In today’s post, I try to answer the question: how much cash flow do you need to change your life?

Every few months I publish an edition of Anno Darwinii, the report on my real estate empire. In the last edition, I announced that we’d reached a projected $29,000 of cash flow from our portfolio for 2021.

As I crunched my numbers and published that post, I felt a sense of pride and momentum from that number. “Finally, the numbers are starting to add up,” I thought to myself.

But as I often do, I considered how some of my higher income readers might consider that number: “Twenty nine thousand dollars? That’s cute, but it’s not enough to move the needle. It’s not worth the hassle.”

This imagined conversation in my head percolated for a while as I considered the more general question: How much cash flow do you need to change your life?

When I say “cash flow” here, I’m talking about income from something outside of your day job. Preferably passive in nature, this is the type of money that can change your life trajectory.

I believe there are two levels of cash flow that can be life changing:

- $1 of cash flow

- Cash flow equal to 20% of your annual income

Please allow me to explain!

Cash flow is a gateway drug

There’s a reason why Nancy Regan famously said, “Just say no” to drugs in 1982. Sometimes, the first taste of a drug is all it takes to cause addiction.

My first taste of cash flow was like a drug. From the very first dollar of cash flow from my rental real estate, I just wanted to grow the cash flow more and more. This led to a rapidly accelerating rate of asset acquisition.

This cash flow accelerated my plan for financial independence, and recently cut an incredible five years off of my 15 year plan to FIRE. All of a sudden, I’m considering a kind of life that is wholly different from the ordinary life I imagined before.

So if you’re like me, any amount of passive cash flow can be life changing. Even $1 of cash flow can change your mindset to understand that true freedom comes when your income is not tied directly to the number of hours you are working.

This realization can quickly lead you down a slippery slope that ends in the blue lagoon of financial independence.

But let’s discuss a more concrete amount that I feel should be everyone’s starting cash flow goal.

The 20% rule

If you’re like most people, you work five days a week. (If you’re a physician, you may work more than this!)

If you can generate cash flow equal to 20% of your income from another business or side gig, a few things have happened.

- You’ve generated the ability to work only four days a week

- You’ve got “the gap” to do some serious compounding

- You’ve got the know-how to keep going

A four day work week?

Imagine what you could do with one full day off every week. Could you:

- Focus more on your health?

- See your kids more?

- Work on your passion projects or side gigs?

- All of the above?

Would you call that life-changing? I certainly would.

Of course, not all jobs will allow for a reduced schedule, but the financial flexibility to even consider this is pretty revolutionary. It opens up your world to all sorts of possibilities.

Buying more life

Even if your job doesn’t allow part time work, that 20% extra income can be put to work to greatly accelerate your path to financial independence.

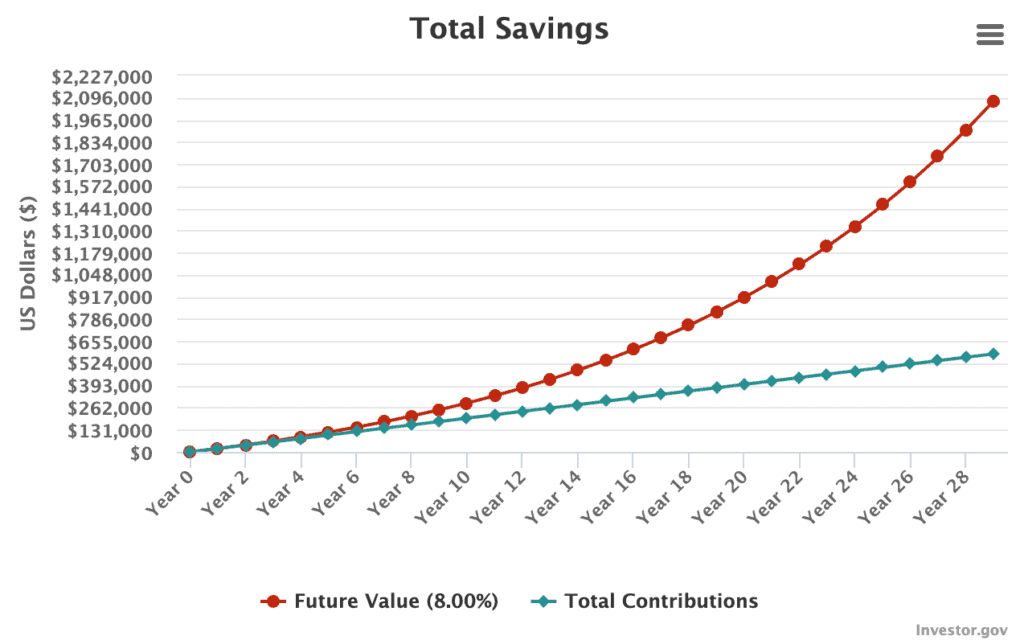

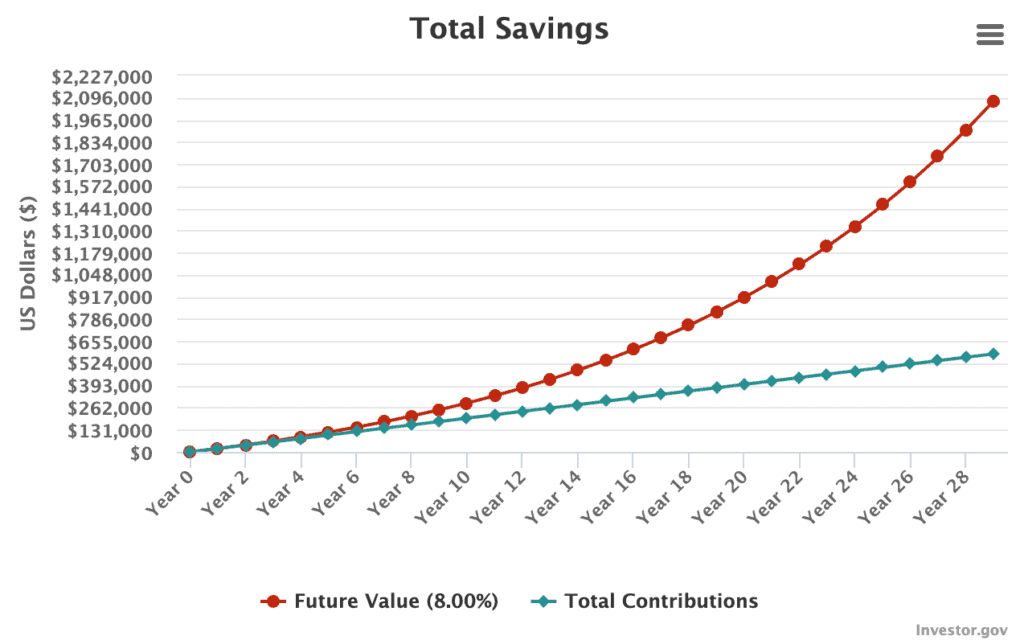

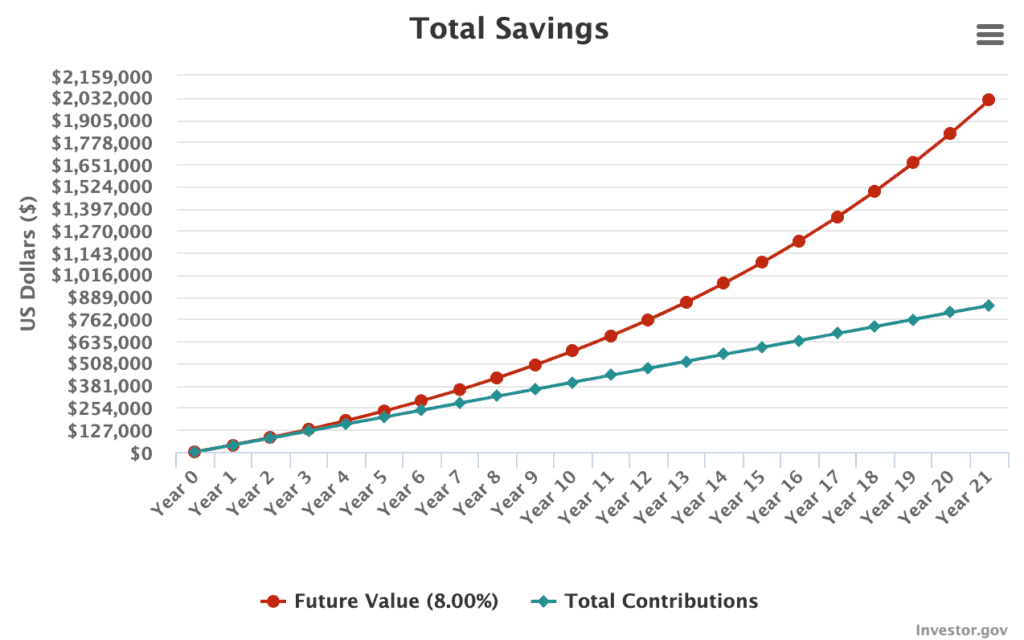

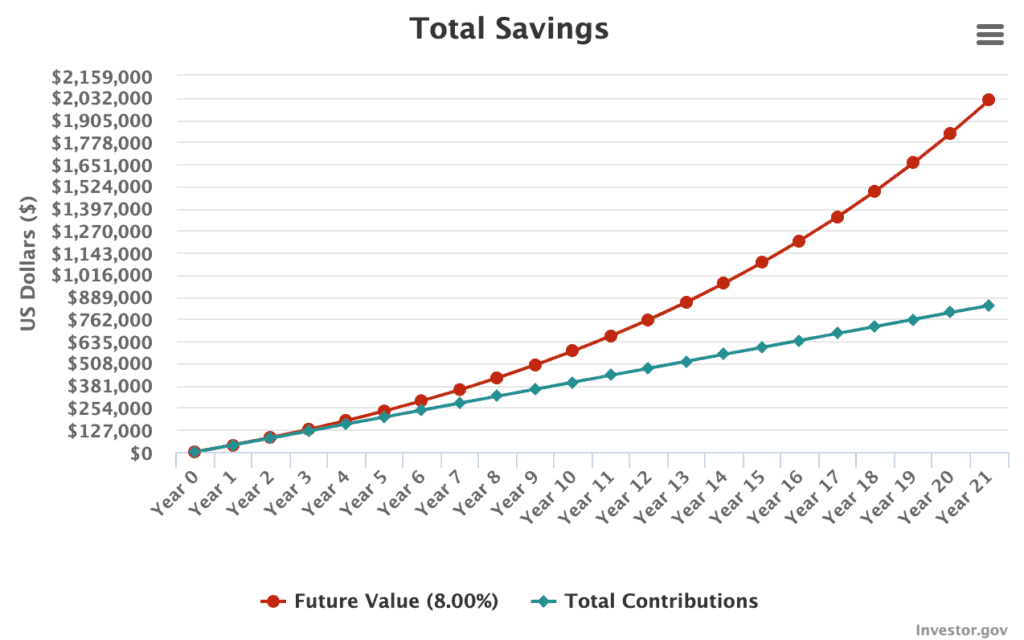

Here’s a simplified example to show you the power of the extra 20%:

- Income of $100,000

- Annual expenditures per year: $80,000

- Regular savings per year: $20,000

- 8% compounding return on savings

- $ needed for financial independence by the 25x rule: $2 million

Without extra cash flow, it’ll take at least 29 years to save enough to retire.

With an extra $20,000 of cash flow every year, it’ll only take 21 years. The extra cash flow shaved off almost a third of the time needed to reach financial independence!

I know, I know, this isn’t revolutionary. It’s just math. Save more, retire faster. But there’s more.

It’s more than money, it’s knowledge

If you’ve successfully been able to generate 20% of your annual income in cash flow, you know what you’re doing. You’ve probably been through enough trial and error to have a road map to continue the growth.

So the sky’s the limit! You have the tools to go for complete replacement of your income, if desired.

Do you think the Dr-ess and I are going to stop when we’ve hit the 20% mark?

How has cash flow changed my life?

Let’s put this question into perspective in my own life. The $29,000 of annual cash flow from my current stabilized portfolio is just under 10% of my annual base salary.

While I agree that this amount doesn’t really dent our significant spending, it already has made a big difference in my day to day.

I feel more freedom to take care of my health and well-being, which helps to combat the negative effects of over-work. I feel less pressure to work overtime, and have more confidence to continue my investing.

And I’m certainly not done. As I’ll outline in the upcoming Anno Darwinii, in the first half of 2021 alone, we tripled the size of our real estate empire. When that all comes on-line… well, I can’t wait to see what happens.

Conclusion

So how much cash flow do you need to change your life?

To answer the question again, I feel that even $1 of cash flow can be life changing. That single dollar can change your whole mindset and break the connection between hours worked and income earned.

But in my opinion, the first time that cash flow starts to change your day to day life is when it replaces 20% of your annual income.

This isn’t a hard and fast rule, though. This answer will really be different for everyone.

— TDD

How much cash flow would you need to change your life? Comment below!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

18 comments

Interesting question.

I always worked 4 days per week.

I felt empowered to go to 3 days a week only after reaching FI.

I think FI is the goal most should shoot for, but you can certainly cut back before then.

I envision a perfect balance of medicine, business, and creative pursuits in the future. It’ll probably end up “good enough” at some point, hopefully sooner rather than later.

That’s an interesting way to look at it. If you cash flow 20% of your income, you can work only 4 days a week… Hmm…

I’ve been focusing so much on price appreciation that I have no clue what my cash flow looks like on a yearly basis. Maybe I should change my investment approach and actually focus on cash flowing assets now.

Just my humble opinion (and somewhat arbitrary). Thanks for reading! I like prompting the question, because really I think it’s different for everyone.

Cash flow is great. But I have to say after making like $10K/month real estate cash flow, it felt amazing at first. Felt “wealthy” for the first time- went on vacation that year and spent maybe close to $50-70K and taking extended family on 7+ trips in 1 year. however, the reality was that I was working a ton to make that happen and spent thousands of hours to actually get there. Real estate for all its wonders is not a passive endeavor. Actually no real investing is truly passive. Everything requires hard work, maintenance, research, bookkeeping,etc.

From my personal perspective, seeking “passive cash flow” to replace your income is a fool’s errand for physicians. The amount of work to get there is tremendous and I doubt it really benefits your life overall.

I think physicians should focus more on asset accumulation, appreciation (real estate) in the MOST passive way possible and put TIME as a priority above all else.

Meaning the traditional pathway of rental real estate ($100,000 homes in texas that gets you $200-400/month net cash flow) or even $1000/month cash flow in STR/Airbnb home is not something most physicians can do easily.

I find super passive -automated stock/index investing to be #1 best way to maximize returns per time committment (almost zero).

Then next level is options trading to add leverage to your investment (But only for long term investing, not short term options which becomes like another job).

Then utilize leverage to the maximum potential both in your primary home – HELOC and in your stock portfolio – (M1 finance at 2%) or go to banking’s wealth management side who can offer 2.5% or as low as 1.5% interest line of credit backed by your stock portfolio. Use your borrowing power to reinvest in more stocks or LARGE real estate. Not $100K properties but $1M or more. Focus way way more on appreciation (best locations, good schools, limited housing supply).

Thanks for writing this — do you think if you’d replaced some of your day job (instead of doing it all), you’d have been more willing to continue the real estate?

A few hundred a month can get you out of debt and a few thousand a month can be transformational.

Let’s put this question into perspective in my own life. The $29,000 of annual cash flow from my current stabilized portfolio is just under 10% of my annual base salary

so if math is correct you make about 290,000 per year. do you have any more detail on how you make that salary ?

Thanks for commenting! I’m happy to share – I’m a surgical subspecialist, so a base salary of about $300,000 is pretty typical for my profession. It’s a great salary, but it took a long time to get here, and it’s a pretty demanding job.

[…] happen before you acquire enough passive income to retire. The Darwinian Doctor covers this with How Much Cash Flow do you Need to Change Your Life? I was surprised by his numbers but realized they make sense. Think about your answer before […]

That’s an interesting concept, it gets really weird though after you retire. Right now I have no earned income but my investments increased in value by nearly one million dollars in the last 12 months. That’s ten times my expenses. I guess the other question is at what cash flow do you stop needing a paid job?

Wow that’s quite a jump in your assets! To answer your question, I suppose you stop needing a paid job when your cash flow reliably covers all your living expenses, and is an “evergreen” cash flow source.

I think highlighting how just $1 can be a game changer is really important. A lot of physicians look at the real estate game as not worth the effort. The truth is the numbers are small in comparison to their salary…. So it is only natural to feel that the small gains are not worth it. But making income while relaxing or even working in your primary profession is very rewarding. Passive income of 20% ( tax free) will make a huge difference. Yes it will take some upfront work (what doesn’t) but in the long run it will be worth it.

Thanks for writing this, I feel the same way. That first dollar of cashflow can be revolutionary and cause that mindset shift that will eventually lead to financial independence, or perhaps a more sustainable work-life balance.

You can invest passively in real estate by syndications. The work you do is to vet the sponsor and/or syndicator up front. Once you trust them, you just need to pick which deals you want to be in. As a doc myself, I don’t have time to do active real estate by managing rentals. Then there are other passive assets that you can invest in like ATMs, self storage etc. I started investing for cash flow about 2 yrs ago by liquidating most of my stocks and go all in for cash flow. I have plotted my flow slowly for the last 18 months and the latest tally is about $13k/month, all passive. Our expenses is about $10-15 k/mo, so if this trend continue for another 6mo, I’m comfortable cutting down my work hours to 3-4 days a week no call no weekend….

Fascinating! It must have been a big step to liquidate your stocks. But clearly it’s paid off. Congratulations for being almost to financial freedom! I hope to join you soon.

The big pivot was made due to Covid. Life changing. Market dropped like 30% due to lockdown April 2020. Say if I had 1mil in the market, 300k wiped out. Financial advisor and everyone else couldn’t do anything. Even as docs our work place shut down temporarily due to novel virus and no elective procedures. Shows you how fragile a w2 job was, only 1 source of income. During downtime, did soul and internet search on how to generate passive income. Came across real-estate and syndication, etc. Read a tons of finance related books like Rich Dad, Poor Dad, Cash Flow Quadrant, listened to podcast, read blogs. After 4-6 months when market recovered, fired financial advisor (who earned 10k/yr to manage our account as they couldn’t do anything about the situation when I asked about doing something in real estate), slowly sold off stocks. Identified and vetted a few syndicators, got into 1-5 syndications, and repeated that for last 1.5 years to have most stocks sold off and routed to cash flowing passive income. It’s a paradigm shift that most people won’t even consider but looking back even a decade, I’ve loss so much on stocks vs gains that my return is probably about low 4-5% gains net. Now real-estate so far gains has been 5-7% on the cashflow side and 15-20%+ when an investment sells and capital is returned.

The delayed gratification from syndications is a downside for me. Most that I’ve reviewed have a lower upfront cash flow and possible upside on the sale. I want the higher cash flow now to roll into more investments. But the higher cash flow does come at a time cost with more active deals.