Today I share three lessons I learned from reading an 800+ page book about taxes.

This post may contain affiliate links.

It was about three years ago when I decided to spend some quality time with this tax book (pictured below). It’s over 900 pages now, but at the time I just borrowed it from the library and it was a mere 800+ pages. Here’s the book:

Now you might ask yourself why I decided to spend my scarce time reading this book. That would be a great question. It was because I’d become very frustrated by my tax situation. I heard often how many people paid virtually no income tax, while at the same time I was in the highest tax bracket.

As an employed physician, I was not in a great tax situation. For much of the year, I literally had to send over 50% of each paycheck to either the federal government or the state of California. My average tax rate was about 35%, but my highest marginal tax rate was over 50% when you counted everything. (This includes state, federal, medicare, and state unemployment taxes.)

More reading about taxes:

- What Does FUTA Stand for in Payroll? [Federal Unemployment Tax Act]

- Marginal Tax Rate vs Average Tax Rate: What’s the Difference?

Taxes were my biggest expense

By this point, I’d already undergone my personal finance awakening, and was on a 15 year timeline to financial independence. It was a plan based on brute-force savings into index funds in both my taxable and retirement accounts.

But as I looked for ways to accelerate this timeline and looked over my expenses, one really stood out to me. It was the hundreds of thousands of dollars I was paying every year in income taxes.

Now I believe in the concept of taxes (to certain extent). I suppose they’re necessary to pay for things like municipal services and things like that. Depending on your opinion of modern monetary theory, you might find that supposition debatable. I think it could also be possible that taxes are more of a means of preventing inflation and redistributing wealth.

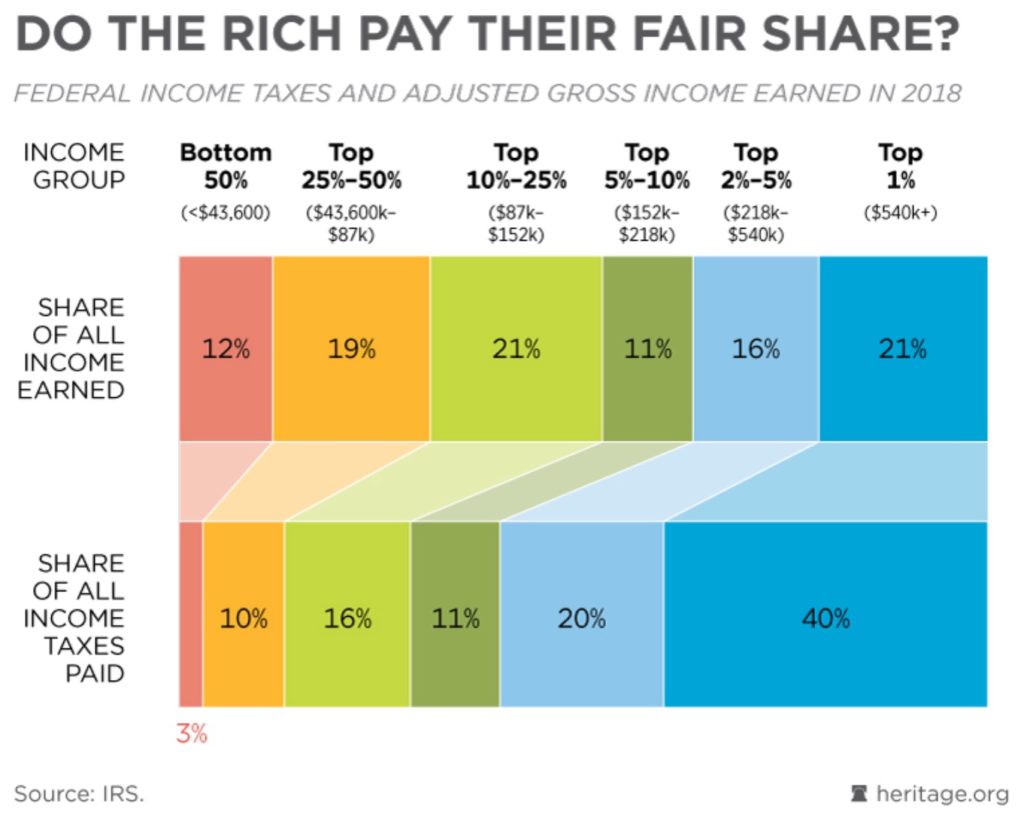

We already know that the top 5% of all income earners pay 60% of our nations taxes.

So as I realized the impact taxes had on my ability to save and invest money, I naturally looked for legal ways to reduce my tax burden. Thus, the huge tax book.

What I discovered

I can summarize my findings with three conclusions:

- Employees have little ability to deduct expenses

- As your income rises, your tax deductions are limited even more

- The tax code favors businesses and real estate investors

Let’s review these briefly one by one.

Employees can’t deduct many expenses

As I recently outlined in a post about tax deductions on food at work, you’re really limited with your work related tax deductions if you’re an employee. It’s not only food — if you’re an employee, you simply aren’t allowed to deduct business related expenses. As an employed physician, I found this very discouraging.

Make more money, lose more deductions

I also read that as your income rises, you get phased out of a lot of a lot of tax programs. For example, there is an income phaseout for the child tax credit, the higher education deduction, and the child care credit.

This makes sense, as many of these programs are targeted to help lower income earners. Deductions and credits like this make much more of a difference when your income is smaller. But again, this realization didn’t help my situation.

The tax code favors businesses and real estate investors

This was the biggest takeaway for me. I realized that if I wanted to increase tax efficiency in my finances, I’d have to follow the IRS playbook. I’d have to read between the lines and invest money into business and real estate. The existence of the favorable tax incentives for real estate in particular means that the government has agreed that it’s good for the country.

I agree with this, as real estate investing generally provides housing and supports multiple industries and jobs.

So that’s what I did

So I started shifting my strategy to real estate over the last 3 years. Currently my unit count is at 25 after some recent consolidation. Along the way, I accelerated my path to financial freedom by at least 5 years.

Conclusion

In conclusion, this tax book taught me that there are many ways to reduce your tax burden, but being a highly paid employee is not one of them. If you’re seeking tax efficiency, start a business, especially a real estate business.

Here’s the companion YouTube video about this post:

Do you want more insights into taxes and wealth tips? Subscribe to my newsletter!

Perhaps you’re more of a Facebook type?

Are you a physician, spouse, or professional and you’re interested in using Real Estate to gain financial freedom? Join us in our Facebook group and accelerate your journey!

Want to support the blog?

- Join our investor club at Cereus Real Estate

- Visit my Recommendations page

- Check out my wife’s food blog: Eat Dessert First

- Stay at our luxury short term rentals

- Check out my TikTok channel

- Follow me on Instagram

- Follow me on YouTube

- Contact me with questions

5 comments

Thank you for the great write-up! What can a real estate investor ( rental property owner ) do to decrease their tax burden as a practice owner? If I understand correctly unless you are claiming professional real estate status there is not much you can do to decrease your taxes on earned income. Thanks

Hey Nima, the big opportunity out there is to materially participate in the operation of a short term rental. Take a look at this post below. Other than this, there isn’t much opportunity other than deducting your business expenses related to your practice (like cars, equipment, staffing, etc).

Amazing Tax Deductions from Your Short Term Rental

Tax code favors businesses, real estate, and investors. It has been that way for many years. Dividends and capital gains are both tax advantaged even at higher incomes.

Thanks for the comment! How do you mitigate the tax drag of the dividends, which are generally taxed at the normal income tax rate (unless they’re qualified)?

Taxes have always been a headache for me, but after reading this, I realize I’ve been missing out on the benefits of professional tax services. Time to make a change!