Here’s an inside look at the 2022 rental income returns from our investment portfolio in Indianapolis, Indiana.

This post may contain affiliate links.

Introduction

When I first realized that I wanted to become an active real estate investor, I chose Indianapolis, Indiana as my chosen market. There were a number of factors that attracted me to the market, including:

- Favorable rent to value ratios

- Stable local economy

- Landlord friendly legislation

Read more: How to pick a real estate investment market

With the purchase of our first duplex, our Indy portfolio was born. Over the years, we’ve added to the portfolio with the purchase of 3 more duplexes and two small apartment buildings. Currently, our Indy portfolio is comprised of 23 units of rental property.

This breaks down to:

- Four duplexes

- One 7 unit apartment building

- One 8 unit apartment building

Read more: The BRRRR method: how we got a 62% return on our first duplex

We took a break from purchasing more property in Indianapolis in 2022 to focus on short term rentals. This was a strategic decision that led to substantial tax savings via the short term rental loophole. Specifically, we received a $105k tax refund for our 2021 tax year via a cost segregation on our property in Palm Springs, CA. We hope to repeat this for our 2022 tax year with a cost segregation on our short term rental in Broken Bow, OK.

Read more: How a Cost Segregation with Engineered Tax Services got me a $105k Tax Refund

However, this doesn’t mean that we just left our Indy portfolio alone. The year was spent renting up our apartment buildings and renovating units as tenants turned over. This allowed us to maximize our rental income from the existing Indianapolis portfolio.

Renovation is expensive

In 2022, we used two different general contracting teams and spent a grand total of $91,217.82 to renovate 3 apartments and complete significant sewer line repairs.

Water related issues are a significant expenditure for all real estate investors, and especially if you invest in older units like we do. I hinted at the end of the following blog post that we were looking at a $10,000 + sewer line related repair, and this turned out to be an underestimate. In total, we spent over $20,000 repairing a sewer line and demolishing a building that unfortunately sat right on top of the pipe.

Read more: Water is a Real Estate Investor’s Worst Enemy | Building the Empire

While the sewer line was an unwelcome surprise, the good news is that in 2022, we started to have significant rental income that helped to offset our renovation costs.

Rental income rising

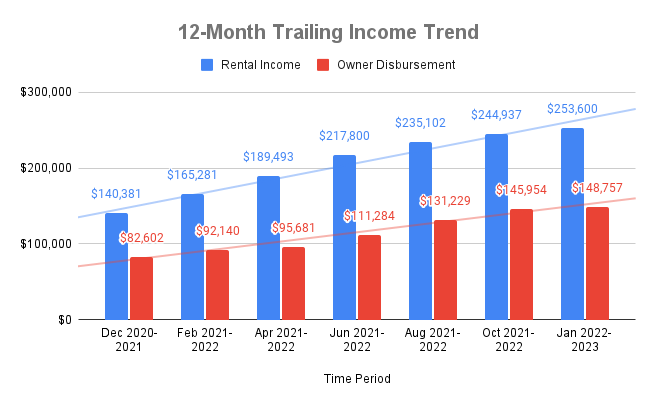

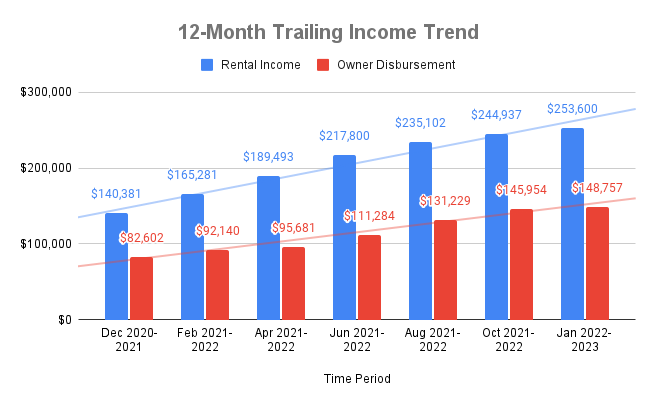

I prepared a chart to represent 12-month rental income totals from our Indy portfolio. In it, you can see how our rental income grew in 2022, despite not purchasing a new property since mid 2021.

To be clear, each bar represents 12 months of income. The blue bars are what we took as gross rental income to our property manager. The red bars are what ended up hitting our bank account.

The 50% rule

It’s typical for rental property expenses to take away about half of the gross income for a rental property. This is called the “50% Rule.” When I look at our own rental income performance from Indianapolis, the average proportion of income that hits our bank accounts from the gross rental income in 2022 was 56%.

However, this red bar doesn’t account for our insurance or property taxes, so with that factored in, I believe our take home % will be lower than 50% in 2022. I believe this is related to the high costs involved with turning over under-rented properties. I am hoping that this will reflect higher costs related to stabilizing our portfolio, and that our take home will increase in 2023.

Typical rental property expenses

I’ll likely do a deep dive into rental property expenses in the future, but I’ll list a few typical ones here. These are expenses that will reduce your rental income, whether you invest in Indianapolis or elsewhere:

- Property management fees

- Turnover costs like cleaning, painting, and repairs

- Advertising

- Property taxes

- Insurance

- Appliance maintenance

- Waste disposal

- Landscaping

- Utilities

There can also be unexpected one time costs for strange things like wild animal incursions. Last year, we paid $359 dollars to remove a racoon that had taken up residence in the roof line of one of our duplexes.

I looked around for the picture from my property manager from that incident, but I can’t find it. It looked something like this:

When people on social media bash landlords for being the parasites of society, I think they fail to account for the costs related to property maintenance. These costs are a normal part of doing business for landlords, but all some people can see is the gross rent going from the tenant to the property management company every month.

Without paying for these expenses, however, properties would rapidly fall into disrepair, taking more housing units off the market. This is unfortunately an argument that usually falls onto deaf ears.

Debt service

It’s also important to note that the 50% rule doesn’t account for debt service. So after normal expenses are removed from the gross rental income, we also have to pay for mortgage costs.

Mortgage debt is generally fixed on 30 year mortgages for 1-4 unit rental property, but for commercial multifamily, it can be very different.

We have the debt on our 7 and 8 unit buildings fixed via commercial loans, but the amortization schedule is on a 20 year term. This increases the month to month debt costs, but also increases the amount of principal that we pay down every month as well. This passively increases our net worth, month after month.

Principal paydown is another one of the five ways that real estate investment makes you money. It’s an important factor of your “Real Return” from real estate.

Read more:

- The 5 ways rental real estate makes you money

- 5 simple steps to calculate your Real Return on rental property

Proof of concept

While I would still say that our Indy portfolio was “unstabilized” in 2022, it’s rewarding to see our income numbers increase over the year. This reflects the value of the capital investment we made to renovate the older units. These renovations allowed us to increase rents to market value and provide quality rental units to the local community.

I feel this is a good “proof of concept” for our investments in Indianapolis.

Conclusion

I hope you enjoyed this rental income report from our Indianapolis portfolio.

As we crunch the numbers, it looks likely that we will hit our SMART goal this year. This is the goal that I set in 2020: I must have $100,000 of tax-free annual cash flow from rental properties by 2025.

Read more: Why you must stretch for your SMART goals

At the time I wrote this post, I gave us five years to get to this income level. It seemed like an aggressive timeline, but if all goes well we should hit this income goal in 2023, two years early.

Now comes the hard part, which is defining what comes next for our real estate portfolio. After a lot of consideration and discussion, it looks likely that 2023 will mark a new era of partnership and accelerated growth.

–The Darwinian Doctor

Curious about what’s next for our real estate empire in 2023, and how it might involve you? Make sure to subscribe to the newsletter so you’re the first to know about any developments on this front!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

2 comments

Congratulations on (maybe) hitting your goals ahead of time. You are a master of the cliffhanger (writing about a new era of partnership and accelerated growth)–I will look forward to your next update.

I’m glad at least some people read to the end of the article 🙂