My real estate empire is bleeding cash. Read below as I review the numbers and come to some conclusions.

This post may contain affiliate links.

Anno Darwinii is the quarterly report on the growth of my real estate empire.

It’s April, so you know what that means: tax time! Perhaps one of the only good things about tax time is that it forces us to review our actual numbers for the previous year. After we do this, my wife and I can look objectively at the performance of our real estate portfolio. With this objective information, we can come to conclusions and alter our plans for the year to come.

2021 was a year of growth

2021 was a year of growth for my real estate empire. As I outlined in my recent net worth update, we grew our real estate portfolio to $6.88 million in 2021-2022. While this does include my primary home in Los Angeles, the vast majority of this figure is from our rental portfolio.

Much of the growth of our portfolio came from the purchase of two small apartment buildings in Indianapolis and a vacation rental in Palm Springs.

Some of this growth of real estate was due to appreciation of our existing properties, but most of the growth was from the purchase of assets. While I’m happy that we expanded aggressively in 2021, we didn’t buy turnkey assets. We mainly bought properties that required a significant amount of renovation.

Therefore, we saw little to no cash flow from these new assets in 2021. As you’ll see below, it was actually quite the opposite.

Check out this link to see all of my Anno Darwinii posts from the beginning: The Anno Darwinii page.

Our stabilized portfolio

Here is a chart showing our 10 rental units of stabilized assets in 2021. By “stabilized,” I mean that these properties are renovated and rented to tenants. Either I bought them turnkey, or I took them through the “BRRRR” process where we renovated, rented, and refinanced them.

Conclusions from our stabilized portfolio

The average cash on cash for our whole stabilized portfolio was 8.6% in 2021. Our actual cash flow from these properties was only $15,584 in 2021. While not bad, these numbers are lower than our projections.

The major takeaway from this chart for me was that the small margins of long term rental are fragile. One large expense can wipe out an entire year’s worth of income.

Let’s address some of the properties that underperformed. I’ve outlined each of these properties before in a previous Anno Darwinii, but I’ll give you a quick run down of why they underperformed.

Birmingham Single Family Home

- Turnkey property

- Cursed from the start: hard to rent, non paying tenant, septic tank issues

- Sold in late 2021 at a small loss

Little Rock Single Family Home

- Turnkey property

- Solid performer in 2020

- Large tenant turnover costs + vacancy wiped out cash flow for 2021

Indy duplex #1

- Duplex BRRRR with high projected cash flow

- Forgot to pay property tax on this property

- Catch up payments in 2021 + various repairs canceled profit for the year

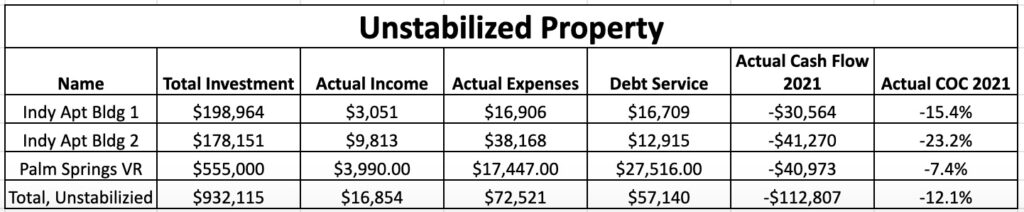

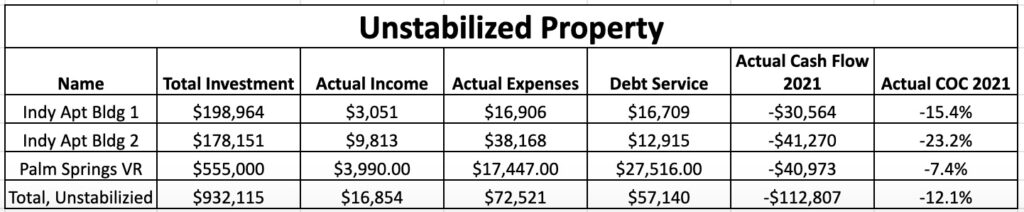

Our unstabilized portfolio

The part of our portfolio I’d call “unstabilized” in 2021 were our two small apartment buildings and our Palm Springs vacation rental. These all required significant renovation, shuffling of tenants, or both. This part of the portfolio is 16 units of rental property.

Here are the numbers specific to this part of the portfolio:

These properties all have their own stories, but all of them should be stabilized within the next 2-3 months.

Conclusions from 2021

As my wife and I munched on risotto at our favorite Italian restaurant on Sunday night, we reviewed these numbers and came to some conclusions. Since this is a summary post I won’t go into them in much detail today, but I may revisit the conclusions in future posts.

- Turnkey properties have thin margins and are susceptible to unprofitability

- Water is a real estate investor’s worst enemy (much of our expenses in 2021 were water related)

- Even with large incomes, big cash investments are very tough to handle

The first two conclusions are self explanatory, but I’ll expound on the last one just a bit.

Large renovations should be financed

Between the purchase and renovation of our Palm Springs vacation rental, our cash outlay for this property alone was over half a million dollars. We used the cash out refinance from the completed BRRRR of Indy Duplex #4 to help fund this, but that still left us on the hook for over $300k.

We pulled this from a number of places, but the majority came from a combination of cash flow from our jobs and a HELOC on our primary home.

In retrospect, I think it would have been best to pursue a formal construction loan (or similar line of credit) for the renovation. It would have kept our books cleaner and lessened the financial pressure of floating such a large renovation. In the future, I’ll gladly pay the interest costs of such a loan to prevent this financial pressure.

Conclusion

In closing, 2021 was a big growth year for my real estate empire. We cut loose some underperforming property, but mainly purchased and renovated a ton of property.

But we also bled cash like crazy, especially towards the end of the year into 2022. Between this fact and our recent purchase of the vacation rental in Broken Bow, we’ve been feeling a bit financially stretched at the Darwinian household as of late.

I’m really looking forward to having our portfolio fully stabilized in the next few months. Once that’s done, our cash flow numbers should start to pick up. Mid to late 2022 should be a very different situation.

— The Darwinian Doctor

I hope you enjoyed this summary of our real estate empire. If you want to read more, please subscribe to the blog below!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

13 comments

Thank you so much for this detailed and honest accounting of your real estate performance. Our real estate investments are also limping along and performing below expectations. I am concerned that all the cheerleading in the physician real estate investing community is making some docs put on rose colored glasses when it comes to investing potential. There is a certain amount of luck involved, which is easy to overlook when everything is going right.

You’re quite welcome. I’m ever the optimist, and to be clear I do expect things to turn around in mid to late 2022 as my renovations cease. One downside of the BRRRR strategy is that unless a complete gut job is done, some parts of the building are going to be older and prone to break down. However, a complete gut job likely would make the project not a great deal. I guess the gamble comes into play in the first few years. Does the building infrastructure fail, or is it sound enough to make it a profitable venture? That’s the question that I’m answering in real time.

A little different perspective- As a general partner, I closed on a 104 unit apartment in Augusta, Georgia in Feb 2021, renovated 20 of them, drove by rents by $100 – $150 per unit and exited in March 2022, with a 2.2X return for our physician investors who invested passively. I would think with that scale, financing, property management and other aspects of the running the business become more manageable. At the end of the day, many physicians are trying to free up time while making passive income. DIY is a much more time intensive, even if there is property manager. For the newer investors who are pursuing a DIY route, while also doing a full time job, it may be challenging to make smaller multifamily assets to cash flow.

Hi Saji, thanks for this. I do think there are a lot of advantages to a larger scale. Certainly speed of the turnover is one of them. As an individual investor, I struggled to find a good team to lead the renovation of my 8 unit apt building for a reasonable price. I’m definitely interested to learn more eventually about pooled asset projects like syndications. Perhaps when my portfolio is cash flowing better!

Hi Dan, wow wonderful transparency. Thank you. I have moved all of my investments over to commercial triple net. Have you ever considered it? Out of state can be tough with residential.

I love the simplicity of commercial triple net, but to be honest I don’t have experience in this space. I love that there are so many options with real estate investing!

Growing pains. But if you keep going, adapting, and growing the portfolio – you will become very profitable. then the next stage = was it worth all your effort to make the extra $$? Short of going serious – go part time on your day job, it’s very hard to get to a point you get comfortable while the work of managing seems to grow exponentially more. Unless you have a partner who can manage the “work” you don’ t like doing (like the bookkeeping for me), the money just doesn’t seem to be worth all that time and effort.

I say this while making my first millions in real estate. in last 12 months I sold 5 properties close to $5M in real estate at huge appreciation profit. But I got started in 2013 and enjoyed probably the BEST decade in real estate for last 50-100 years.

Thanks as always for your insightful comment! I do have a good partner in my wife, who manages most of our bookkeeping and is an invaluable sounding board for investment decisions. This makes it more of a team sport. It’s much easier for me to take the bumps in the road when I have a partner in the investment journey.

Yes it’s interesting how much timing affects things. I wish I’d been able to start investing in 2010, for example, but I was an intern with a negative net worth and no time!

Nice summary for your properties. Thank you for sharing. We also had our toughest year (in 2021) out of the last 13 years of rental ownership. Much of that was due to the Covid related eviction moratorium, that was unduly placed on investors. We still managed to finish the year with an 8.5% ROI, but that is far below our typical ROI in previous years. Fortunately, 2022 is off to a much better start for us. I hope your plan to stabilize the newer units provides a better returns for 2022. It can be a tough business to break into the first few years. Surviving 2021 was an accomplishment for all of us!

Thanks for lending your voice! Yes, certainly the nonpaying (and non-evictable) tenants hurt our returns in 2021. The pandemic has had so many ripple effects throughout the economy, not to mention the tragic loss of life. Our world can be quite cruel sometimes.

I am new to your posts, but having been investing in RE from the 1980s, 2021 was a banner year for us. I am not bragging, but reading your story I am of concern. 1. How you are buying these properties, 2. You are in different markets and are you able to keep up with the different markets? 6 million in RE is nothing, if there is no cash flow and are using your physician money to support your RE ventures. I have never considered my home an investment. It is my home. If and when I go to sell it and make a profit, that is a plus. I can tell you that eventually as time passes, rents go up and pay for everything so there is no out of pocket money. Keep up the good work and you will get there.

Thanks for your concern! My stabilized properties are overall cash flow positive, which is great. I do feel the pinch of pouring money into the unstabilized properties, but I feel like cash flow and profitability is right around the corner… Let’s see how the next 6 months go!

Thanks for sharing this honest and insightful report on the performance of your real estate portfolio in 2021. It’s always refreshing to see people talk openly about the challenges they face in business.

It’s clear that you had a big year of growth in 2021, but it came with some significant expenses, particularly with the purchase and renovation of your vacation rental in Palm Springs. It’s interesting to see the impact that water-related expenses had on your portfolio, and the lesson you learned about pursuing formal construction loans for large renovations.