In this winter installment of Anno Darwinii, I describe the payoff from our short term rental gamble over the holiday season.

This post may contain affiliate links.

We are now 3.5 years from the birth of our real estate empire.

The winter holiday season is traditionally full of merriment and cheer, but I wasn’t sure how it would affect my real estate portfolio. Now that we’re almost at the brink of the New Year, I’m ready to make some conclusions.

Winter has been great for my short term rental portfolio and not as good for our long term rental portfolio.

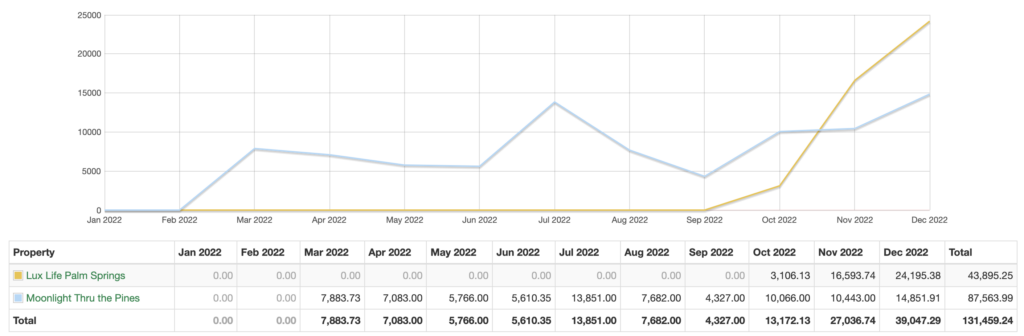

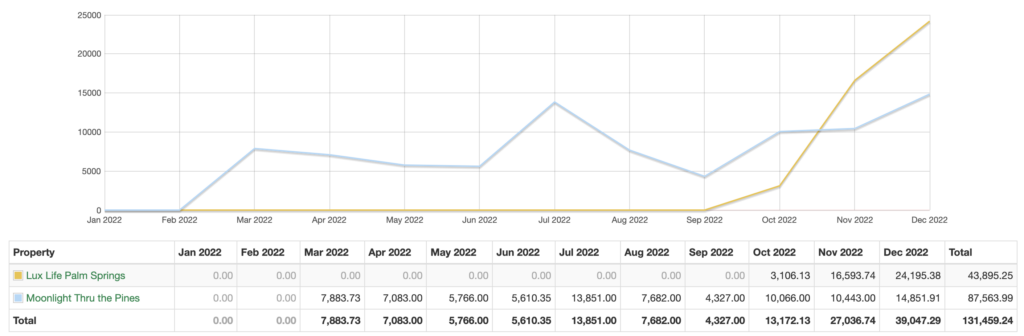

In the last installment of Anno Darwinii, I outlined the swiftly rising annual gross income from our real estate empire. We hit around $350,000 of gross income, which was a big rise from just 1 year ago. At this time last year, our gross income was $127,000.

Read more: $127,000 of Gross Revenue | Anno Darwinii 2.5

I’m glad to report that our gross income continues to grow, mainly off the gamble we made into short term rental properties. Let’s get into it!

Good reviews pay off

It’s been an interesting experience self-managing our short term rentals. While guests are in the homes, I have a mild level of anxiety that’s similar (but definitely not as bad) to being on call at the hospital. At any moment, I worry that the AC might go out, or some appliance might break, leading to a critical situation that requires my attention.

I hope that this feeling will lessen as I gain more experience as a host, but for now, my attention has paid off.

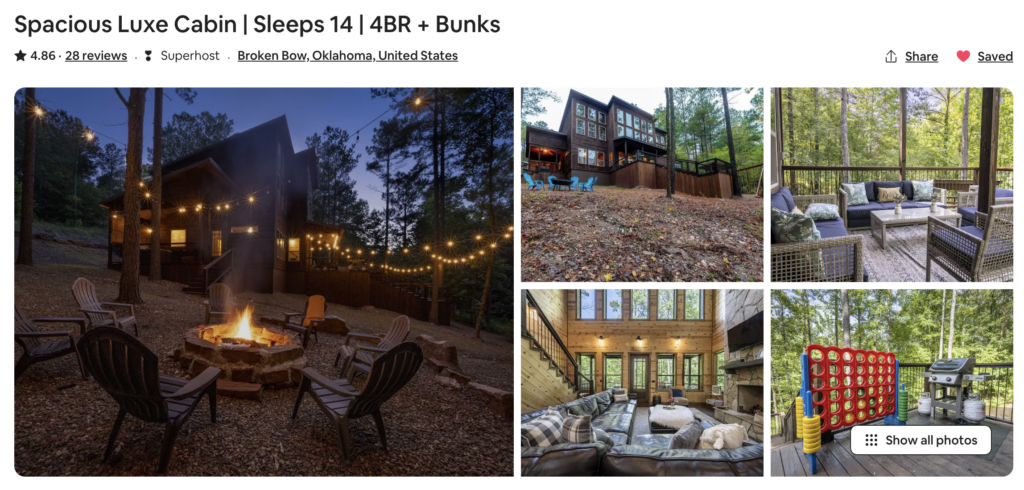

We have gathered 28 excellent reviews of our property in Broken Bow, OK, with an average rating of 4.86 out of 5 stars.

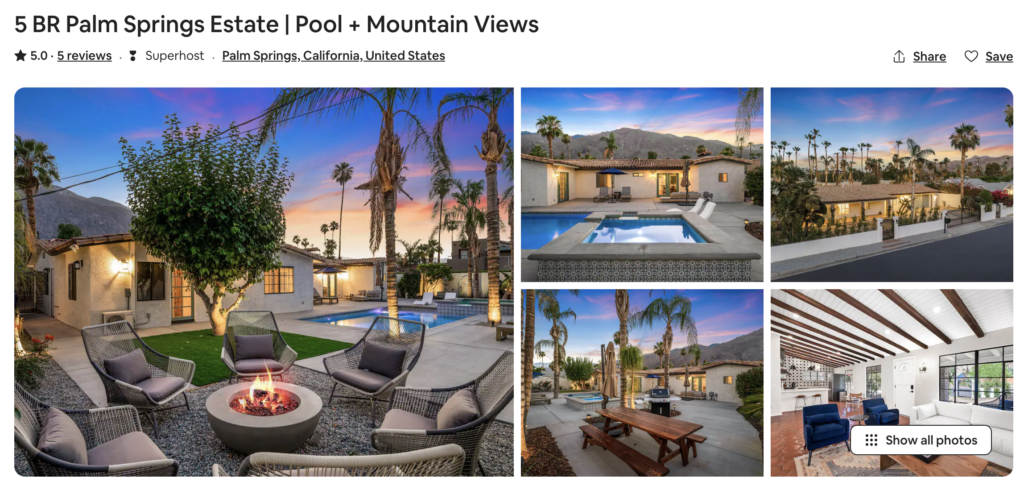

Similarly, guests have been very happy at our Palm Springs, CA property, with a perfect 5 star rating over the first five stays.

I’m especially pleased about the good reviews of our Palm Springs property, since this is the one that my wife and I thoroughly renovated over the last year. We even painstakingly painted it ourselves, which is an experience I never want to repeat.

Read more:

As we gather more positive reviews, this increases the trust of STR shoppers that a stay at our property will be a good experience. I know that eventually there will be an unhappy guest in Palm Springs, but for now, I’m enjoying the glow of perfection.

People love STRs during the holidays

We are finding that people love to get together and celebrate major holidays in luxurious rental homes. We have had high occupancy over the Thanksgiving, Christmas, and New Year’s holidays. This is true even in Broken Bow, OK, where it’s colder than Palm Springs, CA.

I can see the appeal. Hosting a holiday get together at a neutral site like a short term rental takes care of the stress of hosting people in your own home, though it does mean that everyone has to travel.

The financial gamble is paying off (for now)

Our two short term rentals are by far the most expensive investments we’ve made as real estate investors. The Broken Bow cabin was $1.175 million. The Palm Springs property was $1.075 million, plus over $300k in renovations and sweat equity. Honestly I wouldn’t really call our investment into short term rental market a gamble, but at times it definitely felt that way.

Despite the high cash outlay, there are two significant ways that our investment into the short term rentals is paying off:

- Raw cash flow

- Tax benefits

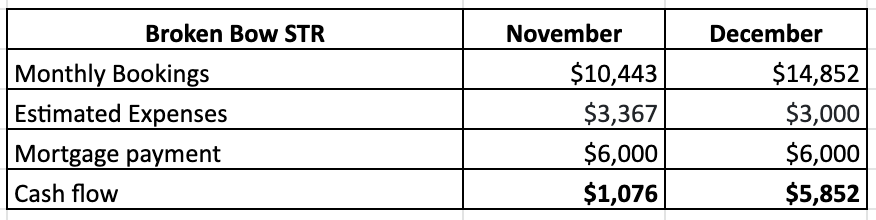

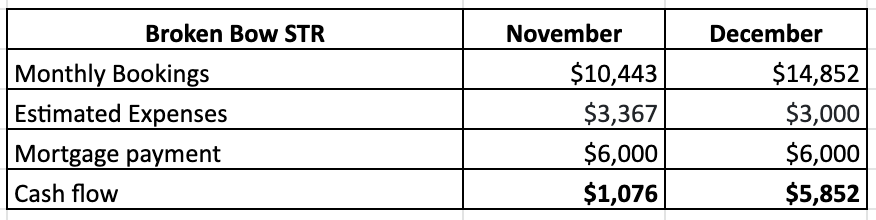

When it comes to the cash flow, there is nothing else in our portfolio that is touching the income from the short term rentals this winter. While I don’t yet have a full year of information to calculate a cash on cash return, I can say that the cash flow from the STRs is significant.

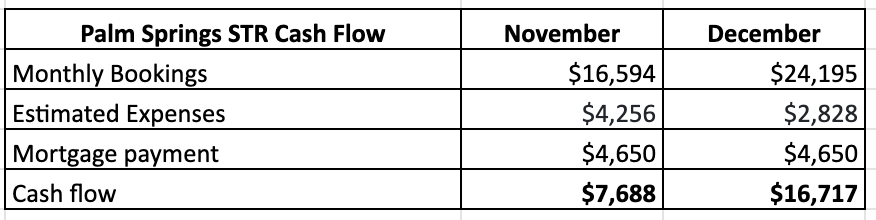

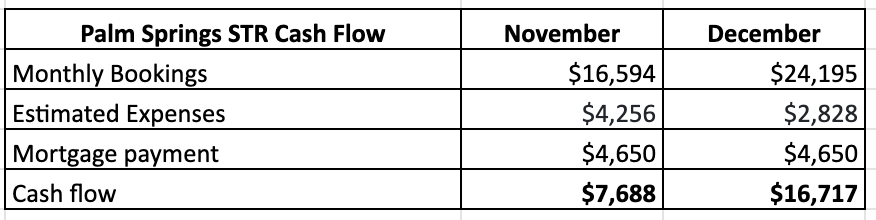

I’ve calculated the cash flow that we expect from November and December, and it’s handily eclipsed the cash flow from the rest of our rental portfolio combined:

The total cash flow from both STRs from November and December alone should be about $31,000. (Edit: as I write this, a monster winter storm is finally receding. It caused major utility damage in Broken Bow, which might limit stays in the near term.)

As I hoped in my last Anno Darwinii, this will push us towards profitability in Q4.

The tax benefits from STRs are immense

Another incredible benefit of a short term rental business are the tax benefits. As a (previously) employed physician, tax benefits were one of the main reasons why I pursued real estate investing.

Read more: Tax benefits | Why I’m investing in real estate over stocks – Part 2

This came into play in a major way, as I brought this full circle this year with a major tax deduction via a cost segregation with Engineered Tax Services for our Palm Springs property that yielded a > $100k tax refund from the IRS.

Read more: How a Cost Segregation with Engineered Tax Services got me a $105k Tax Refund

I intend to repeat this process come tax time in April 2023, utilizing a cost segregation for our property in Broken Bow.

Long term rental turnover is slow in the winter

When it comes to our long term rental portfolio, things are less exciting, but overall positive. We have almost completely finished the renovations on our 7 unit apartment building in Indianapolis. This has been a big drain on our cash flow all year, and I’m looking forward to it finally finishing up next month.

Although our duplex have overall been doing well, a lot of leases ended at the same time in December. Due to turnovers, we have quite a bit of vacancy right now that is coinciding with the winter holidays and a polar vortex causing plummeting temperatures across the nation.

(If you have vacant units, make sure to drip your faucets to help prevent your pipes from bursting!)

Together, this doesn’t create the best environment for quick turnover. I’m hoping to get all of the units tenanted within the next 1-2 months.

If this can happen, our long term rental portfolio should start doing some heavy lifting for our cash flow by springtime.

Conclusion

As we head into the New Year, I’m ever grateful for our real estate portfolio. It’s brought a welcome diversity to our income and gave us the flexibility to make an exciting move across the country. As my wife flourishes in her new role in Memphis, I am considering carefully how to move forward with our real estate acquisitions in the New Year.

I’m also grateful for diversity in our portfolio. From index funds to short term and long term rentals, it all gives us a good buffer against an uncertain future.

Although it’s a bit of a misnomer to call it a gamble, our short term rental acquisitions definitely were a big leap of faith. I’m glad it’s finally paying off.

–The Darwinian Doctor

How has the winter holidays treated your finances and investments? Let me know in the comments below!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

2 comments

Congratulations on your success with your STRs, and good luck with your longer term rentals. The ups and downs of your portfolio are good examples of why diversification is a good thing– I suspect that, over the long haul, you are going to go far. Wishing you an excellent 2023.

Thanks very much for the good wishes! I hope you also have a wonderful 2023.