In this installment of Anno Darwinii, enjoy insights into the various factors that can affect the earnings potential of your rental property, using my portfolio as an example.

This post may contain affiliate links.

Anno Darwinii is the quarterly update on the growth of our real estate empire.

It’s been a full four years since our real estate empire first began with the purchase of a single family home in Birmingham. It most recently grew with the (forced) addition of our former primary home in Los Angeles to our portfolio.

Last update, we talked about finally hitting stabilized occupancy in our Indianapolis portfolio and achieving $600k of annual revenue.

But as you know, revenue is very different than profit. With this in mind, it’s time to get to work to increase real earnings. As one of my real estate mentors Kenji Asakura likes to say, after your property is up and running, that’s when the real work begins.

Below, I’m going to use my portfolio to discuss a few major factors that determine the profitability of a rental unit (aside from occupancy). Specifically, we will discuss:

- Property insurance

- Property tax

- Financing

Further down, I’ll also touch on a couple of other updates, including:

- My personal Airbnb bust

- The next steps for our portfolio

Read more: 15 Things to do When Your House Doesn’t Sell

The Indianapolis portfolio

In the last edition of Anno Darwinii, I reported that we reached 95% occupancy in our Indianapolis portfolio. To recap, this consists of 23 units: four duplexes and two small apartment buildings (a 7 unit and an 8 unit).

The good news is our Indianapolis occupancy is now even better at 100%! Full occupancy is a wonderful thing, as it guarantees the monthly rental income that is the lifeblood of a rental real estate portfolio.

Occupancy rates are certainly important, but the past few months have driven home that other factors are also very important for the profitability of a rental portfolio. Specifically, insurance, property tax, and financing can be major variables that can affect your bottom line.

While a necessary part of a rental business, the thing that bothers me about these variables is that they’re not entirely within your control as the business owner.

Property insurance

Property insurance, also known as hazard insurance, provides protection against potentially costly events that might take place in a rental property. From injuries to fires, property insurance is an essential way for property owners to mitigate risk.

But the cost for property insurance policies are determined by the insurance industry. They use algorithms, prior insurance history, and variables about your property (such as location) to come up with a coverage package.

The cost of your coverage is also affected by your access to quotes, though. If you source insurance quotes on your own, it can be a lengthy, paperwork filled process. But if you decide to use an insurance broker, you are trusting that they are doing the necessary legwork to find you the best policy.

Over the last year, the coverage on my 8 unit building more than doubled, from $3800 to over $8000 a year. As I’ve become more sophisticated in my business, we have up to date bookkeeping so I have an easier time seeing the effect insurance has on our profitability. But it doesn’t take a genius to see that an extra $4200 in annual costs will have a big impact on our bottom line.

To address this, I’m requesting additional options from my insurance broker, as well as talking to two additional brokers.

While there’s a chance that the insurance market has just become more expensive due to soaring construction costs and property values, I find it hard to believe that I’m getting the best deal out there.

Property tax

As an investor, I find property tax an equally frustrating part of real estate investing. While I understand its importance in funding various parts of city governments, I dislike that the property tax changes are also out of my control. While in theory, property tax is predictable based on the various ordinances and laws in your city. But in actuality, it’s not always so cut and dry.

Depending on your city, there are various policies in place that will trigger reassessment of your property tax.

For example, in Los Angeles, due to Proposition 13, there are only a few specific events that could trigger a large increase in property taxes more than 2% a year. The most common event is the sale of a property. Another is major construction. Otherwise, the property tax is reliably about 1% of the assessed value of your property at the time of its acquisition.

In Indianapolis, properties are reassessed at least every two years, regardless of a sale or new construction. Rental properties are taxed 2% of their assessed value, which is the value that a property assessor assigns to a property. The assessment ratio in Indianapolis is fixed at 100% of the sale price, which means that the assessed value will generally be at least what your property last sold for.

Read more about property taxes in Indiana here.

In the case of our 8 unit building, that means that our property was assessed at the sale price in the most recent reassessment. While predictable, I had hoped that it was going to take a little longer to adjust to this level.

The real life consequences of this adjustment is a property tax payment that went from $3,243 to $10,135 annually. Ouch!

There are avenues to consider if you feel your property’s assessment is unfairly high. There are entire law firms that specialize in arguing for lower assessments. Whether or not you’ll be successful with your challenge, however, is a different story.

For example, I attempted a challenge to my property tax assessment in Los Angeles using a law firm. The challenge took over a year and ended with a negligible difference in my ultimate tax assessment. The only saving grace is that these firms generally operate on contingency, which means they only receive payment if they successfully negotiate a lower payment for their clients.

Given the fact that my property assessment now matches the purchase price, I don’t see a viable argument to lower the assessment.

Financing

The final modifiable factor that I’m looking at for my Indianapolis portfolio is financing. The original plan for my apartment buildings was to use financing from a local bank as my starter financing. This would get me through the construction and stabilization phase.

Then, once I had long term leases in place for all the units, I’d be able to refinance the properties into more favorable long term debt.

Currently, I have financing in place for both apartment buildings with the following terms: 5.5% fixed interest rate and 20 year amortization with no balloon. That means that my payment is divided up over 20 years with an interest rate that will not change. The lack of a balloon payment means that I don’t have a deadline to suddenly pay back the full balance of the loan. (I have the full 20 years.)

Two years ago when I acquired these buildings, that interest rate was quite high. Now, it doesn’t look bad at all! My main issue with the current financing now is the 20 year amortization. That makes my monthly payments approximately 21% more expensive than a 30 year amortization schedule.

While this also allows me to pay down my loan principal much faster, it makes it more challenging to have positive cash flow from the buildings.

Read more: The Stealth Wealth Strategy of Principal Paydown

While the current high interest rate environment limits my options, I am considering the following options to deal with this issue:

- Refinance (cash out versus simple refinance of existing debt)

- 1031 exchange (sale and reinvestment)

Segue

Now that I’ve discussed these factors, I want to move onto a quick update on our short term rental portfolio before closing with a look to the future.

My personal Airbnb bust

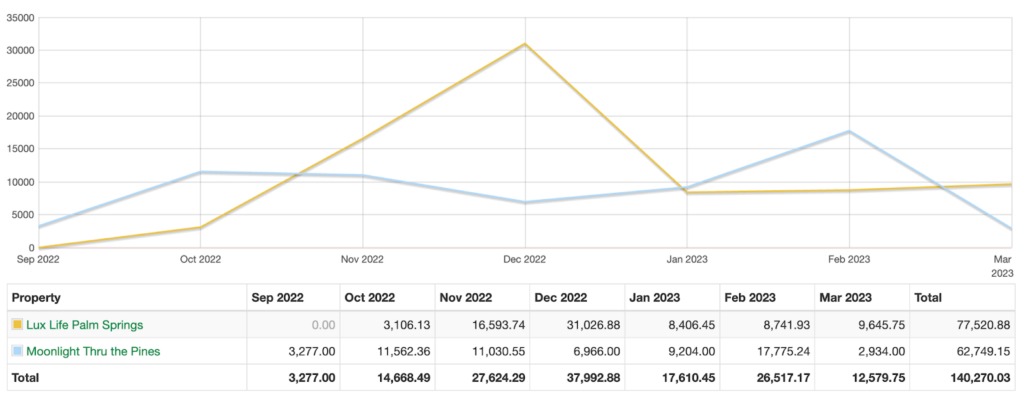

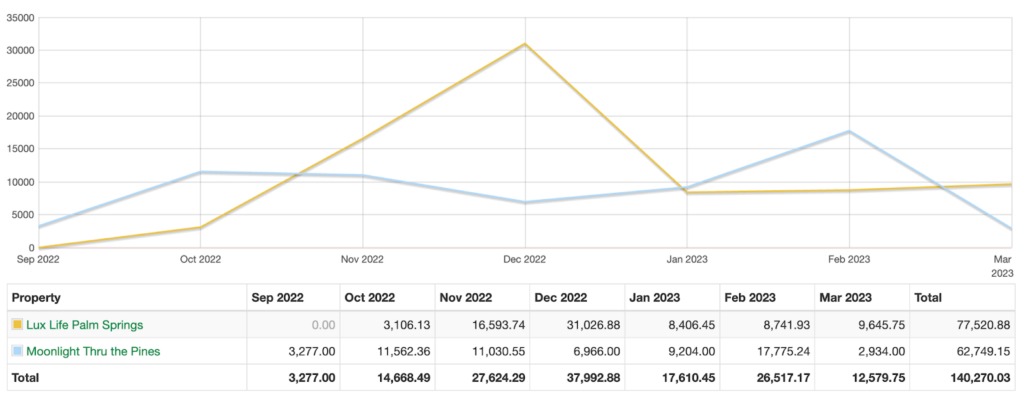

I acknowledged some challenges recently to our short term rental portfolio. My mantra with short term rental has been “high risk, high reward.” Over the winter months, I was seeing the high reward from our two luxury short term rentals. We had great returns during the winter holidays especially, netting $140k of revenue between September 2022 to March 2023.

However, I’ve discussed our run-in with the strict STR regulations in Palm Springs, and our entrance into permit purgatory there since March. In fact, we converted our rental into a monthly rental as soon as our suspension went into effect. While we successfully found a tenant for March, it’s been crickets since then, despite advertising on multiple platforms.

Read more: Palm Springs Short Term Rental Regulations: An Insider’s Guide

It turns out that there is a limited tenant pool who is can pay the kind of monthly rates that we are desiring for the Palm Springs home.

This has coincided with a tightening of the STR market in Broken Bow due to oversupply of units and lower demand. The last 3 months have been quite different for our STR portfolio:

We hope to see this turn around in late August when our Palm Springs suspension is up.

In the meantime, I’m continually working on improving our STR business. We’ve used the downtime at Palm Springs to make some repairs and complete the annual inspection of the property.

In Broken Bow, we’ve improved the experience via upgrades to the kitchen and have completed repairs to the HVAC, servicing of the hot tub, and cosmetic improvements like new welcome mats.

In terms of advertising, we’ve invested some time into the blog on our private booking site: https://www.llstays.com/blog.

We’ve also started an Instagram page for our STR business: https://www.instagram.com/llstays/. (Please follow us on Instagram!)

As a reminder, booking our properties via the private booking site saves you about 14% off of the Airbnb prices due to elimination of the platform fees.

Tax benefits are the only guarantee

The silver lining to our Airbnb bust is that we plan to see another six figure tax deduction from the cost segregation and bonus depreciation from the Broken Bow rental. This should translate to a real life tax refund of about $100k, just like we saw in 2021 from our Palm Springs property.

This benefit lessens the blow from our recent downturn in our short term rental revenue. It also reinforces my belief that when it comes to revenue, tax deductions are the only guarantee.

Read more: Amazing Tax Deductions from Your Short Term Rental

Next steps for our portfolio

The first six months of this year have been spent formalizing various aspects of our real estate company. We now have much better insight into the finances of our portfolio. We also have a better handle on the myriad of deadlines related to property tax payments, insurance renewals, and legal entity renewals.

Now that we’ve created these systems, I’ve been making preparations to expand into the larger apartment building space. This has included some serious education and networking with commercial real estate brokers and lenders.

Read more: How to Create the Ultimate Real Estate Investing Team

Part of the networking and education has also included a planned investment into a real estate syndication. While I do feel that this investment will be a great way to reduce the risk in my overall portfolio, I’m also gaining a lot of knowledge by looking at a real estate syndication from the inside.

Read more: 5 Reasons Why I’m Finally Investing in a Real Estate Syndication

My personal goal is to have a 20+ unit apartment building under contract by the end of the third quarter. This will allow us to close on the building by the end of the year and take advantage of 80% bonus depreciation.

Depending on the size of the building, I’ll most likely be purchasing it with the help of a few investment partners.

Conclusion

Four years is a lifetime. It’s long enough for a medical student to turn into an attending physician. It’s also long enough to gain a wealth of experience in real estate investing. While I certainly would have done a few things differently if I could do it over again, I am thankful for all of the lessons I’ve learned over the last few years.

The lesson from today’s update is that purchasing a property is only the beginning. After your property is purchased, renovated, and rented, it’s time to really roll up your sleeves and increase earnings!

I look forward to continuing to grow in experience and knowledge as our real estate empire continues to grow.

— The Darwinian Doctor

Make sure to subscribe below so you don’t miss any important updates and opportunities!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

4 comments

It’s so nice to follow someone’s journey in real time with current conditions than someone who bought in 2017 with 2.5% interest. Not sure if we will expand into apartments but I look forward to hearing the process as you go through it!

Thanks a lot! I have some evidence based theories about apartment buildings and debt, so we’ll see if it all pans out!

Since the bonus depreciation is very predictable, why don’t you adjust your withholding accordingly? While it’s nice to receive a big check from Uncle Sam every so often, one can get more than 5% from t-bills…

Great point. I did this last year and it worked out well, but for this coming year, the bonus depreciation will be contingent on actually finding a good deal to buy. If I don’t find a good deal and under withhold tremendously, I do run the risk of paying penalties and interest. (It’s probably still worth it to do that, though.)