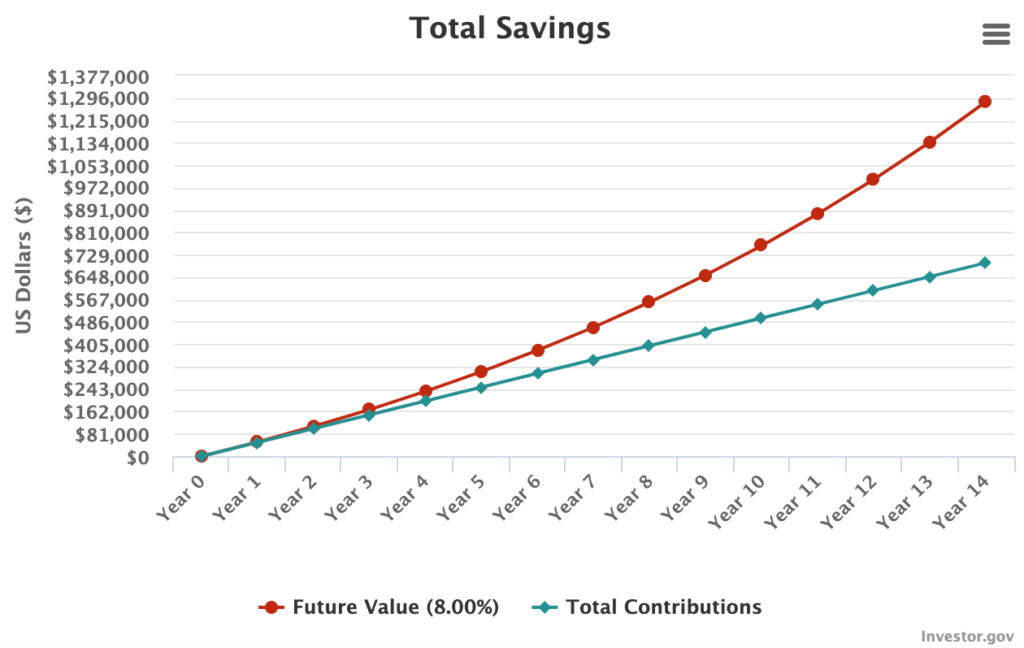

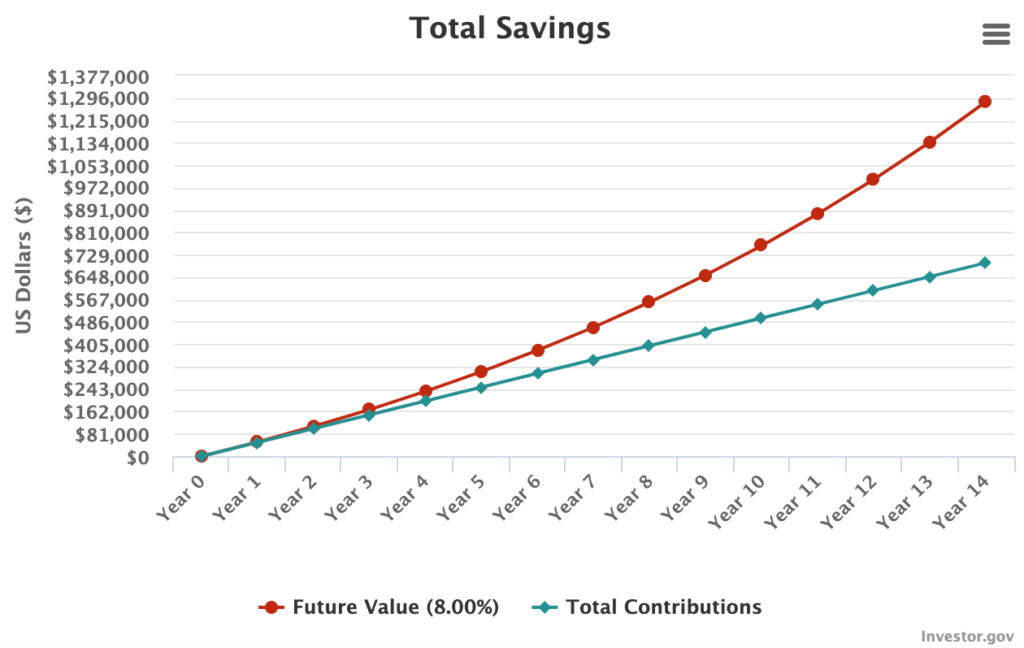

John spends $50,000 a year and makes $100,000 after taxes. He therefore saves $50,000 a year and invests it via index funds that will yield an 8% return, on average. He needs $1,250,000 to retire, based on the 25x rule.

Starting from zero, he’ll reach financial independence in 14 years. Not bad. (Yes, I’m ignoring inflation for simplicity.)

Jane

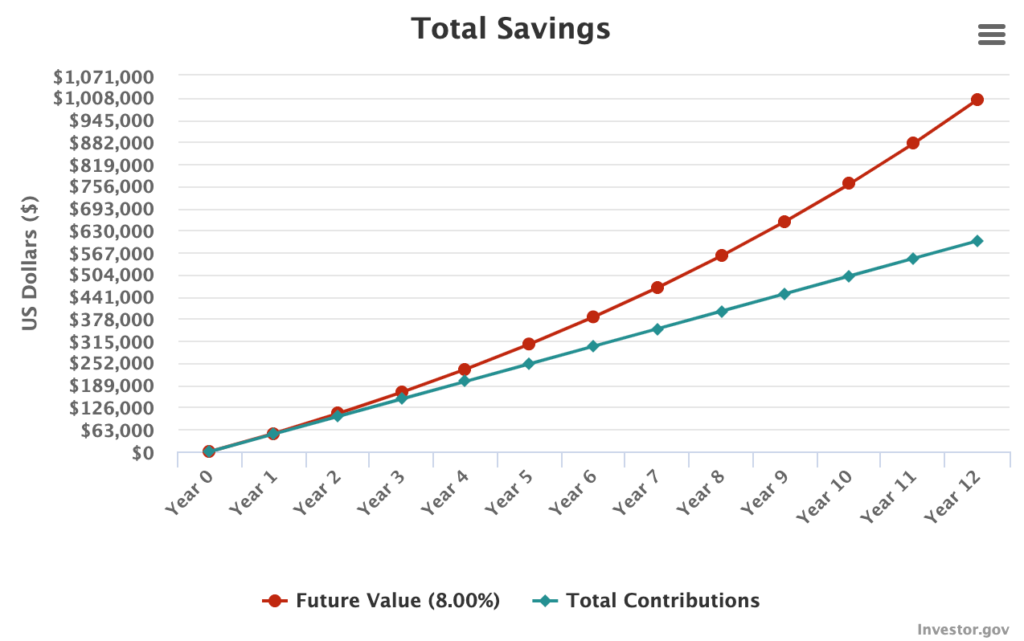

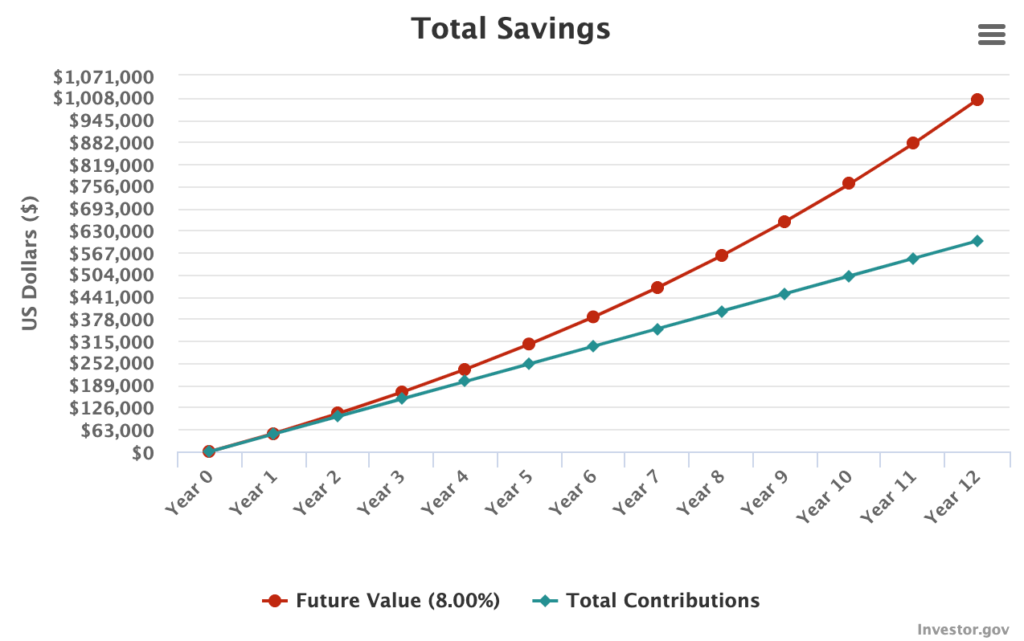

Jane has a similar saving level as John, but she lives on the other side of town. The neighborhood is a little scruffier and there’s no Whole Foods on the corner. She therefore spends $10,000 less on rent and food every year, or $40,000 a year total. To keep things balanced, let’s say she makes only $90,000 after taxes. She therefore still saves $50,000 a year and invests it the same way as John. She’ll only need $1,000,000 to retire, based on the 25x rule.

Starting from zero, she’ll hit financial independence in only 12 years.

Are those two extra years of financial freedom worth the sacrifice of spending $10,000 less a year than John? Maybe. You’d have to ask Jane. Let’s move on for now.

Make more money

This option is a really powerful way to reach financial independence as well. It can arguably be achieved without as much day to day sacrifice. Because if you make more money, you may not need to contract your spending as much to reach your financial goals.

Some jobs have built in raises that correlate with the length of time you’ve been working for your company. My job is like this. I get regular pay bumps every year that I’m with my medical group. It plateaus after 10 years, but the difference between my starting salary and my salary now after 5 years is pretty big.

This increase in my earning allows me to keep my expenditures steady, while steadily growing the amount of money that I can throw towards real estate.

But what if your job doesn’t come with built-in pay increases? You can increase your earning through side gigs!

Side gigs

Side gigs are any pursuits outside of your traditional workplace that you do to earn money. I consider my real estate investing a side gig, and it’s proving to be a major accelerant in my FIRE journey.

There are a million and one ways to make extra money via side gigs. Here are some examples, both serious and silly:

- Start a lemonade stand or sell your baked goods

- Mow lawns or shovel snow

- Start a coaching business

- Start a tele-mental health company

- Invent a medical product to make injections painless

- Start a social equity venture capital firm

- Invest in long term rental real estate

- Invest in short term rental real estate (affiliate link to the Carpe Diem MD course)

(OK, I guess some of these are less side gig and more full time gig.)

Ideally, your side gig is something that you enjoy doing in your spare time and has the added benefit of extra income. Any extra income grows the pie and allows you to increase the gap between your earning and spending. The extra income can then be invested to speed you to FIRE.

Invest your excess capital

You can choose between “spend less” or “make more” and still make it to FIRE, but you can’t really avoid investing your capital. Without proper investment, FIRE will prove very difficult to maintain. Here’s a scenario to explain why:

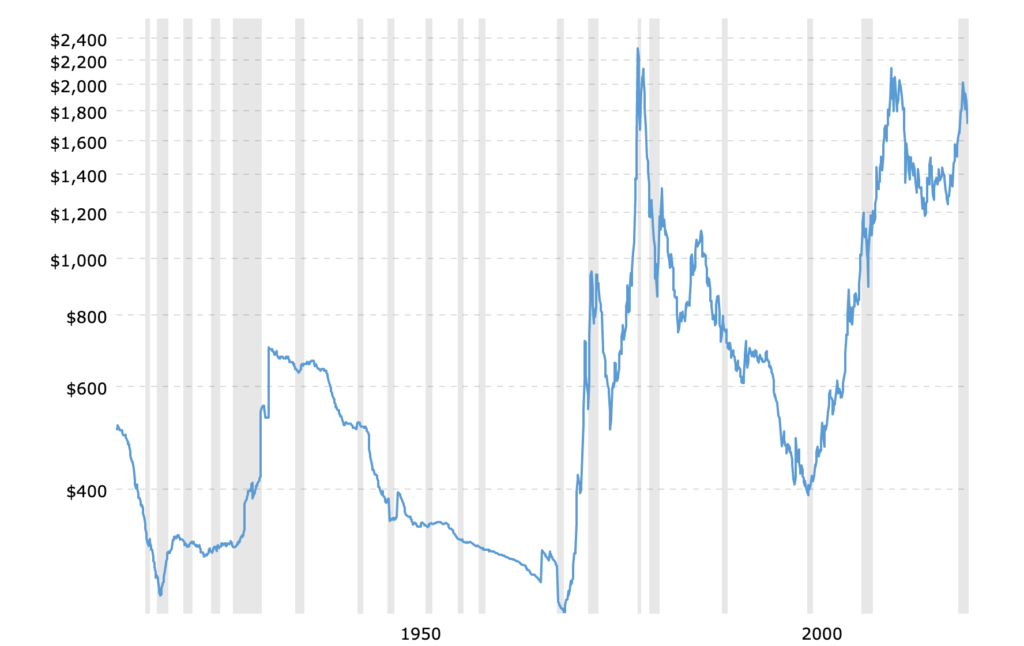

Gold Bar FIRE

Let’s say John, from our example above, doesn’t trust banks. He likes to convert all his money into gold bars and keep them under his mattress. After 14 years, he has $1.25 million in gold bars under his mattress, and amazing back support. But here’s the issue:

Over the last 100 years, inflation adjusted gold prices have only gone from $510 to $1715. That kind of growth will never allow you to maintain financial independence once you stop earning money.

FIRE via stocks

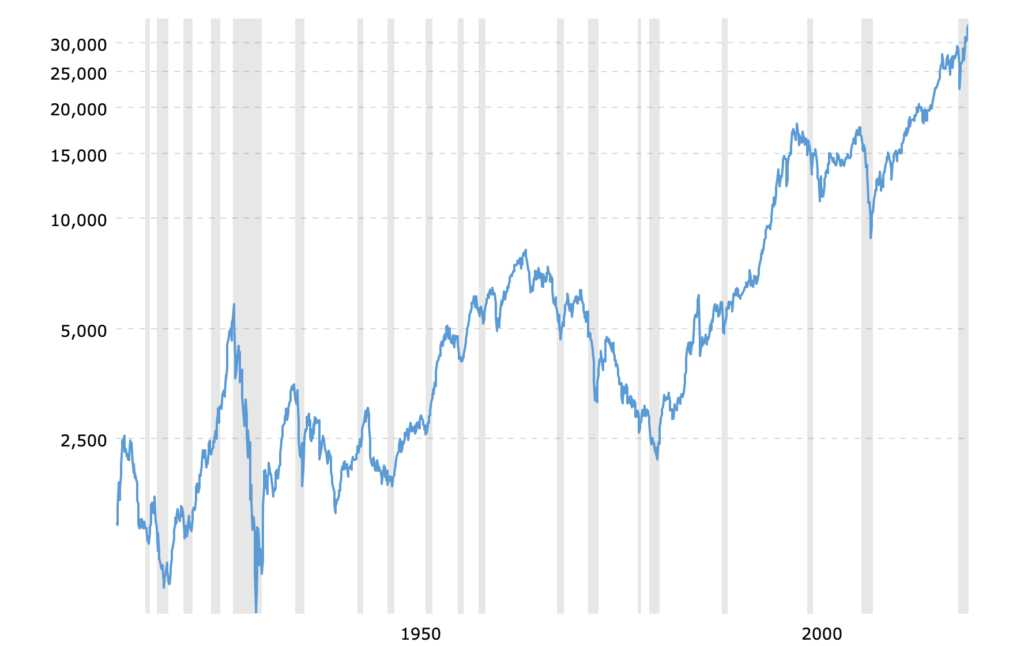

The traditional model to achieve FIRE requires a well diversified portfolio of stocks. This time tested method is based on the Trinity study, and requires somewhere between 50-75% stock allocation to both keep place with inflation and last at least 30 years.

More analysis on the Trinity Study here.

Over the last 100 years, the US stock market had grown from $1457 to $32,981 today.

This chart shows why you need stocks even in retirement to ensure that your FIRE nest egg doesn’t get depleted with your living costs. There are only a handful of things out there that reliably have the required yield to make sense as investments in your FIRE portfolio.

Of course, there are interesting alternatives. A friend of mine is counting on high dividend stocks, for example.

Personally, I’m choosing to concentrate my capital in real estate for the following reasons:

- Why I’m investing in real estate over stocks – Part 1

- Tax Benefits | Why I’m investing in real estate over stocks – Part 2

- Leverage | Why I’m investing in real estate over stocks – Part 3

- You can’t buy avocado toast with VTSAX (Why cash flow is king)

Why are simple things so damn hard?

So let’s circle back now. If getting to FIRE or losing 10 pounds is so intellectually simple, why can’t more people actually do it?

We could devote an entire blog to exploring this question, but I think it comes down to a few key elements that I’ll just list here for brevity.

- The conflict between short term and long term gratification

- Different economic starting points

- Lifestyle creep, consumerism, and hedonic adaptation

Let’s discuss these in the comments below and in future posts.

Conclusion

If you want to reach FIRE (financial independence, retire early), you just need to follow these three simple steps:

- Spend less money

- Make more money

- Invest your excess capital

The beauty of your FIRE journey is that you get to choose which parts of this equation deserve your focus and energy. My family spends a lot of cash every year, and a lot of these costs are non-negotiable for one reason or another (for now). So I’m focusing on making more money and investing wisely.

For your journey, just pick one of these three steps to achieve FIRE and get started!

–TDD

What do you think? Is reaching FIRE as simple as I make it sound? Comment below and please subscribe to my weekly newsletter!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

4 comments

Love this! Cleary I’m biased but I think physicians now more than ever have the chance to create low-overheard telehealth side gigs. But to diversify their own income and continue providing medical care. Also, doing video-based consultations can help provide care and medical access in underserved areas.

Virtual care is a win-win, as long as reimbursement keeps up with technology. Once they’re matched up, I’m sure it’ll really take off.

[…] There are a couple of common objections I hear against going for FIRE (financial independence, retire early). The first and most common objection is that it’s just impossible. I disagree with this, and recently broke down the three simple steps to FIRE. […]

The concept of FIRE is intriguing and motivating. It simplifies the path to financial independence into tangible actions, though the discipline required for execution is a significant challenge. Balancing frugality, income growth, and investment wisely is key to success.